Source: Nikko AM

Please Note: Relative positions against the WGBI (Citigroup World Government Bond Index) Copyright © Citigroup Inc

Global Outlook

In line with our expectations, the latest communique from the US Federal Reserve (Fed) saw a dovish turn and a juxtaposition from a regimented quarterly tightening pace, and instead toward increased data dependency. The FOMC went further, to effectively affirm a neutral policy stance by removing any reference to gradual rate rises in its policy statement. We also believe the balance sheet reduction is unlikely to be left on “autopilot” and the end to the quantitative tightening might occur earlier than we previously expected. We think the US yield curve will likely approach inversion in the first half of 2019, based on slowing inflation data and growth outlook, but expect the curve to steepen in the second half of 2019, driven by a pickup in energy prices and the knock-on effects of the capex spending pick-up in 2018.

The elections to the European Parliament will take place in mid-2019 and may be seen as a market event for the first time. Several national elections will also take place for EU member states. Populism will remain a force in European elections. Populists will further contribute to risk premiums in European markets, limiting reform efforts on deficit reduction and the banking sector, while promoting increased segregation in lieu of integration. The risk of snap elections will remain a persistent threat to market stability, with several fragile coalition governments at risk to populist agendas. On the economic front, despite the recent soft patch, the relatively firm growth momentum observed in prior years saw a marked reduction in the unemployment rate, down to 7.9% from as high as 12% in 2013. The ongoing tightening of the labour market, saw the European Central Bank (ECB) halt its bond-buying program in December last year, as expected. Yet weaker economic activity of late, together with softer headline inflation is unlikely to see Mario Draghi deliver a long-awaited rate hike any time soon.

Brexit still weighs heavily on the outlook for the UK, where the implications of it leaving the EU have yet to be finalised before the March deadline. The nature of the exit is still to be agreed, and whether the deal May’s government agreed with the EU will pass in some form in Parliament. The position of Theresa May as PM and her government seems confirmed for now, as she survived a no confidence vote held after the EU withdrawal bill first went through the House of Commons. We still expect a deal in some form to eventually pass. This was supported when MPs voted for the PM to seek "alternative arrangements" to the controversial Irish "backstop" proposal which, if suitably renegotiated with the EU, should be able to pass in Parliament. However, we still expect there to be more challenges along the way and will only be resolved from both sides at the 11th hour. The chances of a delay in leaving on 29 March has increased to ensure there is an appropriate amount of time to pass the necessary legislation on the agreement. With the assumption of a deal, we expect there to be upside in Pound Sterling, which could reach 1.40 GBP/USD. But if there were to be an exit with a no deal, the range will be 1.15 or lower.

The consensus outlook for emerging markets in 2019 is much less optimistic than it was last year. The general expectation is that the major central banks are likely to continue to tighten liquidity through rate hikes and/or balance sheet reduction throughout the year, albeit at a lesser magnitude than initially expected. Tighter liquidity is a major headwind to emerging market assets, not least because emerging market government debt stands at its highest level since the 1990s. Private sector credit in China remains a concern. We see a glimmer of hope that could come from a moderate growth slowdown of developed economies. Growth in emerging economies, which are more dependent on China, could start to look more attractive on a relative basis. The slowdown in China feeding its way through the emerging world is already well accounted for. We also have to consider the eventuality of a prolonged trade war.

China would be able to utilise a combination of monetary and fiscal stimulus, helping to offset the impact of tariffs to a certain extent. While the consensus view might be bearish, we strongly believe that individual emerging markets will be able to cope better this year. The increased dovish turn by the Fed, where the potential of fewer than expected rate hikes was implied, is a potential positive for emerging market bonds supported by sound fundamentals. They will likely receive welcome support from international investors. We also don’t believe that a full-blown trade war between China and the US is a likely outcome, as the latest news flows point to an increased probability of a positive resolution.

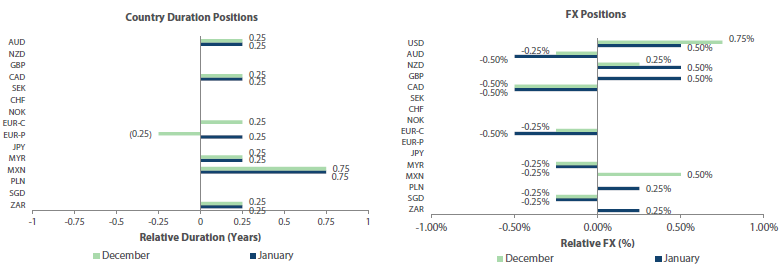

Developed Markets Positioning

We reduced our duration positioning from overweight to neutral as increased volatility experienced toward the end of 2018 was largely transitory and the treasury curve is too rich now, with Fed hikes completely pricing out the market for 2019. We moved to moderate our overweight dollar positioning, given the less hawkish Fed view with the expectation for one to two hikes in the second half of the year. The Fed cycle should pick up once risk assets have evidenced recovery from the fourth quarter sell-off, as data indicate slowing but growing economy. While a US government shutdown will remain a persistent headline risk, we see no material increase in risk outside the reduced economic data output by government agencies in the interim. Our real concern is the ongoing trade dispute with China, which appears no closer to resolution and will impede asset recoveries in the near-term and pose increased risks to currency positioning in Australia and New Zealand.

For Canada, the team has maintained positioning, noting the impact of energy prices and housing weakness may increase the possibility that the Bank of Canada could shift future monetary policy towards cuts rather than hikes. While we noted the elevated risk, the view remained relatively balanced, based on the slowing but growing US economy.

Europe, in contrast to the US, remains problematic as IP and PMI data continue to moderate suggesting further deceleration of the Eurozone economy. We expect that the ECB will extend the TLTRO facility in order to support the Italian banking system and maintain the size of the balance sheet. The expected continued support, but slowing pace of growth, leads us to foresee no significant rise in interest rates and a well-supported periphery. As such, the relatively high carry offered by Spain and Italy will prove hard to resist in this low-yield environment.

In terms of UK exposure, the team has become more constructive in its view on the pound while maintaining its neutral view on Gilts. Theresa May’s stunning defeat in Parliament leads us to conclude that a no-deal Brexit is the least likely outcome at this point and more constructive plans are likely favored, including the possibility of a second referendum. We expect an extension of Article 50 in order to facilitate this new paradigm which should provide for near-term pound strength.

We maintained our long duration in Australia, on the back of the moderation in economic activity in the country. Until recently, given low inflation and subdued wage growth, the RBA was expected to keep rates on hold for the protracted period of time. However, the weakening of the housing market and deteriorating external demand are expected to exacerbate the potential slowdown, adding further pressure on the already weakened construction sector. This, together with feeble private consumption could result in the RBA becoming increasingly dovish, potentially delivering further monetary easing as neither wage growth nor inflation pose risks from the perspective of price/financial stability.

As far as FX exposure within the Antipodean region is concerned, the ongoing trade stand-off between China-US is widely expected to have negative effect on both the AUD and NZD, given the proximity and strong trade/financial ties of both countries to China. We continue to believe that a stronger inflationary impulse and firmer underlying economic activity in New Zealand will likely see the RBNZ take on a hawkish turn ahead of the RBA, leading to the NZD’s outperformance versus its regional peer. As such, we increased our long NZD vs. AUD bet to express our conviction there. We maintained flat duration in New Zealand, largely due to unattractive valuations.

Emerging Markets Positioning

In Emerging Markets, we continued to remain cautious due to concerns over the ongoing trade stand-off between the US and China, further compounded by tightening of US monetary policy to date. We are turning marginally more constructive given attractive valuations and the likely slower path of rate increases by the US Fed over the coming year. We continue to be selectively bullish on a number of EM rates markets, as despite greater risks from the external environment, inflation dynamics remain highly divergent with disinflation facilitating a more dovish stance in a select few countries.

We remain underweight on the Malaysian Ringgit as the manufacturing side of the economy is struggling as a result of weaker demand, attributable to slowing Chinese consumption and the US-China trade disputes. We expect the Ringgit to continue to closely track the Renminbi, which should exhibit a slight weakening bias in order to maintain competitiveness. Given the lack of inflation pressures in the economy, we are likely to see an extended pause in monetary policy in Malaysia.

Despite remaining constructive on Mexico, we decided to tactically reduce our overweight allocation to the Mexican peso, locking in strong relative performance during the course of the past two months. The currency’s strong performance versus its peers came on the heels of the incoming President AMLO’s inaugural budget, which proved to be more prudent than initially expected. With core inflation at close to 3.7%, the country’s local bonds continue to offer very attractive real yield support, giving us confidence in maintaining our long duration bet in MBonos.

We remain neutral on duration in Poland, as a very strong local bond market rally in December last year looked overstretched, making valuations very expensive. We did turn slightly more positive on the Zloty versus the Euro in particular, as the economy is widely expected to remain at an above-potential pace of growth. Poland’s government reversed its purge of the country’s Supreme Court, following the ruling by the European Court of Justice. The concession is by no means the end of that conflict between Polish government and Brussels, but it represented a striking change in tone.

We increased our allocation to the South African Rand, taking the exposure to a small overweight. With improved risk-taking this year and the growing popularity of incumbent Cyril Ramaphosa, widely regarded as the voice of wisdom/moderation with the ANC, ahead of General elections in May, the currency is likely to perform well, relative to its high beta peers. We remain overweight duration as the ongoing disinflationary impulse domestically and elsewhere is likely to see the SARB on hold, making the valuation of local bonds in South Africa particularly attractive.

Global Credit

January was a positive month for global credit markets, which recouped some of the losses inflicted toward the end of 2018. Some industry sectors have benefited better than others in 2019 such as financials, where our overweight insurance aided performance. We are underweight in the banking sector (which has been a detractor on performance) but we are trying to fill this void in the portfolio to become more neutral. We would also note that longer duration bonds have also been a surprisingly strong contributor to the market. Additionally, the rally is focused on high-quality end, with investment grade performance seeing good performance. As we currently stand, our lower rating positions have not really rallied to the same extent.

So far in 2019, our CDS bonds position has underperformed by 6-7 bps. The CDS market is expensive but we will look to add to our position over the year, as we found in 2018 that the market was far more liquid when facing uncertainty. We will seek to mitigate these risks to the portfolio in the future.

Overall, we believe that the fundamental credit environment remains strong. Leverage hasn’t dramatically increased so far and we believe it is still a good time to invest, given solid company results and low default rates. Moody’s forecasts default rates will remain below the historic average.

We would argue that credit markets have solid potential to recover from the weak performance in Q4, as the risk of further trade war escalation has been reduced and the US central bank has put its tightening bias on hold. We see action by global central banks and the US/China trade relationship as key factor for performance of credit markets in 2019 and beyond.

We recently updated our key investment themes for global credit in 2019. We will reduce risk and focus on non-cyclical credits, financials and hybrid bonds with a strong bias for shorter duration bonds. Risk reduction will mainly take place in high yield and cyclical sectors like automotive. In addition, Asia will remain a very important investment area for us.

About the Global Fixed Income Team

Andre Severino

Global Head of Fixed Income

Holger Mertens

Head Portfolio Manager, Global Credit, CFA

Steven Williams

Head Portfolio Manager, Core Markets

Raphael Marechal

Head Portfolio Manager, Global Emerging Markets