Global Outlook

This year’s communique from the Fed saw a dovish turn and a pivot from a regimented quarterly tightening pace toward increased data dependency. The FOMC went further, to effectively affirm a neutral policy stance by removing any reference to gradual rate rises in its policy statement. Yet minutes from the latest policy meeting suggest the interest rate hikes could resume if the US economy maintains its momentum later this year. We also now believe the balance sheet reduction is unlikely to be left on “autopilot” and the end to the quantitative tightening might occur earlier than we previously expected. We think the US yield curve will likely approach inversion in the first half of 2019, based on slowing inflation data and growth outlook, but expect the curve to steepen in the second half of 2019, driven by a pickup in energy prices and the knock-on effects of the capex spending pick-up in 2018.

The elections to the European Parliament will take place in mid-2019 and will potentially be seen as a market event for the first time. Several national elections will also take place for EU member states in 2019. Populism has been and will remain an ongoing force for European elections. Populists will further contribute to risk premiums in European markets, limiting reform efforts on deficit reduction and the banking sector, while promoting increased segregation in lieu of integration. The risk of snap elections will remain a persistent threat to market stability, with several fragile coalition governments at risk to populist agendas. On the economic front, despite the recent soft patch, the relatively firm growth momentum observed in the prior years saw a marked reduction in the unemployment rate, down to 7.9% from as high as 12% in 2013. The ongoing tightening of the labour market, saw the ECB halt its bond-buying program in December last year. Yet the weaker economic activity of late, together with softer headline inflation is unlikely to see Mario Draghi deliver a long awaited rate hike any time soon.

The uncertainty surrounding Brexit persists to weigh heavily on the outlook for the UK, where the implications of the UK leaving the European Union have yet to be finalised and we now face a precariously short amount of time before the March deadline. The deal May’s government agreed with the EU is still to pass the UK’s Parliament, and the terms of the deal are still to be universally agreed upon. We still expect a deal in some form to eventually pass as the Prime Minister seeks to configure a solution that can be agreed upon by multiple parties. It is expected that a reformed deal that addresses the Irish "backstop" proposal will win around enough support from MP’s and as a result will be passed in Parliament. We still expect there to be more challenges along the way and will only be resolved from both sides at the 11th hour. The chances of a delay in leaving on 29 March has increased the need to ensure there is an appropriate amount of time to pass the necessary legislation on the agreement. With the assumption of a deal, we expect there to be upside in Pound Sterling, which could reach 1.40 GBP/USD. But if there were to be an exit with no deal, the range will be 1.15 or lower.

The consensus outlook for emerging markets in 2019 remains much less optimistic than it was last year. The general expectation is that the major central banks are likely to continue to tighten liquidity through rate hikes and/or balance sheet reduction throughout the year, albeit of lesser magnitude than initially expected. As we’ve seen, tighter liquidity is a major headwind to emerging market assets, not least because emerging market government debt stands at its highest level since the 1990s. Private sector credit in China remains a concern. However, we see a glimmer of hope coming from a moderate growth slowdown of developed economies. Indeed, growth in emerging economies, which are more dependent on China, is starting to look more attractive on a relative basis. The slowdown in China, which has feed its way through the emerging world, is already well accounted for. In addition, we have to consider the possibility of a prolonged trade war. However, China is utilising a combination of monetary and fiscal stimulus, helping to offset the impact of tariffs to a certain extent. So, while the consensus view might be bearish, we strongly believe that individual emerging markets will be able to cope better this year. Given the dovish turn by the Fed, with fewer than previously expected rate hikes, we see this as a positive for emerging market bonds that are supported by sound fundamentals, as they will continue to receive welcome support from international investors. We also do not believe that a full-blown trade war between China and the US is a likely outcome, as the latest news flows point to an increased probability of a positive resolution to the protracted trade stand-off.

Developed Market Positioning

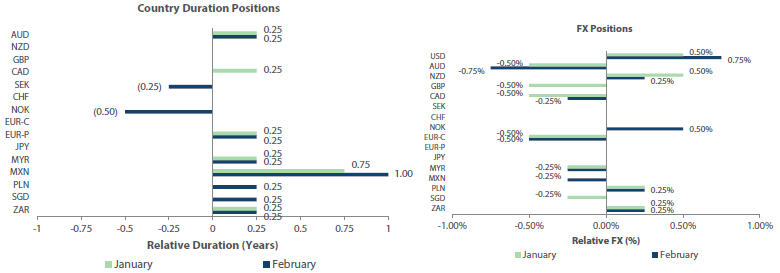

The Global Fixed Income team remained steadfast in maintaining its overweight USD positioning while maintaining an overall neutral duration stance in the Portfolio. The team made key minor changes to the portfolio reducing duration in Northern Europe based on more Hawkish views from central banks and notably increased duration in Mexico on very attractive rate differentials and curve steepness. The team also moved to increased exposure to the Norwegian Krona with energy markets showing signs they have bottomed and cut positioning in GBP ahead of the key Brexit vote mid-March.

For the US we observed a continued recovery in risk markets with the S&P recovering three quarters of the drawdown that began at the end of September. While the Fed continued to hold a dovish stance the resurgence in equity and high yield assets argue that the Fed’s rationale for a switch to more accommodative guidance at year-end has waned, especially now with continued positive Economic data and preliminary 4Q GDP coming in at 2.6% versus expectations of 2.2%. We note that the ongoing US China discussions remain constructive for now, and do indicate a willingness on both sides to potentially come to a compromised agreement.

Across the Atlantic to Europe, the team noted economic data were indicative of an ongoing slowdown with PMI surveys continuing to fall. While there was no ECB meeting in February, the lack of clear guidance on the TLTRO was overlooked by equity markets with the Stoxx index performing in line with global risk assets. Despite the rally in risk assets, rates markets remained well bid with German 10yr rates approaching levels last seen since 2016. With rates markets likely to remain in the doldrums on a less than robust growth outlook, and rising uncertainty surrounding the changeover in ECB governance and monetary policy outlook, the Team maintained its bearish outlook for the Euro and is sanguine in its outlook for European rates in general. Intra-Europe the team moved to reduce exposure to Spain on the over extend rally and diversify peripheral exposure to Italy and Ireland, with Italy remaining cheaply priced given the outstanding political risks.

We have remained decidedly bullish on the Norwegian Krona as Oil prices continue to recovery while inflation remains a persistent threat for the Norges bank. Despite weakness in oil prices in the fourth quarter in 2018, inflation came in relatively hot raising expectations that the Norges bank will follow on with a hike at its March meeting. For Sweden, the team remained constructive given the slight uptick in GDP data, but note consistent inflation prints under target continue to make the argument against the need for further rate hikes, especially with the ECB on hold for now. While the EURSEK cross has sold off to levels not observed since the GFC, the lack of a near-term catalyst for the Riksbank suggests no near-term rebound in the cross for now.

During our latest IP meeting we decided to maintain our long duration exposure in Australia, as the ongoing moderation in economic activity domestically, driven by both internal factors (slowing housing market and feeble consumption) together with deteriorating external environment, have materially increased the likelihood of interest rate cuts in the latter part of the year. For the time being however, the RBA maintains its relatively balanced view. But a dovish turn in the coming months is expected which is likely to keep bond prices supported. The bond market in New Zealand appears to score well on a valuation basis, hence we maintained our flat duration exposure.

Given our expectation for a potential dovish turn by the RBA, we continue to be comfortable maintaining our long NZD vs. AUD position. This is particularly true considering the underlying inflationary pressures and the tightness of the labour market appears to be somewhat stronger in New Zealand vs. Australia, which ought to continue see NZD outperform AUD in the coming months.

Emerging Markets Positioning

In Emerging Markets, we have turned more constructive on duration overall, given the likely slower path of rate increases by the US Fed over the coming year. In FX, however, we remain neutral overall as we are somewhat skeptical of a trade deal between the US and China, despite the apparent progress made to-date, due to the structural nature of the issues at hand.

We remain underweight the Malaysian Ringgit as we expect the manufacturing side of the economy to struggle as a result of weaker external demand, attributable to slowing Chinese consumption. We expect the Ringgit to continue to closely track the Chinese Renminbi which should exhibit a slight weakening bias in order to maintain competitiveness. Amidst diminishing inflation pressure, primarily due to lower consumption taxes and the removal of petrol subsidies, we are likely to see an extended pause in monetary policy in Malaysia.

We turned more cautious on the Mexican Peso following the strong performance during the course of the past three months. Growth momentum has weakened of late in Mexico, coupled with an increasingly nationalistic rhetoric from newly inaugurated President Andrés Manuel López Obrador (AMLO), which we believe justifies a higher risk premium to compensate for political uncertainty. Furthermore, with inflation exhibiting a strong downward momentum we increased our exposure to MBonos which offer significant value, with yields close to 5% above inflation.

We also upgraded duration in Poland, with domestic growth losing some momentum of late, inflation printing below expectations, as well as expectations of a more dovish turn in policy from the ECB, all being supportive of Polish bonds. We remain marginally positive on the Polish Zloty, relative to the Euro, as despite some early signs of moderation the economy is still widely expected to remain well above the aggregate pace of growth in the common currency area. Furthermore, political risk has diminished somewhat following the Polish government’s reversal of its purge of the country’s Supreme Court.

We remain marginally overweight the South African Rand due a nascent growth rebound which should bolster the popularity of incumbent President Cyril Ramaphosa, widely regarded as the voice of reason with the ANC, ahead of General Elections in May, as such the currency should perform well relative to its high beta peers. We also remain overweight duration as the ongoing disinflationary impulse domestically and globally is likely to see the SARB remain on hold, making the current valuation of local bonds in South Africa particularly attractive.

Global Credit

Regarding the teams opinion on favouring IG or HY, within the US we would be more in favour of IG as an investment theme. As a whole, HY has now come back from mid 750s to a 400 range, therefore we think HY is somewhat priced out of the market and remains neutral and should be indifferent in owning HY or treasury’s at the moment based on future expected return, the BBB part of the credit curve looks most attractive, whereas the A part of the curve looks too tight. In Asia we are currently positive on HY in particular where in February, Asia HY names have performed strongly as tightening in spreads more than offset the slight rise in UST yields. Given the Fed's dovish pivot, we believe this will indicate demand for Asian regional bonds will be well supported. Against such backdrop, we hold a positive bias towards high yielders, such as Indonesian and Philippine bonds.

In Emerging Markets outside Asia, we prefer sovereigns over corporate credit. Despite emerging corporate’s strong performance of late, we are of the opinion that it is more prudent to invest in the sovereign portion within some, more vulnerable, emerging markets, as typically sovereigns will do whatever it takes to save themselves while crowding out the private sector in the longer term. In addition, we would avoid some State Owned Enterprises in countries such as South Africa and Mexico where there has been a chronic lack of investment and they are now approaching a point where their debt may need to be restructured by the state.

We are beginning to see signs from China that it is trying to introducing economic measures to stabilize the market at a quicker rate than what was expected in the form of expansionary Fiscal and Monetary policy. The Chinese government has stated that it has additional monetary policy measures that it can take to support economic growth this year, and will cut to help finance large-scale tax cuts. These promised tax cuts and promotion of infrastructure spending to help businesses and protect jobs, will be implemented as a result of economic momentum being expected to cool further due to softer domestic demand and the trade war with the US. This policy taken by China is likely to not only the country but a catalyst for economic growth in the region.

Lastly, it is worth noting that Q4 earning season has been received positively by the credit market. Particularly in the US, where earnings have been solid. Idiosyncratic events were causing some of the problem credits but for the most part, earnings remained relatively strong and just a bit slower compared to last year.