Introduction

We arrived in Beijing during the second week of the National Party Congress (NPC), so there was plenty to discuss with Chinese industry participants, experts and consultants. The broad theme was centred on a potential to enter a period of re-leveraging after two years of de-leveraging amidst supply-side reform and environmental protection.

Where to for GDP?

China’s 6.0 to 6.5% GDP growth target for 2019 is broadly seen as “just-right”. The upper-end shows a desire to prevent the economy from getting too hot: it is below last year’s 6.6%, so is consistent with the view that the economy is slowing (understandably, given the absolute scale of the economy) and shows no real aim for an all-out stimulus push to maintain growth rates at historical levels.

There is room for the Government to loosen supply side reform if required – upstream industries have made substantial profits over the past two years as beneficiaries of supply side reform (higher utilisation and prices). Should externalities warrant it, the Government will tolerate lower industrial margins and even loss making industries for a while to maintain activity levels.

The fact that credit supply growth targets of total social financing (TSF) and money supply (M2) are broadly in line with nominal GDP further reinforces the stable but no stimulus view. The lower end shows the Government has a bottom line. Amidst all the uncertainties thrown up by the US-China trade war, the Government will provide some support to prevent things from getting too cool. Bottom line: consensus was expecting closer to 6% growth, so the range was seen as mostly bullish.

Positive on property

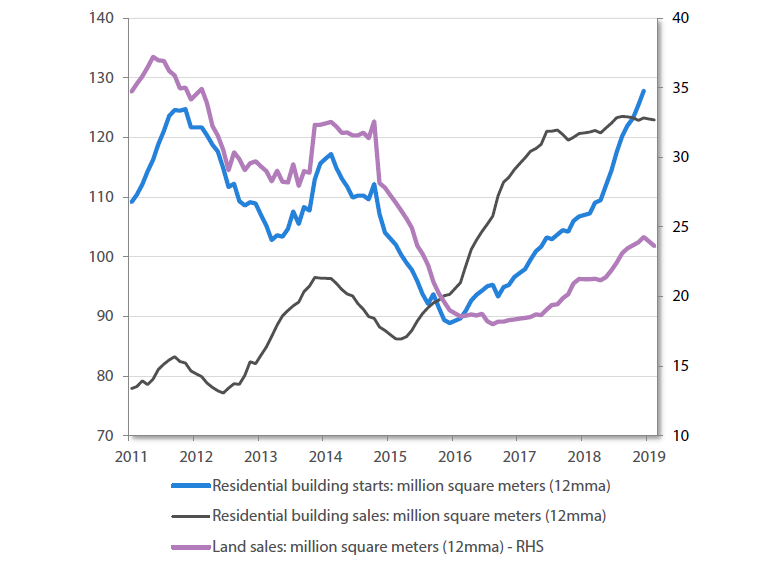

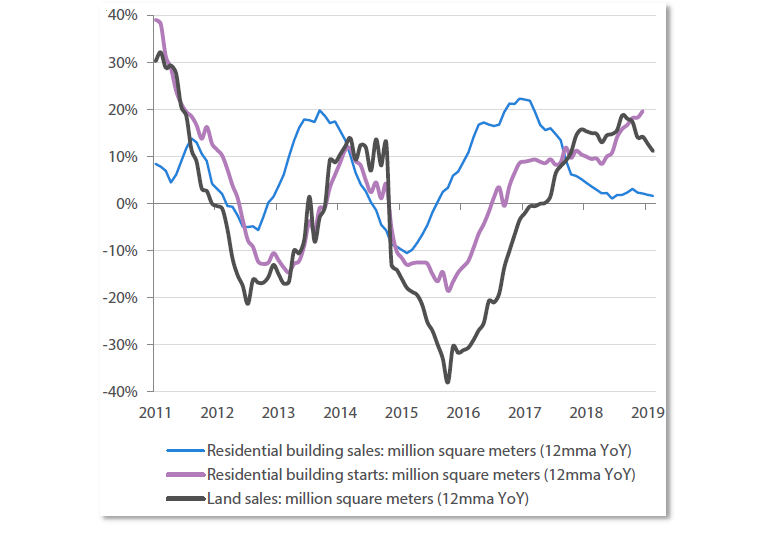

Property is an important factor for China’s economic growth, and the Government’s stated aim for a stable property market appeared to give some reassurance to the market participants we met. Sales slowed considerably in 2018 after peaking in the prior year, but with mortgage rates starting to fall from the highs of 2018, there is an expectation for support in the second half of this year.

Encouragingly, property experts see completions finally turning positive with +8% growth, after two years of strangely negative growth despite strong sales and starts data, which is supportive of commodities demand (including mineral sands). Iluka provides us with exposure to this theme and while we don’t forecast substantial further improvement in zircon prices, steady demand and supply constraints should see prices well supported.

Overall, while most see a slowdown in Chinese property sales over 2019, it is seen as being potentially moderate, with levers available to Government should it need to promote growth. Shanty town renewal has been a strong tool used by Government to stimulate the property sector, and while the consensus view is a 25% step-down in this program from 6m units in 2017 and 2018 to 4.5m in 2019, there remains a strong potential for this to be topped up, if required.

Chart 1 China residential property starts and sales (million square metres 12mma)

Source: Bloomberg, JP Morgan

Chart 2 Residential property starts vs land sales 12mma, YoY change

Source: Bloomberg, JP Morgan

Investment in infrastructure

Infrastructure investment remains a key driver of fixed asset investment (FAI) and will be called upon in 2019 to ensure economic targets are hit. That spending will increase this year is in line with what we heard in September 2018, when infrastructure investment was hitting all-time lows. An expanded special bond issuance allowance and a small recovery in shadow banking should flow through local governments to regional rail, road, water and other projects to facilitate population growth of major cities.

In the future, we expect to see the composition of infrastructure shift away from commodity intensive projects towards data, telecommunications and artificial intelligence, but for now city services infrastructure is still the primary focus.

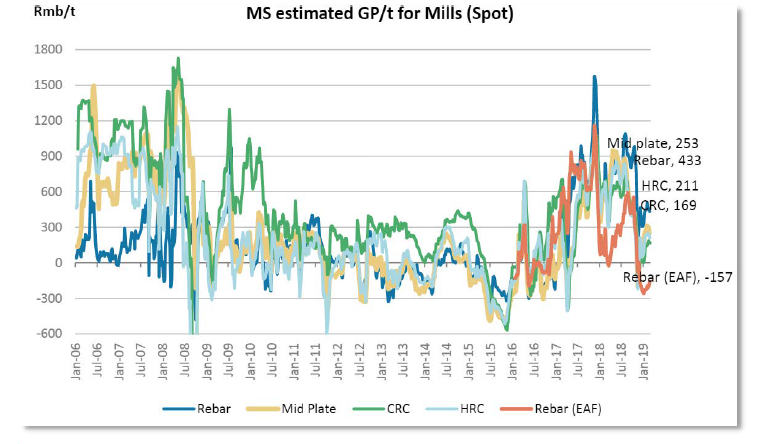

With property construction and infrastructure projects expected to remain robust, it is a positive for steel demand; last year’s demand was surprisingly strong and this year may see similar levels. However, production has also been particularly (and unexpectedly) strong, with steel producers we spoke to in the Tangshan region virtually unaffected by winter closures.

Winter cuts in Tangshan were lower than expected due, in part, to higher environmental compliance coupled with less government intervention to support the economy. We got the sense that the Government has been less strict on winter curtailments, preferring to focus on economic activity and employment after the sharp 4Q slow-down. This is effectively reflected in current Chinese steel mill profitability, with margins around half of last year’s levels.

Chart 3 MS estimated GP/t for mills (spot)

Source: Morgan Stanley

Outlook

Steel iron ore and coking coal

The lower profitability for Chinese mills is a combination of lower steel prices (due to ample supply) and high raw material pricing in iron ore and coking coal. Iron ore prices are currently elevated due to the Vale Brumadinho mine disaster and subsequent mine closures.

The Chinese mills we spoke to were clearly concerned about the high prices for their inputs and preferred to wait for prices to recede before restocking already low mill inventory levels. However, export data shows Brazilian exports are only now starting to show signs of the supply disruption, as Vale had been selling down inventories. This situation may culminate in a squeeze on the mills as the seaborne ore shortages, low mill inventories, and seasonal peak steel production periods coincide.

Beyond mid-year, a supply response may fill the Vale gap – whether it be domestic Chinese mines, non-traditional markets or indeed Vale itself (provided the Brazilian government and regulators permit it), but the world’s ability to do this in a timely fashion is a key point of debate. If we do see a supply response, iron ore prices should start to moderate but until then, Australian iron ore producers will be enjoying the benefits of strong margins and under-geared balance sheets, which could see extra-ordinary capital returns maintained.

While investment and activity seem to be supported through policy loosening, lower industry profitability could drag down commodity prices over the medium term, similarly to pre-2017.

Mineral sands, base metals and other metals

Zircon

Zircon prices are expected to be stable over 2Q/3Q 2019 with demand flat YoY. Overall, the chemical industry is being impacted by environmental regulations and there is a growing concern for the potential to increase regulation on radioactivity of products from zircon derived chemicals. Generally, the zircon consuming manufacturers are making ‘normal’ margins according to the experts we met, which should allow for pricing stability.

Titanium dioxide

We were surprised by the speed of the build-out of Chinese chloride titanium dioxide capacity, which should see an increase in China’s demand for high-grade feedstocks like rutile. This has led to increasing prices for rutile supply in China, which we believe should flow through to Iluka over the course of the year. Longer term, if prices go too high China may look to source its own ilmenite supplies, but for now, the outlook appears bullish as China becomes a more meaningful buyer.

Conclusion

All up, things seem reasonably bullish, especially for mineral sands. Economic stability and employment are now the focus over environmental policy and supply side reform; credit availability seems to be improving and China is prepared to enter a period of re-leveraging, if required. Although no one expects chunky stimulus, all were generally positive on the outlook for FAI (mostly infrastructure and to a lesser extent, property). In fact, infrastructure investment as the key driver of FAI this year is consistent with what we heard on our last trip in 2018 and is certainly showing up in the data.

Winter cuts in Tangshan were much lower than expected; in part due to higher environmental compliance, but also less government intervention to support economy. There are reports of enforcement taking effect now, but it seems to be more ad hoc in nature and with many mills improving compliance through investment, overall cuts should be less.

Property views were divergent: consensus view is weaker on slowing Government subsidised housing; those more bullish on property think the Government will ensure market stability by increasing shanty town redevelopment spending. Mortgage rates are declining and there is the carryover of construction from solid starts/sales from 2018.

With respect to mineral sands environmental policy has pushed the long-awaited expansion of chloride pigment and rutile prices could lift 15% this year. In iron ore, of those we spoke to, most believe current iron ore prices are too high and expect new supply to be incentivised, however, with seaborne shortages only now starting to show up in port data, the prospect of a supply squeeze seems very real.

As usual, it’s difficult to know how this is all going to play out. While investment and activity seem to be supported through policy loosening, lower industry profitability could drag down commodity prices over the medium-term as we saw in pre-2017.