Global Outlook

The US Federal Reserve (Fed) saw a dovish turn from a regimented quarterly tightening pace towards increased data dependency. The Fed went further to affirm a neutral policy suggesting no rate hikes for the year and potentially beyond, while also lowering inflation and growth outlooks, noting that the latter “is slowing somewhat more than expected” and “financial conditions remain less supportive.” The move reignited a debate among investors that economic conditions are deteriorating faster than initially expected and that the cycle may be coming to an end, leading the rates market to price-in an increased probability of rate cuts during the coming quarters. The Fed also updated its balance sheet policy, suggesting an end to balance-sheet reduction by September this year. When completed, the Fed would still likely maintain the balance sheet at around USD 3.5 trillion in bonds, which is more than four times the amount it held prior to the financial crisis in 2008. As expected, the US bond yield curve inverted amid slowing inflation data and the growth outlook. Still, we expect that a pickup in energy prices and the knock-on effects of last year’s capex spending increase should see the curve re-steepen during the second half of the year.

European Parliamentary elections will take place in mid-2019 and have the potential to be seen as a market event for the first time. Several national elections will also take place for EU member states in 2019. Populism has been on the rise and will remain a force for European elections. Populists will further contribute to risk premiums in European markets, limiting fiscal reform efforts on deficit reduction and on banking sector stimulus, while promoting increased segregation in lieu of integration. The risk of snap elections will remain a threat to market stability, with several fragile coalition governments at risk to populist agendas. One the economic front, the latest set of data suggest activity within the Eurozone continues to ease, as a slowdown in global growth on the back of the China-US trade dispute appears to be filtering through the Euro-area manufacturing sector. Lower growth and a softer inflation outlooks eventually led the European Central Bank (ECB) to put plans to normalise policy on hold, providing banks with more liquidity, while delaying any rate hike until 2020 at the earliest. Liquidity provisions will take the form of targeted longer-term refinancing operations or TLTRO–III, commencing in September this year and comprising seven quarterly operations. TLTRO–II launched in 2016 and was vital for financing/refinancing, by providing 99% of the ECB’s total lending to banks, equivalent to 7.3% of total customer loans. Italian and Spanish banks have been the largest beneficiaries of the programme, and their reliance on a cheap source of funding is likely paramount to the soundness and stability of their respective banking sectors.

The UK Prime Minister is expected to resign at some point this year, as Theresa May recently signaled her departure (albeit making contingent on getting her deal passed). There are a number of potential candidates aligning themselves for the role of Prime Minister and we predict there to be an extensive process during the summer months. It is also worth noting due to the recent events in Westminster over Brexit and its clear stalemate, it has risen the very real prospect of a general election, or a further referendum, and the latter would produce a serious split in both the Conservative’s and the Labour Party surrounding Brexit. We still expect a deal in some form to eventually pass as the Prime Minister seeks to configure a solution that can be agreed upon by multiple parties. It is very likely there to be more challenges along the way and will only be resolved from both sides at the 11th hour. Outside of Politics, the latest set of indicators came in better than expected, including Q4 GDP, retail sales and manufacturing PMIs, which is reassuring considering the uncertain nature of the current political environment.

The consensus outlook for emerging markets in 2019 remains much less optimistic than it was last year. The general expectation is that the major central banks are likely to continue to tighten liquidity through rate hikes and/or balance sheet reduction throughout the year, albeit of lesser magnitude than initially expected. As we’ve seen, tighter liquidity is a major headwind to emerging market assets, not least because emerging market government debt stands at its highest level since the 1990s. Private sector credit in China remains a concern. We still see a glimmer of hope coming from a moderate growth slowdown of developed economies. Indeed, growth in emerging economies, which is more dependent on China, is starting to look more attractive on a relative basis. The slowdown in China, which has made its way through the emerging world, is already well accounted for. In addition, we have to consider the possibility of a prolonged trade war. China is utilising a combination of monetary and fiscal stimulus, helping to offset the impact of tariffs to a certain extent. So, while the consensus view might be bearish, we strongly believe that individual emerging markets will be able to cope better this year. Given the dovish turn by the Fed, we see this as a positive for emerging market bonds that are supported by sound fundamentals, as they will continue to receive welcome support from international investors. We also do not believe that a full-blown trade war between China and the US is a likely outcome as the latest news flows point to an increased probability of a positive resolution to the protracted trade stand-off.

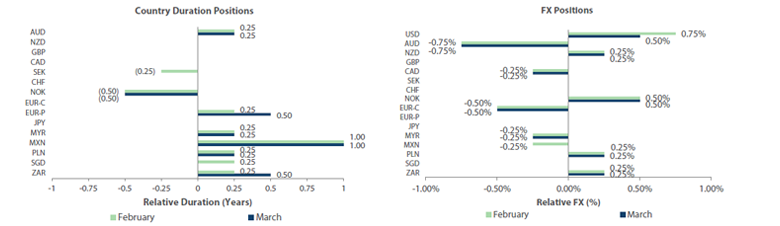

Developed Market Positioning

The team has moved to an underweight duration on the view that the rally in rates was overstretched. US data remains moderately positive and the market views the Fed as too dovish at the moment. The team reduced its dollar positioning slightly to offset neutralizing its Mexican peso positioning. While we have become more cautious on the dollar after the more dovish than expected Fed meeting, we noted the risk of inflation in the second half of the year on a continued rally in oil prices. The team slightly tweaked our duration positioning with marginal increases in Euro periphery duration on TLTRO III and general slowing growth. The team has looked to barbell positions in the US, Canada and Australia on the view that the belly of the curves are trading rich relative to a blended barbell approach. Mexico still remains the team’s top position in duration exposure given the overall carry and steepness of the 2s-10s part of the yield curve.

For the UK, we remain neutral on all sterling positioning in the face the binary event risk surrounding Brexit. The continued political impasse demonstrates no clear path for the future of the UK, EU relationship and thus remains a binary event in our view. While we tend to favor the more favorable Brexit outcome and remain constructive on GBP, we view the down side risk as a significant probability and look to justify spending risk budget in other areas.

For Australian and New Zealand, the team has continued to demonstrate favorable bias on New Zealand versus Australia, but note that both regions face increased risk on trade exposure to China. The team noted that it expects the RBA to be the central bank that would be more likely to cut first, ahead of the RBNZ and expect the Australia/US 10-year spread to continue to trend through historic lows. On a combined basis, the team has continued to reduce exposure to on the increasing risk of a China slowdown.

For the Nordics, the team has neutralized duration positioning in SEK, but notes that slowing data in the Eurozone, does not support the Riksbanks stated 4th quarter hike. The team has moved to neutralize duration on the longer duration view in Europe. The team remains cognizant of the ongoing Baltic banking scandal, but do not view this as posing much systematic risk at the moment. For Norway, the team has maintained its overweight FX, underweight duration positioning on the positive momentum in energy markets as well as the Norges Bank’s increasing hawkishness.

For Canada, we maintain a slight underweight FX view and neutral duration positioning on the Bank of Canada’s dovish turn laving rates unchanged as the recent deterioration in economic data have outweighed the impact from higher oil prices.

Emerging Markets Positioning

In emerging markets, we remain constructive on duration overall, given the likely slower path of rate increases by the Fed over the coming year and still high real yields in many emerging local currency bonds. In FX, we have also turned marginally more constructive overall as we are starting to see the benefits of China’s stimulus measures in its economy, which should also benefit other emerging market economies, even if we remain somewhat skeptical of the scope of an imminent trade deal between the US and China due to the structural nature of the issues at hand.

We remain underweight the Malaysian ringgit as the economy remains weak as the manufacturing side of the economy remains under pressure as a result of weaker external demand. Political ineptitude now threatens domestic demand with previous consumption tax stimulus measures starting to wane. We also expect the ringgit to continue to closely track the Chinese renminbi which should exhibit a slight weakening bias relative to its peers in order to maintain competitiveness. Amidst diminishing inflation pressure primarily due to lower consumption taxes and the removal of petrol subsidies, we are likely to see an extended pause in monetary policy in Malaysia, keeping local currency bonds supported.

We turned neutral on the Mexican peso as growth momentum has partially recovered from a weak patch in late 2018. But increasingly nationalistic rhetoric from President Andrés Manuel López Obrador (AMLO), which we believe justifies a higher risk premium to compensate for political uncertainty, prevents us from moving overweight. With inflation exhibiting strong downward momentum, we maintain our exposure to MBonos which offer significant value with yields over 4% above inflation.

We remain overweight duration in Poland, with domestic growth losing some momentum as well as expectations of a more dovish turn in policy from the ECB, all being supportive of Polish bonds. We remain marginally positive on the Polish zloty relative to the Euro as despite some early signs of moderation, the economy is still widely expected to remain well above the aggregate pace of growth in the common currency area.

We remain marginally overweight the South African rand due to a growth rebound, supported by a nascent rebound in Chinese demand. This should help bolster the popularity of incumbent President Cyril Ramaphosa, widely regarded as the voice of reason with the ANC, ahead of General Elections in May as such the currency should perform well relative to its high-beta peers. We also remain overweight duration as the inflation outlook remains benign, with Core CPI close to the mid-point of the SARBs inflation band, which should see them remain on hold, making the current valuation of local bonds in South Africa particularly attractive.

Global Credit

We have seen solid returns for global credit in March and a continuation of the strong performance for the start of 2019. The markets that made excess returns were Latin America and US Investment Grade (even betting High Yield). What is apparent from this recent rally is that a significant component of these returns came from the rates side. The best performing in absolute performance was Asia High Yield. What we are also observing is that there is a dispersion between rates and credit. At some point, this dispersion will need to clear and there will be either be a recession where spreads will widen or the rates market is over run and the credit market is correct. Looking at credit from a global context, we would argue that the rates markets are a bit too concerned with the state of the economy, in particular in Europe where the domestic demand is still strong and exceeding the relative weakness from the export manufacturing side.

The macro segment of the European market has shown some signs of deteriorating. In particular, the German economy has seen negative results in terms of PMI and export numbers. Elsewhere in Europe, there have been inflection points in economies such as Spain, France and even the UK, based on data (in spite of Brexit concerns). Political risk is still a concern where Brexit and European Parliament elections results are still unknown and how this could affect credit markets. We still have some concern on Q1 earnings and credit ratios but overall we don’t expect there to be too much impact on the numbers. European credit flows has seen large inflows for 2019, on the back of largest outflows in 2018. This has helped to soak up demand for corporate bonds in the region. Elsewhere liquidity has improved dramatically since the end of 2018.

Looking at the US in more detail, there are similar themes to Europe where credit has grinded tighter. Regarding Investment Grade, we are approaching tight credit levels close to last October. The overall sentiment on credit is fairly good. From an economic perspective, there is an overhead of political uncertainty globally, which is seen with President Trump’s future trade policy. In the US, we remain focused on more domestic sectors that can remain independent to geo-political risk and international business, such as telecommunications and utilities. Over recent weeks, we have become more bullish on the commodity sector and we will observe this market closely in order to develop future trade ideas.

In Australia, we have seen some negative headlines but overall we see more positive indicators in the market. There is a sense within the market that the economy could enter a period of uncertainty. We note this maybe because of the upcoming general election to take place where it is expected that the Australia Labor Party will triumph over a relatively weak Liberal Party. We would argue that overall business sentiment is down and political risk heightened. We remain positive where defaults are low and leverage and earnings are reasonable. Additionally, valuation spreads for credit are satisfactory and do offer an opportunity for investors. Lastly, within Australian credit there are two opportunities that are attractive within the current market, Australian REITS and the AAA and AA level of the Australian RMBS market.

In Asia, weaker-than-expected global economic releases in March, including weak export data from China, soft US jobs numbers, and the ECB’s material downgrade of its growth forecast led to concerns regarding a deepening global growth slowdown. The negative impact on credit spreads from these growth concerns were more than offset by the positive effect from increasingly dovish major central banks around the world. Reassurance from Chinese policymakers that targeted policies to support domestic growth will be pursued, together with overall better-than-expected earnings by Asian corporates, and relatively subdued primary market activity, also contributed to a steady tightening in spreads over the month. There was a notable reduction in India’s election risk premium as the ruling party demonstrated marked improvement in its opinion poll performance. This supported sentiment towards Indian credit. Meanwhile, political uncertainty remains elevated in Thailand following its first election since 2014. While establishing the government is likely to be a long drawn-out and difficult process, the preliminary election results have had minimal effect on Thai credit spreads so far. Activity in the primary market slowed slightly in March, due in part to the start of earnings results season. The slowdown was more pronounced within the investment-grade space.