Corporate Governance Reform

One of the key areas of development in the Japanese equity market has been corporate governance reform under the leadership of Prime Minister Shinzo Abe. Since the introduction of the Stewardship Code (2014), Corporate Governance Code (2015) and the subsequent revisions to these in 2017 and 2018, there is no doubt that the reform is having an impact on Japanese companies. The recent evidence of improving corporate governance at Japanese companies includes:

- Distribution to shareholders (sum of dividends and share buybacks) set to double over the past five years to exceed JPY15tn (approx. USD 13.6bn) and break a record high in FYE March 2019 (+25%yoy).

- Seven consecutive years of decline in cross-shareholdings, at 9.5% (-0.6%yoy) in FYE March 2018.

- Increase in the number of outside directors: % companies with 2+ outside directors is now at 91.3% vs. 18.0% in 2013.

- Increase in the number of companies with nomination/compensation committees: 43.1% and 45.6%, respectively, in December 2018, up from 10.5% and 13.4% in July 2015.

Sources: Tokyo Stock Exchange, Nikkei and Nomura Institute of Capital Markets Research

Secondary Effect

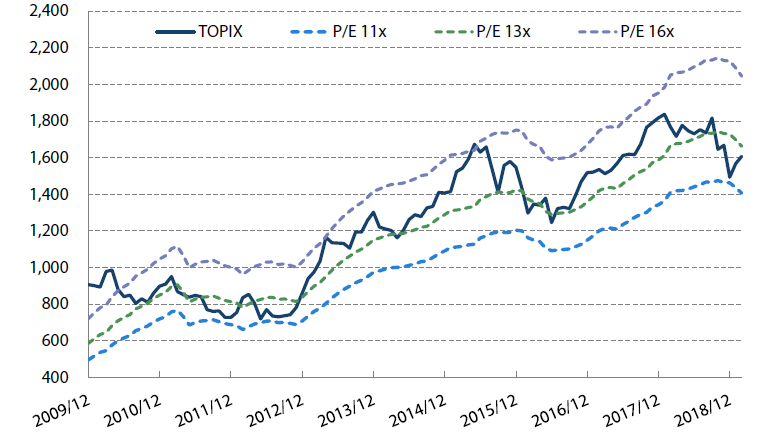

That said, our recent discussions with global investors across countries/regions leads us to believe that a large number of them are still sitting on the sidelines to see if the governance reform will gain momentum from here. Many of these investors believe that the Japanese equity market is undervalued at the current valuation (trading at 13.0x P/E at the time of this writing on March 25, 2019. See Exhibit 1). However, they believe that more catalysts on the governance front will be key drivers to move the market higher. Some skeptics of the reform argue against any optimistic outlook, saying:

- How do you enforce corporate governance & stewardship codes, when they are not hard law?

- The pace of the reform appears to be slower than expected.

Exhibit 1: TOPIX P/E vs. Historical range

Source: Factset as of end-February 2019

While there is some truth in these comments, we think that they implicitly assume there are no other factors at play in improving corporate governance. On the other hand, we think that the ongoing governance reform is laying the groundwork for shareholder activists to unlock and create value for companies. In other words, we believe the emergence of activism will play a key role in putting more pressure on companies, shaping the future of corporate governance practices in the years ahead.

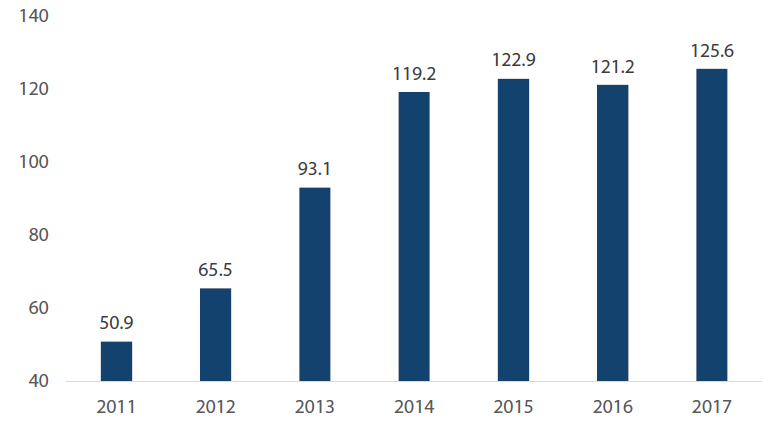

Growth in Activist Hedge Fund AUM

If we take a step back and look at the assets tied with shareholder activists globally, we can see that there is a growing amount of assets managed by activists over the years (See Exhibit 2).

Exhibit 2: Total activist hedge fund AUM (USDbn)

Source: JP Morgan, HFR Industry Reports © HFR, Inc.

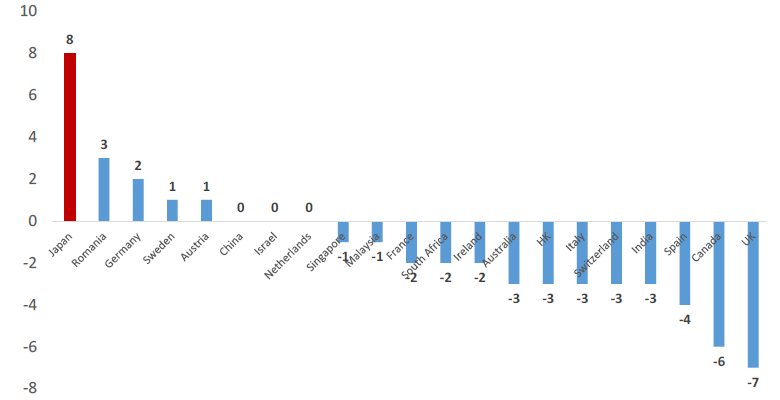

While activist investments in the US (461 targets out of 805 globally in 2017) dwarf other regions, these investors will have to look elsewhere to generate returns given the heightened valuation in the US of late. As Activist Insight put it in The Activist Investing Annual Review 2018, “As U.S. activists face fewer opportunities at home, the exodus to Europe and Asia may continue given the presence of trading discounts, the shifting shareholder structure from founders to index funds, and cultural adaptation.” In fact, the country that saw the number of companies publicly subject to activist demands rising the most year-on-year in 2017 was Japan (See Exhibit 3).

Exhibit 3: YoY increase in # of activist targets by company headquarters (2017)

Source: The Activists Investing Annual Review 2018, “Outbound Activism”

While “outbound” activists’ assets are increasingly being deployed in Japan, there is also an increasing number of homegrown activists raising more assets to put to work. According to Nikkei (based on Quick/FactSet data), the total amount of activists’ investments in Japanese companies was at a record high at JPY1.6tn (or approx. USD14.6bn) in March 2018, up 20% year-over-year. This is expected to continue to grow due to a better investment outlook.

Better Odds for Activists

There have always been skeptical views claiming that “hostile” activism can’t be as successful in Japan as it is in the US because of the historical and cultural context. This may have been the case before the corporate governance reform, i.e., pre-Abenomics. However, given the rapidly changing environment, we have started to see successful activists’ campaigns recently. Examples include large-scale share buybacks and/or dividend hikes (and often higher stock prices as a result) by companies that are owned by activists, including the Murakami family. In the recent case of ShinMaywa Industries, a cash-rich, small cap transportation equipment manufacturer that had been targeted by the Murakami family, the company decided to buy back as much as 27.7% of its shares outstanding in a tender offer at a premium “in order to increase EPS and capital efficiency ratios such as ROE.” There is also a growing number of companies proactively increasing distribution to shareholders as a way to fend off any attacks by activist investors.

We believe the better odds to succeed are attributed to the changing environment where shareholder support is getting easier to win due to:

- Institutional investors complying with Stewardship code don’t necessarily side with company management anymore.

- Unwinding of cross-shareholdings is resulting in higher free float, resulting in decline in stable shareholders.

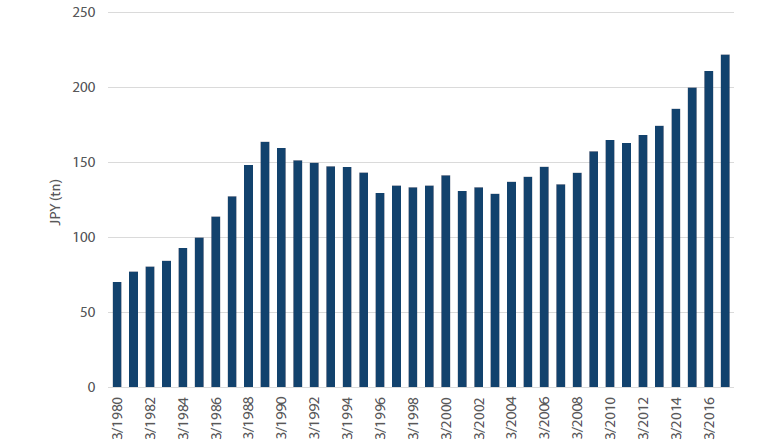

- Companies have become even more cash-rich over the years due to solid earnings but with mediocre shareholder distribution (See Exhibit 4).

Exhibit 4: Cash holdings by Japanese companies (excl. financials)

Source: Ministry of Finance, Financial Statements Statistics of Corporations by Industry (September 2018)

In 2019, we are also expecting to see a rare case where a Japanese company bringing an activist shareholder on its board. In January, Olympus Corp, a medical equipment maker which boasts a top global market share in endoscopy products, announced plans to propose an election of a representative of its top shareholder as a board member. This top shareholder is a renowned US activist investor and it came as a surprise by many, boosting the company’s share price. Some may argue this is an isolated case; however, we are seeing more Japanese companies doing what is “right” for their shareholders, even if it means going out of their “comfort zone.”

Hostility as the "Right” Thing

Doing what is “right” for shareholders may mean having to go hostile. Just as Olympus thought it would be in the best interest of its shareholders to bring an activist investor on its board, Itochu, a top-tier general trading company, believes it would in the best interest of its shareholders to be “hostile,” having disagreements with the management of its listed, equity method company Descente (apparel) over its strategic leadership.

In January, Itochu announced a tender offer for Descente’s shares, putting a hefty premium (50% above the previous day’s close price) on the stock. Descente later indicated that they are opposed to the suitor’s bid and wasted no time in announcing its new management plan to increase shareholders value. After a month and a half of tender offer period, Itochu’s bid turned out to be successful, allowing it to raise its stake above 1/3 of Descente’s outstanding shares. It is worth noting that the Nikkei article (8 February, 2019) editorial said that “one should not overreact and view hostile takeover attempts as a taboo.” The significance of this hostile move is that this is made by a well-established, prestigious, large corporation. This “healthy” competition of ideas (to create value) between a vocal shareholder and management may not be a bad thing for the collective interest of its shareholders.

Activists’ Pendulum Swings

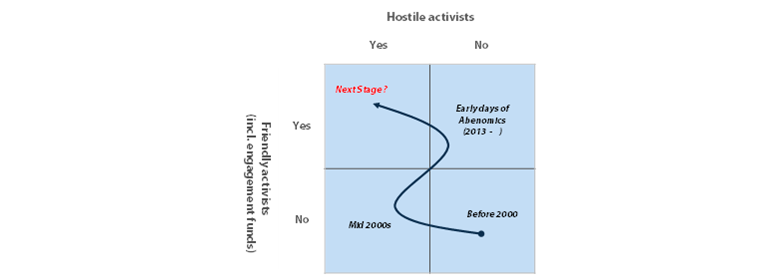

The emergence of hostile suitors does not just mean companies are under attack. It also means that companies will be more prone to listen to different opinions from various investors. We think that companies faced with pressure from increasing hostility, are more likely to engage with friendly (or less hostile) investors to increase shareholder value. In other words, we believe that constructive shareholder engagement (encouraged by Stewardship Code) would work better with hostile investors actively targeting companies in the market (See Exhibit 5).

Exhibit 5: Evolution of hostile and friendly activists in Japan (Illustrative purpose only)

Source: Nikko AM

In general, Japanese companies prefer to work behind the scenes than being forced to put on the spot and change, perhaps more so than global counterparts, from a cultural standpoint. Given the increasing cases of “hostile” activities, we believe that having a combination of friendly and hostile investors in the market will surely contribute to unlocking/creating shareholder value for companies in Japan.

About the Japan Equity Team

Hiroki Tsujimura

Chief Investment Officer, Japan

Jiro Nakano

Head of Japan Equity Fund Management

Masanori Hoshino

Head of Japan Equity Research

Junichi Takayama, CFA

Investment Director