Raymond Kurzweil is pretty smart, and his track record of over 80% accuracy at predicting the future is pretty phenomenal, especially when a top quartile fund manager would be proud of a 65% hit rate! His predictions include the emergence of medical-use nanobots and self-driving cars in the 2020s, almost real virtual reality by the 2030s, and wireless linking of the human brain’s neocortex to the cloud (allowing us to multiply our intelligence a billion-fold) in the 2040s. What’s implicit in these predictions is the presence of a ubiquitous, ultra-low latency, high-speed wireless communication network. Enter 5G.

Still a Pipe Dream?

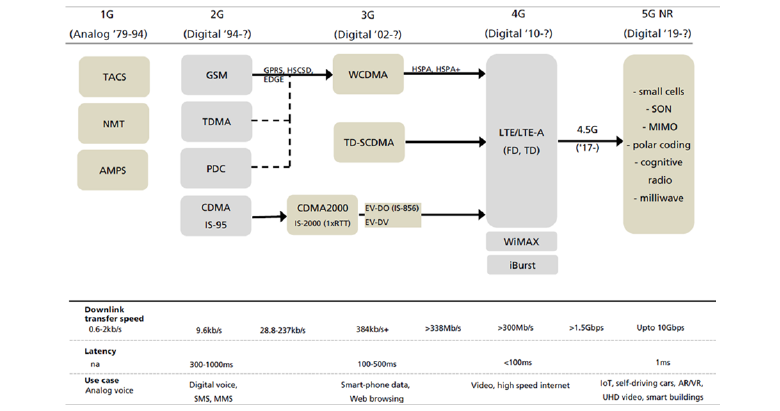

Mobile communications have come a long way from 1G networks offering analog voice. In the interim we have seen 2G, which combined analog and digital technologies by adding SMS capability. Afterwards, 3G technology then bolted on the ability to send data through services like video-calling and Internet browsing and 4G networks currently offer higher speed internet, allowing for functions like mobile gaming and video streaming. The world now awaits the introduction of 5G.

History of Mobile Networks

Source: Cisco Systems, UBS

A lot of newsprint has focused on 5G lately. The mobile technology has three main features: enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (uRLLC) and massive machine type communication (mMTC). This technology enables an “everything is connected” ecosystem, rather than merely an ecosystem of connected mobile devices. This will allow for network virtualization using Software Defined Networks (SDNs), such that users can leverage cloud-based core elements while deploying generic hardware at termination points. From a user perspective, that means 5G offers exceptionally high speeds, a mobile signal everywhere and all the time, and a widespread Internet of Things (IoT). At the same time, the communication network is faster, more flexible, more scalable and more efficient. Networks using 5G can act as the platform for building innovative and disruptive new applications that can transform a wide range of industries, such as autos, textiles, healthcare and software. However, this also presents significant network security challenges because of the pervasive use of software, as most software is hackable.

Note: In chess, the Sicilian defence is a popular response to White's first move.

Over the past decade, mobile telecommunication services have become integrated in national economies. They have been a major driver of productivity growth, which is the main driver of income growth over the long term. This is particularly true of developing economies, where it is estimated that the positive impact of mobile telephony on economic growth may be twice as large as that in developed countries1. Another study concluded that mobile data usage per 3G connection has a positive effect on the growth rate of per capita GDP2 . Meanwhile, even a developed economy like the UK was estimated to see an aggregate increase of 0.7% in productivity thanks to 4G LTE mobile broadband3. And 5G technology promises even bigger and better things. According to a study commissioned by the Australian government4 , 5G could add an additional AUD 1,300 to AUD 2,000 in gross domestic product per person after the first decade of the rollout. That is roughly a 2.5% increment to current per capita GDP.

As an illustration, eMBB, one of the aforementioned main features of 5G technology, could potentially upend today’s fixed broadband industry by delivering speeds equivalent to optic fibre for up to 600 mobile devices per cell site. At the same time, it would be significantly cheaper—for example a fifth of the cost in a region such as ASEAN. In countries where fixed line infrastructure is either absent or outdated, wireless solutions can be a panacea. In Indonesia, mobile penetration is almost 100% but fixed broadband penetration is only 9%. So rolling out a 5G wireless broadband solution would overcome the hurdle posed by the lack of expensive wired communication infrastructure. EMBB could also potentially disrupt the media industry. Free-to-air, Direct-To-Home, and Cable TV will now need to contend with 5G as alternative method of content delivery. The rise of Netflix, iQiyi and other digital media providers suggests that media consumption models will be completely redesigned. And we haven’t even begun to digest the potential of augmented reality (AR) and virtual reality (VR) on consumer industries. It’s easy to understand why countries the world over are eager to launch 5G services.

What you sow is unfortunately not what you reap

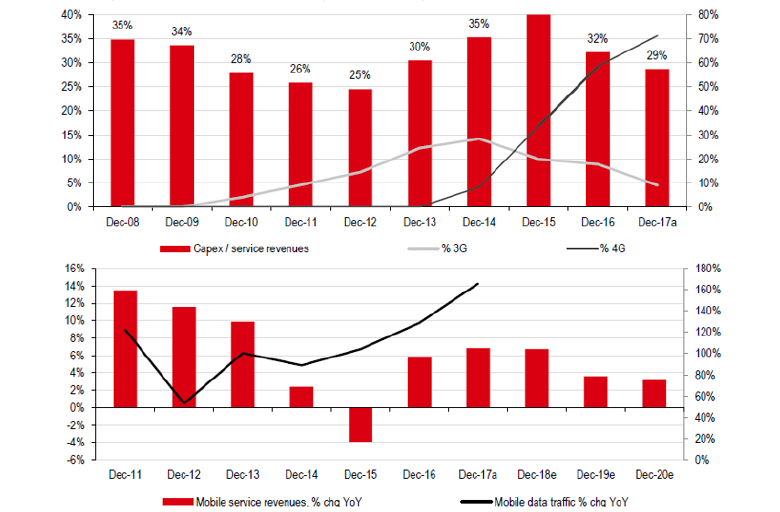

Source: Company Data, HSBC. Note: The red bars (ratio of capex to service revenues and on-year % change in mobile service revenues) refer to the left axes while the line graphs (3G and 4G% and on-year % mobile data traffic change) refer to the right axes in both charts.

There has been a less enthusiastic response from most telecom operators however, even though none of them deny the significant potential of 5G technology. The economic returns from the capital invested in successive generations of telecom networks have been steadily deteriorating. As each investment cycle has become progressively shorter, so too has the window to monetize these investments. This is demonstrated in the graphs above using aggregate data from all three Chinese telecom operators, where there is marked divergence between capital expenditure and revenue momentum. This trend holds true in other markets too.

A commercial 5G Strategy is still work-in-progress

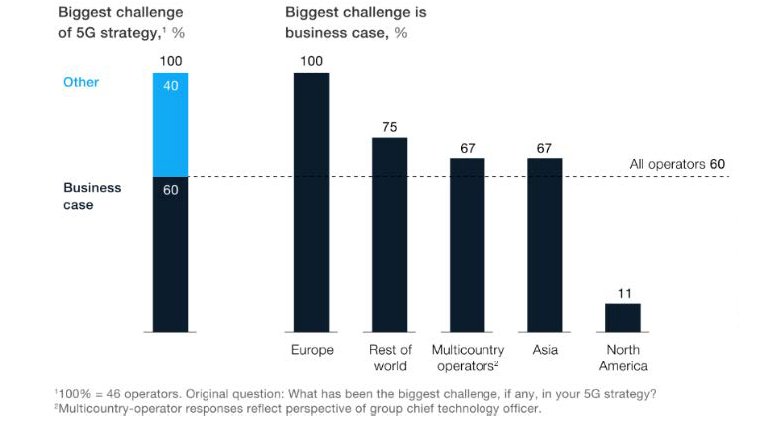

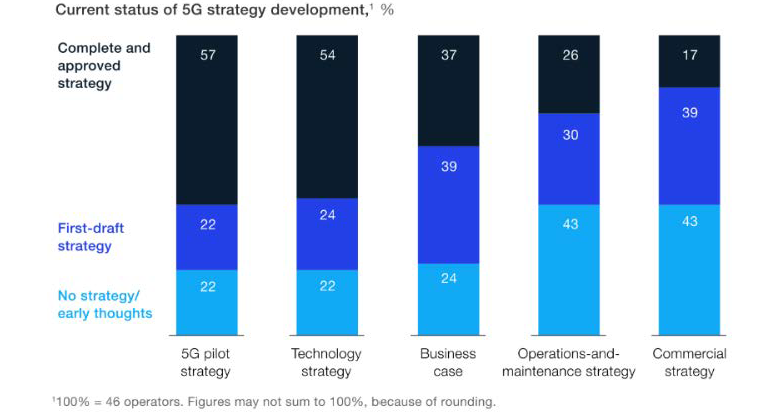

Source: McKinsey & Company

Business strategies that can exploit all the features offered by 5G are still being crafted. What telecom operators believe they can immediately charge for is higher mobile speeds—which is essentially just an augmented 4G; this is a concept the industry refers to as “5G NSA” (Non-standalone). In a global survey of 46 telecom operators conducted by McKinsey & Company, respondents admitted that true 5G deployment (5G SA or 5G standalone) on a commercial scale is probably two to three years away (graphs above). Recent news referring to the launch of commercial 5G services in South Korea and the US are actually about the roll-out of 5G NSA services, not full-fledged 5G services. Thus far, China is the only country that appears to be on the verge of launching a trial of 5G SA this year.

Intellectual Capital to Grow

Earlier this year, Forbes magazine published an article introducing Herbert Wertheim as “the greatest investor you’ve never heard of.” This self-made billionaire amassed his considerable fortune from buy-and-hold investing. And he developed a unique process in which he eschews the analysis of financial statements. Wertheim is instead devoted to reading patents. “What’s more important to me is, what is your intellectual capital to be able to grow?” he is quoted as saying. If we applied this standard to the world of 5G, China should score very highly.

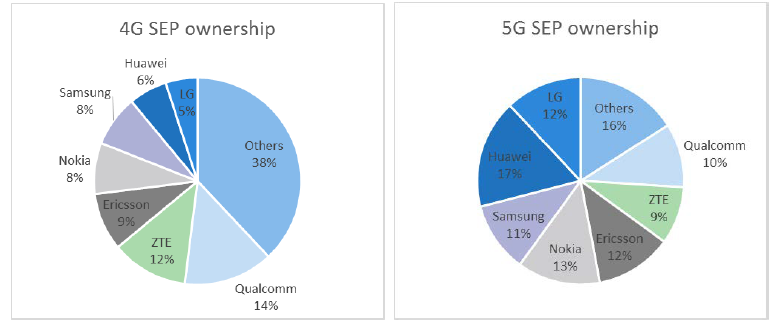

Standard Essential Patents (SEPs) are patents that anyone looking to implement a standardised technology will need to use. A company’s ownership of SEPs has no bearing on its ability to supply equipment or services to others. The owner of an SEP earns royalties regardless, and is able to participate in standard-setting for 5G and future developments.

SEP Ownership Comparison

Source: Cyber Creative Institute; "Evaluation of LTE essential patents declared to ETSI"

While they were mere bystanders in the development of 3G and 4G standards, Chinese companies are at the forefront of 5G SEP ownership. There is significant variation in the technical and economic value of SEPs, but in general, SEP ownership is a good indicator of expected return because of royalty fees. And, critically, it allows owners to shape the direction of technological progress. Huawei Technologies and, to a lesser extent, ZTE Corp., are the China’s flag-bearers when it comes to SEP ownership.

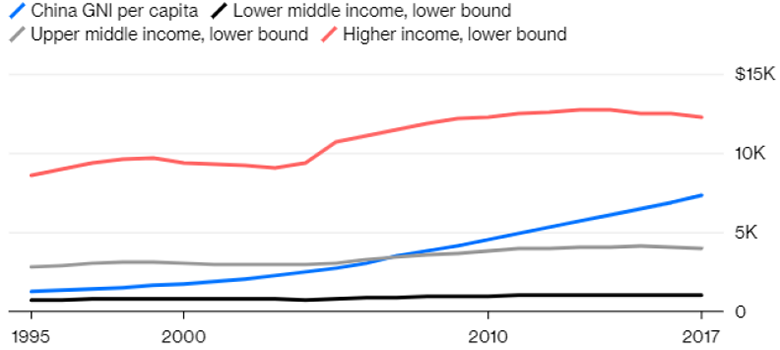

China’s explicit focus on and support for innovation is not a recent phenomenon. With the productivity uplift from fixed asset investments having largely run its course following rapid industrialization, the next leg of productivity gains can only come from a shift toward higher value-added activities. An increase in total factor productivity is essential for China to avoid the middle-income trap.

Beijing has reason to believe its innovation thrust focused on technological development will work. The International Monetary Fund (IMF) found that for Chinese firms, a 10% increase in patent stock implies about 1.5% increase in real output and value added. It also found a similar rise in capital and employment, and a 4% increase in export value. And this improvement in productivity is nearly three times higher than that cited in a prior study using US data5.

Therein lies the issue.

Can China avoid the middle income trap?

Source: World Bank

The Best of Times, the Worst of Times?

“There are at the present time two great nations in the world, which started from different points, but seem to tend towards the same end….Their starting-point is different, and their courses are not the same; yet each of them seems marked out by the will of Heaven to sway the destinies of half the globe.” Alexis de Tocqueville made these remarks about the US and Russia in 1840, anticipating the Cold War a good 100 years in advance. Replace Russia with China, and he could well have been talking about the current state of affairs.

Huawei’s and ZTE’s rise in the 5G world is seen as the result of backing by China’s government, raising the stakes in a much larger geopolitical game between China and the US, whose companies dominated in 3G and 4G technologies. That Huawei’s founder, Ren Zhengfei, was a technologist in the People’s Liberation Army, has given credence to the view that Huawei is a state proxy. ZTE’s state links are less ambiguous. Because every Chinese company can be asked by the government to assist with intelligence gathering, there are concerns that Huawei and ZTE equipment could be used to spy on companies and governments around the world. And with software playing a much more significant role in the 5G ecosystem, with the potential to touch virtually every industry in an economy, this is by no means a trivial issue. While these security concerns are legitimate, they are by no means exclusive to Huawei or ZTE products. Design issues, bugs and loopholes are inherent in all complex software. Continual updates to mobile phone operating systems are a reminder that even Apple and Google, true-blue American companies, have to regularly contend with such issues.

The US, Japan, Australia and New Zealand, and companies such as British Telecom and Orange have banned both Huawei and ZTE from their 5G network deployments. A handful of other countries have made cautionary noises, including the UK, Canada, the Czech Republic and Poland, as have other companies like Deutsche Telekom. Never mind that Google, whose Android mobile operating system accounts for over 80% of all smartphone sales worldwide every year, shares Sensorvault data with US law enforcement. Sensorvault is a database that collects user data including detailed location records from around the world. Incidentally, Google’s work on drones, known as Project Maven, is exempt from the US Freedom of Information Act because it has “critical infrastructure security information.”

5G Leader Board

An optimal 5G roll-out will require concerted telecom and media regulation efforts, legislative support, intensive infrastructure and ecosystem development (i.e. smartphones, applications, etc.), and the ability to run pilots across multiple industries. A more technical consideration, but a critical one nonetheless, is the availability and cost of adequate spectrum. The frequency of the spectrum determines signal propagation characteristics, with lower frequencies offering greater coverage. In China, 5G is being rolled out on sub-6GHz frequencies, whereas frequencies currently in use in the US are 24GHz or higher. South Korea, meanwhile, is using a combination of 3.5GHz and 28GHz. In China, spectrum is allocated by the regulator to the telecom operators for free, while in most other countries, including the US and the EU, it is auctioned to the highest bidder. In South Korea, for instance, the telecom operators paid KRW 3.6 trillion (USD 3.2 billion), while US spectrum auctions have so far raised a total of USD 1.3 billion. All These factors suggest that the US operators are likely to focus on 5G services in urban locations rather than a nationwide roll-out, while Chinese operators can afford a more comprehensive rollout.

The US, EU, Japan, South Korea and China have all identified 5G leadership as a priority. However only China is a command economy that controls all the essential ingredients. With nearly 1.4 billion people and a USD 13 trillion economy, the domestic market affords the scale to make a 5G technology rollout viable, and renders the market attractive enough for neutral technology vendors to stay interested. All three of China’s telecom operators are SOEs, where the national agenda takes precedence over economic returns or minority interests. Huawei and ZTE are among the leading manufacturers of telecom network equipment, as well as mobile devices, globally. It’s not surprising that China is furthest along in implementing trials of 5G SA. ZTE, Ericsson, and China Mobile have announced a successful video call between a 4G and a 5G handset both manufactured by ZTE and using network equipment from ZTE and Ericsson. China Telecom, Huawei and the State Grid Corp. of China claim to have completed the world’s first test on a real power grid in compliance with 5G SA specifications6.

If imitation is the sincerest form of flattery, it is amusing that President Donald Trump's re-election team has raised a plan for the US government to take active part in managing US 5G networks, which promptly elicited strong industry resistance.

True 5G has the power to transform the world and drive significant increases in productivity. As with any transformational technology, it is difficult to see all of its potential uses in the early days of rollout. But over time, business models, applications and services are developed to take full advantage of the resources and platforms available. Benefits are typically democratised because they can be exported, copied and adapted. So, if everyone is eventually going to benefit from the rollout of 5G, does it really matter who wins today? Or, as in chess, if China appears to be playing white?

Footnotes:

- Waverman, Leonard; Meschi, Meloria and Fuss, Melvyn, “The Impact of Telecoms on Economic Growth in Developing Countries”, 2005

- Williams, Chris; Strusani, Davide; Vincent, David and Kovo, David, “The Economic Impact of Next-Generation Mobile Services”, 2013

- Capital Economics, “Improving Connectivity – Stimulating the Economy”, November 2014

- Bureau of Communications & Arts Research, Dept. of Communications & the Arts, Government of Australia “Impacts of 5G on productivity and economic growth”, 2018

- International Monetary Fund Working Paper WP/16/249; “China’s Rising IQ (Innovation Quotient) and Growth: Firm-level Evidence”, 2016

- https://www.huawei.com/en/press-events/news/2019/4/huawei-sgcc-first-5g-sa-power-grid-slicing; 10 April 2019