Summary

- The MSCI AC Asia ex Japan (AxJ) Index gained 1.9% in USD terms in April, buoyed by better-than-expected economic data from the US and China, stabilisation in global risk sentiment and a more dovish stance by the US Federal Reserve.

- Singapore stocks were the biggest winners among regional equities in April, surging 6.3% in USD terms, owing to strong gains from banking stocks. Conversely, Malaysia was the worst performing Asian market in April (-1.0% in USD terms), with investors unenthused by the government's policies.

- Taiwan did well, led by strength in semiconductor stocks and robust consumer confidence numbers. China posted a gain of 2.2% in USD terms, following the release of better-than-expected 1Q19 economic data.

- While we remain constructive on Asian markets given the attractive valuations notwithstanding the rally year-to-date, we are equally cognisant that a number of factors could lead to higher volatility. Factors that have been priced in by the market include some imminent resolution to the US-China trade war; the Modi government remaining in power; and Joko Widodo's win in Indonesia. Conversely, any deviation from this narrative will raise risk premia, at least in the short run.

Asian Equity

Market Review

Asian equities gained in April

Asian stocks continued their ascent in April buoyed by better-than-expected economic data from the US and China, and stabilisation in global risk sentiment. Expectations of an imminent US-China trade deal and the more dovish stance by the US Federal Reserve (Fed) also boosted sentiment over the month.

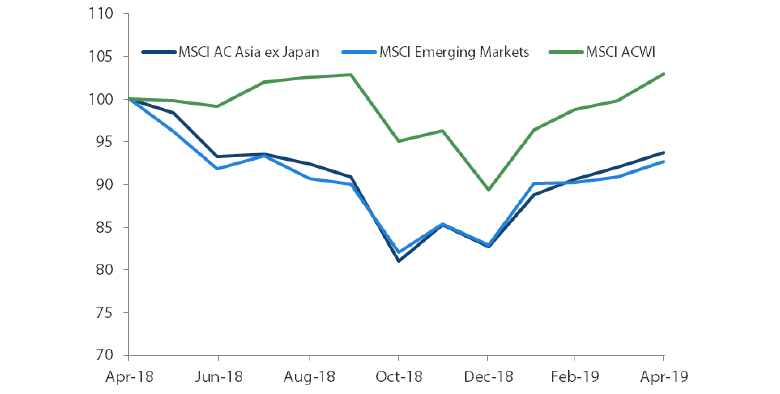

For the fourth consecutive month this year, the MSCI AC Asia ex Japan Index recorded positive monthly returns, having climbed 1.9% in USD terms in April. US GDP expanded at a 3.2% annualised rate in 1Q 2019. A surprising robust year-on-year (YoY) growth of 6.4% for the Chinese economy in 1Q 2019 gave additional support for Asian ex-Japan equities. Returns within the region, however, diverged, with Singapore and Taiwan posting strong gains, while Malaysia turned in losses.

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 April 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

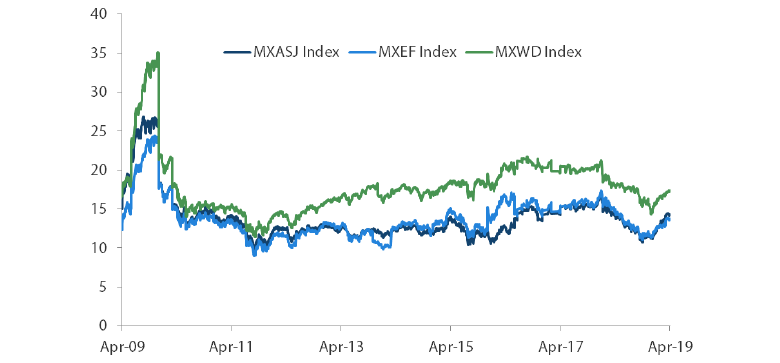

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 30 April 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

Within ASEAN, Singapore outperformed, but Malaysia slumped

Singapore stocks were the biggest winners among regional equities in April, surging 6.3% in USD terms, owing to strong gains from banking stocks, particularly benchmark heavyweights DBS Group and United Overseas Bank. DBS Group posted solid quarterly profits in 1Q 2019, as strong lending income offset weakness in wealth management, brokerage and investment banking fees. Conversely, Malaysia was the worst performing Asian market in April (-1.0% in USD terms), with investors unenthused by the government's policies. The country's exports posted their steepest fall in over two years in February, declining 5.3% YoY. Refined petroleum and palm oil products, which are Malaysia's key exports, fell by 3.09% and 13.4% respectively.

Elsewhere in the ASEAN region, Thailand, the Philippines and Indonesia were up 2.0%, 1.4% and 0.8% respectively in USD terms for the month. The Thai cabinet approved economic measures worth THB 21.8 billion in a bid to support a slowing economy weighed down by weaker exports. In Indonesia, re-election prospects of incumbent president Joko Widodo brightened after preliminary results indicated that he garnered around 55% of the votes, while his rival Prabowo Subianto had won about 44%.

Taiwan and China gained

Taiwanese stocks also did well for the month, rising 4.0% in USD terms. Semiconductor stocks led the gainers in Taiwan after Taiwan Semiconductor Manufacturing Company signalled that the semiconductor slump was nearing its end. Taiwanese equities were also boosted by the country's robust April consumer confidence numbers, which reached the highest reading since May last year, and news that Foxconn's founder Terry Gou, who is cordial towards China, will run for the Taiwanese presidency.

Elsewhere, China stocks posted gains of 2.2% in USD terms, following the release of better-than-expected 1Q 2019 economic numbers. Despite disappointing PMI numbers for April, Chinese equities still managed to move higher. Other North Asian markets, namely Hong Kong and South Korea, eked out gains of 1.1% and 0.4% respectively in USD terms for the month. South Korean stocks were weighed down by the country's disappointing quarterly GDP, which contracted 0.3% in 1Q 2019 from the previous quarter.

India rose marginally

Indian stocks returned 0.6% in USD terms, as a spike in oil prices weighed on the rupee in April. India's central bank cut interest rates for the second time this year, lowering its benchmark rate from 6.25% to 6%, citing a slowdown in the economy.

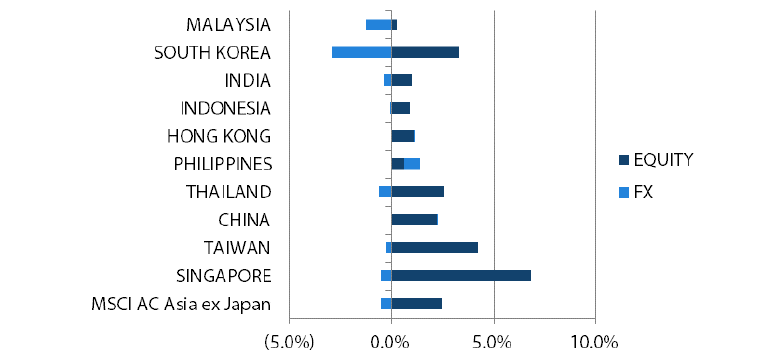

MSCI AC Asia ex Japan Index1

For the month ending 30 April 2019

Source: Bloomberg, 30 April 2019

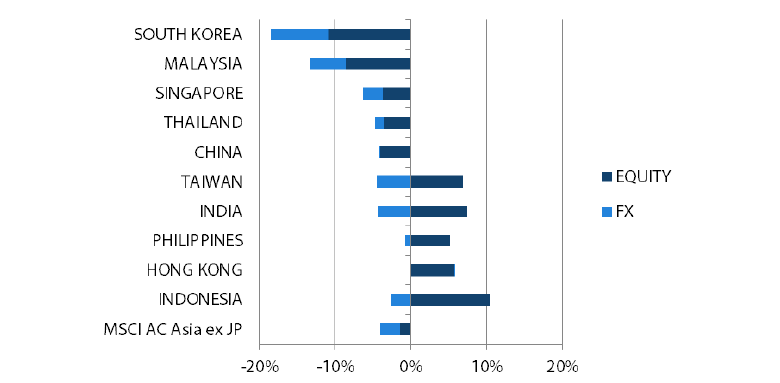

For the period from 30 April 2018 to 30 April 2019

Source: Bloomberg, 30 April 2019

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Focus on quality businesses

A more dovish Fed and relatively resilient economic data out of the US suggest that while growth is slowing in the world's largest economy, things are still on an even keel. The Fed's stance has supported a rally in risk assets. While we remain constructive on Asian markets given the attractive valuations notwithstanding the rally year-to-date, we are equally cognisant that a number of factors could lead to higher volatility. Factors that have been priced in by the market include some imminent resolution to the US-China trade war; the Modi government remaining in power; and Joko Widodo's win in Indonesia. Conversely, any deviation from this narrative will raise risk premia, at least in the short run.

Still positive on insurance, healthcare and software sectors in China

The more measured approach by the Chinese government to support, rather than boost, the economy is heartening to see as it underscores the commitment to quality over quantity and is a marked departure from the profligate spending on fixed assets in the past. Tax cuts and capital market reforms, and recent commentary by President Xi Jinping acknowledging some of the concerns raised by the US, augur well for genuine progress on the gradual opening up of the Chinese capital markets. The Fund's stance with regards to core long-term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged.

A Modi election victory has been priced in

We remain positive on the Indian equity market over the longer term. While there is much handwringing about the impact of the ongoing general elections on equity markets, especially in the near term, history suggests that in the medium to long term, elections matter little for equity market returns. A Modi win is now more or less priced in, suggesting any outcome otherwise is likely to spook markets. With valuations providing little cushion, and economic data points offering little to cheer, the next few months are likely to offer better opportunities to buy well-run businesses. Meanwhile, we remain invested in strong private sector banks and real estate developers.

Selective in South Korea and Taiwan

The technology sector has endured a torrid few quarters, and by extension, so have the South Korean and Taiwanese equity markets. In South Korea, the economic outlook remains lacklustre. In pockets of the market, we find quality South Korean companies at attractive valuations, namely healthcare, electric vehicle, niche technology companies and content producers. In Taiwan, the Technology sector seems to have put the worst behind it with ongoing inventory digestion indicating some sort of bottom is imminent. Still, it is too early to turn unequivocally positive. Only a handful of names provide attractive risk-reward trade-off owing to their capabilities, niche product portfolios and valuations.

Election implications remain in play for ASEAN

Elections remain topical in the ASEAN region, with Thailand and Indonesia having completed their national elections, while the Philippines deals with mid-term elections in May. The incumbents are likely to retain power in all three markets. In Indonesia at least, the expectation is that the government now utilises its renewed mandate to roll out much needed infrastructure build-out. A potential consumption recovery and a better positioned banking system makes Indonesia the preferred market.

Appendix

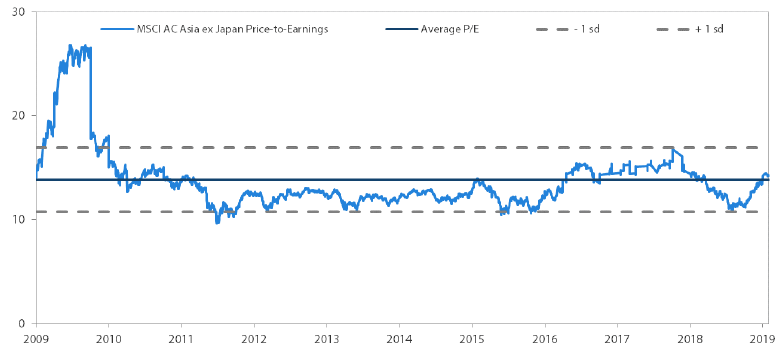

MSCI AC Asia ex Japan Price-to-Earnings

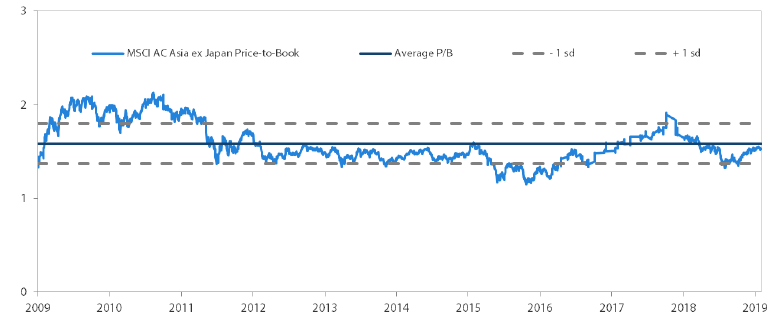

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 30 April 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.