Summary

- In December, US Treasury (UST) yields fell as risk assets came under pressure from various factors, triggering ‘safe-haven’ buying. These factors include growth concerns in major economies, an increased likelihood of a no deal Brexit, US government shutdown and a sharp decline in energy prices. The US Federal Reserve (Fed) raised interest rates by another 25 basis points (bps) while lowering the median rate hike projection for 2019 to 2 times from 3 times, as last projected in September.

- Overall, the 10-year UST yield fell by about 30bps from 2.99% to 2.69% in the month.

- Asian credit ended higher in December with the sharp decline in UST yields supporting returns. Asian high-grade returned 1.32%, despite spreads widening about 11bps. High-yield corporates also performed well, returning 1.34%, as spreads tightened about 4bps as sentiment improved towards certain segments of the high-yield market.

- Inflationary pressures across Asia were mostly lower, particularly in the Philippines where the headline Consumer Price Index (CPI) recorded a sharp drop. Separately, the US and China reached a truce on trade disputes, while the Bank of Thailand (BoT) raised interest rates by 25bps for the first time since 2011.

- Meanwhile, the primary market activity continued to be fairly active in December. There were 20 new issues worth around USD 8.7bn in the high-grade space, while the high-yield space saw a total of 31 issues amounting to about USD 5.5bn.

- We are positive on Indonesian bonds due to the country's relatively stable inflationary pressures and the central bank's likelihood to stay on hold. Meanwhile, a more dovish new central bank governor, moderating inflation and Open Market Operations (OMO) from the RBI should lend support to Indian bonds. We also believe Chinese bonds will continue to trade firmly on the back of accommodative monetary policy from the People's Bank of China (PBoC).

- On currencies, we favour the Singapore Dollar (SGD) vis-à-vis the Malaysian Ringgit (MYR) as we expect the Monetary Authority of Singapore (MAS) to keep an appreciating FX stance, supporting demand for the SGD. In contrast, we expect the ringgit to underperform as a result of lower oil prices.

- As for Asian credit, the macroeconomic backdrop for Asian countries heading into 2019 should remain broadly neutral for credit performance. GDP growth is expected to moderate across key economies; Fiscal policy should remain supportive of growth; and with subdued inflation, monetary policy is also expected to stay neutral to accommodative. However, the risk from US-China trade conflict remains. Meanwhile, valuations look attractive from a historical context.

Asian Rates and FX

Market Review

USTs registered a strong rally in December

USTs fell in December. The ceasefire in the trade war between China and the United States after talks at the G20 summit in Argentina between U.S. President Donald Trump and Chinese President Xi Jinping did little to support sentiment. Risk assets came under continued pressure from a multitude of factors including growth concerns in major economies, an increased likelihood of a no deal Brexit, US government shutdown and a sharp decline in energy prices. Despite the market developments, the Federal Open Market Committee (FOMC) raised rates during their meeting in mid-December. It also indicated that “some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term”. Market reaction to the FOMC decision was severe with risk assets coming under further pressure. However, the widening in Asian credit spreads was just moderate. Subsequently, markets began to price out any rate hikes in 2019 causing another down move in UST yields. Overall, 2 and 10-year yields ended at 2.49% and 2.69% respectively, about 30bps lower compared to end-November.

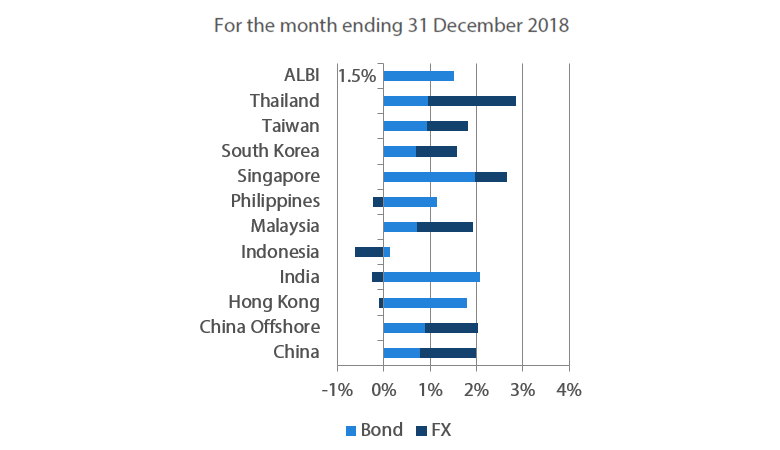

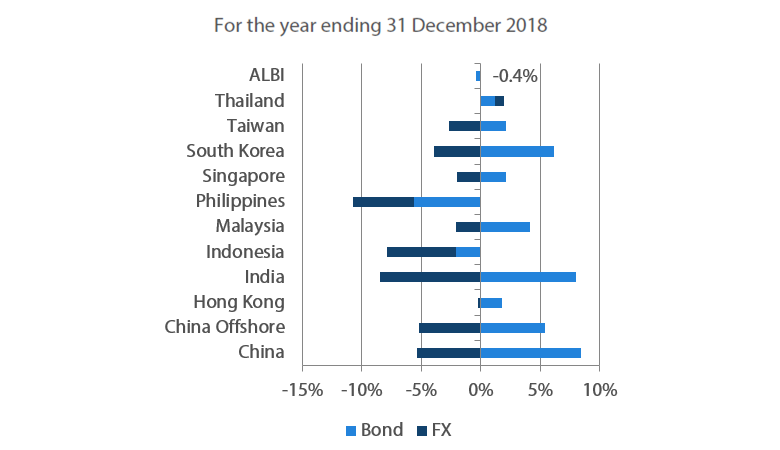

Markit iBoxx Asian Local Bond Index (ALBI)

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 December 2018

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures across Asia mostly lower

Headline CPI inflation prints registered mostly lower across the region. Particularly, headline CPI in the Philippines recorded a sharp drop. The moderation to 6.0% Year-on-Year (YoY) from 6.7% in the previous month, was prompted mainly by lower food inflation, likely reflecting a drop in rice prices. Similarly, inflation prints in Thailand, Korea, China and Singapore have all shown moderation from the previous month. On the other hand, inflationary pressures in Indonesia rose for a second straight month, due partly to a further rise in transport inflation.

US and China reached a truce on trade disputes

President Trump and President Xi declared a 90-day truce on the implementation of additional tariffs during a meeting on the side lines of the G20 summit. Both sides have also announced that trade negotiations would resume, with the White House announcing that China will be buying an unspecified "but very substantial" amount of farm, energy, industrial and other produces to reduce the bilateral trade deficit. Separately, on 1 December, the CFO of Chinese telecom giant Huawei's chairman was arrested in Canada on US request, over potential violations of US sanctions on Iran, triggering concerns on the ongoing trade negotiation.

BoT raised interest rates

For the first time since August 2011, the BoT voted 5 to 2 to raise the policy rate by 25bps to 1.75%. The central bank also lowered its growth forecasts for 2018 and 2019 by 20bps each, to 4.2% and 4.0% respectively. Still, the central bank described economic growth as "consistent with its potential" and noted that tourism had "started to show signs of improvement." Meanwhile, Thailand's Monetary Policy Committee expected its projection for headline inflation to be broadly unchanged, while core inflation was expected to rise on gradual increases in demand-side pressures.

Market Outlook

Positive on Indonesian, Indian and Chinese bonds

Markets are increasingly pricing in a less aggressive Fed for 2019. Against such a backdrop, we believe that higher yielding bonds are likely to outperform, supporting our constructive views on Indonesian and Indian bonds. Relatively stable inflationary pressures, coupled with a central bank that is likely to stay on hold, will boost demand for Indonesian bonds as market focus turns to attractive real yields offered in the space. Meanwhile, a more dovish new central bank governor, moderating inflation and OMO from the RBI should lend support to Indian bonds. Separately, we believe that Chinese bonds will continue to trade firmly on the back of accommodative monetary policy from the PBoC.

Favour Singapore Dollar vis-a-vis the Malaysian Ringgit

We favour the SGD vis-à-vis the MYR. As Singapore core inflation prints remain elevated, the MAS is likely to keep an appreciating FX stance, supporting demand for the SGD. In contrast, lower oil prices pose a risk to Malaysia's ability to meet its fiscal targets, which may heighten concerns of a possible credit rating downgrade for Malaysia.

Asian Credit

Market Review

Asian credit ended sharply higher in December

Asian credit registered positive returns in December with the sharp decline in UST yields supporting returns. Asian high-grade returned 1.32%, despite spreads widening about 11bps. High-yield corporates also performed well, returning 1.34%, as spreads tightened about 4bps as sentiment improved towards certain segments of the high-yield market.

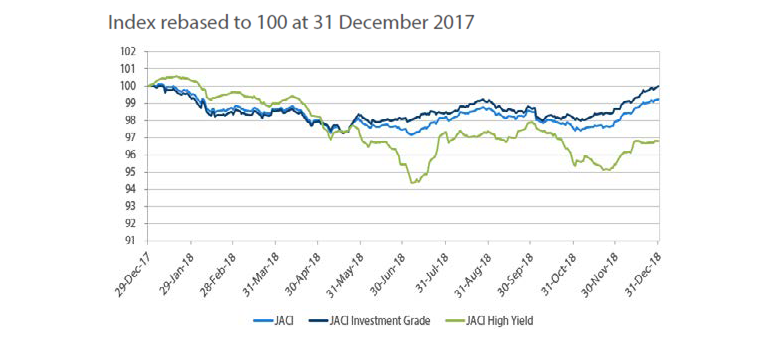

Strong December returns capped a volatile 2018

The strong returns in December capped a volatile year for Asian credit. For 2018, high-grade returned -0.04% recovering from a -2.74% return in May with spreads widening by about 55bps over the year. High-yield corporates fared worse returning -3.24% recovering from a -5.74% return in June, as spreads widened 165bps in 2018. Over the year, intensifying trade tensions between the US and China, concerns that China’s deleveraging efforts have started to tighten financial conditions onshore and further weigh on domestic growth, and broader Emerging Market developments have weighed on spreads. For high-yield, a shift in supply and demand dynamics provided yet another headwind. Tighter liquidity conditions in the onshore Chinese market caused Chinese offshore bond supply to remain heavy, but simultaneously moderated demand from onshore investors.

Primary market activity remained buoyant

Primary market activity continued to be fairly active in December. Total issuances amounted to about USD 14.2bn in the month, compared to about USD 23.8bn in November. The high-grade space saw about 20 new issues worth around USD 8.7bn including USD 3bn from a 3 tranche Indonesian sovereign issuance. Within high-yield, there were a total of 31 issues amounting to about USD 5.5bn. For the year, total issuance was around USD 231bn with high-grade accounting for around 70% of the total. This was lower than the more than USD 300bn in 2017 but still higher compared to preceding years.

JP Morgan Asia Credit Index (JACI)

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 December 2018

Market Outlook

Volatility likely to persist into 2019

Heading into 2019, the macroeconomic backdrop for Asian countries should remain broadly neutral for credit performance. GDP growth is expected to moderate across the key economies, notably China, although hard landing scenarios are not expected to materialise. Fiscal policy should remain supportive of growth in most Asian economies, notably China, and act as a stabiliser to weakness in external and private domestic demand. Given the national elections in India and Indonesia, some fiscal slippage is to be expected, although the broad fiscal consolidation trend in these countries remain intact and is likely to resume in the coming years. Last but not least, with inflation remaining subdued, monetary policy is expected to stay neutral to accommodative across most Asian economies. The US and China are currently in negotiations to resolve the trade conflict, with a tentative deadline of 1 March 2019 to reach a deal. Failure to come to a compromise, on trade and other strategic issues, will likely be negative for credit spreads and broader risk environment.

Valuations look attractive from a historical context

Both high-grade and high-yield spreads have cheapened over the course of 2018. High-grade spreads are at 214bps, which is near the historical post global financial crisis mean level. With the high-yield underperformance in 2018, high-yield corporate spreads at 621bps have cheapened to a level last seen in 2016. Even after the rally in UST yields in December, high-grade yields have risen to a more attractive level of 4.79%; a level last seen during the taper-tantrum in 2013 prior to this sell-off in 2018. Similarly, high-yield corporate yields has risen to 8.87%; a level last seen in 2012 after the European crisis.