Summary

- In March, central banks in developed markets turned decidedly dovish, triggering a rally in global rates markets. Sharp dovishness by the US Federal Reserve (Fed) also triggered steep gains for US Treasuries (USTs) across the curve. Weakness in European and American manufacturing data released thereafter weighed on concerns of an economic slump, causing the UST yield curve to invert. Overall, 2-year and 10-year yields were at 2.26% and 2.41% respectively, about 25 basis points (bps) and 31bps lower compared to end-February.

- Asian credit registered further gains in March, supported by spread tightening and UST gains. The negative impact on credit spreads from global growth concerns were more than offset by the positive effect from the increasingly dovish lean by major central banks around the world. Asian high-grade spreads tightened 4bps, returning 1.80% on a total-return basis. Asian high-yield corporates outperformed, returning 2.84% as spreads contracted by 32bps.

- Regional headline Consumer Price Index (CPI) data were mixed in February, while China set a lower growth target for 2019 of “6.0-6.5%.” Central banks within the region left their policy rates unchanged. Separately, Benjamin Diokno was appointed as the new Philippine central bank governor and Thailand held its elections.

- Activity in the primary market slowed slightly, due in part to the start of earnings results season. The slowdown was more pronounced within the investment grade space, which had just 23 new issues amounting to USD 11.3 billion in the month, while the high-yield space saw 34 new issues amounting to USD 13.4 billion.

- For Asian local currency bonds, we prefer bonds with mid to high carry, and have room for a shift to dovish monetary policy in the near-term. We expect central banks in Indonesia, the Philippines and Malaysia to possibly adopt looser monetary policy this year, in light of a benign inflation outlook. On currencies, we are positive on the yuan and expect the won to underperform.

- The demand for Asian credit is expected to be supported by the dovish Fed and slower growth outlook. Separately, the outcome of the US-China trade talks remains unpredictable. The upcoming election outcomes in Thailand, India and Indonesia also call for close monitoring.

Asian Rates and FX

Market Review

A rally in global rates

Central banks in developed markets turned decidedly dovish in March, triggering a rally in global rates markets. Earlier, the European Central Bank (ECB) slashed its growth outlook to below-trend, pushed out the timing of its first post-crisis rate hike to next year (at the earliest), and launched a new Targeted Long-Term Refinancing Operation. However, it was the US Fed's sharp dovishness that triggered steep gains for USTs across the curve. The Fed slashed its forecast from two hikes for the year to zero, and announced an intention to halt balance sheet shrinkage by September. Weakness in European and American manufacturing data released thereafter weighed on concerns of an economic slump, causing the UST yield curve to invert. At the end of the month, 2-year and 10-year yields were at 2.26% and 2.41% respectively, about 25bps and 31bps lower compared to end-February.

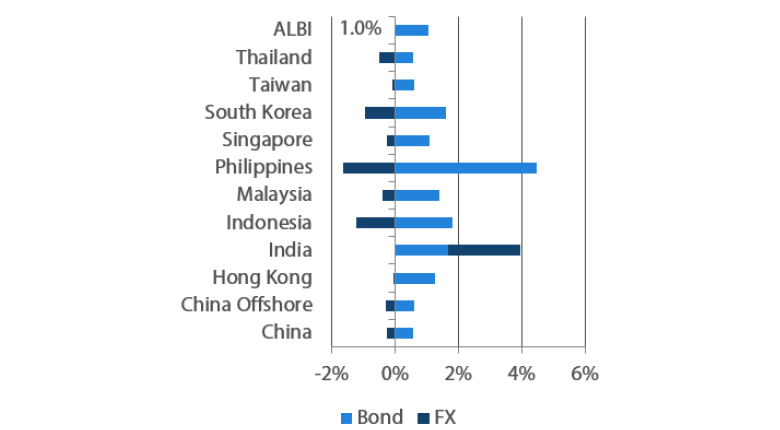

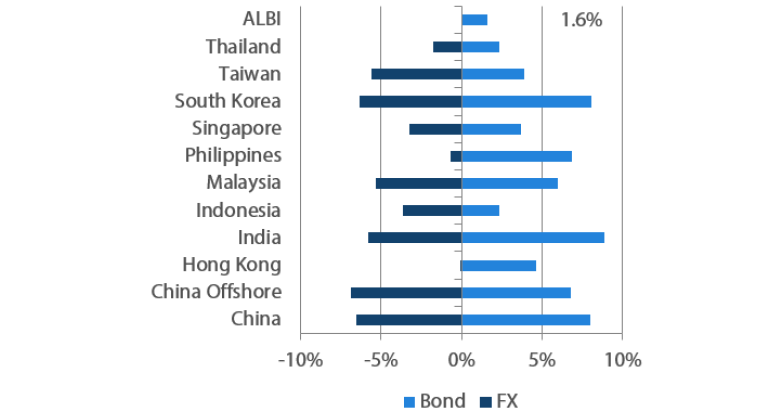

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 March 2019

For the year ending 31 March 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 March 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressure across Asia registered mixed in February

Headline CPI inflation was mixed across the region. Inflationary pressure rose (but stayed benign) in India, Thailand and Singapore, and moderated in China, South Korea and the Philippines. Headline CPI in Thailand hit a three-month high, as oil and fresh food prices climbed. Easing food deflation prompted the rise in headline CPI in India, while a more gradual decline in private road transport and accommodation costs was the main driver of the slightly higher headline number in Singapore. In contrast, a moderation in food price inflation prompted retail inflation in China to ease, and lower oil and fresh food prices pushed headline CPI in South Korea lower. In the Philippines, CPI eased to within the central bank's target range. The moderation was broad-based, and brought the figure to a one-year low. Elsewhere, Malaysia recorded a second month of deflation in February as fuel prices dropped.

Monetary authorities left policy rates unchanged

The Bank of Thailand's decision to leave rates unchanged was unanimous, with the central bank also lowering its 2019 GDP growth forecast to 3.8% from 4.0%, and raised its 2019 core inflation forecast to 0.8% from 0.7%. Bank Indonesia cited ongoing “efforts to strengthen the external stability” of the economy, and reduce “the current account deficit to a manageable threshold” as reasons to maintain rates. In the Philippines, the Bangko Sentral ng Pilipinas said prevailing monetary policy settings “remain appropriate” amid cooling inflation. Meanwhile, Bank Negara Malaysia struck a dovish tone in its statement that accompanied its decision to leave its policy rate unchanged, flagging downside risks to growth. Markets took this as a signal that the central bank is opening the way for a rate cut soon.

Benjamin Diokno appointed as the new Philippine central bank governor; Thai elections held

Philippine President Rodrigo Duterte appointed former Budget Secretary Benjamin Diokno as the new governor of the Bangko Sentral ng Pilipinas, replacing Nestor Espenilla who passed away in February after battling cancer. The new governor, known for his pro-growth policies when he was still part of the president's cabinet, said his priorities would be price and economic stability, and ensuring the independence of the institution. Markets largely perceive Diokno as more dovish, and have increasingly priced in looser monetary policy under his watch. Elsewhere, political uncertainty remains elevated in Thailand following its first election since a 2014 coup. While unofficial results reveal that junta leader Prayut Chan-o-cha has a good chance of returning as prime minister, establishing the government is likely to be a long drawn-out and difficult process.

Market Outlook

Prefer mid to high carry bonds with potential pivot to dovish monetary policy

We expect demand for regional bonds to be well supported, as central banks in developed markets signal even greater patience in raising rates. Our preference would be for bonds with mid to high carry, and to have room for a shift to dovish monetary policy in the near-term. As inflation eased in India, the Reserve Bank of India (RBI) became the first Asian central bank to reduce its policy rate. Going forward, we expect the RBI to remain dovish as long as headline inflation remains below its target. We expect the dovish stance to support Indian bonds, and are also not ruling out a further rate cut this year. We are looking at central banks in Indonesia, the Philippines and Malaysia possibly adopting looser monetary policy this year, in light of a benign inflation outlook.

Positive on the yuan; expect won to underperform

Continued progress in trade talks, together with MSCI's move to increase the weight of Chinese A-shares in its global equity indexes, are reasons that support demand for the Chinese yuan. In contrast, we anticipate the Korean won to underperform regional peers, on the back of a continued slowdown in global trade, weak domestic economy and stalled denuclearisation talks between North Korea and the US.

Asian Credit

Market Review

Asian credit rose in March

Asian credit registered further gains in March, supported by spread tightening and UST gains. Asian high-grade spreads tightened 4bps, returning 1.80% on a total-return basis. Asian high-yield corporates outperformed, returning 2.84% as spreads contracted by 32bps.

During the month, a run of weaker-than-expected global economic releases, including weak export data from China, soft US jobs numbers, and the ECB’s material downgrade of its growth forecast led to concerns regarding a deepening global growth slowdown. The negative impact on credit spreads from these growth concerns were however more than offset by the positive effect from the increasingly dovish lean by major central banks around the world. Reassurance from Chinese policymakers that targeted policies to support domestic growth will be pursued, together with overall better-than-expected earnings by Asian corporates, and relatively subdued primary market activity, also contributed to a steady tightening in spreads over the month. By country, there was a notable reduction in India’s election risk premium as the ruling party demonstrated marked improvement in its opinion poll performance. This supported sentiment towards Indian credit. Meanwhile, political uncertainty remains elevated in Thailand following its first election since 2014. While establishing the government is likely to be a long drawn-out and difficult process, the preliminary election results have had minimal effect on Thai credit spreads so far.

China lowered its 2019 economic growth target; Local Government Financing Vehicles (LGFVs) bond issuance requirements relaxed

At the annual National People’s Congress, Chinese Premier Li Keqiang announced that the government is targeting GDP growth of “6.0-6.5%” in 2019, down from last year’s “around 6.5%.” He declared that a larger scale of tax and fee cuts, among others, will be deployed to address downward pressure on the economy. Over the 10-day session, various policymakers acknowledged the need for further easing on both monetary and fiscal policy. Notably, the premier’s 2019 government work report encouraged using market approaches to address the issue of maturing LGFV debts, and avoid delays in, or work suspension on, projects financed by such debts due to lack of funding. Following this, China’s securities exchanges were reportedly given “window guidance” to relax requirements for corporate bond issuance by some LGFVs, which subsequently lifted sentiment on LGFV debt in both the onshore and offshore USD markets.

Slightly slower pace of new issuance

Activity in the primary market slowed slightly in March, due in part to the start of earnings results season. The slowdown was more pronounced within the investment grade space, which had just 23 new issues amounting to USD 11.3 billion in the month. Meanwhile, the high-yield space saw 34 new issues amounting to USD 13.4 billion, including a USD 2.4 billion two tranche sovereign issue from Sri Lanka.

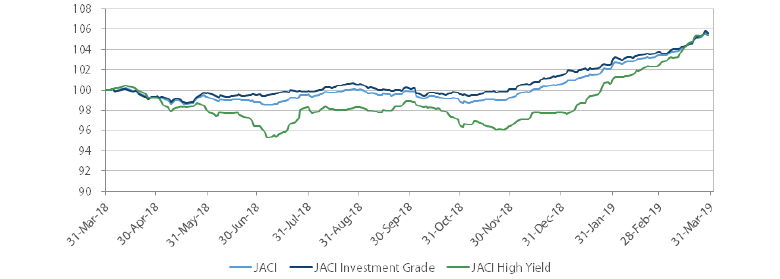

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 March 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 March 2019

Market Outlook

Demand for Asian credit to be supported by dovish Fed and slower growth outlook

Recent global economic data has turned softer, particularly in manufacturing, and especially in Europe. However, the labour market in most key countries remain steady. The US shows signs of wage growth pick up, which should support household incomes and consumption. Recession risks as currently priced by global rates markets appear overstated. That said, it may take time for economic data to turn sufficiently positive to prompt the US Fed and other major central banks to shift away from their current dovish lean. The combination of a dovish Fed and slower, albeit not recessionary, global growth outlook are supportive of global credit (including Asia and other Emerging Markets) performance, and momentum-driven inflows into the asset class. Additionally, Chinese macro data show signs of stabilisation in response to ongoing stimulus, and 2H 2018 corporate earnings results across Asia have been broadly positive. Thus, while valuation has regressed back to a less-attractive range vis-a-vis the long-term average post the sharp year-to-date rally, Asian credit spreads look poised to stay supported near-term, barring a sudden surge in new supply upsetting the current favourable technicals.

US-China trade talks continue to be a wildcard; regional elections bear close monitoring

The outcome of the ongoing US-China trade talks remains unpredictable. A positive outcome, with tariffs taken out or scaled down, could lead to higher UST yields and tighter credit spreads, while a collapse in negotiations would likely have a magnified contrary effect. Meanwhile, upcoming election outcomes in Thailand, India and Indonesia call for close monitoring, although the base case for now points to benign impact on respective country credit spreads.