Market Outlook

Global equity markets rallied throughout 2017 without any major setbacks. With volatility at extreme lows, it could be said that 2017 was an unusually fortunate year for market participants in terms of risk and reward. While earnings have plateaued following a long period of profit growth, many Japanese companies have entered a new phase of investment in anticipation of a variety of technological advances and growth in demand expected from the 2020s onward.

It is our general investment view that the Japanese stock market is underpinned by the country’s mature economic foundation. It is highly cyclical and tends to exhibit repeating patterns, for this reason we believe a consistent and thorough application of a contrarian value-oriented investment approach is most effective in delivering excess returns over the medium to long term.

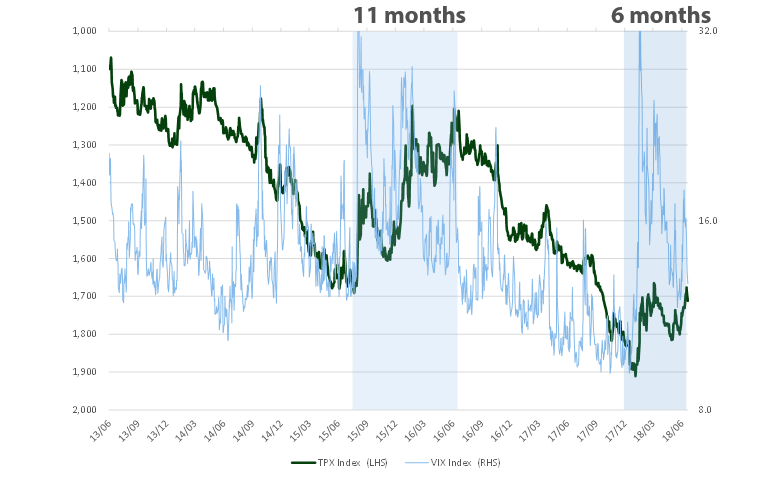

The market correction from February in the Japanese equity market following a rise in interest rates is one example of increasing risk factors driving volatility (See Exhibit 1). However, the strong fundamentals supporting the Japanese equity market show no signs of abating. Most recently, the market saw the emergence of compounding risk factors such as trade tensions and turmoil in emerging markets as risk aversion grew among investors. The strategy’s benchmark, the TOPIX (w/dividends), ended Q2 roughly flat, rising 1.05%, however there was significant variation in performance across sectors.

Exhibit 1: VIX vs TOPIX

Source: Bloomberg, NAM (As of July 2018). (Note: LHS axis is reversed)

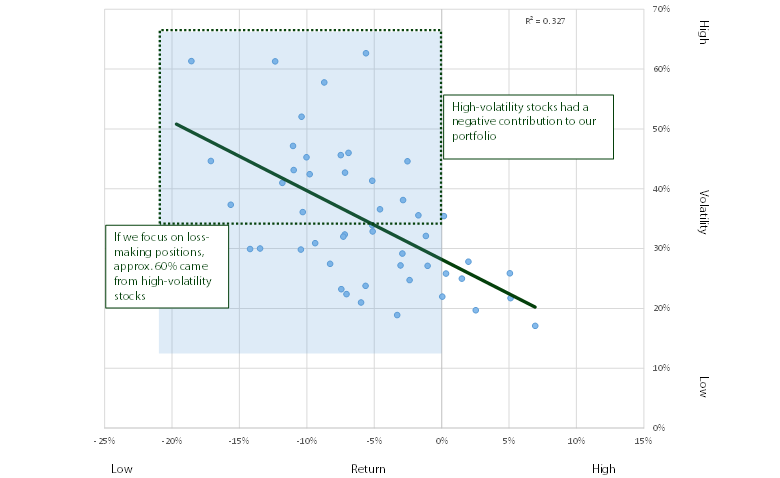

Globally, the market has been led by the IT and healthcare sectors, however the performance of these sectors in Japan overshot even this global trend. While Japan’s major healthcare stocks increased almost 30% during the quarter, major capital goods stocks declined almost 20%, creating a disparity in sector performance comparable to the dot-com bubble of 1999. Our analysis found a very strong negative correlation between volatility and returns in the market during this period amid a massive shift of investor flows into low-risk stocks (See Exhibit 2). However, from experience, we believe that the market will soon return to normalcy.

Exhibit 2: Volatility vs Return

Source: Bloomberg, NAM (From Feb 22-June 28, 2018)

The Long View

As earnings have plateaued following a long period of profit growth, we are unlikely to see many significant earnings revisions in the near term. Nevertheless, we believe that at the moment there are plenty of catalysts that could drive a turnaround in stock prices. These include the recent significant correction in the stock market on excessive pessimism over trade tensions between the US, China, and the rest of the world; attractive valuations seen in many names as a result of the correction; and an improvement in shareholder returns that is unlikely to be reversed. We believe the current market offers us an ideal opportunity to invest in companies that are likely to expand their market capitalization over the next five years.

In early July, our investment team conducted a week-long research trip to Shenzhen and Beijing—which are generally thought to be at risk from current trade tensions. We concluded that there is a significant gap between market concerns and reality. China’s management of its economy is growing more stable as the government aims to achieve its target of growth of around 6.5% by increasing the sophistication and added value of its products and services.

Although the impact of deleveraging is being seen in some areas, firms are eager to invest into innovation in areas including 5G, electric vehicles, the Internet of Things and healthcare. Meanwhile, private consumption is growing and becoming more diversified thanks to the shift to electronic payments as the de facto transaction standard. While it is true that China has information controls in place, it has kept its composure in its diplomatic relations with the US thus far and refrained from engaging in arguments, issuing criticisms, boycotting US goods, or other hostilities. Amid increasingly tense relations with the US, China is also eager to maintain close relationships with neighbouring countries to anchor its position in the region.

Sino-Japanese relations are likely to stabilize in the coming one to two years, beginning with a meeting between Japan and China’s foreign ministers as well as Chinese premier Li Keqiang’s visit to Japan and continuing with Japanese Prime Minister Shinzo Abe’s visit to China in the fall and Chinese President Xi Jinping’s visit to Japan scheduled for next year. Although changes in China happen extremely quickly and we must keep a careful watch of new developments, we plan to reflect this information asymmetry between market perceptions and reality in the management of our strategy in order to secure good returns when a turnaround occurs.

Direction of Earnings and Strategy

Japanese corporate earnings are heading for a plateau following six straight years of sustained profit growth starting in FY2012. Companies face significant obstacles toward further earnings growth given an increase in forward-looking investments in growth fields and a need for more conservative cost estimates amid rising raw material prices. However, such cost factors were rapidly factored into stock prices during the large-scale market correction beginning earlier in the year. In addition, many Japanese stocks have declined as investors excessively priced in concerns over a global economic slowdown and systemic risks.

Looking at valuations and the direction of shareholder returns, we believe this is an ideal opportunity to invest. Our top priority in terms of investment themes is incorporating stocks that will benefit over the long-term from new global innovations and increased demand for materials and next-generation services from the 2020s and beyond. While investors tend to anticipate overly idealised outcomes for such developments, we maintain a realist approach that is further supported by interviews with the management teams of firms.

Risk Factors

The biggest risk facing global markets at present is the negative impact from protectionist trade measures, so we are continuing to watch developments in this area. In particular, we will carefully monitor the impact on China’s growth targets and the impact on the global economy if Trump is unable to back down from his hard-line stance due to public pressure following the mid-term elections.

Although we believe that the Japanese equity market will continue moving upwards in 2018 and beyond, we expect some periods of higher stress, as many of the factors that helped bolster equities in 2017 may instead spur market volatility going forward. For example, rising resource prices initially provided support to the market by driving up inflation expectations, but now we must consider the possibility that as time goes on, resource prices may begin weighing on corporate earnings and consumer spending. While our basic market outlook remains bullish, we would still like to outline these potential risk factors below.

Interest rates

Movements in long-term interest rates have been relatively subdued overall despite the global economic upturn and a shift to the normalization of non-traditional monetary policies, thus we do not anticipate significant risks arising in this area for the time being. At the same time, we must still closely monitor rising interest rates in certain countries. In the US, tighter monetary policy may have indicated that yields have embarked on a long-term upswing. US markets have historically seen a negative correlation between equities and long-term interest rates, and with US equities rallying for over eight years since hitting bottom in 2009, the stock market is likely to become more sensitive to interest rate movements going forward. As such, we plan to watch this situation carefully.

Commodity prices

The worldwide electric vehicle (EV) boom is creating a sharp rise in demand for commodities such as copper, nickel, cobalt and lithium, all key components in EV motors and batteries. Cobalt and lithium, in particular, are highly scarce: more than half of the global supply of cobalt comes from south central Africa, while high-purity, stable lithium can only be produced through a limited number of methods. Natural gas is also experiencing increased demand amid a growing need for cleaner energy sources. Similarly, the supply side is facing various constraints including environmental regulations, laws limiting mining activity, and the impact of the sharp drop-off in oil-related investment that occurred in 2015-2016. We expect such structural factors to put additional upward pressure on commodity prices.

Inflation

Inflation is one of the key risk factors to watch going forward. In particular, we plan to pay careful attention to inflation trends in China and some other emerging countries, where inflationary signs are beginning to appear. At the same time, a moderate level of inflation is expected in Japan as the country nears the end of a long period of structural deflation, and a growing number of factors are supporting such inflation expectations. In addition to higher gasoline prices, the prices of green vegetables and other fresh foods are surging as the result of shrinking fishing hauls and poor weather conditions.

Moreover, while wages for ‘non-regular’ (temp and part-time) workers have been rising since 2017, many Japanese companies have raised wages of regular employees earlier this year as well. These factors are driving inflation expectations in both supply and demand terms and will likely impact interest rate trends and real estate valuations as well.