Within the next few weeks the African National Congress (ANC) will be subjected to one of its most pressing decisions in its over 100 year history. During the party conference scheduled for December 16th-20th, more than 5000 delegates across nine provinces, three leagues (Women, Youth and Veterans) and provincial and national executives (PEC, NEC) will meet to cast their votes for the top six officials, including the most important of all, the chairman of the ANC. The latter will initially take over the presidency of the ANC from the incumbent party leader and country’s president Jacob Zuma, but within the subsequent two years, she or he will also become a key candidate in the presidential run, as well.

Given the still overwhelming popularity of the ANC among South Africans, the presidential elections will likely be one sided, as neither the Democratic Alliance (DA) nor Economic Freedom Fighters (EFF), the key opposition parties, are expected to garner enough popular support to stand any realistic chance of competing against the ANC candidate. Unless, of course, the new party leader fails to stem the deepening internal ANC divisions by further promoting cronyism and fostering state capture, which could result in the emergence of a splinter party from within the ANC (backed by the more pragmatic faction), and an effective breakup of the ANC. In this scenario, the presidential run in 2019 would be wide open and highly unpredictable, as the position of the ANC would have been significantly undermined. At this stage, however, the latter scenario seems unlikely.

Party Congress - December 16-20

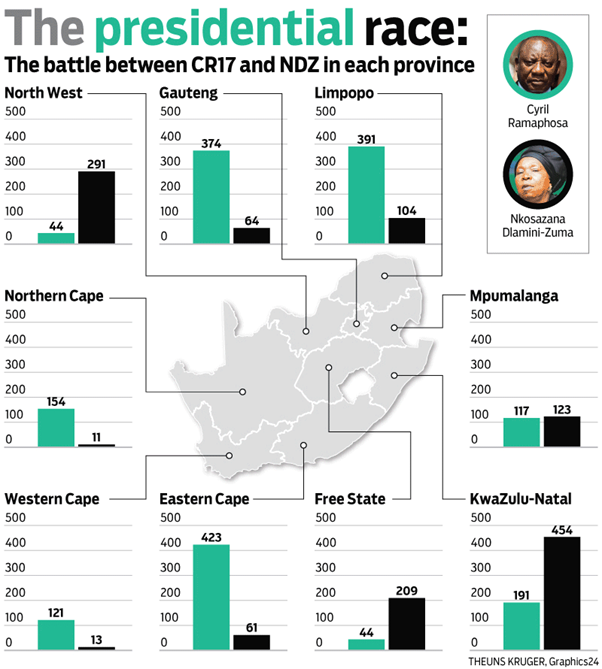

There are two candidates that are seen as front runners for the leadership contest. The incumbent president’s (Jacob Zuma) ex-wife, Nkosazana Dlamini-Zuma, and South Africa’s deputy president Cyril Ramaphosa. According to the latest available information (see below), the latter was nominated by the majority of the ANC branches within the party’s provincial structures, which at first glance ought to give him an edge over Dlamini-Zuma to succeed Jacob Zuma as ruling party leader.

Yet ANC voting procedures are often marred by opaqueness and are prone to manipulation. In theory, the branches are set to account for slightly over 90% of the 5000 plus voting delegates, with the remaining coming from the party leadership structures and the leagues. Given some larger branches are likely to have more than one delegate, and there is little guarantee the delegates will vote as instructed (votes are secret), the suggestions from the initial branch nominations are likely just that. As such, there are a number of factors that can still influence individual delegates before the final vote including strong lobbying or even in extreme cases, bribery. Furthermore, at this stage there are still up to 25% of the delegates whose votes are yet to be determined, as such, swing voters could also play a significant role in the final nomination.

Source: Huffington Post

http://www.huffingtonpost.co.za/2017/12/05/ramaphosa-vs-dlamini-zuma-the-race-for-anc-presidency-by-numbers_a_23297528/

Nominees

The outgoing party leader, Jacob Zuma, whose decade-long rein has been largely characterised as scandal ridden, controversial and generally lacking merit, has openly campaigned for his ex-wife Dlamini-Zuma, partly in the hope that she would spare him from prosecution. Despite her technocratic leanings, she is also believed to be a strong proponent of radical economic transformation to place more of South Africa’s wealth into the hands of the black majority.

Ramaphosa, a lawyer and former labour-union leader, is seen by many as belonging to the modernist camp. He understands the key issues facing the country (poor growth, extremely high unemployment rate, inequality, weak institutions and corruption) and has strongly pledged to address them, if elected.

Scenarios

A victory for Ramaphosa would likely be perceived by market participants as a relatively positive outcome. Recent polls have suggested an increased likelihood of his success; hence, in our view a relief rally following his potential nomination, particularly in the Rand, may be somewhat muted, as some of the expectations have already been priced in, explaining the currency’s strong performance recently. Given his pledge to revive the ailing economy, address high unemployment and eradicate rampant corruption, his candidacy is often seen as one that could see a sharp improvement in both consumer and, more importantly, business sentiment.

According to some measures, as much as ZAR1tr of idle cash is being kept on companies’ balance sheets due to the current economic and political uncertainty. A boost to business sentiment could see some of that cash being allocated to productive activities, as political uncertainties are removed, lifting the economy into a cyclical recovery. A prolonged period of structural economic decline has seen GDP per capita on a downward trajectory for the best part of the post GFC period. Ramaphosa’s commitment to tackle structural bottlenecks is indeed encouraging, yet it will take time before the economy can regain its structural growth momentum, while also being costly in terms of political capital.

The alternative scenario is a victory of Dlamini-Zuma. We believe this outcome would likely cause a negative market reaction for a number of reasons. Despite being perceived as a technocrat, her close ties to President Zuma and her advocacy of Black Economic Empowerment via radical economic transformation is likely to leave some of the structural bottlenecks largely unaddressed. The uncertainties related to her affiliation with President Zuma will keep businesses uneasy, thus a cyclical upturn on the back of lower political risk will be minimal, at best. In our view, the latter scenario will see the Rand sell off about 3-5% and in time put upward pressure on inflation, given the country’s fast and relatively large degree of FX pass-through (10-15%). This scenario also carries an increased risk of a rating downgrade (particularly by Moody’s), especially if the Ministry of Finance’s February budget is as equally underwhelming as the most recent one, which foresees public debt to GDP expand by as much as 10% in the coming year. Dlamini-Zuma’s victory could also see growing internal divisions within the ANC, in time leading to a breakup of the ANC, ahead of general elections in 2019, opening South Africa’s political arena to the emergence of opposition parties (either standing alone or in collation) that could truly threaten the ANC’s over-20 year period of near total dominance.

The least likely scenario is the one of a compromise (mixed slate), which could see both candidates, Ramaphosa and Dlamini-Zuma, jointly lead the party for the two years until general elections. This outcome would be seen as a strategic move on the part of the ANC, aimed at boosting internal cohesion, and solidifying the ANC position as the front runner in the 2019 general elections for National Assembly, at the same time buying the ANC more time to select the best presidential candidate to take over after Jacob Zuma the same year. The key to success would be a strong united front and a clearly defined political agenda, which could in time up ease the markets. This together with solid progress made in February’s budget, could win South Africa some time, preventing Moody’s from delivering its “final strike”, and aligning its rating with the other two credit rating agencies in junk territory.

Ratings

In late November, two key rating agencies concluded their scheduled credit review for South Africa. S&P decided to lower the country’s long term local currency sovereign credit rating from the lowest level of investment grade (BBB-) to junk (BB+). At the same time the foreign currency rating was lowered to BB from BB+. Both were assigned with a stable outlook. The key rationale behind the credit action was the ongoing weakness in the country’s GDP growth. The latter has led to the ongoing deterioration in public finances, which was deeper than the S&P’s initial assumptions. The agency did however emphasise that following the party leadership contest later this month, the government ought to introduce some offsetting measures in attempt to replenish public coffers, but the effort and the scope is unlikely to stabilise the trajectory of public debt. The net impact on growth is also likely to be unfavourable.

Moody’s on the other hand decided to refrain from an outright downgrade, instead the agency put the country on watch for a downgrade (which typically implies a roughly 50% chance of a downgrade within the next few months), which maintains the country’s investment grade status for now. The poor state of the economy was also highlighted, which has had severe ramifications for the state of public finances. The agency however, decided to maintain a “wait and see stance” for now in order to “assess the South African Authorities’ willingness and ability to respond to these rising pressures through growth-supportive fiscal adjustments that raise revenues and contain expenditures; structural economic reforms that ease domestic bottlenecks to growth and improvement to SOE governance that contain contingent liabilities.”

A downward move by Moody’s would carry a significant risk from the perspective of bond flows. Following the April downgrade to junk by Fitch, South Africa was excluded from the JPMorgan Investment Grade-Only sub-indices (both hard and local currency), which led to estimated outflows of about $2.4bn. The most recent downward revision by S&P, will also see the country excluded from Barclay’s Global Aggregate Bond Index, but this flow is also likely to be relatively small at about $2bn.

The largest market reaction, however, is likely to happen should the country be excluded from the World Government Bond Index (WGBI). This will occur if Moody’s takes the country’s rating to junk, which we believe could well happen after the MinFin budget in March next year. The full scale of bond outflows is still unclear (as some investors might reallocate ahead of time) but some indicate that the outflow could be as large as $10bn.

Summary

There are a number of key event risks that markets will watch closely in the coming months. The most imminent, the election of a party leader during the ANC party congress later this month, has the opportunity to re-shape the country’s future. A new business oriented and open-minded party chairperson could steer the country on to the path of recovery and, in time, address the most pressing issues currently facing South Africa, i.e. a number of structural bottlenecks, which prevent the economy from shifting into higher gear. A continuation of the current status quo with Zuma’s fostered state capture at its core, will not only heighten the risk of an ANC break up, but will also increase the risk of a rating’s downgrade, particularly if the February fiscal budget disappoints. There are exciting opportunities laying ahead, and hopefully, South Africa can capitalise on them.