Summary

- Yields of US Treasuries (USTs) rose in April. Upbeat hiring in the US and improvement in industrial production in parts of Europe caused yields to rise initially. The release of better-than-expected data from China suggested the country’s current slowdown may have bottomed out, easing fears of a synchronised slowdown in global growth. Expectations for a US Federal Reserve (Fed) rate cut grew. Overall, 2-year and 10-year yields ended at 2.27% and 2.50% respectively, about 0.4 (basis points) bps and 10bps higher compared to end-March.

- Asian credit registered positive returns, driven mainly by tighter credit spreads, as the UST curve edged up. High-grade spreads tightened by about 7bps, returning 0.32% on a total-return basis. High-yield spreads contracted by only 2bps, but delivered a higher total return (+0.44%) than high-grade on lower duration and higher carry.

- Headline Consumer Price Index (CPI) inflation in Malaysia, Thailand, Singapore, China and India rose, while similar gauges of consumer inflation fell in Indonesia, the Philippines and South Korea. The Reserve Bank of India (RBI) reduced rates while the Monetary Authority of Singapore (MAS) maintained its FX policy. In China, policymakers shifted to a more neutral tone. Separately, Standard & Poor's (S&P) upgraded the Philippines’ credit rating.

- Meanwhile, April saw a deluge of new issuances in the primary market. There were 32 new issues amounting to USD 20.6bn within the high-grade space, while the high-yield space saw 44 new issues amounting to USD 14.8bn.

- For Asian local currency bonds, we continue to prefer mid to high carry bonds with room for a dovish shift in monetary policy. On currencies, we expect the Chinese Yuan to stay relatively resilient. Additionally, the month of May tends to be a period of seasonal weakness for regional currencies, due to factors including Ramadan, a seasonal fall in tourist demand and scheduled dividend repatriation.

- The combination of a dovish Fed and slower global growth outlook are supportive for Asian credit. Separately, the outcome of the ongoing US-China trade talks remains uncertain. Regionally, the likely re-election of Jokowi as Indonesia’s president, while broadly expected, will likely support Indonesian credit spreads. Election outcomes in Thailand and India also call for close monitoring.

Asian Rates and FX

Market Review

Yields of USTs rose

The initial rise in UST yields was triggered in part by upbeat hiring in the US, and improvement in industrial production in parts of Europe. News that trade negotiations between US and China have entered the final stage further supported the rise. In Asia, the slew of better-than-expected data from China suggested that the country's current slowdown may have bottomed out, easing fears of a synchronised slowdown in global growth. However, subsequent idiosyncratic political noise in Emerging Markets (EM) such as Argentina and Turkey triggered broad-based US dollar strength and a slight dip in yields. Expectations for a US Fed rate cut also grew, despite US 1Q 2019 GDP report that beat expectations, prompted in part by a meaningful slowdown in the US personal consumption expenditures price index – the Fed's preferred inflation measure. At the end of the month, 2-year and 10-year yields were at 2.27% and 2.50% respectively, about 0.4bps and 10bps higher compared to end-March.

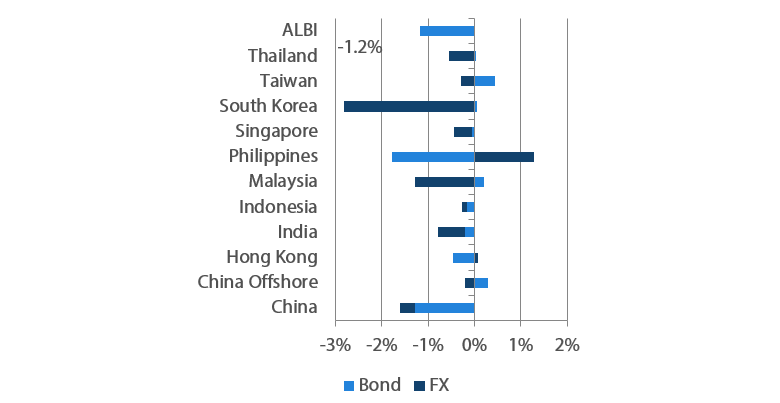

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 April 2019

For the year ending 30 April 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 April 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures mostly rose in March

Headline CPI inflation in Malaysia, Thailand, Singapore, China and India rose, while similar gauges of consumer inflation fell in Indonesia, the Philippines and South Korea. Deflation worries in Malaysia eased as CPI was back in positive territory in March, driven by higher prices for housing and utilities, restaurants and hotel, as well as education and food. Headline inflation in Thailand also accelerated, on the back of higher raw food prices and a pick-up in energy inflation. However, excluding raw food and energy, core CPI inflation was unchanged from February. In Singapore, headline inflation inched higher, owing to more modest declines in private road transport and accommodation costs. Stripping out these two components, MAS' measure of core inflation actually eased. Meanwhile, inflationary pressures in the Philippines moderated as a result of a favourable base effect, as well as lower food inflation. Similarly, lower energy and food prices caused headline CPI inflation in Indonesia to ease in March.

RBI reduced rates; MAS maintained FX policy

India's central bank delivered its second successive 25bps interest rate cut, to boost growth amid weak consumption and external risks. It also said that it stands ready to use all tools available to ensure liquidity in the banking system, and kept its 'neutral' policy stance unchanged. The central bank lowered its forecast for consumer price growth, and also downgraded its growth projections. Meanwhile, the MAS said it will maintain the current rate of appreciation of the SGDNEER policy band, and will also leave the width of the band and the level at which it is centred, unchanged. The decision followed official advance estimates that showed Singapore's economic growth moderated to 1.3% in the first three months of 2019, amid a contraction in the manufacturing sector. Notably, the monetary authority also downgraded its 2019 forecast range for core inflation to 1% to 2% (from 1.5% to 2.5%).

South Korean economy shrank in the first quarter; policymakers proposed a supplementary budget

South Korean real GDP contracted 0.3% quarter-on-quarter in the first quarter – the lowest growth since the fourth quarter of 2008. The central bank attributed the weak figure to a drop in capital investment and falling exports. The downbeat GDP report came a day after the government proposed a supplementary budget amounting to 0.4% of GDP. Of the total KRW 6.7tr package, KRW 2.2tr is being allocated to tackle air pollution, while KRW 4.5tr is being earmarked for export credit financing and creating jobs. The extra budget will be financed via issuance of KRW 3.6tr of government funds and leftover tax revenues. According to the finance minister, the implementation of the extra budget could boost this year's growth by 0.1%, adding at least 73k jobs.

S&P upgraded the Philippines' credit rating

The credit rating agency upgraded the Philippines' long-term sovereign credit rating from 'BBB' to 'BBB+' with a 'stable' outlook. This is the highest credit rating – two notches above investment grade - that the Philippines has received so far. According to S&P, the country's strong growth outlook, solid government fiscal accounts and low public debt were the main drivers of the upgrade. It also noted that the country could clinch a further upgrade over the next two years "if the government makes significant further achievements in its fiscal reform programme, or if the country's external position improves." That said, S&P also warned that a downgrade could happen in the event of a significant decline in real GDP, or if the fiscal programme "leads to much higher-than-expected net general government debt levels."

Market Outlook

Prefer mid to high carry bonds with potential pivot to dovish monetary policy

Recent global macroeconomic data has showed signs of stabilisation, led by China, as the government's ongoing stimulus has begun to transmit through the economy. That said, we expect demand for regional bonds to be well supported, as central banks in developed markets signal patience in raising rates. Our preference for mid to high carry bonds of countries with room for a dovish shift in monetary policy in the near-term remains. We expect central banks in the Philippines and Malaysia to possibly embark on a looser monetary policy, amid a benign inflation outlook. The Philippine central bank governor Benjamin Diokno has said that it is only a matter of timing as to when monetary policy is eased. Hence, we believe that once the inflation rate becomes well-entrenched within the central bank's target, and inflation expectations are largely stable, a reserve requirement ratio or policy rate cut could be announced. Similarly, Bank Negara Malaysia has clearly struck a cautious tone on the Malaysian economy, leading us to believe that a move to lower policy rates is imminent.

Expect the Chinese Yuan to stay relatively resilient

We note that the month of May tends to be a period of seasonal weakness for regional currencies, due to factors including Ramadan, seasonal fall in tourist demand and scheduled dividend repatriation. Among regional currencies, we expect the Chinese Yuan to stay relatively resilient. Recent news suggest that a trade deal between China and the US is coming soon. This, together with continued stability in the Chinese economy support our preference for the currency.

Asian Credit

Market Review

Another month of positive returns for Asian credit

Asian credit closed the month 0.35% higher. Gains were driven mainly by tighter credit spreads, as the UST curve edged up in April. High-grade spreads tightened by about 7bps, returning 0.32% on a total-return basis. High-yield spreads contracted by only 2bps, but delivered a higher total return (+0.44%) than high-grade on lower duration and higher carry.

Asian credit spreads stayed range-bound in the first half of April, despite positive narrative on US-China trade negotiations, as markets coped with hefty new issuances, particularly within the high-yield space. Spreads subsequently moved lower, as fears of a synchronised slowdown in global growth eased following the release of Chinese data indicating more signs of economic recovery in March. Meanwhile, positive rating actions on several Chinese high-yield property issuers following robust 2018 earnings results, also contributed to the improvement in risk sentiment. By country, Indonesia outperformed, as investors cheered Joko Widodo’s (Jokowi) likely re-election to a second term as president of Indonesia. Towards month-end, Chinese policymakers tempered market expectations of further stimulus measures via a statement issued following the Politburo meeting. The shift in tone caused a knee-jerk sell-off in Chinese onshore equity markets, although the impact on Chinese credit spreads was largely contained. Similarly, signs of stress in a few Chinese companies were treated as mostly idiosyncratic events by the market, while the impact of the tragic bombings in Sri Lanka was limited to the country’s sovereign credit spread. S&P upgraded the Philippines’ long-term sovereign credit rating from ‘BBB’ to ‘BBB+’ with a ‘stable’ outlook at month-end, triggering a marked tightening in Philippine credit spreads on the last day of April.

Economic data from China rebounded; policymakers shifted to a more neutral tone

The Chinese economy grew at a steady 6.4% in the first quarter of 2019. Other official economic data showed a clear recovery in March. Industrial production growth jumped, retail sales growth ticked up, and fixed asset investment growth rose slightly. Credit growth, which slowed down in February, also accelerated in March, with aggregate financing registering RMB 2.86tr. Meanwhile, policymakers became increasingly wary of monetary easing in April, suggesting that the bar to further easing is relatively high. Similarly, a statement from a Politburo meeting chaired by President Xi Jinping, sounded more positive about China’s growth prospects, while calling for prudent monetary policy “with an appropriate degree of intensity”. In addition, there was a call for “structural deleveraging” and continued reference to curbing speculation in the property market.

A bumper month of new issuances

The month saw a deluge of new issuances in the primary market. There were 32 new issues amounting to USD 20.6bn within the high-grade space, including the mammoth USD 6.0bn five-tranche issue from Tencent Holdings. Meanwhile, the high-yield space saw 44 new issues amounting to USD 14.8bn, including the USD 3bn multi-tranche issue from China Evergrande Group.

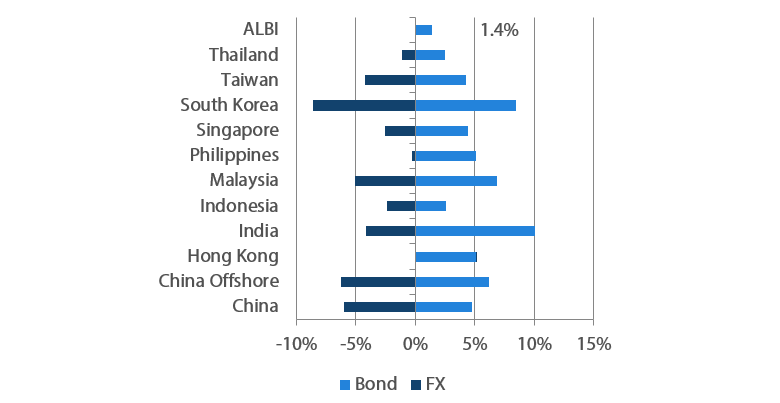

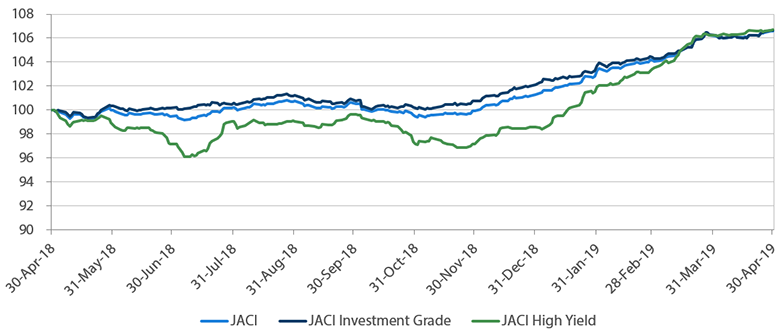

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 April 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 30 April 2019

Market Outlook

Dovish Fed to support demand for Asian credit

Recent global macroeconomic data has showed signs of stabilisation, led by China, as the government’s ongoing stimulus has begun to transmit through the economy. As noted at end-March, recession risks, as priced by the global rates market then, appear overstated. However, it may take some time before global economic data turn sufficiently positive for the US Fed and other major central banks to shift away from their current dovish lean. The combination of a dovish Fed and slower, but not recessionary, global growth outlook are supportive of EM credit market performance, and momentum-driven inflows into the asset class. In addition to improved macro data, 2H2018 corporate earnings results across Asia have been broadly positive. Thus, while valuation has reverted to a less attractive territory relative to long-term average after the sharp rally year-to-date, Asian credit spreads look likely to stay supported in the near term.

US-China trade talks continue to be a wildcard; regional elections bear close monitoring

The outcome of the ongoing US-China trade talks remains an uncertainty, although recent headlines continue to suggest a positive resolution. The likely re-election of Jokowi as Indonesia’s President, while broadly expected, will likely support Indonesian credit spreads. Election outcomes in Thailand and India call for close monitoring, although the base case for now points to benign impact on respective country credit spreads.