Emerging markets (EM) slid from February through the year-end on the back of a stronger dollar, an escalating trade war and notably weaker growth in China. However, we see evidence that these previous headwinds may now be turning into tailwinds. While uncertainty remains, the outlook is certainly greatly improved, especially given attractive valuations.

Aggressive US Federal Reserve (Fed) tightening, coupled with a fiscal boost to growth, kept the dollar strong, which is invariably a broad headwind against EM assets. However, the fiscal boost is wearing off and the Fed has turned dovish, which suggests the tightening cycle may be coming to an end.

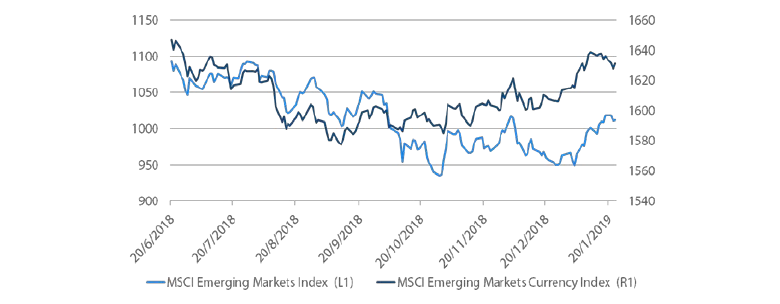

While equities continued to sell off through the year-end on a deteriorating growth outlook, EM currencies actually began to outperform the dollar beginning in late September.

Chart 1: Emerging equities versus currency

Source: Bloomberg, January 2019

Counterintuitively, the broad equity sell-off which finally enveloped the US beginning in early October might have been a positive for EM, as it was enough to cause the Fed to rethink its pace of tightening – not just in rates but also in balance sheet reduction. The sharp drop in US equities also demonstrated that the US is not immune to the negative effects of rising tariffs, seeming to push Trump back to the table to get a deal done.

Our base case is that additional tariffs will be avoided but the trade war will grind on through other legal channels such as recent actions taken against Huawei. This is long-term negative for global trade, but positive for avoiding further tariffs that could weigh on growth and earnings.

Weak growth in China was clearly a drag on EM sentiment, and while authorities continue to tweak monetary and fiscal levers to preserve private sector growth without undoing important efforts to deleverage, the so-far weak transmission to growth is clearly making markets nervous.

While China may be more patient than markets to find quality growth, we do expect healthier growth to be achieved by the second or third quarter of 2019. It will have a different complexion that favours consumption over investment to leave commodities in a more normal range of demand, but this is positive for sustainability of long-term growth.

A weaker dollar, a truce on tariffs and returning growth to China are all firm positives for EM assets, but we remain concerned about liquidity conditions, given that central banks in the West continue to remove accommodative policy.

Just as Turkey and Argentina fell under stress during the summer months, we expect the markets will continue to test other imbalanced economies and companies that have been overly dependent on easy, cheap money. In this environment, sticking with quality assets remains critical.

Asia growth eases, while valuations are attractive on earnings momentum

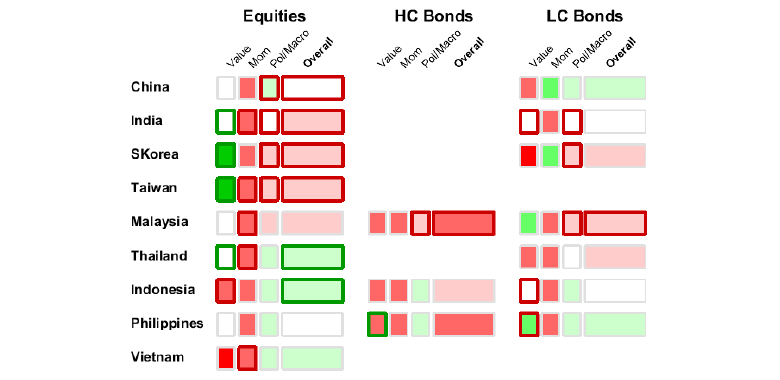

North Asian equities were downgraded across the board. China moved to neutral for deteriorating growth and earnings momentum while Taiwan and South Korea were dropped to neutral-negative mainly on account of deteriorating demand for technology hardware for both servers and smartphones – which weigh heavily in these markets.

India was also downgraded for momentum shifting negative and deteriorating macro, though we note valuations are shifting to neutral after appearing expensive for some time. Macro has shifted from positive to neutral because of a high profile default among non-bank financial corporations which is likely to impede credit growth. Also, RBI governor Urjit Patel abruptly resigned amidst pressure by the Modi administration to compromise the central bank’s independence.

Malaysian bonds were downgraded for deteriorating fiscal dynamics, while elsewhere in the ASEAN region, Indonesian and Thai equities were upgraded on account of improving momentum and more attractive valuations, respectively. Overall, growth is proving to be resilient despite rate hikes while low inflation means the tightening cycle is likely coming to an end.

Overall, ASEAN has proven defensive against North Asia, which has been pressured both by trade wars and a downturn in the technology hardware cycle.

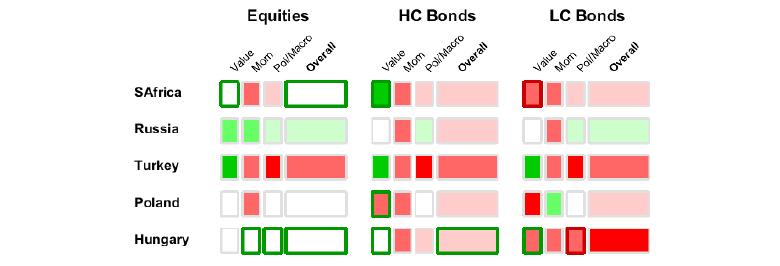

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

China growth down but not out

The China government has perhaps never been as tested in its resolve to stay the course in its commitment to deleveraging and reducing systemic risks. Through its harsh squeeze on shadow banking, it at first appeared that mainly speculation was being taken out of the market, but the real economy is now clearly impacted with banks keeping credit tight. Efforts to push credit to the real economy have so far disappointed, owing to concerns about record defaults and uncertainty surrounding the trade war with the US.

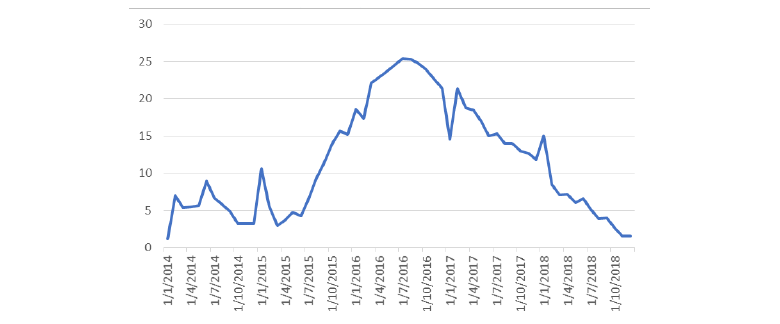

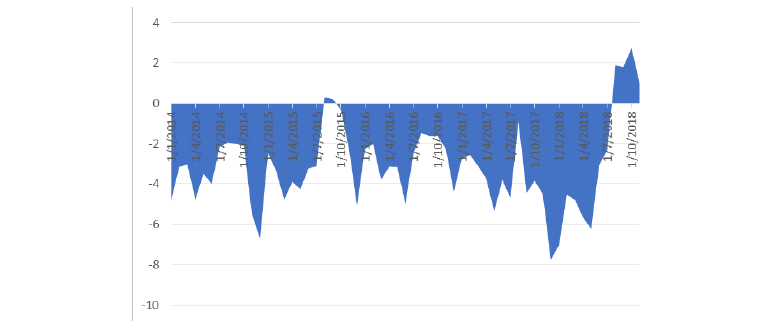

Despite efforts to stimulate the economy, including cuts to reserve requirements, encouraging banks to lend to SMEs and broad tax cuts, credit creation has continued to deteriorate. This is reflected by declining money supply (M1) that is back down to the dark days of early 2015. However, there is some evidence of new loan issuance in December, so perhaps the tide is turning.

Chart 2: China money supply (M1)

Source: Bloomberg, January 2018

Add to this a downturn in China trade at least partly attributable to front-loading in anticipation of rising tariffs, a relatively weak consumer and a tepid property market, and the outlook is far from promising.

Nevertheless, staying the course on reforms is the right move for long-term sustainability. Our base case is that through the fine tuning of monetary and fiscal policy, quality growth will return in Q2 or Q3, but with negative data flow until then.

Not surprisingly, China equity markets, and A-shares in particular, have sold off harshly on the back of poor growth data and trade war uncertainty. But given the turning tides in the dollar, China growth and a trade war resolution, extreme valuations currently present a compelling buying opportunity.

Chart 3: China A-shares (CSI 300) forward price-to-earnings

Source: Bloomberg, October 2018

Favour ASEAN growth over North Asia tech

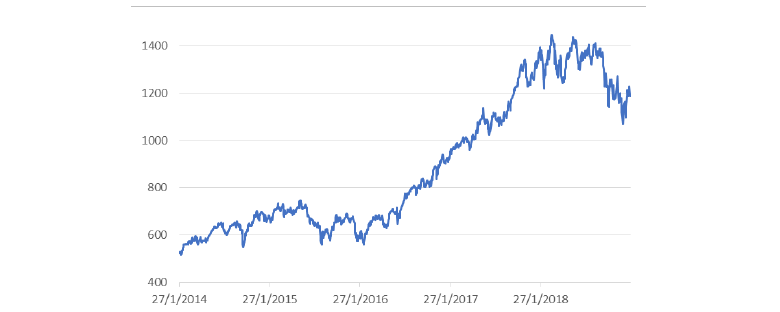

The extended technology hardware sector had a particularly difficult Q4 with the semiconductor index down about 16%, which was a deep drag on performance for chipmakers in Taiwan and South Korea. The pullback is partly for falling server demand – some attributable to less appeal for mining falling cryptocurrencies – but mostly for the slowdown in demand for smartphones, Apple in particular, as consumers await bigger leaps in technology such as 5G and folding screens.

Chart 4: Philadelphia Stock Exchange Semiconductor Index

Source: Bloomberg, January 2019

The tech cycle ebbs and flows and while we still see long-term opportunities in hardware related to cloud computing, artificial intelligence, the Internet of Things and next generation smartphones, ASEAN presents a more interesting near-term opportunity as a function of attractive valuations and still-healthy growth that is likely to pick up as monetary tightening nears completion.

EMEA still mixed

Turkey and South Africa are on a better course, but political instability is very much still in play with any number of catalysts on the horizon that could cause markets to further discount such risks accordingly.

Central and eastern Europe remain surprisingly resilient as most data point to overheating – particularly in Romania and Hungary – but so far markets have not particularly discounted this rising risk given that growth remains attractive and inflation has not yet reached dangerous levels.

Russia may be rounding the bend to at least find a pause in the relentless escalation of sanctions. Washington now appears more focused on China as a source of potential wrongdoing on which there is bipartisan support. Despite remaining a geopolitical pariah, we still like owning Russian risk for its particularly strong macro fundamentals.

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Turkey adjustment in process, but with high risk

Turkey has done much to win the support of markets since the dark days of last August when political risk was firmly on the rise – President Erdogan defying the US by detaining the American pastor on terror-related charges while suggesting that rates needed to be cut (not lifted) to contain inflation.

These events triggered a deep sell-off – the currency, in particular – but weeks later the central bank capitulated with a firm (orthodox) lift in rates while authorities decided to let the pastor go to at least partially restore relations with the US. In October, after the grisly murder of Saudi journalist Khashoggi at the Saudi embassy in Turkey, President Erdogan seemed to find leverage on Saudi Arabia that at least for now may have offered a further backstop to stability.

The rate hike and other adjustments have helped to curtail the country’s most nagging imbalance – the current account deficit. In fact, the current account has shifted from deficit to surplus since August as domestic demand has collapsed.

Chart 5: Turkey’s current account balance

Source: Bloomberg, January 2019

Clearly, the shift to orthodox policy and the external adjustment have been a strong tailwind for Turkish assets, but political risk is far from removed. President Erdogan remains committed toward consolidating his power and pushing an unfriendly market agenda.

Already, since the US had decided to withdraw its troops from Syria, it appears that Erdogan is likely to test the US’s resolve to protect the Kurds that is certainly not in keeping with his agenda. We suspect volatility will remain elevated.

US pivoting focus from Russia to China?

The worst seems over as far as the barrage of escalating sanctions by the US against Russia from alleged election tampering to the Skripal poisoning in the UK. Robert Mueller’s yet-to-be disclosed findings from his investigation may still include evidence of collusion between the Trump administration and the Russians to take the 2016 US Presidential election, but the possibility seems increasingly remote as time wears on and the appetite for punishment is turning from Russia to China where both parties can agree.

Meanwhile, Russian assets still benefit from passable growth and a very healthy external position – a return to twin surpluses (2.7% budget surplus and 7% current account surplus) – owing to strong policies that have withstood quite significant declines in oil prices. Over 2018, the biggest risk was the threat of further sanctions, and if this threat gradually dissipates – as we think it will – Russian assets have scope to further rerate to the upside.

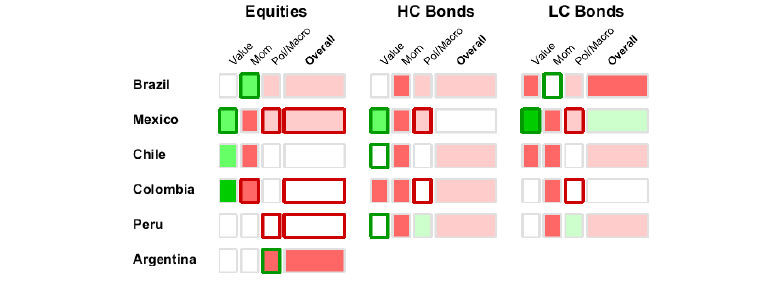

LatAm politics continue on the mend

Political prospects may be diverging between Brazil and Mexico, but markets seemed to have overshot the relative sense of optimism and pessimism, respectively. Brazil is seeking to reform while Mexico is leaning left, but the trajectories are early and far from the outcomes that markets are pricing.

Brazil equities were upgraded to neutral as a function of momentum shifting positive while valuations are still reasonably attractive against decent earnings prospects. Mexican assets were left flat as deteriorating politics is being offset by increasingly compelling valuations.

Colombia equities were downgraded to neutral for momentum shifting negative though we note valuations remain among the most compelling in the region. Peru equities were also downgraded to neutral for weaker growth, both in investment and consumption.

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Markets continue to cheer for Bolsonaro

Jair Bolsonaro was inaugurated on 1 January as President of Brazil with a surprisingly high approval rating of 75%. His popularity remains a critical measure of the weight of his mandate as he prepares to push what should be a very unpopular reform agenda including pension reform.

Markets seem to be mapping his popularity directly to the probability of his success, but it is important to remember that two prior presidents (Rousseff and Temer) were unable to get the job done.

Under these prior administrations, it was argued that Congress would push difficult reforms through on the back of an unpopular President who would serve as a scapegoat. So far, the populace is cheering Bolsonaro as a function of leaving the old and corrupt guard, but will his popularity be sustained as voters recognise that reforms are due to take benefits away?

It is far from clear, and therefore, we cast a bit more doubt on the smooth passage of a reform agenda that will necessarily inflict a painful adjustment against the broad populace. We still like the Brazil story, but we keep a very watchful eye on various signposts to distinguish hope from what can be assured.

Mexican bonds appear attractive

Back in July, it was well-anticipated that leftist Andrés Manuel López Obrador (AMLO) would win the Presidential election, so it was a much bigger surprise how badly markets were punished after the election.

Bond yields blew out nearly 150 basis points (bps) from the election through late November on a stream of news that AMLO was (not surprisingly) delivering on his promised agenda – from cancelling the new airport to reversing elements of energy reform. Yes, the path to execution might have been smoother with a more market-friendly touch, but the market “surprise” to the downside seemed excessive.

Chart 6: Mexico local currency bond yields

Source: Bloomberg 2018

Currently, Brazil bonds yield about 40bps more than the Mexican equivalent which is quite unusual given the vast difference in current credit quality. Note, Brazil yields averaged over 250bps over Mexico over the last year and 525bps over five years. We like Mexico over Brazil for the strong optionality to the upside should there be any shift in sentiment to cause the spread to diverge to more normal levels.