Summary

- In February, risk assets rallied and US Treasury (UST) yields rose. Positive sentiment was sustained by comments from the US Federal Reserve (Fed) Chairman as well as encouraging developments on high-level US-China trade talks. Chinese trade and credit data which exceeded market expectations further supported markets' constructive tone. Overall, 10-year UST yields ended the month at 2.72%, about 9 basis points (bps) higher compared to end-January.

- Overall, Asian credit rose in February, helped by the rally in risk assets. Asian high-grade returned 0.68% and Asian high-yield corporates returned 1.61% as tightening in spreads more than offset the slight rise in UST yields.

- Within the region, inflationary pressure moderated further. The fourth quarter GDP growth accelerated in Thailand and Malaysia, but moderated in Singapore. Separately, China's credit growth surged in January, while India's central bank lowered interest rates by 25bps. There was also limited impact to India credit spreads from the India-Pakistan tensions.

- Meanwhile, the primary market remained robust despite the Chinese New Year holidays. The high-grade space had a total of 21 new issues amounting to USD 12.55 billion, while the high-yield space saw a total of 31 new issues amounting to around USD 11.24bn.

- The Fed's dovish pivot indicates demand for regional bonds will be well supported. Thus, against such a backdrop, we continue to prefer bond markets with high carry, such as Indonesian and Philippine bonds. We also like China bonds as we believe the inclusion of RMB-denominated government bonds into Bloomberg's index will boost demand. On currencies, a more accommodative Fed is likely to provide a tailwind for regional currencies to generally do well.

- As for Asian credit, the Fed’s dovish tone is supportive of credit spreads in the near-term. Technicals are also turning more neutral. On the supply front, although new issuances within the Asia high-grade space have picked up in February, the total amounts issued in January and February were less than amounts seen in the last two years. Within the high-yield space, the new issuances have been easily absorbed with the more benign risk environment.

Asian Rates and FX

Market Review

Yields of USTs ended higher in February

Risk assets rallied in February. Positive sentiment was sustained by US Fed Chairman Jerome Powell's comments which solidified the central bank's policy shift last month and encouraging developments on high-level US-China trade talks which culminated in US President Donald Trump's delay of tariff increases on Chinese imports. Chinese trade and credit data which exceeded market expectations further supported markets' constructive tone. As risk assets rallied, UST yields rose. 10-year yields ended the month at 2.72%, about 9bps higher compared to end-January.

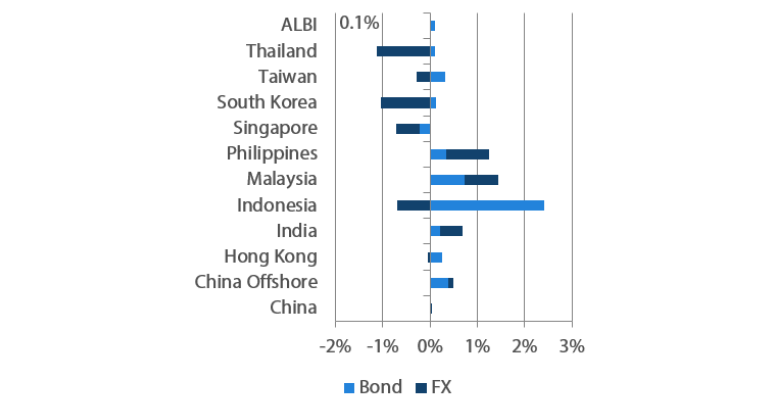

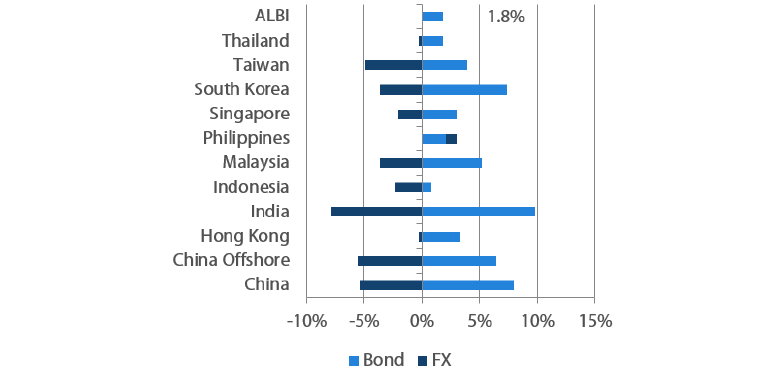

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 28 February 2019

For the year ending 28 February 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 28 February 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures moderated further

Headline Consumer Price Index (CPI) inflation prints across Asia moderated further in January. Lower food inflation prompted the drop in Indonesia and China's headline CPI. In Thailand, lower energy and transportation prices dragged the headline number down to 0.27% (from 0.36%). Similarly, the moderation in inflationary pressures in the Philippines and South Korea were driven largely by softer transport inflation. A sharp drop in retail fuel prices prompted consumer prices in Malaysia to decline for the first time since November 2009. Elsewhere, headline CPI in Singapore eased to 0.4% (from 0.5%) in January, on the back of a slower pace of increase in the cost of electricity and gas, which outweighed higher inflation in services.

Fourth quarter GDP growth accelerated in Thailand and Malaysia, but moderated in Singapore

GDP growth in Thailand printed 3.7% Year-on-Year (YoY) in the last three months of 2018, faster than the downwardly revised 3.2% growth in the third quarter. Private consumption growth edged up and gross fixed capital formation growth rose, while external demand remained weak. Overall, the Thai economy posted 4.1% growth in 2018, up slightly from 4.0% in the previous year. Growth in Malaysia similarly recovered in the fourth quarter, registering 4.7% YoY. Economic activity was supported by a stronger net export contribution while contribution from domestic demand fell. In Singapore, fourth quarter YoY growth was revised lower – to 1.9% from 2.2% - prompted largely by softer manufacturing sector growth. Elsewhere, GDP growth in Indonesia was steady at 5.2%, unchanged from the previous quarter.

India cuts interest rates by 25bps

The Reserve Bank of India (RBI) surprised markets by lowering its key lending rate by 25bps. The central bank also changed its policy stance back to 'neutral" from "calibrated tightening". In addition, it pared its inflation forecasts to 2.8% YoY for the fourth quarter of Fiscal Year (FY) 2019 (ending March), and to 3.2-3.4% for the first half of FY20, citing lower food and oil prices. Notably, this was the first policy meeting chaired by new RBI Governor Shaktikanta Das.

Market Outlook

Maintain preference for China bonds and bond markets with high carry

We maintain that the Fed's dovish pivot indicates demand for regional bonds will be well supported. Against such backdrop, we hold a positive bias towards high yielders, such as Indonesian and Philippine bonds. Our positive view on Indonesia is further encouraged by relatively stable inflationary pressures and a central bank that remains focused on financial stability. We also note that the government has front-loaded supply and has already issued about 27% of budgeted gross issuance for the year. Meanwhile, inflationary pressures in the Philippines continue to moderate. As inflation expectations adjust lower, demand for Philippine bonds is likely to be supported. Separately, we believe the inclusion of RMB-denominated government bonds into Bloomberg's index will be a boost to demand.

Expect Asian currencies to generally do well

A more accommodative Fed is likely to provide a tailwind for regional currencies to appreciate vis-à-vis the USD. We anticipate the RMB to outperform regional peers, on the view that the inclusion of RMB-denominated bonds into Bloomberg's index, together with progress in trade talks with the US, will offer strong support for the currency.

Asian Credit

Market Review

Another month of positive returns for Asian credit

Overall Asian credit rose in February, helped by the rally in risk assets. Asian high-grade returned 0.68% and Asian high-yield corporates returned 1.61% as tightening in spreads more than offset the slight rise in UST yields. Broadly, spread compression between lower-rated high-grade and high-yield issues against their better quality counterparts continued with the improving sentiment. As risk assets rallied, UST yields rose. The UST yield curve steepened slightly, with the difference between 2-year and 10-year UST yields rising 3bps to 20bps.

China’s aggregate financing data hit a record high; limited impact from India-Pakistan tensions

China’s reported new loan and aggregate financing data hit a record high in January, suggesting that policymakers’ push towards easing credit access to private enterprises is bearing fruit. Details revealed a significant increase in corporate bond and local government special bond issuance, as well as recovery in shadow credit. Easing liquidity remains a policy focal point, with China Banking and Insurance Regulatory Commission (CBIRC) announcing the government is targeting a more than 30% increase in outstanding loans to small, micro companies this year. The CBIRC added that it will ensure that more of the new loans will be extended to private companies. Meanwhile, the flare-up in India-Pakistan tensions following the attacks in Kashmir had some short-lived impact to India credit spreads so far. Separately, the inability to reach an agreement on “denuclearisation” during the meetings in Hanoi between Kim Jong Un and US President Trump did not have any impact to Korea credit spreads or the broader market sentiment.

Active primary market despite Chinese New Year holidays

Activity in the primary market remained robust, despite Asia celebrating the Chinese New Year holidays. There were 21 new issues amounting to USD 12.55 billion in the high-grade space, including a USD 1.85 billion subordinated debt issue from China Construction Bank and a USD 2 billion two tranche Indonesia sukuk sovereign deal. Meanwhile, the high-yield space saw heavy issuances of 31 new issues amounting to around USD 11.24 billion.

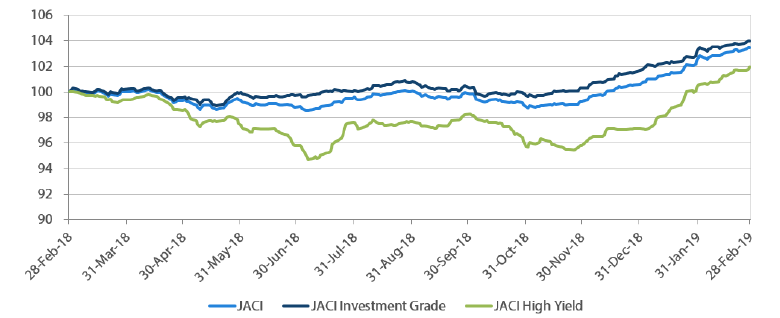

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 28 February 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 28 February 2019

Market Outlook

Dovish Fed supportive of returns; near-term technicals turning more neutral

The dovish tone from the Fed is supportive of credit spreads in the near-term. With signs that the US-China trade talks are progressing, the near-term risk sentiment should remain positive. Meanwhile, technicals have turned more neutral towards the end of February. On the supply front, new issuances within the Asia high-grade space have picked up in February. However, total amounts issued in January and February were less than the amounts seen in the last two years. Nonetheless, within the high-yield space, supply continues to be robust with new issuances exceeding those in past years. These issuances have been easily absorbed with the more benign risk environment. Near-term risk events would include an escalation in the India-Pakistan tensions.