Summary

- US Treasuries (USTs) ended stronger in January. There was renewed optimism in markets, prompted largely by further policy easing in China and dovish communication from the US Federal Reserve (Fed). The Fed also left interest rates unchanged, signalling that additional rate increases could be in for a major pause. Overall, 2 and 10-year yields ended at 2.46% and 2.63%, respectively, about 3 basis points (bps) and 6bps lower compared to end-December.

- Asian credit registered strong gains in January, driven mainly by tighter credit spreads, although UST yields also ended lower. In total returns, Asian investment grade was up 1.60%, with spreads narrowing about 13bps, while high-yield corporates outperformed, returning 3.24%, with spreads ending about 49bps tighter.

- Inflationary pressures mostly moderated across Asia in December, prompted in part by the correction in global oil prices. The fourth quarter GDP growth accelerated in the Philippines and South Korea, but moderated in Singapore and China. Separately, China's central bank announced another reserve requirement ratio (RRR) cut and introduced central bank bills swap.

- Meanwhile, the primary market activity remained robust. The investment-grade space had a total of 26 new issues amounting to USD 13.35bn, while the high-yield space saw a total of 43 new issues amounting to around USD 15.33bn.

- Against a backdrop of a dovish Fed, we have a positive bias towards high yielders such as Indonesian and Philippine bonds. Additionally, we believe that the inclusion of RMB-denominated government bonds into Bloomberg's index will boost demand for China bonds. We also expect Asia currencies to generally do well, although the Philippine Peso (PHP) may lag.

- As for Asian credit, the Fed’s dovish tone is supportive of returns in the near term. However, returns would also be dependent on the progress made from the US-China trade talks where some positive outcome seems largely priced in. Heading further into 2019, Fed policy tightening remains a possibility if the US economy continues to perform strongly. Meanwhile, technicals have become more positive in January, and this looks set to continue into February. Additionally, valuations look more neutral from a spread perspective after the tightening in January. All-in yields are also at reasonably attractive levels.

Asian Rates and FX

Market Review

USTs ended stronger in January

There was renewed optimism in markets in January, prompted largely by further policy easing in China, together with dovish communication from the US Fed. The improvement in risk sentiment was further bolstered by suspension of the government shutdown, as well as news that China was sending high-level delegates for trade talks in the US. At the end of the month, the Fed left interest rates unchanged, signalling that additional rate increases could be in for a major pause, after it dropped explicit references to future interest rate increases. This prompted UST yields to drop sharply. Overall, 2 and 10-year yields ended at 2.46% and 2.63% respectively, about 3bps and 6bps lower compared to end-December.

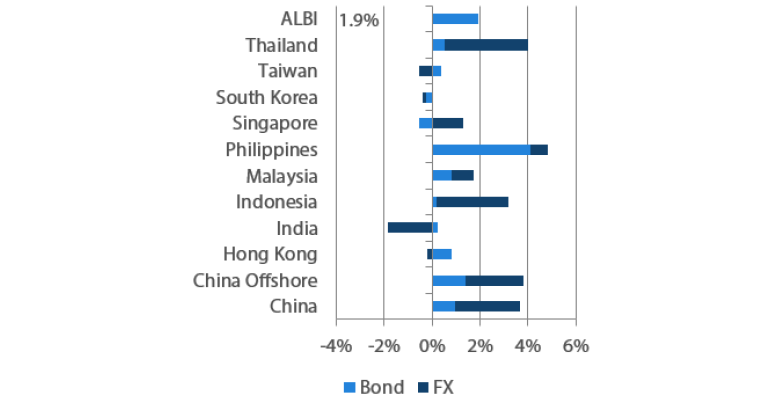

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 January 2019

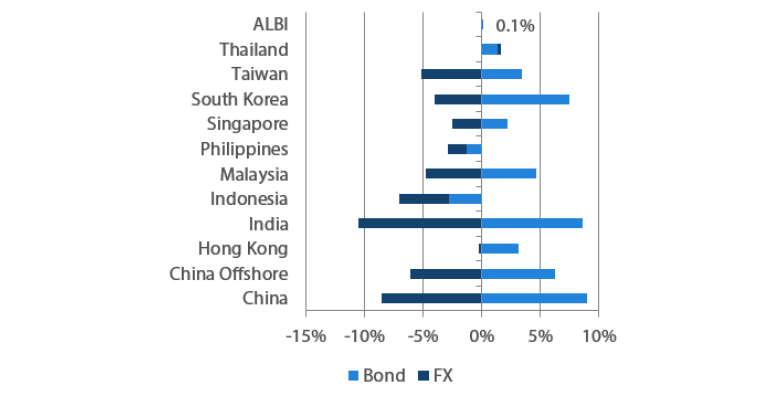

For the year ending 31 January 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 January 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Fourth quarter growth in the Philippines and South Korea accelerate, moderate in Singapore and China

The Philippine economy grew slightly faster in the last quarter of 2018, with the rebound driven mainly by construction, trade and repair of vehicles and household goods, and other services. Consequently, full-year 2018 GDP growth registered 6.2%, below the 6.5-6.9% full-year target of the Duterte administration. The South Korean economy expanded 3.1% Year-on-Year (YoY) in the same period, accelerating from the 2% rise in the previous quarter, as government spending jumped. For the whole of last year, the economy grew 2.7% - the slowest expansion in six years. In contrast, the economic slowdown in China deepened in the last three months of 2018, on the back of weakness in the service and farm sectors. For the full-year 2018, China recorded a 6.6% growth rate – the slowest annual pace since 1990. Similarly, the flash estimate of fourth quarter GDP growth in Singapore came in slightly slower than the previous quarter at 2.2% YoY. Manufacturing was the main driver of growth, as the electronics and biomedical sub-sectors grew strongly. This brought Singapore's full year 2018 GDP growth to 3.3%.

Inflationary pressures moderate across Asia

Headline Consumer Price Index (CPI) inflation prints moderated across Asia in December, prompted in part by the correction in global oil prices. Headline CPI in the Philippines recorded another sharp drop. Apart from slower gains in transport costs, the drop in the headline number to 5.1% YoY was also aided by lower food inflation. In Thailand, the headline number registered 0.4% in December, dragged down by food and energy prices, as well as a favourable base effect. Inflationary pressures in South Korea similarly moderated, as petrol prices dropped. Elsewhere, softer non-food inflation was the primary driver of China's lower headline number, and the drop in oil prices prompted softer inflation prints in India. Meanwhile, headline CPI inflation in Malaysia rose 0.2% YoY in December, matching the pace in November, while a moderation in accommodation cost deflation prompted the higher headline CPI print in Singapore.

Chinese RMB-denominated bonds to be added to Bloomberg Index

Towards month-end, Bloomberg announced that Chinese RMB-denominated government and policy bank securities will be added to the Bloomberg Barclays Global Aggregate Index from April 2019. The data provider said that the inclusion will be phased in over a 20-month period and added that, once fully accounted for in the index – which is currently tracked by an estimated USD 2.5tr of funds - the RMB will be the fourth largest currency component.

Market Outlook

Positive on China, Indonesian and Philippines Bond

We believe the Fed's tilt towards a more patient and less aggressive tightening pace means demand for regional bonds will be well supported. Against such a backdrop, we have a positive bias towards high yielders such as Indonesian and Philippine bonds. Relatively stable inflationary pressures, coupled with a central bank that is likely to stay on hold, will boost demand for Indonesian bonds as focus turns to the attractive real yields offered in the space. Indonesian authorities continue to signal that stability in the face of elevated external risks is a priority. Meanwhile, inflationary pressures in the Philippines have peaked, as headline CPI declined in recent months. Consequently, inflation expectations are likely to adjust lower, which should be positive for Philippine bonds. Meanwhile, we believe that the inclusion of RMB-denominated government bonds into Bloomberg's index will be a boost to demand.

Expect Asia currencies to generally do well, although PHP may lag

We expect Asian currencies to generally hold up well as markets increasingly price in a slower pace of Fed tightening. We anticipate the RMB to outperform regional peers, on the view that the inclusion of RMB-denominated bonds into Bloomberg's index, together with progress in trade talks with the US will offer strong support for the currency. In contrast, we anticipate the Philippine Peso to lag regional peers, as risk of continued deterioration in the current account persists on the back of the infrastructure build-out.

Asian Credit

Market Review

A strong start to the year

Asian credit registered strong gains in January, driven mainly by tighter credit spreads, although UST yields also ended lower. In total returns, Asian investment grade was up 1.60%, with spreads narrowing about 13bps, while high-yield corporates outperformed, returning 3.24%, with spreads ending about 49bps tighter.

China’s economy slowed to 6.6%; policymakers announced another RRR cut

The economic slowdown in China deepened in the final quarter of 2018. Weakness in the service and farm sectors were the primary drag to growth, which printed 6.4% YoY in the fourth quarter. For the full-year 2018, China recorded a 6.6% growth rate – the slowest annual pace since 1990. Meanwhile, the Chinese central bank further freed up funds for banks by reducing cash reserve requirements by 100bps. The first 50bps reduction was effective 15 January, with the second 50bps cut effective 10 days later. The move almost immediately followed calls from Premier Li Keqiang for more aggressive policy easing and better use of RRR cuts. Separately, the People’s Bank of China (PBoC) also announced a new central bank bill swap, allowing holders to swap commercial bank perpetual debt for central bank bills, a move which it hopes will “increase the financing support for the real economy.”

Primary market activity remained robust

Activity in the primary market remained robust. The investment-grade space had a total of 26 new issues amounting to USD 13.35bn, including a USD 1.5bn sovereign issue from the Philippines. Meanwhile, the high-yield space saw a total of 43 new issues amounting to around USD 15.33bn. Notably, Chinese property developers were the active issuers within the high-yield space, which included a USD 3bn three tranches deal from China Evergrande.

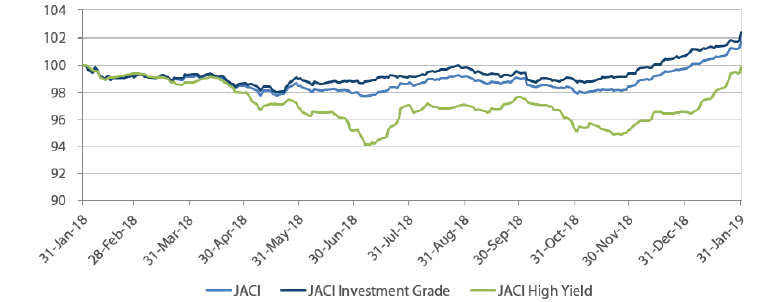

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 January 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 January 2019

Market Outlook

Dovish Fed supportive of returns in the near-term; near-term technicals positive

The dovish tone struck by the Fed is supportive of credit spreads in the near-term. However, returns in the next few months would also depend on the progress made from the US-China trade talks where some positive outcome seems largely priced in. Heading further into 2019, the resumption of Fed policy tightening remains a possibility if the US economy continues to perform strongly. Fading trade tensions and stabilising growth in China would be less supportive of UST yields and returns. Meanwhile, technicals have become more positive in January, and this looks set to continue into February. Inflows into emerging market hard currency debt have risen sharply in January, which is supportive for demand technicals. On the supply front, new issuances for Asia high-grade came in less than expected, which was less than amounts seen in the last 2 years. While the high-yield supply was robust, this was easily absorbed with the more benign risk environment. The introduction of the new central bank bill swap by Chinese authorities is also supportive for technicals, especially for Chinese USD bank perpetual securities by making it more attractive for Chinese banks to issue onshore in addition to enjoying more favorable onshore pricing at the moment.

Valuations look more neutral; all-in yields reasonable

After the tightening in January, valuations look more neutral from a spread perspective. High-grade spreads have declined to slightly below the post-GFC historical mean levels while high-yield corporate spreads ended slightly above the mean levels. While all-in yields for high-grade have declined sharply from the peak of around 5.07% to 4.59%, with the rally in risk-free rates in the past few months, yields are back to the level last seen in April 2018 and remain at reasonably attractive levels which is higher than historical mean levels. High-yield corporates are also offering yields at levels not often seen outside crisis periods.