January – A Good Time for Ta(l)king Stock?

Stock picking is in our DNA and the Future Quality characteristics of the businesses that we invest in don’t change just because we have a new desktop calendar. That said, January often seems like a good time to take stock and have a look at where things are going and where they could be going better. If nothing else, it always feels better to be in greater control over your own fate.

Talking of DNA, Greig Bryson recently subscribed to 23andMe, to see if their catalogue of DNA-based tests could reveal any insights that would help him become a better version of himself. At the very least, he was hoping for some good dinner party conversation starters. Unfortunately, other than revealing that his muscle composition was common in elite power athletes (!), the results were generally underwhelming on that front. He found it particularly disappointing to learn that his ancestry is almost 80% UK & Irish (so not particularly newsworthy) and that he is genetically predisposed towards being about average weight. Even defining ‘about average’ very generously, Greig comments that he’ll “need a bit of gym time to get there” and that “those ‘elite muscles’ have a lot to answer for…”

The desire to affect greater control over your destiny is particularly understandable at times of heightened uncertainty. As 2018 wore on, investor concerns clearly increased regarding the health of the global economy. If Central Banks really were determined to remove the medicinal benefit of apparently limitless liquidity, how would the patient respond?

The Global Equity Team’s response to these concerns was to re-examine all of the ‘Future Quality’ stock investments, to better answer 2 questions;

- How dependent were our forecast returns on a continued, supportive economic cycle?

- Were any of our ‘structural’ growth stories really more cyclical or potentially over-earning, based on unsustainable under-investment?

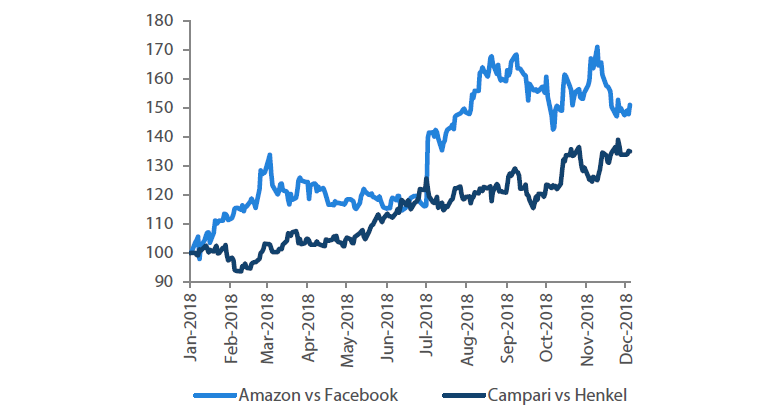

This process drove several transactions throughout the year that had a significant beneficial impact on the returns that we delivered for our clients. For instance, January’s switches out of Facebook and into Amazon and out of Henkel into Campari (see below). In each case, the team decided that the long-term growth of the businesses sold would require substantially greater additional investment than the market appeared to be anticipating at that time. This was also true of June’s switch out of Ryanair and into Hexagon.

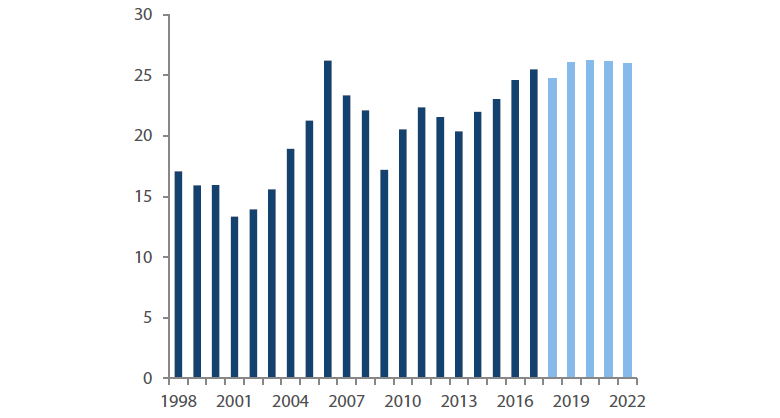

Figure 1: Future Quality in Practice

Source: Bloomberg and Nikko AM as at January 2019

None of this increased scrutiny is to say that an enduring economic slowdown is inevitable or even our base case. We are still reasonably optimistic – especially for Future Quality companies. If the economic waters are likely to become choppier it just increases the importance of having the right boat (franchise) and the right captain (company management) – both key pillars of the companies that we invest in.

LHC Group

We see recent purchase LHC Group as just such a company. LHC was founded by the current CEO and his wife (a qualified nurse) at their kitchen table in Louisiana in 1994, with the aim of better looking after local people in their own homes. From treating 4 patients, they have gone on to become one of the largest providers of home healthcare in the US, employing 32,000 people.

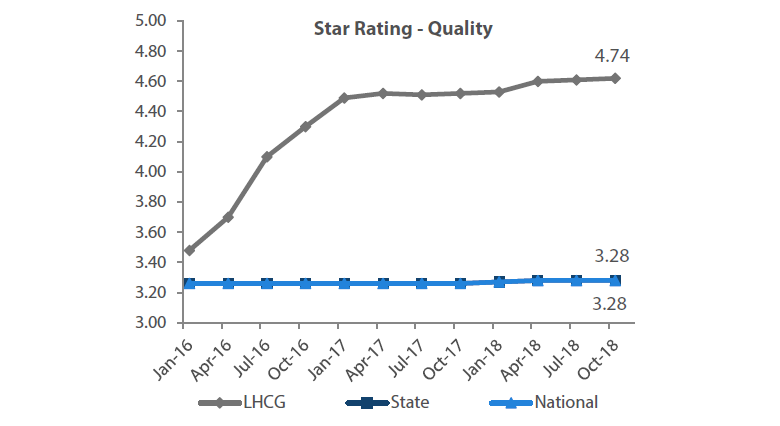

One of the key principles of the ongoing reform of US healthcare delivery is that the system needs to better match patient experience to payment (known as ‘value-based care’). Happily, LHC are recognised as one of the best quality providers in the market by the Centers for Medicare & Medicaid Services (CMS).

Figure 2: Quality of Healthcare Providers

Source: Centers for Medicare & Medicaid Services (CMS) and Nikko AM as at October 2018

This relentless focus on quality allows LHC to consistently gain market share in a market that is growing 4-6% annually, supported by an ageing US population. It also places them well for potential bonus payments from CMS in coming years.

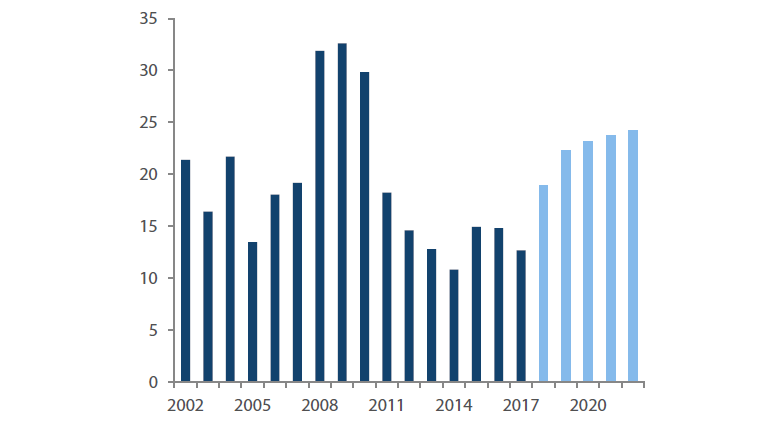

The advent of value-based care is also encouraging hospitals to focus on their core functions, whilst looking for trusted, high quality third party providers of related services. Looking after patients following hospital visits is exactly such a function and hospitals continually approach LHC Group with a view to forming partnerships. This capital-light inorganic growth has seen LHC deliver strong double digit revenue growth and we expect this to continue going forwards, driving returns higher.

Figure 3: LHC - Cash Return on Investment

Source: Nikko AM estimates as at January 2019

Management quality and company culture are hallmarks of LHC and they are also very evident at the other company that we added to our portfolios in Q4, Danaher Corporation.

Danaher

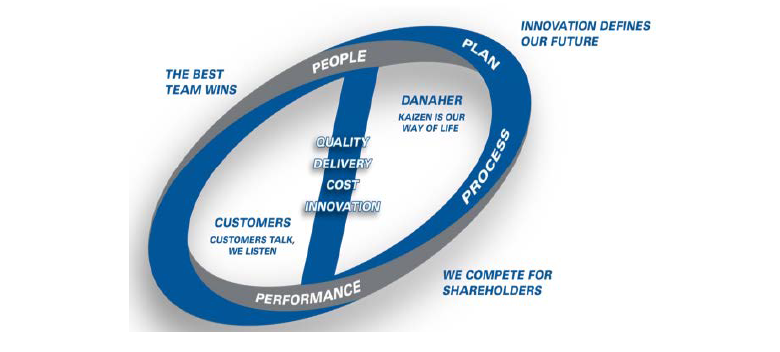

It is often pretty tricky to gauge whether corporate values and culture are really entrenched or just a veneer, designed to make a company look more interesting to investors. When we were doing our research, Danaher’s conviction in its DBS (Danaher Business System) certainly sounded convincing (they mentioned it sixty six times in a two hour Investor Day). What really made us comfortable, however, was our experience with another, existing investment. The transformation in operating performance at Livanova, following the arrival of Damian McDonald from Danaher in 2016 has been pretty remarkable by any standards and bears all the hallmarks of ‘DBS’.

Figure 4: Danaher – Corporate Values

Source: Danaher Company Website, Investor Presentation sourced February 2019

DBS is all about running your business as efficiently as possible and redeploying most of the cost savings into areas that protect long-term growth and customer relationships (Research & Development and Sales & Marketing). This may sound obvious but to do this properly requires a really deep understanding of your own business and that of your customers.

DBS has allowed Danaher to consistently expand profit margins and achieve very strong cash flow generation. Management have very successfully deployed these in acquisitions. The companies acquired (including Pall & Cepheid) have also, in turn, benefitted from the deployment of DBS, delivering meaningful benefits for Danaher shareholders. We expect this virtuous circle to continue.

Figure 5: Danaher - Cash Return on Investment

Source: Nikko AM estimates as at December 2018

Conclusion

As we gradually transition from a world of abundant, cheap liquidity, 2019 may finally see a meaningful divergence between technologies that are really ‘the next big thing’ and those that are already yesterday’s news. Cash (flow) really could be king. We remain optimistic that the proven cash generation of our Future Quality companies will hold our clients and us in good stead if this turns out to be the case.

Reference to individual stocks does not guarantee their continued inclusion in the strategy’s portfolio, nor constitute a recommendation to buy or sell.

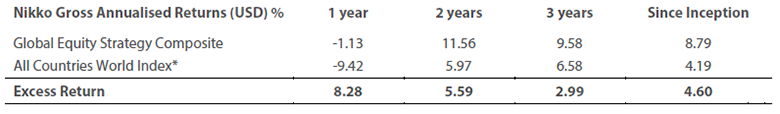

Global Equity Strategy Composite Performance to Q4 2018

Cumulative Returns October 14 to December 18

Past performance is not indicative of future performance.

Source: Nikko AM, FactSet, Bloomberg

The track record for Nikko AM portfolio is based on a composite portfolio from 01 October 2014 to 31 December 2018. *The benchmark for this composite is MSCI AC World Index. The benchmark was previously the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest.

*The track record for SWIP is based on a composite portfolio managed by the investment team whilst at SWIP from 31 March 2011 to 31 March 2014. The team was subsequently acquired by Nikko AM in August 2014. The benchmark for this composite was the MSCI World Index.

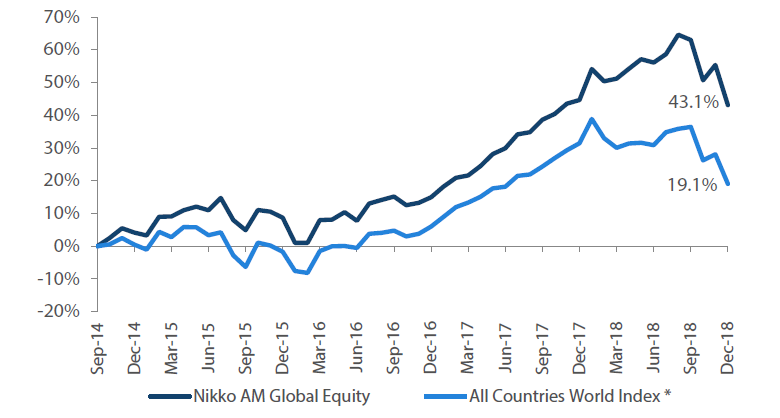

Nikko AM Global Equity: Capability profile and available funds (as at 31 December 2018)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

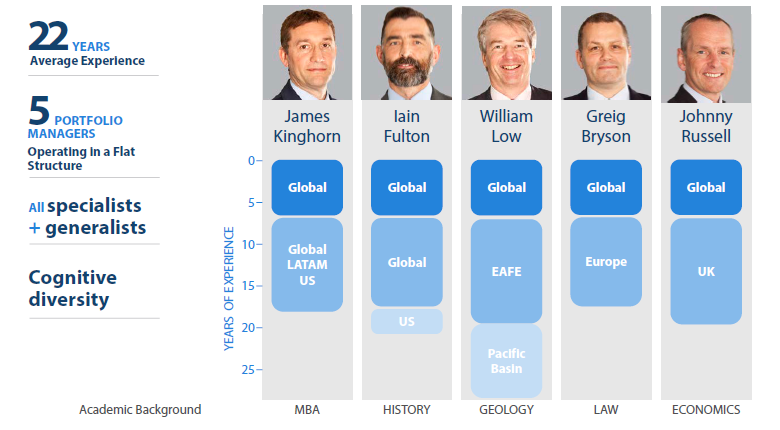

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually ‘joining the dots’ across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers/analysts have an average of 22 years’ industry experience and have worked together as a Global Equity team for seven years. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of ‘Future Quality’ companies will lead to outperformance over the long term. They define ‘Future Quality’ as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With US$ 203 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 31 December 2018.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.