As the world experiences more extreme weather patterns and climate-related incidents, pressure is mounting to curb greenhouse gas emissions.

Carbon budget, 2C, 1.5C, the Paris Agreement, Transition Risk and Task Force on Climate-related Financial Disclosures – these are terms increasingly bandied about mainstream investor conversations. In this paper, we briefly explain where global climate action stands in relation to the key terms, with climate science speak in parentheses.

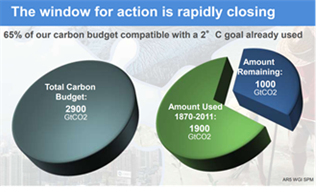

Carbon budget in a 2 degree scenario

Climate-related impacts refer to events caused or aggravated by a rise in global average temperature. This rise in temperature is due mainly to human (or “anthropogenic”) activities emitting greenhouse gases.

A 2C increase relative to preindustrial levels is set as a goal, in fear of likely non-linear, irreversible and catastrophic changes. Contrary to popular belief, this widely cited figure came from a Yale climate economist, William Nordhaus, and not the climate science community. The basic concept of the carbon budget is simple. Total emissions since the industrial revolution must be kept below a certain amount – hence, the “budget” - to achieve the 2C target. At the current pace, the ‘budget’ will be used up in less than 20 years.1

The challenge is first to have annual emissions reach a maximum (or “peak”) and then fall, in order to stay within the budget. If the peak is delayed, there will be too little time to decarbonize.

Source: IPCC Fifth Assessment Report: Synthesis Report- IPCC Intergovernmental Panel on Climate Change. December 7, 2015

Since 2011 another 300GtCO2 has been used, so less than 700GtC02 remain.

Costs of inaction

One Citi estimate expects a loss of global GDP of US$44 trillion by 2060 in a do-nothing scenario.2 There are sharply higher climate losses as the scale and number of very large climate disaster events climbs. Over the last four decades, in the U.S., the number has increased between three and five times as economic losses increased around five times to over $80 billion on average, recently exceeding $300 billion in 2017, a historical record.3

There will be more frequent extreme heat days, ‘five-sigma’ heat waves that will be ‘devastating and irreversible.’ 4 In addition, water is considered one of the primary medium in which climate-related impacts are felt. This could be through a clean water crisis in cities, rising pollution health risks, drought and degraded arable land, damage to marine ecosystems and an unstoppable rise in sea levels. All of which could lead to large-scale involuntary migration, multiplying geopolitical and, most likely, global risks.5

What about the Paris Agreement?

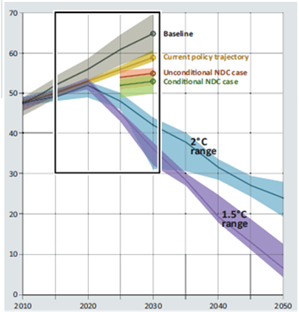

If we meet the targets set out in the Paris Agreement, are we not safe? Unfortunately not. Annual emissions have not, and do not peak under the Paris Agreement. It was lauded as a success for near global consensus for action, but the aggregate of nationally determined contributions (NDCs) are not adequate to achieve the 2C target.

Many targets are based on energy intensity, on a per GDP basis, instead of absolute emissions. The carbon budget however is based on absolute emissions - physical forces do not care about GDP.

2C and 1.5C

Source: UN Environment Programme (UNEP). The Emissions Gap Report 2017: A UN Environment Synthesis Report. November 2017

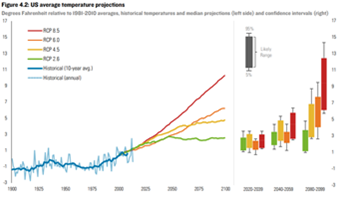

The Intergovernmental Panel on Climate Change reported that based on current trajectories, the world is to reach a 2C by 2050 and 4C by 2100. In 2016, we have reached a 1C increase; the chart below shows average temperature projections for the US.

Source: Solomon Hsiang, Robert Kopp, Amir Jina, Michael Delgado, James Rising, Shashank Mohan, Robert Muir-Wood, D. J. Rasmussen, Michael Mastrandrea, Paul Wilson, Kate Larsen and Trevor Houser. "American Climate Prospectus: Economic Risks in the United States” October 2014 (version 1.2)

Aggressive climate action needed

Much more aggressive action is needed, and the next five to 10 years is critical. Economic transition is still in the early stages, with annual emissions rising.

The IPCC’s special report just released last month laid out the benefits of limiting warming to 1.5C but also the ‘far-reaching’ and ‘unprecedented in terms of scale’ industrial transitions required to do so. Confirming that the Paris Agreement NDCs will not limit warming to 1.5C, and the benefits to keeping warming to 1.5C or below, we anticipate a re-doubled effort to strengthen policy response.

The report is, further, very suggestive of the importance and likely central role of limiting climate change to achievement of the UN Sustainable Development goals.6

If it’s 1.5C, 2C, or 4C, how much does it matter? A group of Stanford University researchers in a study earlier this year estimated that by 2100 per capita output would be 15-25% lower under the current Paris based commitments (2.5-3%C warming), as much as 30% lower under a 4C warming scenario, and that the world would be some $20 trillion cumulatively better off achieving the 1.5C target relative to 2C target, compared to the growth otherwise achievable if temperatures were at the 2000-2010 level.7

There continues to be evidence that the public and private sectors’ will to address climate risk continues to build. We especially note the following--The Task Force on Climate-related Financial Disclosures (TCFD) launched in 2016, set to be a game-changer, requires companies to disclose their governance, strategy, risk and performance in relation to climate change.

The recent Global Climate Action Summit in San Francisco saw a series of announcements made. Almost a fifth of Fortune Global 500 companies are committed to Science Based Targets initiative (SBTi), which is based on a carbon budget aligned to the 2C goal.

Economic growth and greenhouse gas emissions are decoupling. About 27 cities, including London, New York and Sydney, have reached peak emissions while their populations and economies grew by an average of 1.4% and 3% per year, respectively. The Global Green Bond Partnership was also launched to scale green bond issuances mainly by sub-national entities and corporations, as the green bond market rapidly grew from annual issuance of US$3.4 billion in 2012, to US$161 billion in 2017.

About 400 investors with US$32 trillion in assets under management are involved in one or more areas under The Investor Agenda, an umbrella of investor initiatives relating to Climate Change. Evaluating climate change risks and opportunities in business and investment decisions will be the new norm. Some climate change impacts are likely to be unavoidable, but as we see it, climate action certainly is unstoppable.

Nikko Asset Management is proud to be one of about 50 global investors - and the first one of only two asset managers headquartered in Asia – to be supporting all four areas under The Investor Agenda.

References:

- IPCC, 2015

- Energy Darwinism II Why a Low Carbon Future Doesn’t Have to Cost the Earth, August 2015, Citi GPS Jason Channell et al

- NOAA National Centers for Environmental Information https://www.ncdc.noaa.gov/billions/time-series

- BaML & World Bank, 2014

- World Economic Forum, 2017

- IPCC Global Warming of 1.5C, Headline Statements October 2018

- Large potential reduction in economic damages under UN mitigation targets. M Burke, W. M Davis, N S. Diffenbaugh. Nature May 23, 2018