Summary

- The MSCI AC Asia ex Japan (AxJ) Index gained 1.7% in USD terms in March. Returns within the region diverged, as India and China outperformed their ASEAN counterparts. Optimism about progress made by the US and China towards a mutually acceptable trade deal helped Asian equities stage a late rally at the close of the month.

- India outperformed as sentiment was buoyed by expectations of an election victory for Indian Prime Minister Narendra Modi. Conversely, South Korean stocks sold off, hit by the country’s deteriorating manufacturing PMI data, which marked the fourth straight month of contraction in February.

- Returns in ASEAN were mixed. Malaysia and Thailand saw USD losses of 2.8% and 1.6% respectively in March, while Singapore and Indonesia both generated muted gains of 0.6% in USD terms. The Philippines saw the biggest gains among ASEAN markets, advancing 2.1% in USD in March.

- Despite weaker growth data globally, which resulted in an inversion of the US yield curve, the first quarter of the year has been a very strong one for Asian markets. Valuations have only just picked up from close to all-time lows.

Asian Equity

Market Review

Asian equities gained in March

Asian stocks, lifted by strong equity gains in India and China, managed to overcome lingering growth concerns about the global economy to turn in positive returns in March. This saw the MSCI AC Asia ex Japan Index rising 1.7% in USD terms over the month. However, returns within the region diverged, as India and China outperformed their ASEAN counterparts. Optimism about the progress made by the US and China towards a mutually accepted trade deal helped Asian equities stage a late rally at the close of the month. A rebound in China's official February purchasing manager index (PMI), which moved into expansionary territory, also lifted regional stocks at the end of March.

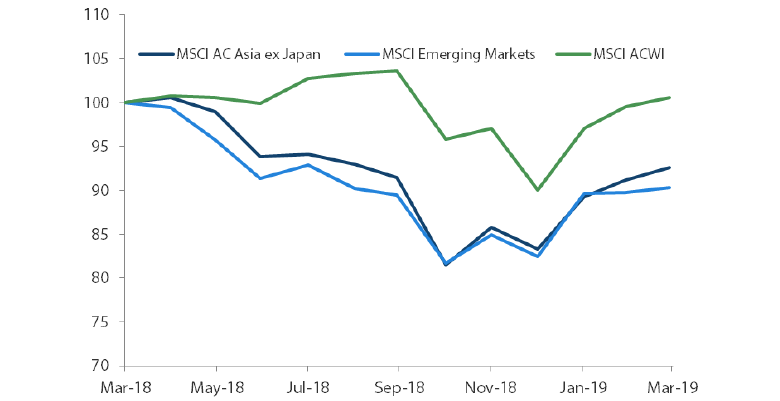

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 March 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

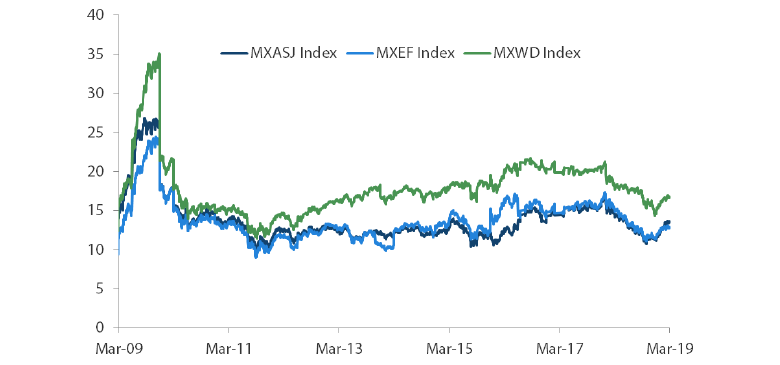

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 31 March 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and Taiwan outperformed, but South Korea slumped

China posted its third monthly gains for the year, rising 2.4% in USD terms in March on hopes regarding market opening and trade talks. Investors cheered at Beijing's pledge to further liberalise the country's financial markets. Renewed hopes of progress in US-China trade talks, plus the rebound of China's official PMI to 50.5 from 49.2 in February, also gave Chinese stocks a boost.

Taiwan climbed 2.3% in USD terms for the month, with big benchmark name TSMC rising nearly 3% in March on hopes that the non-memory semiconductor market will recover in 2Q 2019. Elsewhere, stocks in Hong Kong saw modest gains of 1.3% in USD terms. Hong Kong's property market rebounded along with the stock market, with the country's housing prices rising in February.

The worst performing Asian stock market in March was South Korea, which slumped 3.1% in USD terms after bearing the brunt of market anxieties about a possible global economic downturn. South Korean stocks were also hit by the country's deteriorating manufacturing PMI data, which marked the fourth straight month of contraction in February and the steepest decline since June 2015. On the corporate front, Samsung Electronics—ahead of preliminary results due early April—warned that its 1Q financial results would fall short of market estimates due to falling memory-chip prices.

India was the best-performing market

Indian equities were the biggest winners among regional stocks in March, surging 9.2% in USD terms. Sentiment was buoyed by expectations of an election victory for Indian Prime Minister Narendra Modi and prospects of a second interest rate cut this year at the Reserve Bank of India (RBI)'s meeting in early April. Inflation in India rose by 2.6% year on year (YoY), which is lower than the government's target of around 4%.

ASEAN saw mixed returns

Returns in the ASEAN region were mixed. Malaysia and Thailand saw USD losses of 2.8% and 1.6% respectively in March, while Singapore and Indonesia both generated muted gains of 0.6%. Thailand voted in its first general election since the 2014 coup. However, the results are unclear, with both main political parties—the pro-military Palang Pracharat party and the opposition Pheu Thai party—claiming they had enough support to form a coalition government. Official results are expected to be released in early May. In Singapore, the core CPI in February was below expectations at 1.5% year-on-year, while consumer prices in Malaysia fell for the second month in a row in February as fuel prices dropped. The Philippines saw the biggest gains among ASEAN markets, advancing 2.1% in USD terms in March. The country's central bank maintained the lending rate at 4.75%, as inflationary pressures eased on the back of lower food prices, and lowered its 2019 inflation forecast downward to 3%, from 3.1%.

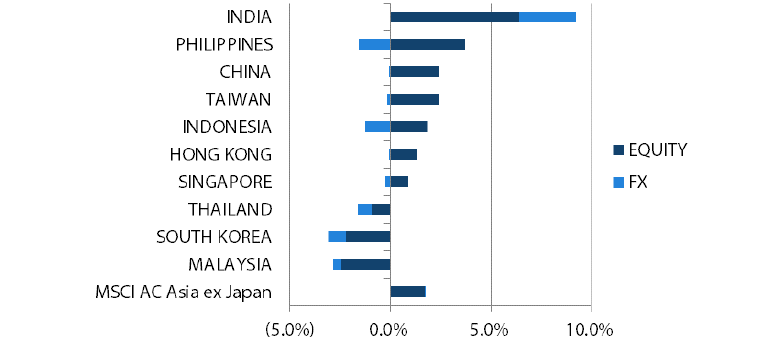

MSCI AC Asia ex Japan Index1

For the month ending 31 March 2019

Source: Bloomberg, 31 March 2019

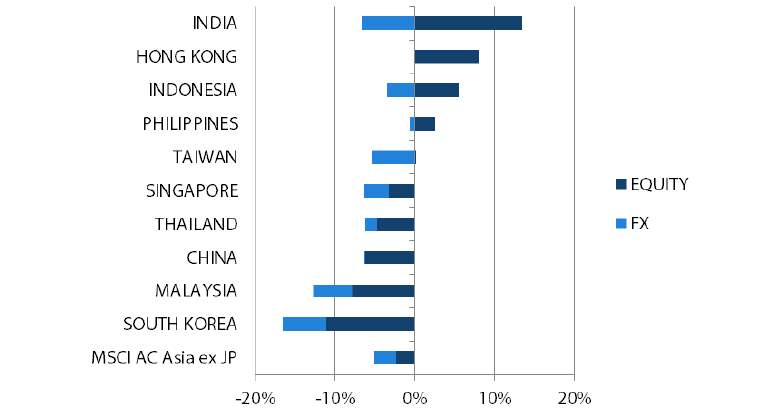

For the period from 31 March 2018 to 31 March 2019

Source: Bloomberg, 31 March 2019

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Valuations in Asia have only just picked up

In spite of weaker growth data globally, which resulted in an inversion of the US yield curve, the first quarter of the year has been a very strong one for Asian markets. Stocks rebounded off an extreme low base of expectations at the end of 2018, as China began loosening its fiscal and monetary policy, and the Fed turned more dovish. It also helped that there is now greater optimism around a US-China trade deal. Quality companies with long-term sustainable earnings growth potential were well supported through the period. Given the Fund's focus in building up exposure to such mispriced quality companies during the market correction in the prior six to nine months, the Fund is now beginning to reap the dividends. Despite the market rally year-to-date, valuations have only just picked up from close to all-time lows, and we continue to be positioned in stocks we can hopefully own for the next five to 10 years.

Focus on insurance, healthcare and software sectors in China

We see grounds for optimism in China, which has been a key source of weakness in global demand in the past nine months. Whilst a cumulative stimulus of circa USD250 billion has been announced to date, the distinctive and encouraging sign about this round of easing suggests that the Chinese government is not only looking to boost infrastructure spending but also reduce burden on corporates and boost consumption through corporate and personal tax cuts. We expect further reforms to come through this year, in particular reforms in capital markets, which is paramount to attracting capital inflow in light of China's impending structural current account deficit. The Fund's stance with regard to core long-term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged but with greater representation in A-shares, where we have found better long-term bottom-up opportunities in recent quarters.

Cautiously optimistic on India, with a focus on private sector banks and real estate

India continues to be a story we like in the long term and lately has been getting some reprieve from a more dovish Fed. Its near-term macro uncertainties are slowly easing, with inflation still remaining benign, and its current account looking to narrow due to lower oil prices and GDP growth. As we get closer to national elections, opinion polls are no longer indicating a hung parliament, and we now expect the narrative to slowly move toward the government's reform agenda upon election. Reforms to raise fiscal revenue, increase export competitiveness and accelerate infrastructure spending will all be crucial to the long-term Indian growth story. Valuations, however, remain high despite a slightly brighter near-term outlook. Hence, we retain a cautiously optimistic stance, with a focus on strong private sector banks and the real estate sectors, where we believe regulatory-led consolidation will yield huge opportunities for the strongest players.

Remain selective in South Korea, Taiwan and ASEAN

Tech hardware names in South Korea and Taiwan continue to be under pressure from multiple headwinds, namely the US-China trade dispute, slowing demand growth and continued capacity expansion, which all suggest it might take some time for excess inventory to be fully digested. In particular for South Korea, the economic outlook is also increasingly murky, with President Moon's approval ratings sliding owing to the fall-out of his populist policies. However, given extremely attractive valuations in pockets of the market and the possibility of more proactive domestic fiscal stimulus, we see this as an opportunity to buy some quality South Korean companies with a focus on healthcare, electric vehicles, niche technology and content producers.

Political contests remain a central theme for the ASEAN region in 2019, with national elections in Thailand and Indonesia, and mid-term elections in the Philippines. The outcome of Thailand's first national election since the coup four years ago remains fluid, but the base case would be for the incumbent to remain in power with a coalition. There are signs of a nascent recovery in consumption in Indonesia together with a banking system that has been working through a bad debt cycle for over three years and has abundant capital for growth. Indonesia remains our preferred market in the ASEAN region. We maintain a zero weight to the Philippines where abrupt monetary policy tightening should start impacting domestic consumption and asset quality in the banking sector.

Appendix

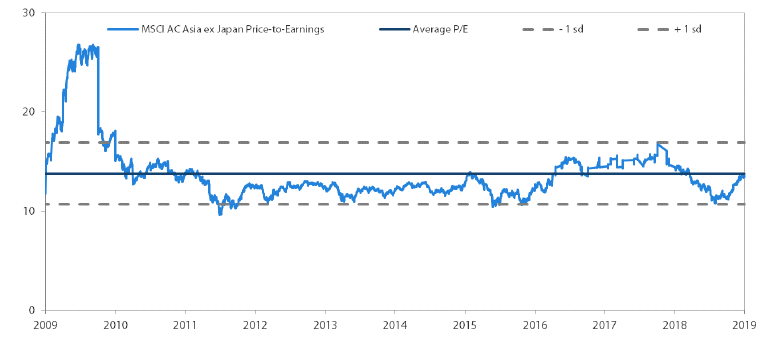

MSCI AC Asia ex Japan Price-to-Earnings

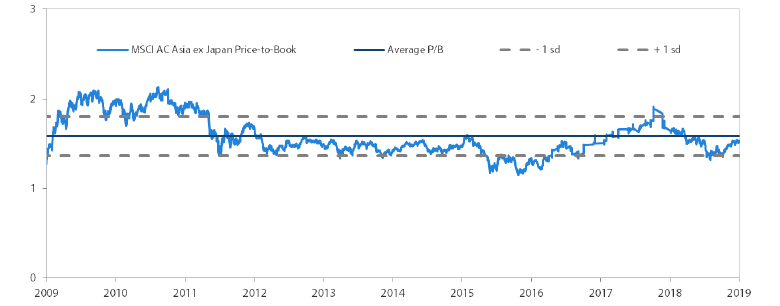

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 March 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.