Summary

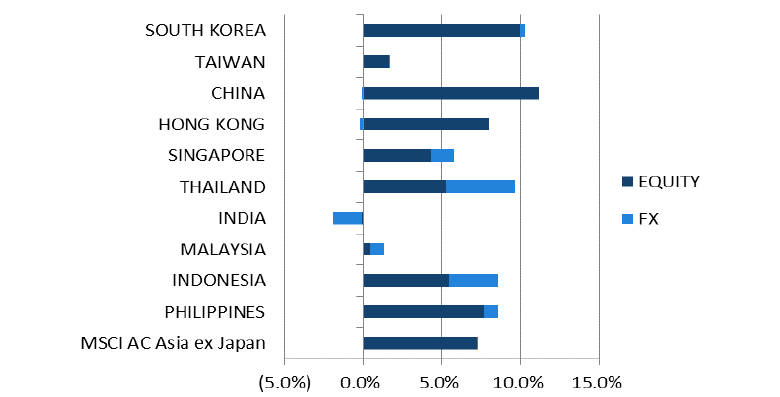

- The MSCI AC Asia ex Japan (AxJ) Index gained 7.3% in USD terms in January. At the month-end, the US Federal Reserve (Fed) kept interest rates on hold and struck a more dovish tone than expected, raising risk appetite. Signs of progress in the US-China trade talks also buoyed sentiment. Most Asian currencies appreciated against the USD, while oil prices rose.

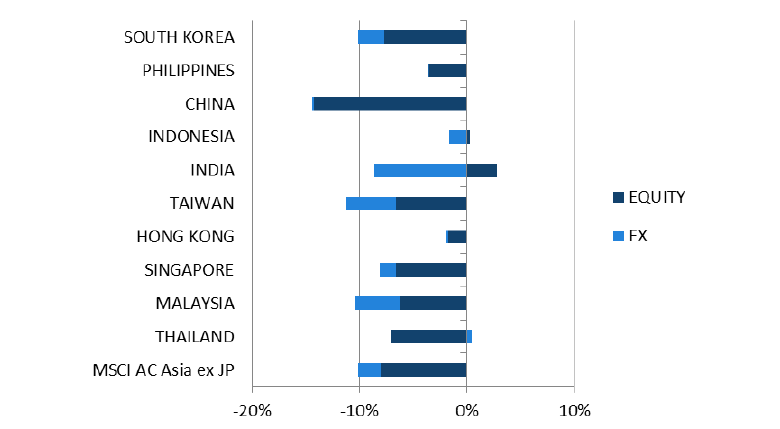

- China and Hong Kong outperformed on the back of optimism around trade negotiations, although economic data continued to be lacklustre. South Korea also did well, underpinned by semiconductor stocks such as Samsung Electronics and Hynix. Conversely, Taiwan underperformed with a gain of 1.7% in USD terms.

- ASEAN generally rallied in line with the benchmark, except Malaysia which edged higher by 1.4% in USD terms. The Philippines benefited from lower oil prices and government efforts to stabilize the cost of rice. India was the only market with a negative return in January, as rising oil prices weighed on the rupee.

- While valuations across most Asia ex-Japan markets are attractive, and the risk-reward favourable, geopolitical events will make for volatile times. With years of cheap and abundant capital now behind us, equity risk premia will rise. Domestic politics will also play a major hand in the region. We continue to invest with a medium- to long-term horizon, opportunistically adding quality franchises with sustainable business moats.

Asian Equity

Market Review

Asian equities gained in January

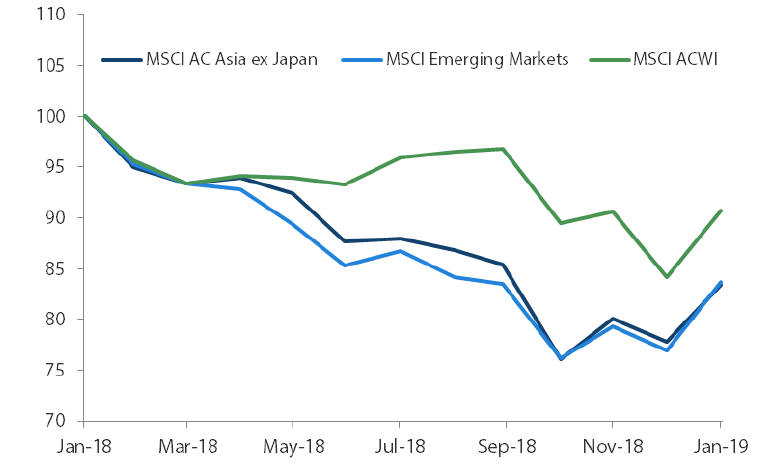

Asian stocks rebounded in January, with the MSCI AC Asia ex Japan (AxJ) Index gaining 7.3% in USD terms. Technology stocks in particular recovered from their steep declines in December. Some gains were capped by worries over slowing growth in the Eurozone and caution ahead of US-China trade negotiations. Tensions between the two countries had risen after the US filed charges against China’s Huawei for stealing American technology and breaking sanctions against Iran. At the month-end, however, the US Federal Reserve (Fed) kept interest rates on hold and struck a more dovish tone than expected, raising risk appetite. Signs of progress in the US-China trade talks also buoyed sentiment. Most Asian currencies appreciated against the USD in the month, while oil prices rose, breaking their three-month long losing streak.

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 January 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

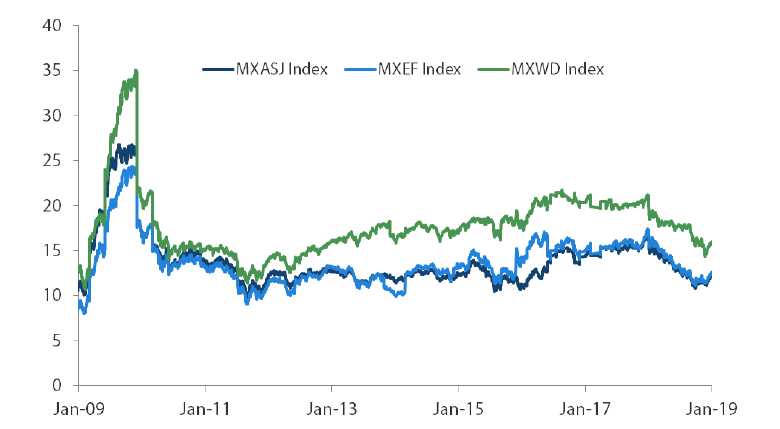

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 31 January 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

China, Hong Kong and Korea outperformed, but Taiwan lagged

China and Hong Kong outperformed with respective gains of 11.1% and 7.8% in USD terms. Optimism around the trade negotiations buoyed sentiment, although economic data continued to be lacklustre. China's fourth-quarter GDP growth came in at 6.4%, mainly due to its crackdown on financial leverage and the impact of the trade war. Manufacturing PMI also remained in contractionary territory in January, although it edged up to 49.5 from December's reading of 49.4. However, thanks to a raft of stimulus measures, fixed asset investment growth stabilised in 2018, while retail sales and industrial production rebounded in December. In early January, the People's Bank of China cut banks' reserve requirement ratio by 100 basis points (bps).

Elsewhere in North Asia, South Korean stocks surged in January, gaining 10.3% in USD terms. Semiconductor stocks, namely Samsung Electronics and Hynix, were among the top performers. Taiwan rose by 1.7%, underperforming its regional peers. On the corporate front, TSMC cut its revenue growth forecast in 2019 and announced plans to slash investments, citing weak demand of smartphones.

ASEAN generally rallied in line with the index

Within ASEAN, Thailand was the strongest performer with a return of 9.7%, while Malaysia lagged with a 1.4% gain. Inflation prints mostly moderated across the region in December, with food inflation falling in the Philippines, Thailand and Indonesia. Central banks also left interest rates unchanged after having tightened policy in late 2018. The Philippine economy grew by 6.1% in 4Q18, although full-year growth missed the government's target. The Thai baht was the best-performing currency on the back of strong foreign direct investment, its current account surplus and lower oil prices. Markets were also cheered by the announcement of its national elections on 24 March, after repeated delays in scheduling the vote.

India was the only market with a negative return

Conversely, India declined by 1.9% in USD terms and was the only market with a negative return in January. Rising oil prices weighed on the rupee, while there was general caution ahead of the 2019 budget announcement. Growth in its services and manufacturing sectors also slowed in December, with the composite PMI falling to 53.6 from November's reading of 54.5.

MSCI AC Asia ex Japan Index1

For the month ending 31 January 2019

Source: Bloomberg, 31 January 2019

For the period from 31 January 2018 to 31 January 2019

Source: Bloomberg, 31 January 2019

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Valuations in Asia continue to be attractive, but volatility is likely to persist

The positive start to equity markets in 2019 should not be construed as a harbinger of the year to come. While valuations across most Asia ex-Japan markets are attractive, and the risk-reward favourable, geopolitical events will make for volatile times with risk-on playing hide-and-seek with risk-off. The Fed's apparent bowing to pressure to 'ease', and the Reserve Bank of India following suit, does not necessarily mean easier monetary conditions. With years of cheap and abundant capital now firmly behind us, equity risk premia globally will rise; some of this has been priced in, particularly in emerging markets, and notably in China. Domestic politics will also play a major hand in most markets the Fund invests in. It therefore behoves us to tread carefully, and continue to invest with a medium- to long-term horizon in mind, opportunistically adding quality franchises with sustainable business moats.

Focus on China sectors orientated towards insurance, healthcare and software

China's commitment to deleveraging the economy was perhaps too effective, slowing down growth more than expected. However, the efforts by the government to ease have not followed playbooks from the past of relying on large scale, arguably indiscriminate fixed asset investment. The shift in focus from quantity to quality remains firmly in place evidenced by the fact that easing has been through more formal channels than in the past. The Fund's stance with regards to core long term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged. An accelerated A-share inclusion to major global indices could drive renewed interest in China's structural stories.

Favour private sector banks and real estate sector in India

India faces a pivotal 2019 as we head into election season against a mixed macro environment. Discordant noises, both within the ruling Bharatiya Janata Party (BJP), and from rival parties, notably the Congress which won a couple of key state elections, is on the rise. The Reserve Bank of India's surprise rate cut just after month end does not augur well given India's fiscal situation. Growth remains uninspiring, even as companies report some signs of green shoots. Thus, the relative risk-reward trade off warrants a more cautious stance, with a focus on strong private sector banks and the real estate sector where we believe regulatory-led consolidation will yield huge opportunities for the strongest players.

Remain selective in Korea and Taiwan

Multiple headwinds plaguing the technology sector, namely the US-China trade spat, waning demand growth, and continued capacity expansion, suggest tough times will likely continue; this sector accounts for a big chunk of the equity markets in both Korea and Taiwan. In addition, in Korea, the economic outlook is also increasingly murky, with President Moon's approval ratings sliding owing to the fall-out of his populist policies. Hence we remain selective in both markets, choosing to focus on healthcare, electric vehicle, and certain niche technology companies.

Maintain underweight in ASEAN

ASEAN will see political contests in 2019: national elections in Thailand and Indonesia, mid-term elections in the Philippines. It will be a test for Thailand, in particular, which will be holding its first national election since the coup four years ago. There are signs of a nascent recovery in consumption in Indonesia. Both Indonesia & Thailand are relatively favoured. Delayed monetary tightening in the Philippines has yet to work its way through the economy, which warrants a wait-and-watch approach.

Appendix

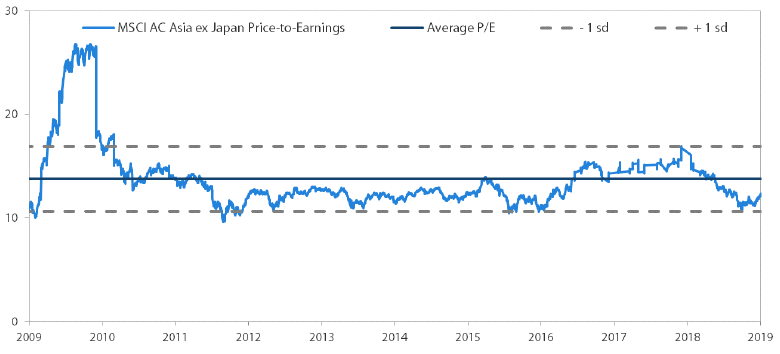

MSCI AC Asia ex Japan Price-to-Earnings

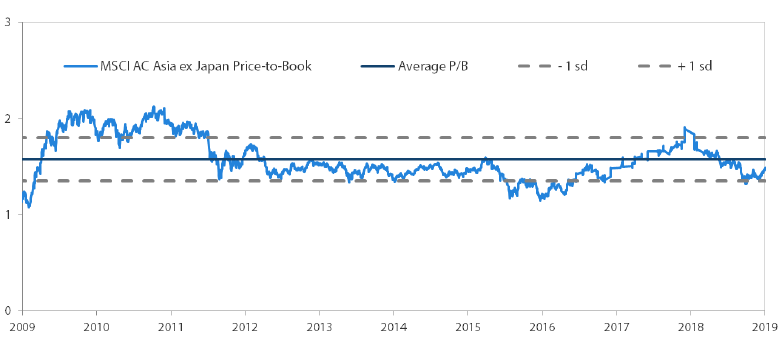

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 January 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.