Summary

- US Treasuries (USTs) registered gains in November, while yields fell along with faltering US equities. Conflicting news on US-China trade negotiations, weak economic numbers from China, and the sharp decline in global oil prices pushed yields further down. Towards the month-end, dovish comments made by Federal Reserve (Fed) Chairman Jerome Powell caused risk assets to rally.

- Overall, 2 and 10-year yields ended at 2.79% and 2.99% respectively, about 8 basis points (bps) and 16bps lower compared to end-October.

- Asian credit ended higher in November despite widening credit spreads, as UST yields moved lower. Asian high-grade returned 0.57%, despite spreads widening about 9bps. High-yield corporates underperformed, returning 0.10%, as spreads widened about 28bps.

- GDP growth in most Asian countries slowed down in the third quarter. The monetary authorities in Indonesia, South Korea and the Philippines raised their policy rates, while Malaysia announced an expansionary budget for 2019.

- Separately, the Chinese president pledged further support to the private sector.

- Meanwhile, there was a pick-up in primary market activity in November, as issuers rushed to tap the market ahead of the year end. There were 35 new issues worth around USD 16.6bn in the high-grade space, while the high-yield space saw a total of 23 issues amounting to about USD 7.2bn.

- We are positive on Indonesian bonds on the back of improving bond supply technicals and stabilising risk sentiment. We have turned positive on Philippine bonds as we expect that inflationary pressures may have peaked, especially given the recent multiple rollbacks in retail oil prices.

- On currencies, we are positive on the peso due to a seasonal surge in remittances from overseas Filipinos. We also expect the ringgit to underperform as a result of lower oil prices and weak growth.

- Asian credit spreads are likely to remain volatile heading into the final month of 2018, but with market activity and liquidity tapering into the final week of December. Progress of Brexit negotiations and the ongoing fiscal budget tussle between Italy and the European Commission remain risk events in December.

Asian Rates and FX

Market Review

USTs registered gains in November

10-year UST yields tested their multi-year highs at the start of the month, on fears that a tight US labour market will place upward pressure on wages. However, yields turned lower soon after, as US equities faltered. Conflicting news on US-China trade negotiations, weak economic numbers from China, coupled with a sharp decline in global oil prices pushed yields further down. Towards the end of the month, Fed Chairman Jerome Powell remarked that interest rates were "just below" where they should settle in the long run. This was taken by markets to suggest that the Fed is close to ending its cycle of rate hikes, causing risk assets to rally and the 10-year UST yield to dip below 3%. Overall, 2 and 10-year yields ended at 2.79% and 2.99% respectively, about 8bps and 16bps lower compared to end-October.

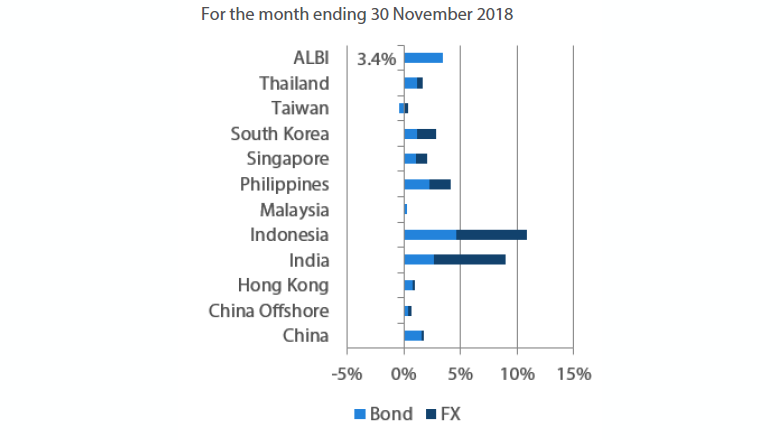

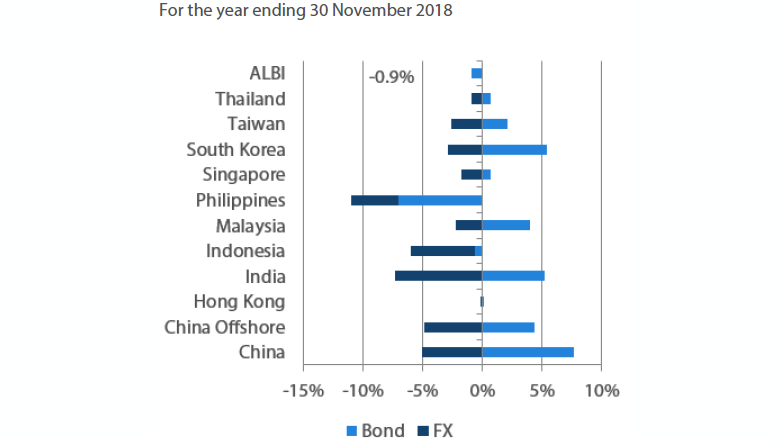

Markit iBoxx Asian Local Bond Index (ALBI)

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 November 2018

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures across Asia register mixed in October

Headline Consumer Price Index (CPI) inflation prints registered mixed across the region. Inflationary pressures rose in Indonesia and South Korea, driven partly by a pick-up in food and transport inflation. In China, a moderation in food price inflation offset the rise in non-food price inflation, leaving the headline number at 2.5% Year-on-Year (YoY) in October, unchanged from the September level. Similarly, headline CPI in the Philippines remained unchanged (albeit elevated) at 6.7%. Easing food inflation was offset by the increase in prices of energy related components. Meanwhile, inflationary pressures in India and Thailand eased. The moderation in India's headline CPI was prompted by a contraction in food inflation, while the lower CPI print in Thailand was due partly to high base effects for the energy component, as well as a further decline in raw food prices.

Third quarter GDP growth moderates

GDP growth in most Asian countries slowed down in the third quarter, with weaker exports being a main drag. In the Philippines, growth registered 6.1% YoY in the period, lower than the upwardly revised 6.2% print in the second quarter, on the back of weaker household consumption and exports. Similarly, the significant weakening in Thailand's economic activity in the third quarter, was prompted by weakening external demand, with robust domestic demand providing an offset. Third quarter growth in Indonesia registered 5.2% (from 5.3% in the second quarter), while Malaysian GDP printed 4.4% (from 4.5%) over the same period. For both countries, weaker exports was a main contributor to the moderation in economic activity. Elsewhere, third quarter GDP growth in India moderated significantly from the April to June period, due partly to a slowdown in consumption and softer net exports.

Monetary authorities in Indonesia, South Korea and the Philippines raised policy rates

The Philippine central bank raised its benchmark interest rate by another 25bps in November, citing elevated inflation expectations as the main reason for the move. The overall tone of the policy statement remained hawkish, with the monetary authority describing economic prospects as "generally favourable" and hence "allow some scope for a measured adjustment in the policy rate to rein in inflation expectations and pre-empt further second-round effects." Bank Indonesia (BI) similarly raised its policy rates by 25bps in the month. However, the Indonesian central bank's sixth rate hike this year was largely unexpected, and prompted by the need for "further measures to strengthen the efforts to lower the current-account deficit until it reaches the safe level." Similarly, the Bank of Korea announced a 25bps policy rate increase, as it prioritised narrowing the gap between its seven-day repo policy rate and the Fed fund rate, despite mounting downside pressure on the economy.

Malaysia announced an expansionary budget for 2019

Malaysian Finance Minister Lim Guan Eng unveiled an expansionary budget, projecting a fiscal deficit of 3.4% for 2019. In addition, the 2018 fiscal deficit was revised to 3.7% - substantially higher than the original 2.8% budget under the previous government - after taking into account payments for previously "unbudgeted items" that the new government uncovered. The main driver of the modest decline in the 2019 fiscal deficit is a reduction in expenditure. Although some new revenue measures were announced, the revenue base has notably narrowed, with the government resuming its heavy reliance on oil-related revenues. For 2018 and 2019, the government is projecting an expansion of 4.8% and 4.9%, respectively.

Market Outlook

Positive on Indonesian and Philippine bonds

We maintain our positive view on Indonesian bonds. Bond supply technicals further improved on the Finance Ministry's announcement that remaining bond auctions for 2018 have been cancelled. With overall risk sentiment stabilising, we believe that market focus will increasingly turn to the attractive real yields offered in the space, further boosting demand for Indonesian bonds. Indonesian authorities continue to signal that stability in the face of elevated external risks is a priority. Despite 2019 being an election year, the government has budgeted a lower fiscal deficit. These factors, taken together, provides reassurance to investors. Meanwhile, we turned positive on Philippine bonds, on the back of expectations that inflationary pressures may have peaked, especially given the recent multiple rollbacks in retail oil prices.

Positive on peso; expect ringgit to underperform

We also maintain our positive view on the peso for the rest of the year, due to a seasonal surge in remittances from overseas Filipinos. Within the region, we expect the ringgit to underperform. Lower oil prices are likely to pose a risk to the government's ability to meet its fiscal targets, which may heighten concerns of a possible credit rating downgrade for Malaysia. Moreover, against the backdrop of weak growth, Bank Negara Malaysia may turn dovish in the future.

Asian Credit

Market Review

Asia credit ended higher in November

Overall Asian credit registered positive returns in November despite widening in credit spreads, as UST yields moved lower. Asian high-grade returned 0.57%, despite spreads widening about 9bps. High-yield corporates underperformed, returning 0.10%, as spreads widened about 28bps.

Chinese president pledged further support to the private sector

Chinese President Xi Jinping held a meeting with more than 40 private business owners at the start of the month, where he assured them that policy makers will find ways to help them. Among other things, Mr. Xi mentioned ‘substantial’ tax cuts, equal treatment of the private and public sectors, lowering entry barriers to the financial markets, as well as broadening financing channels for private enterprises. A week later, China Banking and Insurance Regulatory Commission Chairman Guo Shuqing pledged that in the next three years, at least 50% of banks’ new corporate loans will be directed to private enterprises.

A pick-up in primary market activity

There was a pick-up in primary market activity in November, as issuers rushed to tap the market ahead of the year end. Total issuances amounted to about USD 28.8bn in the month, compared to about USD 19.5bn in October. The high-grade space saw about 35 new issues worth around USD 16.6bn, including a mammoth USD 4bn debutante issue from Indonesian quasi-sovereign Asahan Aluminium. Within high-yield, there was a total of 23 issues amounting to about USD 7.2bn, including a USD 1.4bn issuance from Zhongyuan Bank and USD 1.6bn issuance from Scenery Journey Ltd (a subsidiary of China Evergrande Group).

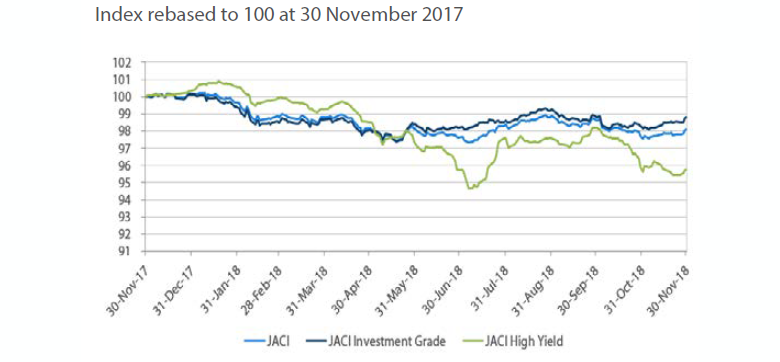

JP Morgan Asia Credit Index (JACI)

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 30 November 2018

Market Outlook

Volatility likely to persist into year-end

Asian credit spreads are likely to remain volatile heading into the final month of 2018 but with market activity and liquidity tapering into the final week of December. The first of the two key events in December was the high profile meeting between President Donald Trump and President Xi Jinping at the G20 summit. The longer term outlook remains uncertain despite the 90-day truce called by both presidents. In addition, the less hawkish tone by the Fed during the recent FOMC meeting in the middle of the month led to some volatility in risk-free rates. Progress of Brexit negotiations and the ongoing fiscal budget tussle between Italy and the European Commission remain risk events in December. Volatility in global risk assets which include developed market credits are also likely to influence sentiment towards Asia credit markets, as evident from developments in more recent months.