Summary

- The MSCI AC Asia ex Japan (AxJ) Index fell by 2.6% in USD terms in December, as concerns about slowing global growth, tightening monetary policy and rising geopolitical tensions continued to drive sentiment.

- The US Federal Reserve (Fed)'s decision to raise interest rates for the fourth time this year caused some uneasiness, while crude prices continued to fall on fears of oversupply and weak global growth.

- China returned -5.1% in USD terms and was the weakest performer in the region over the month and year. Economic data was lacklustre, as its deleveraging efforts continued to bite.

- Korea and Taiwan also declined as the US-China trade war and a slowdown in demand for smartphones hurt their technology sectors.

- Conversely, India edged higher as falling crude oil prices eased concerns about its current account deficit. However, central bank chief Urjit Patel’s resignation sparked uncertainty about the direction of India’s monetary policy.

- Within ASEAN, the Philippines was the best performer, while Singapore and Thailand saw negative returns. The Bank of Thailand raised its key policy rate for the first time since 2011, and cut its 2018 GDP growth forecast to 4.2%.

- In recent months, the market has been more focused on pricing risk than on any structural stories. As a result, valuations have become extremely attractive across large swathes of the Asia ex-Japan universe, particularly in China, Indonesia and select areas within India.

- For investors with a longer term horizon, the current backdrop throws up inexpensive opportunities to pick up quality franchises benefiting from structural tailwinds.

Asian Equity

Market Review

Asian equities fell in December

Asian stocks declined in December, closing out a challenging year with the MSCI AC Asia ex Japan (AxJ) Index falling by 2.6% in USD terms. Concerns about slowing global growth, tightening monetary policy and rising geopolitical tensions continued to drive sentiment over the month. The US Federal Reserve (Fed)’s decision to raise interest rates for the fourth time this year caused some uneasiness, while the US government shutdown further added to the uncertainty. Meanwhile, crude prices continued to fall on fears of oversupply and weak global growth. At the month-end, markets recovered some losses after Donald Trump mentioned “big progress” on resolving the trade war with China.

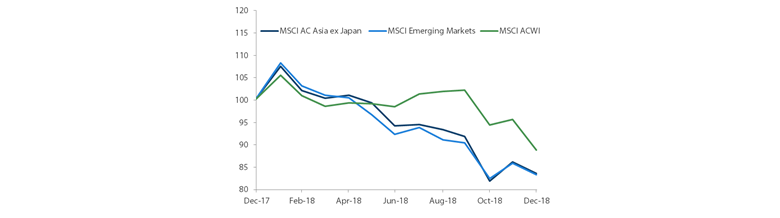

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 December 2018. Returns are in USD. Past performance is not necessarily indicative of future performance.

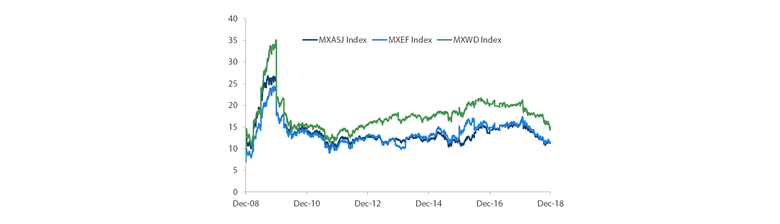

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 31 December 2018. Returns are in USD. Past performance is not necessarily indicative of future performance.

China was the biggest laggard over the month and year

China returned -5.1% in USD terms in December and was the weakest performer in the region over the month and year. Economic data was lacklustre, as its deleveraging efforts continued to bite: manufacturing PMI contracted in December for the first time in over two years, while growth in industrial output and retail sales slowed. The People's Bank of China left benchmark interest rates unchanged and signalled it would not resort to significant monetary stimulus in 2019, but it launched a new medium-term lending tool to spur lending to smaller firms. In corporate news, Tencent rebounded after China ended its nine-month freeze on video game licences. Hong Kong edged lower by 0.3%. While the property sector continued to be weak, unemployment remained at its lowest level in 20 years.

Korea and Taiwan weighed down by their technology sectors

Korea and Taiwan also declined as the US-China trade war and a slowdown in demand for smartphones hurt their technology sectors. Taiwan's PMI fell to a three-year low of 47.7, and consumer confidence dipped. Korea's manufacturing PMI also remained in contractionary territory in December. The Bank of Korea said it would keep monetary policy accommodative in the face of low inflationary pressure and slowing economic growth.

India benefited from lower oil prices

Conversely, India edged higher by 0.5% in USD terms as falling crude oil prices eased concerns about its current account deficit. However, central bank chief Urjit Patel resigned after a stand-off with the Modi government, sparking uncertainty about the direction of India's monetary policy. He was replaced by Shaktikanta Das, who oversaw Modi's demonetisation programme in 2016.

ASEAN ended mixed

Meanwhile, ASEAN markets ended December mixed. The Philippines was the best performer in the region, while Singapore and Thailand saw negative returns. Apart from being a beneficiary of lower oil prices, the Philippines was also buoyed by easing inflation concerns, given government efforts to stabilise the cost of rice. The central bank left its interest rate unchanged for the first time in six meetings as inflation eased and the peso strengthened. Elsewhere, the Bank of Thailand raised its key policy rate for the first time since 2011, and cut its 2018 GDP growth forecast to 4.2%. In addition to the global market weakness, Singapore shares were also weighed down by disappointing manufacturing data. The Ministry of Trade and Industry estimated that 4Q18 GDP growth would come in at 2.2%, below economists' forecasts.

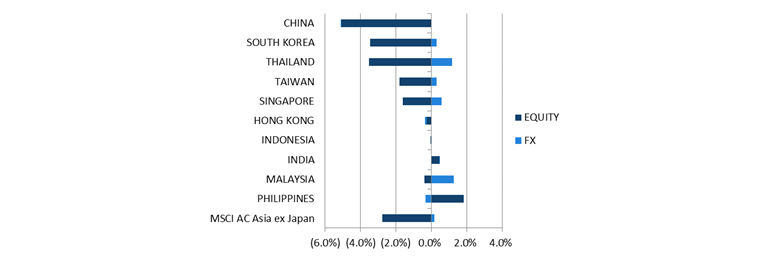

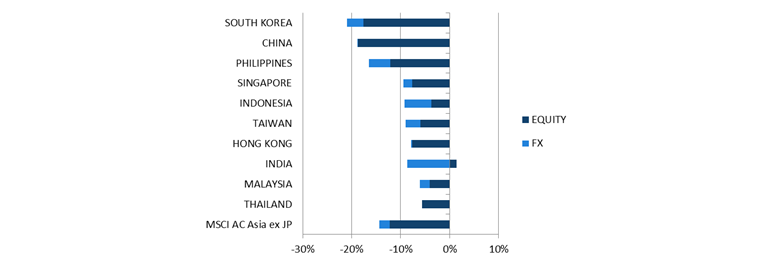

MSCI AC Asia ex Japan Index1

For the month ending 31 December 2018

Source: Bloomberg, 31 December 2018

For the period from 31 December 2017 to 31 December 2018

Source: Bloomberg, 31 December 2018

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Valuations in Asia continue to be attractive

As we look forward to the coming year, uncertainties about the global trade outlook, slower global economic growth and tight global liquidity conditions continue to be reasons for caution. Any encouragement for Asian markets would likely have to come from the underlying policy directions of both the Federal Reserve and Chinese authorities. Investors will also be paying close attention to critical national elections which are happening across almost half our markets. While we are cognizant of the risks of undesired surprises, our expectations are for most of these elections to yield investor-friendly results, which could fuel further momentum for reforms in the region.

In recent months, the market has, justifiably, been more focused on pricing risk than on any structural stories. As a result, valuations have become extremely attractive across large swathes of the Asia ex-Japan universe, particularly in China, Indonesia and select areas within India. For investors with a longer term horizon, the current backdrop throws up inexpensive opportunities to pick up quality franchises benefiting from structural tailwinds.

Focus on China sectors orientated towards domestic consumption, healthcare and software

Beyond the near-term cyclical developments in the economy, we believe China's commitment to reform remains resolute. The shift from quantity to quality of growth should continue over the medium term. However, we expect the government could briefly take its foot off the gas on the ongoing deleveraging campaign in order to provide some stability in the short run. In particular, support for consumers will be paramount, as evidenced by recent incremental policy changes. Going into 2019, regulatory pressure on the country's structural areas of growth should also subside. These areas include the Fund's core long term holdings of insurance, healthcare, software and select consumer sub-sectors. An accelerated A-share inclusion to major global indices could be one of the many potential catalysts for renewed interest in China's structural stories.

Favour private sector banks and real estate sector in India

India faces a pivotal 2019 as it heads into election season against the backdrop of a mixed macro environment. Tension has been rising especially after a series of weak state election results for the ruling BJP party, and there is limited room for any fiscal easing in the run up to the national election. While economic growth is slowing, business sentiment continues to be positive and companies expect prospects to be brighter going forward. Our long term constructive view of the country remains unchanged given a number of positive structural reforms in recent years. At the same time, we are cautious about stresses within the financial sector, and growth uncertainty in the run up to national elections. We remain focused on strong private sector banks and the real estate sector where we believe regulatory-led consolidation will yield opportunities for the strongest players.

Remain selective in Korea and Taiwan

In Korea, sentiment has turned as the market's focus shifted from reconciliation with North Korea to the lacklustre domestic economy. The country's political outlook is also increasingly murky, with President Moon's approval ratings sliding amid concerns about his populist policies. The move to increase the minimum wage has in part been responsible for the uptick in unemployment rates. In addition, the politically driven crackdown on chaebols via an extraordinarily hawkish stance on the economy's promising nascent industries could also have further negative ramifications on the economy in the long run. In the technology sector, trade issues together with waning demand growth and capacity expansions are likely to lead to further downside in both the memory and hardware sectors which are large components of the Korean and Taiwanese markets. Hence we remain selective across both markets with a focus on healthcare, some niche technology companies and electric vehicles.

Maintain underweight in ASEAN

ASEAN will also see several political contests in 2019, with national elections in Thailand and Indonesia and a midterm election in the Philippines. It will be a test for Thailand, in particular, which will be holding its first national election since the coup four years ago. Early polls, barring negative surprises, suggest status quo outcomes across these countries, which should bode well for stability and renewed capital flows in the region. Domestic conditions are also showing nascent signs of recovery in places like Indonesia where consumption is gradually improving. Delayed monetary tightening in the Philippines has yet to work its way through the economy, which warrants a wait-and-watch approach.

Appendix

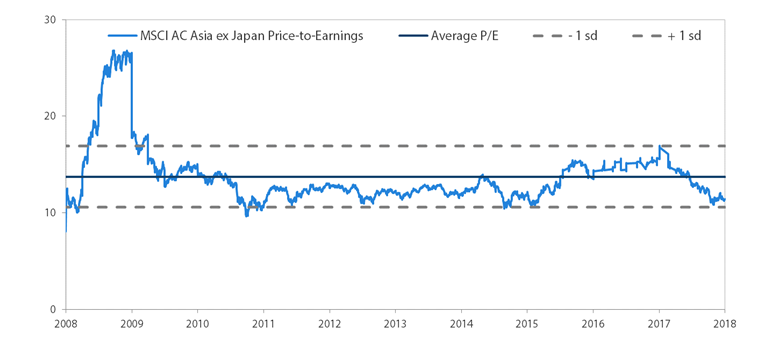

MSCI AC Asia ex Japan Price-to-Earnings

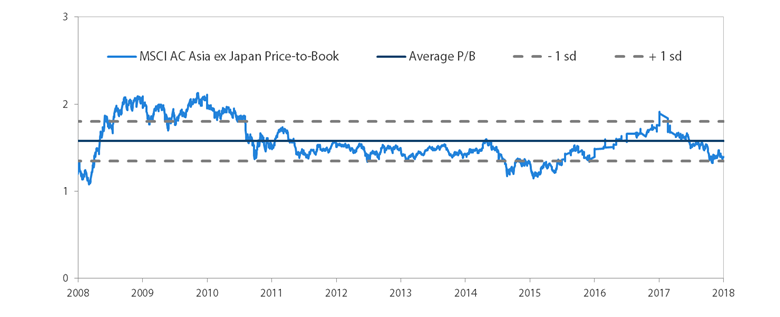

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 December 2018. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.