Summary

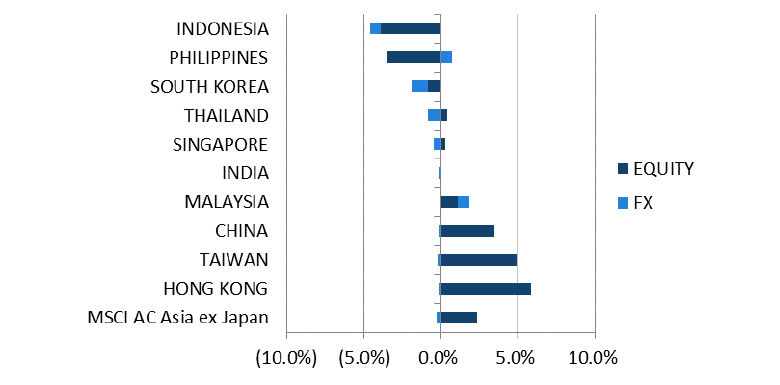

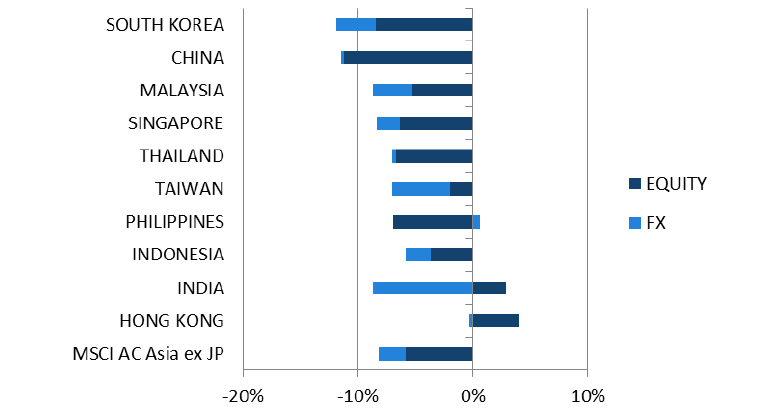

- The MSCI AC Asia ex Japan (AxJ) Index gained 2.1% in USD terms in February. However returns within the region diverged, as North Asia and Australia outperformed their ASEAN counterparts. The US Federal Reserve (Fed)’s decision to maintain interest rates buoyed sentiment, along with signs of progress in the US-China trade negotiations.

- China outperformed, as Beijing’s stimulus efforts led to increased liquidity in the economy. MSCI’s decision to quadruple the inclusion factor of A-shares in its emerging markets index to 20% further lifted markets. Conversely, South Korean stocks sold off following the abrupt termination of the Trump-Kim summit in Vietnam.

- Returns in ASEAN were largely muted. Malaysia was the only market that saw positive returns, on the back of better than expected 4Q18 GDP growth and a wider trade surplus. Conversely, Indonesia and Philippines were the worst performers.

- The rebound in Asian equity markets does not come as a surprise to us given the extreme pessimism and attractive valuations that prevailed into the end of 2018, particularly across A-share markets. We believe we have been able to find a number of quality businesses with long-term sustainable growth potential over recent quarters. We would also note that despite the year-to-date rally, valuations have only just picked up from close to all-time lows – we believe significant upside remains.

Asian Equity

Market Review

Asian equities gained in February

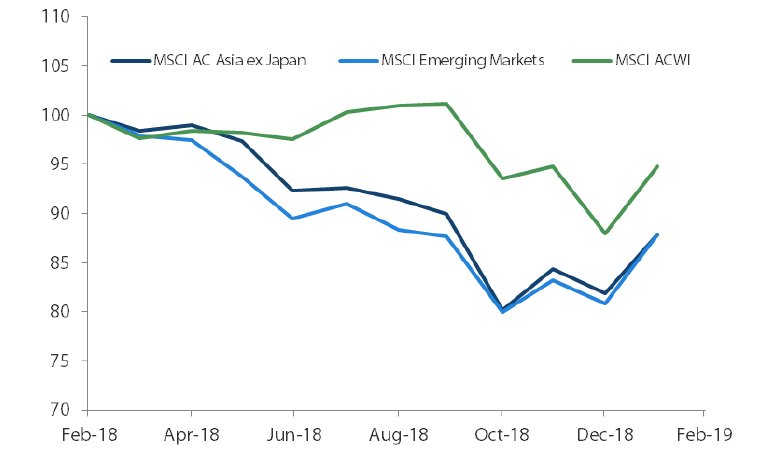

Asian stocks continued their strong start to the year, with the MSCI AC Asia ex Japan (AxJ) Index gaining 2.1% in USD terms in February. However returns within the region diverged, as North Asia and Australia outperformed their ASEAN counterparts. The US Federal Reserve (Fed) maintained interest rates and signaled it would be patient on further hikes, citing increased risks of a slowdown in global growth. Progress in the US-China trade negotiations also buoyed markets, as Trump postponed raising tariffs on Chinese imports beyond the March 1 deadline. Continued easing from China and MSCI’s decision to boost China’s weighting in its emerging markets index also drove sentiment over the month.

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 28 February 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

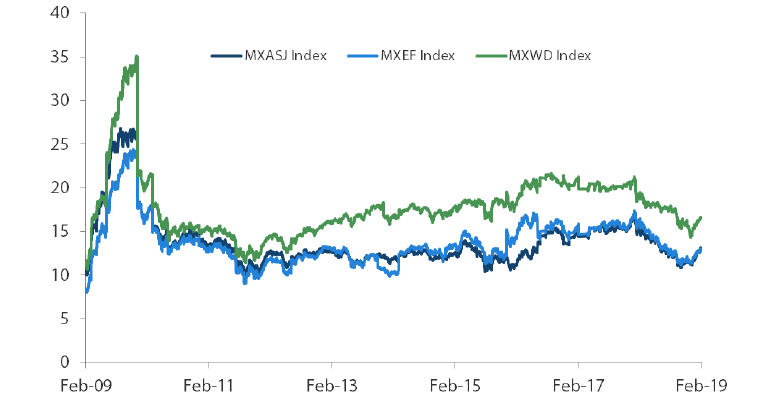

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 28 February 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

China, Hong Kong and Taiwan outperformed, but Korea lagged

China and Hong Kong outperformed, with respective USD gains of 3.5% and 5.9%. Apart from optimism around the trade talks, Beijing’s series of stimulus measures has also underpinned sentiment this year. The country’s total social financing (TSF), a broad measure of liquidity in the economy, reached a record 4.6 trillion yuan in January, which allayed some fears about weaker credit growth. Towards the end of the month, stocks also rose following index provider MSCI’s decision to quadruple the inclusion factor of A-shares in its emerging markets index to 20%.

Elsewhere in North Asia, Taiwanese stocks climbed 4.8% in USD terms partly on the postponement of US tariff hikes on China. Sentiment was also lifted by higher consumer confidence. Conversely, South Korean stocks fell 1.9% in USD terms in February. The bulk of the equity selloff came late in the month, following the abrupt termination of the Trump-Kim summit in Vietnam, as the leaders failed to reach an agreement on de-nuclearisation. Semiconductor stocks, such as Samsung Electronics and Hynix, were among the benchmark names that underperformed. On the economic front, South Korea’s unemployment rate rose to a nine-year high of 4.4% in January.

India ended flat

Indian stocks ended flat in February, amid concerns about its intensifying conflict with Pakistan. In the last quarter of 2018, its GDP grew by 6.6%, down from 7% in the previous quarter and its lowest rate of expansion in over a year. The central bank cut its interest rate for the first time in six months, citing lower inflation, lower oil prices and a global economic slowdown. In January, headline inflation eased to 2.05% as food prices fell. This was below the Reserve Bank of India’s medium-term target of 4%.

ASEAN saw broadly muted returns

Within ASEAN, Malaysia was the only market that saw positive returns, on the back of better than expected 4Q18 GDP growth and a wider trade surplus. Conversely, Indonesia and Philippines were the worst performers, with respective declines of 4.6% and 2.8% in USD terms. Indonesia’s manufacturing PMI fell to 49.9 in January, entering contractionary territory for the first time in a year. The Philippines posted a wider than expected budget deficit in 2018, owing to a spike in government spending. Both the Philippine and Indonesian central banks kept interest rates on hold in February. Elsewhere, Thailand saw political drama ahead of its March elections, as the Thai king blocked his sister’s surprise bid to run for prime minister. In Singapore, the banks posted weak results, with OCBC in particular seeing an 11% fall in net income in 4Q18. The lenders expect subdued loan growth in 2019, against the backdrop of persistent geopolitical risks and China’s economic slowdown.

MSCI AC Asia ex Japan Index1

For the month ending 28 February 2019

Source: Bloomberg, 28 February 2019

For the period from 28 February 2018 to 28 February 2019

Source: Bloomberg, 28 February 2019

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Valuations in Asia continue to be attractive

It has been a frantic start to 2019 across Asian equity markets, led primarily by China. This does not come as a surprise to us given the extreme pessimism and extremely attractive valuations that prevailed into the end of 2018, particularly across A-share markets. The rebound has been driven by a combination of the US Fed delaying further rate hikes, China’s monetary and fiscal easing and more optimism around a US/China trade deal. Irrespective of these top-down drivers we believe we have been able to find a number of good quality businesses with long term sustainable earnings growth potential and at very attractive valuations over recent quarters. These are stocks we can hopefully own for the next five to ten years. We would also note that despite the near 10% rally year-to-date, valuations have only just picked up from close to all-time lows – significant upside remains.

Focus on China sectors orientated towards insurance, healthcare and software

China has clearly stepped up its efforts to support the economy with reserve requirement cuts, a pick-up in loan growth and targeted fiscal policy. We do not believe this is a return to previous stimulus campaigns that led to significant amounts of misallocated credit as authorities remain committed to their goal of shifting economic growth from quantity to quality. The Fund’s stance with regards to core long term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged but with greater representation in A-share stocks where we have found better long term bottom-up opportunities in recent quarters.

Favour private sector banks and real estate sector in India

While we continue to like India from a long term perspective we note it faces a pivotal 2019 as we head into election season against a mixed macro environment. The recent border conflict with Pakistan is a distraction from a continued resurgence of the leading opposition Congress party. Elsewhere, and under new leadership, the Reserve Bank of India has taken a decidedly dovish turn which, given India’s fiscal situation likely increases the prospect of further rupee weakness. Valuations remain high versus an uncertain near term growth outlook, hence we retain a cautious stance, with a focus on strong private sector banks and the real estate sectors where we believe regulatory-led consolidation will yield huge opportunities for the strongest players.

Remain selective in Korea and Taiwan

Multiple headwinds continue to pressure hardware technology. The US-China trade disputes, waning demand growth and continued capacity expansion suggest tough times will likely continue, and this sector accounts for a big chunk of the equity markets in both Korea and Taiwan. In addition, in Korea, the economic outlook is also increasingly murky, with President Moon’s approval ratings sliding owing to the fall-out of his populist policies. Hence we remain selective in both markets, choosing to focus on healthcare, electric vehicle, niche technology companies and content producers.

Maintain underweight in ASEAN

We maintain limited allocations to ASEAN which will see political contests in 2019: national elections in Thailand and Indonesia, and mid-term elections in the Philippines. It will be a test for Thailand, in particular, which will be holding its first national election since the coup four years ago. There are signs of a nascent recovery in consumption in Indonesia together with a banking system that has been working through a bad debt cycle for over three years and has abundant capital for growth. Indonesia remains our preferred market in ASEAN. We maintain a zero weight to Philippines where abrupt monetary policy tightening should start impacting domestic consumption and asset quality in the banking sector.

Appendix

MSCI AC Asia ex Japan Price-to-Earnings

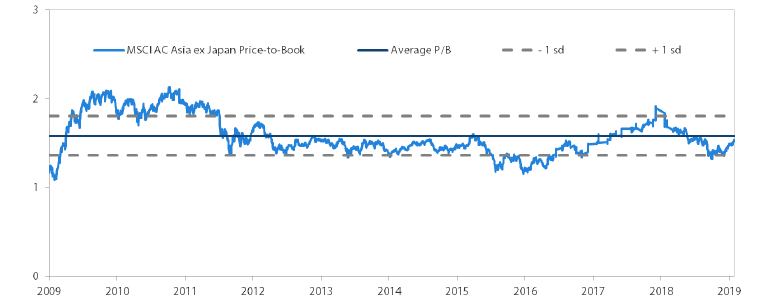

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 28 February 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.