Global Outlook

The US Federal Reserve (Fed) has taken a more dovish turn in recent months, affirming a neutral policy and patient stance, suggesting no rate hikes for the balance of the year and potentially beyond. However, the latest meeting also saw Fed Chairman Jerome Powell push back against imminent rate cuts, despite markets pricing in an increased probability of a rate cut for the coming quarters, suggesting recent inflation weakness ought to be transitory, as a number of underlying inflation measures are running at a rate closer to target.

Meanwhile, trade tensions with China escalated this month. The US raised tariffs on USD 200 billion of imports from China to 25% and said it would “shortly” impose a 25% tariff on the remaining $325 billion of Chinese imports, citing too slow progress in negotiations. This came as a shock to many market participants given the recent constructive tone of the talks. Concerns that trade escalations will lead to a growth slowdown has seen much of the US yield curve invert, prompting fears of an imminent recession. However, we believe these concerns are overblown and that the US consumer sentiment remains relatively robust.

In European elections, populist parties gained ground at the expense of the continent’s long standing political centre. Despite the European People’s Party (EPP) and Socialists and Democrats (S&D) losing their combined majority, pro-European parties will continue to hold a strong majority, due to the solid performance of both the Liberals and Greens. On the economic front, the latest set of data suggest activity within the Eurozone will continue to ease as a slowdown in global growth, on the back of the ongoing China-US trade disputes, appears to be filtering through to the euro area manufacturing sector. Lower growth and softer inflation outlooks eventually led the ECB to put plans to normalise policy on hold, while also providing banks with more liquidity, delaying any rate hike until 2020 at the earliest.

In Australia, federal elections saw the ruling conservative party (the Liberal Party of Australia) secure a surprise win, despite the opposition Labor Party leading in pre-election polls for more than two years. The result was a relief rally in equities, led by bank shares, as fears related to ending tax breaks for landlords eased. The Reserve Bank of Australia (RBA), as expected delivered a cut to the policy rate in June, amid lower-than-expected inflation and a deteriorating external backdrop.

In New Zealand, the Reserve Bank (RBNZ) decided to lower its policy rate by 25bps to 1.5%. The Monetary Policy Committee argued further stimulus was needed to support the outlook for employment and inflation, on the back of a deteriorating external backdrop, low business sentiment, soft household consumption and prevailing weak inflationary pressures. Given dovish stance of the RBNZ, rates markets priced in a total of 40bps worth of rate cuts for the coming 12 months.

Following a widely expected policy rate hike during the March MPC meeting, the Executive Board of Norges Bank (Norway’s central bank) kept the policy rate unchanged at 1.0% in May. Despite heightened uncertainties surrounding global trade, the outlook and balance of risks continues to suggest a need for a gradual tightening of policy, as capacity utilisation continues to rise, while inflation is running ahead of projections.

In Canada, the latest escalation in trade conflicts continued to put pressure on the domestic economy, as trade restrictions introduced by China are also having a direct impact on Canadian exports. Positively, the removal of steel and aluminium tariffs and rising prospects of USMCA ratification are likely to boost the country’s exports and investment, partially offsetting the negative implication of the US-China trade war. As such, the Bank of Canada sounded confident that the slowdown in late 2018 and early 2019 was deemed to have been temporary and a pick-up in economic activity starting from Q2-19 is expected. For the time being, however, the BoC will remain on hold, preserving its data dependency bias as far as future path of interest rates is concerned.

The consensus outlook for emerging markets remains much gloomier than last year. The general expectation at the start of the year was that the major central banks were likely to continue tightening liquidity through rate hikes and/or balance sheet reduction throughout the year. However, we now see EM benefitting from a moderate growth slowdown of developed economies. Indeed, growth in emerging economies, which is more dependent on China, is starting to look more attractive on a relative basis. Furthermore, the slowdown in China, which has fed its way through the emerging world, is already well accounted for and China’s economy is now starting to recover. We have to consider the possibility of a prolonged trade war, however, particularly after the recent escalation where Trump declared an increase in tariffs from 10% to 25% on USD 200 billion of imports from China. However, China is utilising a combination of monetary and fiscal stimulus, helping offset the impact of tariffs to a certain extent. So, while the consensus view might be bearish, we strongly believe that individual emerging markets will be able to cope better this year. Furthermore, given the dovish turn by the Fed, with no further rate hikes expected, we see this as a positive for emerging market bonds that are supported by sound fundamentals, as they will continue to receive welcome support from international investors.

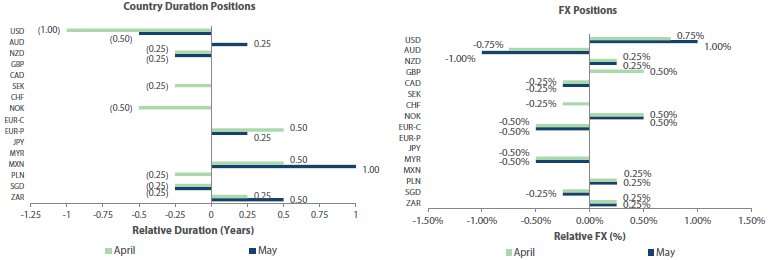

Developed Markets Positioning

We’ve maintained our underweight duration positioning on the portfolio from the intra-month change in US rates. We had an overall short bias on our duration view, making several incremental changes in reducing positioning across the board with larger changes in positioning in Mexico and Poland. The key drivers of our underweight duration view were the continued positive economic and earnings data out of the US, the imminent onset of new highs in equity markets and a more constructive view on trade negotiations between the US and China at the time. We note that recent negotiations have broken down with uncertainty likely to persist for some time. There was some marginal disagreement surrounding the underweight positioning in the US, however we agreed to have an intra meeting discussion if rates breach the 2.80% level. We remain positive on our US dollar position, using the same underlying view on interest rates we question the market’s view of three Fed cuts without any confirmation in economic data.

We have moved to overweight exposure to sterling on a status quo of a “nothing” view on Brexit over the next quarter, noting that local rates imply a much higher GBP from here with an equilibrium level closer to 1.40. However, the team does not foresee any realistic progress on the political front as the status quo stalemate will persist over the near term despite the results of the European elections. The team preferred to leave its rates view unchanged due to its top level underweight view on duration and reduced confidence in its near-term view on the direction of sterling rates.

We have maintained our overweight periphery, underweight core European sovereign positioning on the positive carry presented by Italy relative to Germany. The team further sought to reduce its positioning in Spain on valuation while increasing relative positioning in Italy. There was some concern on the absolute level of interest rates in core Europe, but given the continued slowdown in economic momentum, the level appeared justified for now.

One of the team’s top trade recommendations for the year has been long duration positioning in Mexican government bonds. While Mexican rates have rallied nearly 120bp YTD, the team decided to reduce its long positioning somewhat, but still maintain an overweight duration bias. In other emerging countries, the team noted South Africa remained favorable as well on both a currency and rated positioning given undervaluation ahead of elections that were held on 8 May.

In Scandinavia, the team maintained its short-duration, long NOK positioning on the positive momentum in energy markets and increased hawkishness of the Norges Bank, while marginally reducing positioning in Swedish rates on extreme valuation, but noted that the Riksbank has extended forward guidance towards 2020.

For Australia and New Zealand, the team maintained its relative positioning in AUD/NZD, while noting that AUDNZD has rallied against the team view, we have decided against cutting risk on the view that the New Zealand Dollar has tended to sell off on jawboning from Adrian Orr. The team notes that the RBNZ did reduce interest rates by 0.25% while the RBA unexpectedly maintained its benchmark rate post in its May meeting, while cutting in June, with further cuts to be expected late summer.

Emerging Markets Positioning

In emerging markets, we have turned more defensive. We continue to see value in selected rates markets, which still offer high real yields, but have reduced our overall duration stance to neutral given the strong year-to-date performance in a number of markets. In FX, we have also turned more cautious as China’s better-than-expected growth rebound is already leading policy makers to refrain from additional stimulus. We also remain skeptical regarding a trade deal between the US and China, due to the structural nature of the issues at hand.

We increased our underweight on the Malaysian ringgit as the economy remains weak. The manufacturing side of the economy remains under pressure as a result of weaker external demand, while political ineptitude also threatens fixed investment and domestic demand. We also expect the ringgit to continue to closely track the Chinese renminbi, which should exhibit a weakening bias in order to maintain competitiveness. Despite low inflation we have turned neutral duration in Malaysia as much of the disinflation is transitory, primarily due to lower consumption taxes and the removal of petrol subsidies. Furthermore, FTSE Russell’s decision to put Malaysia on watch for potential exclusion from the WGBI index adds yet another risk to the ringgit and Malaysian government securities.

We remain neutral on the Mexican peso as growth momentum has partially recovered from a recent weak patch. However, increasingly nationalistic rhetoric from President Andrés Manuel López Obrador, which we believe justifies a higher risk premium to compensate for political uncertainty, prevents us from moving overweight. Furthermore, given the strong rally in MBonos this year, and with inflation proving sticky of late, we have reduced our long exposure to MBonos, though remain overweight as they still offer significant value, with yields over 4% in excess of core inflation.

We have moved to underweight duration in Poland as inflation has gained momentum of late, with tightness in domestic labour markets adding to inflationary pressure. We remain marginally positive on the Polish zloty, relative to the euro, as despite growth losing some momentum of late, the economy is still widely expected to expand well above the aggregate pace of growth in the common currency area.

We also remain marginally overweight the South African rand due to a nascent growth rebound which should boost the fortunes of the ruling ANC party in general elections in May and thus support incumbent President Cyril Ramaphosa in pursuing structural reforms. As such the currency should perform well relative to its high beta peers. We also remain overweight duration as the inflation outlook remains benign, with Core CPI close to the mid-point of the SARBs inflation band, which should see them remain on hold, making the current valuation of local bonds in South Africa attractive.

Global Credit

The Global Credit team developed three main themes at its most recent allocation meeting. Firstly, the team expects the credit curve to steepen in the near term. Additionally, we have noticed that new issues which have come to market have been expensive based on historic levels; this has made it difficult to purchase them. Lastly, like other segments of global fixed income, the team has become increasingly concerned regarding the trade war and its potential spillover effects across the broader global credit markets.

In Asia, concerns from the trade war have affected macro data in the region, where indicators such as PMI data from China and Indonesia show signs of weakening after a strong first quarter. Within the region, there have been many elections such as those in Thailand, India and Indonesia. None of these elections produced any surprises—there were some small-scale riots in Indonesia following the result, but they weren’t a large cause for concern. In terms of earnings, we did seem some disappointments in high yield, but in terms of supply we still see healthy levels despite weakening in spreads.

In Australia, we see weak economic indicators, but this is more a product of the election. To the surprise of most, the Liberal Party won the election and there was no change of government. If the Australian Labor Party had won there could have been substantial changes in mortgages and housing policy, especially in terms of taxation. Instead we expect the figures to remain more in line with current levels. However, we still believe that the biggest impact on economic data for the economy will be the trade war and how China, Australia’s biggest trade partner, will be affected. Moving to the credit markets more broadly, we still see healthy supply from the Australian market, but this is mostly from financials. This is due to the market being relatively conservative in issuance. It therefore seems less responsive compared with other markets. We haven’t seen a sharp spread movements like in other developed markets. Australian credit has been relatively stable and has shown steady outperformance versus other markets. More generally, we have seen bank curves become steeper.

In the US, economic data have been rather unattractive. US PMI surveys were all negative and political risk has picked up over the last couple of weeks, due to the continued trade war with China along with Mexico and tense relations with Iran. As we get closer to the US presidential election in 2020, we will start to see more pointed language from candidates on policy objectives. There has also been some increased pressure on Democratic leader Nancy Pelosi to start the process of impeaching the president. On the other hand, the fundamentals still look strong as many companies are looking to deleverage. Default rates are low as capital markets have stayed open, and rating drift is slowly decreasing. Elsewhere, flows have become negative, supply positive and valuation at a point of neutral. Overall in the US, we are looking to avoid bad stories within the portfolio. We see energy as weak at the moment, and where high-yield bonds have underperformed, we continue to avoid them and keep an underweight exposure.

In Europe, we have not seen much change on the macro front, which continues to be weak and stable. That said, there are still no signs of a recession. However, German and European PMI’s continue to be below consensus. The European Parliament elections went as expected with some mainstream parties losing seats. We await the outcome of the next G20 meeting in Osaka where President Trump and Chinese President Xi may meet in order to negotiate the trade impasse between the two countries. Elsewhere, from a technical standpoint, we notice that some UK names are slipping into distressed space, and we could see default rates (from historic lows) start to increase towards year end. Leverage continues to be largely benign and earnings this quarter have been somewhat mixed—but nothing sufficient to cause concern. Lastly, it is worth mentioning that, although there has been a solid amount of issuance come to market, we have seen limited value in entering these primary issues once revised guidance prices have been enforced.