The Chinese consumer has become wealthier in recent years and consequently is always on the lookout for something better—not just in form but in substance. What is less appreciated is that this demand is driving significant changes in many different areas, including product design and innovation in the Fast-Moving Consumer Goods (FMCG) industry, as well as supply-chain logistics. The humble and ubiquitous cup of tea serves as the protagonist as we attempt to illustrate the changing habits of the Chinese consumer, and the implications thereof.

Tea Generation 3.0

Tea is gaining traction with a younger demographic in China who view and consume it differently from the older generation of consumers, who traditionally drink tea out of earthen pots. This revolutionary cohort of tea drinkers, associated with fresh ingredients and lifestyle choices, is known as “Tea Generation 3.0”.

A roaring trade in China where annual volume consumed is equivalent to 34 Olympic-sized swimming pools, the tea business is no longer merely about beverage consumption, but also about offering a lifestyle concept. In 2016, 70.3 million litres of hot tea and 15.2 million litres of cold tea were sold in China1 , making it the largest tea market in the world. Estimates show that sales of freshly prepared tea have continued to grow, expanding 19% in 2017. This contrasts with a 4% decline in sales of coffee.2 We estimate that the tea market is worth RMB 71 billion (USD 10.6 billion) annually, with 70% of urban residents aged between 15-54 years old buying 15 cups of tea at an average of RMB 15 per cup. Each incremental cup sold per person would lead to additional annual sales of RMB 4.7 billion.

This trend is supported by multiple drivers from premiumisation and production innovation to marketers’ focus on customers. We discuss the drivers in the following paragraphs.

Evolution of Tea

Source: Nikko Asset Management, Citic Securities. 2019.

Consumption Upgrade

In the early 1980s, the Taiwanese founder of bubble tea, Chun Shui Tang, hit upon the idea of serving tea cold instead of hot after a visit to Japan. Bubble tea officially came into being in 1998, when his product manager poured traditional fen yuan (flour balls) into ice cold tea.3

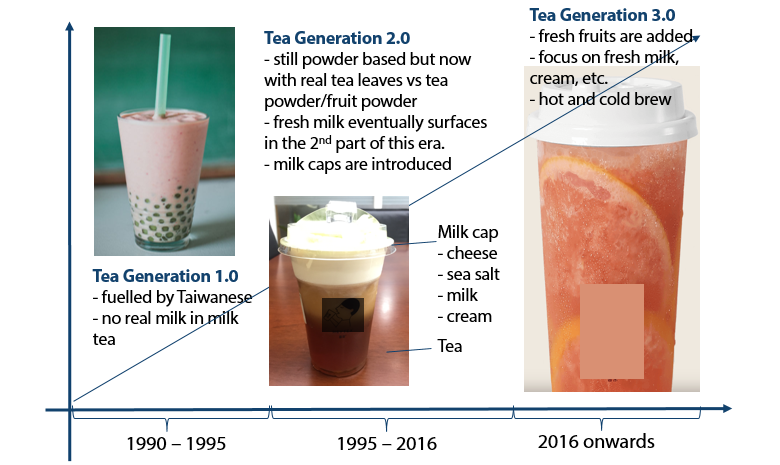

Bubble tea has gradually evolved from is origins in “Tea Generation 1.0”, which was marked by the use of tea powder, creamer and powdered fruit flavouring. “Tea Generation 2.0” took place between 1995 and 2016, where tea powder was upgraded to tea residue or shreds, and creamer was replaced by an innovation called milk tea “caps”. The idea of milk caps was inspired by latte, where coffee is topped with a layer of milk. Milk caps consist of a layer of cream, milk, salt and cheese blended into a creamy mixture used to top the tea.4

By 2015, bubble tea companies started using premium tea leaves and fresh milk or imported cream. With the premiumisation of bubble tea, average selling prices could be raised, supported by the increase in consumer incomes.

Since the advent of Tea Generation 3.0 in 2016, consumers have focused on natural and fresh ingredients. Fresh fruit, yoghurt and cheese are some of the ingredients used as “caps” to the tea. Fresh milk is used along with imported cream. Bubble tea now has three layers—fruit juice, tea and a milk cap. Fruit juices have real fruit in them. This reflects a broader change in China's consumption patterns with rising wealth.

Social Phenomenon

Freshly brewed tea has become a social phenomenon. Consumers enjoy it at leisure and take it as a treat while on the go or shopping. Social media influencers have also fuelled this phenomenon by becoming vocal advocates of tea drinking.

Retail tea chain Heytea, founded in 2012 in Guangdong by Nie Yunchen, has successfully leveraged social media to turn tea drinking into a trendy and fun activity. With drinks and décor that translate well on Weibo (the China equivalent of Instagram) or Tencent’s Moments, it is no longer about the drink itself but the entire experience. When the store first opened in Beijing, people waited in line for two to three hours and stand-ins could be hired to save one’s place in the queue for tea. Transparent cups allow customers to view the different colours of the tea and a dual cap feature allows for drinking via the top lid and generating milk-cap moustaches.

What the company sells is a lifestyle concept. It uses an almost generic logo of a side profile of a tea drinker that appeals to the common person on the street, yet makes them feel privileged by association.

Heytea’s turnover has reached an average of over RMB 1 million per month per store—about 2,000 cups a day. The highest turnover is realised in one of its Shenzhen locations, at up to RMB 1.7 million per month. According to Citic Securities, another location, the Shanghai Raffles City store, generates daily sales of RMB 80,000 or 4,000 cups a day.

Source: Nikko Asset Management, 2019.

Healthy Appeal

With its natural associations to good health, tea appeals to Tea Generation 3.0 consumers who are health conscious and active participants in the premiumisation phenomenon. Heytea has successfully positioned its use of high quality ingredients and freshly made tea with juice and real fruit against packaged drinks. To ensure a stable supply of quality fruit, another company, Tea of Naixue (also known as “Nayuki”), has invested in a strawberry farm in Yunnan and even hired a professor to help ensure the harvest is of good quality.5

The average price of freshly made drinks is RMB 15.2 per cup, significantly more expensive than packaged beverages at RMB 3 to 4. With increasing demand for premiumisation, freshly made beverages should continue to grow in popularity.

Innovation

Competing to engage with customers and enlarge their customer base, tea companies are constantly innovating and launching new products. Heytea, for example, launches seasonal fruit menus and new items like crème brulee tea or grape cheese tea. Its newer and unique toppings include frozen black sugar milk balls, mochi (rice cake) and red pomelo bits.

Nayuki won the hearts of consumers through novel products such as cold brew tea and four-layered tea. New items are launched each month in order to keep up with the fresh and fun image, attracting new customers while retaining old ones. In order to increase purchase frequency and the average ticket size of consumers, shops are also starting to sell innovative combo sets—from buns with bubble tea to pudding as an add-on.6

Source: Nikko Asset Management, 2019.

Innovation also extends to packaging. Noticing that traditional cups were designed with the male consumer in mind and too wide for the hand grip of female consumers, Nayuki’s founder, Peng Xin, had the cups redesigned to suit the female grip, using her own hand as a model. The company made 18 moulds before deciding on the final design. In addition, to prevent lipstick from staining the lid, a groove was made on it.7

Consumers are treated to a sensory feast as fresh ingredients give play to a myriad of colours viewed through fanciful and transparent cups and bottles. The pretty packaging creates Instagram-worthy photographs for consumers to share through social media.

Heytea’s latest innovation is a series of concept stores, Heytea pink, Heytea DP and Heytea black. Each store has a unique concept which draws interest on social media. The chic interior of the stores coupled with strategic locations in shopping malls help to elevate the overall image of the tea chain and entice customers to physically visit the stores for photo opportunities.

The rising popularity of bubble tea is further fuelled by the ease of access. Gone are the days when you had to physically visit the store just to buy bubble tea. With the rise of delivery services such as Meituan Dianping and Eleme, customers can simply order bubble tea online and have it delivered to any location within an hour. Consumers may also choose to order online via “mini programs” located within social media company Tencent’s platform and collect their tea at the store to skip the long queue.

Investing in Tea

As consumer interest in tea gathers momentum, private equity has been eager to benefit from this trend. Over the past year, tea chains have become prime investment targets.

In March 2018, Nayuki announced the completion of an A+ round of financing of a few hundred million yuan. The investor was Tiantu Investment, and the current valuation after the round of investment was said to be RMB 6 billion. 8The same year, Heytea also completed a RMB 400 million Series B funding where Longzhu Capital, a venture capital subsidiary of Meituan-Dianping, participated as an investor. Earlier in August 2016, Heytea obtained over RMB 100 million from IDG Capital and well-known investor He Boquan. Teasoon, established in June 2016, completed Series A financing of RMB 8 million just 1.5 years after its inception, in December 2017. Star Capital and Oriental Fortune Capital valued the company at nearly RMB 100 million.

More recently, Unison Capital Inc. has put Taiwanese bubble tea maker Gong Cha up in the market for USD 442 million9, valuing the company at 15x EBITDA vs the industry valuation of 15-17x. Reports place the bubble tea maker’s margins at 24–25% compared with Starbucks global margin of 21%.

As a public equity investor, it is important to keep track of the unlisted space on top of monitoring developments in the listed space. In many instances, as with tea, the unlisted market10 is more vibrant and active than the listed market. As some of these companies seek to expand, it is likely that they will look to tap the equity markets for growth capital. Examples include La Kaffa International, parent of bubble tea maker Chatime, and upstream supplier Sunjuice, listed in Taiwan. B & S International Holdings, the franchise owner of Taiwanese Ten Ren Tea in Hong Kong, is listed on the HKEx. In assessing investments in such companies, knowledge of the goings-on in private capital markets is essential.

So the next time you see someone at a tea shop in Shanghai ordering a four-layered, Instagram-worthy bubble tea and wonder what other changes are afoot, remember the ancient Chinese proverb ”better to be deprived of food for three days than tea for one” (寧可一日無食,不可一日無茶).

Footnotes

1. Source: Fusion tea wins over young people, 21 June 2018.

2. Source: Fusion tea wins over young people, 21 June 2018.

3. Source: Bubble tea: How did it start?, 12 July 2017.

4. Source: Citic Securities report, June 2017.

5. Source: 一杯茶+一个面包,奈雪の茶为何火爆?全解密, September 2017.

6. Source: 喜茶出面包了!深圳首家, May 2017.

7. Source: 奈雪の茶, February 2019.

8. Source: Nine Snow's tea valuation of 6 billion behind the three innovation + unique DNA, April 2018.

9. Source: Korean Investors

10.Source: Bubble-Tea Retailer Has a Bubblicious IPO