Summary

- After four consecutive months of positive returns, Asian stocks' winning streak came to an abrupt end in May, following a flare up in the US-China trade dispute. Fresh tit-for-tat tariff measures from the US and China stoked recessional fears and set off an adverse, risk-off tone, causing the MSCI AC Asia ex Japan Index to slump 8.5% in USD terms over the month.

- Within the region, China, South Korea and Singapore posted the biggest losses. China was weighed down by trade fears and weaker-than-expected purchasing managers’ index (PMI) numbers. South Korea fell on concerns over a technology supply-chain disruption and a drop in its trade surplus, while sentiment in Singapore was dampened by its disappointing 1Q 2019 GDP growth.

- India and the Philippines bucked the downtrend and turned in marginal gains in May. Indian equities remained resilient after a resounding win for Indian Prime Minister Narendra Modi and the Bharatiya Janata Party-led coalition in the Indian general election. Stocks in the Philippines were buoyed by a cut to the key interest rate and reserve requirement ratio.

- As geopolitical tensions escalate, there are indications of slowing growth in the world's largest economies. The turn in the interest rate environment is a big positive for many emerging markets which were under significant liquidity stress throughout last year and into the start of 2019. In Asia, this has also come at a time when elections have passed smoothly and delivered market friendly results in two of the region's most populous nations, India and Indonesia. We remain constructive and focus on areas of structural growth and positive fundamental change.

Asian Equity

Market Review

Asian equities declined in May

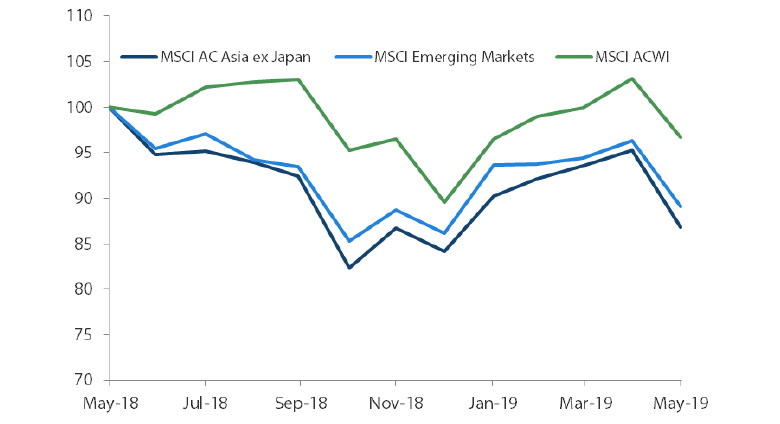

After four consecutive months of positive returns, Asian stocks' winning streak came to an abrupt end in May, following a flare up in the US-China trade dispute. Fresh tit-for-tat tariff measures from the world's two biggest economies stoked recessional fears and set off an adverse, risk-off tone, which rattled global equities. This caused the MSCI AC Asia ex-Japan Index to slump 8.5% in USD terms over the month. Global growth uncertainties caused by the escalating US-China trade war not only beset stocks but also deepened the yield curve inversion between three-month and 10-year US Treasuries, portending the possibility of a recession.

Trade talks between the US and China broke down in early May. Thereafter, market sentiment took a turn for the worse after US President Donald Trump slapped additional tariffs (from 10% to 25%) on USD 200 billion worth of Chinese imports on May 10. In addition, Trump signed an emergency order to restrict Huawei from selling its equipment in the US. In a retaliatory move, China hit back by announcing that it would impose additional tariffs on USD 60 billion worth of US goods to China from 1 June.

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 May 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

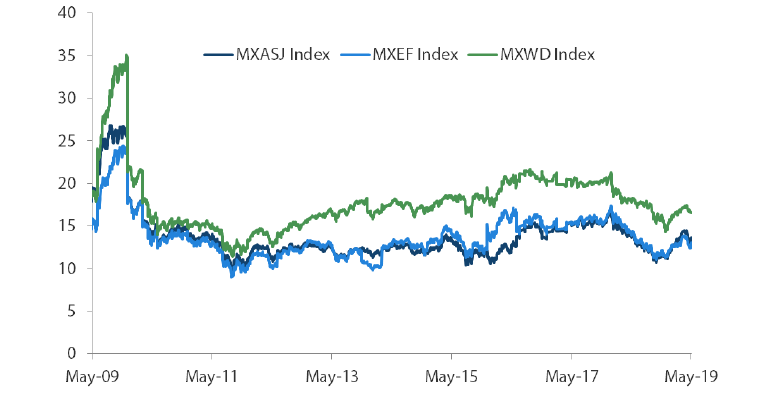

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 31 May 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and South Korea hardest hit

China stocks bore the brunt of losses in the region, slumping 13.1% in USD terms over the month. At month-end, sentiment worsened after Chinese state media hinted that Beijing could cut off rare earth materials to the US as a countermeasure in the trade battle. China stocks were also weighed down by the country's weaker-than-expected PMI numbers in May.

Elsewhere, technology and export heavy stock markets of South Korea and Taiwan slumped 9.3% and 7.8% respectively in USD terms in May, on concerns over technology supply chain disruption, weaker sales and little support from domestic economic growth. South Korea's trade surplus plunged to USD 2.3 billion in May from USD 6.2 billion in the same month a year ago, mainly due to a slump in exports. In Taiwan, its manufacturing PMI remained in a contraction in May while consumer confidence declined significantly during the month to reach the lowest level since July 2017.

India bucked downtrend

In India, stocks bucked the regional downtrend and returned 0.2% in USD in May. Indian equities held firm and remained resilient during the risk-off month after a resounding win for Indian Prime Minister Narendra Modi and the Bharatiya Janata Party (BJP)-led coalition in the April-May Indian general election. Stocks were buoyed by prospects of further reforms and policy continuity from Modi and his government.

Most ASEAN markets saw negative returns

In the ASEAN region, the worst performer was Singapore, whose stock market dived 8.8% in USD terms in May. Investors were concerned that the open economy of Singapore would be vulnerable to any slowdown in global trade. Sentiment was also weighed down by the city-state's disappointing 1Q 2019 GDP growth, which grew at 1.2% on a year-on-year (YoY) basis or the slowest rate in nearly a decade, owing to a contraction in manufacturing on the back of weak global semiconductor demand.

Indonesia, Thailand and Malaysia were also down 2.9%, 2.2% and 0.7% respectively in USD terms for the month. Despite being relatively more insulated from trade disruptions, these ASEAN markets witnessed slower GDP growth in 1Q 2019. Indonesian equities bounced back from losses earlier in the month as incumbent President Joko Widodo (Jokowi) clinched a second term in office. Despite protests orchestrated by his opponent Prabowo Subianto, Jokowi will be sworn in later in the year. In Thailand, official election results released in May showed that the opposition Pheu Thai Party won the most seats. But it is unlikely to form a government because no party holds a majority of seats in the House of Representatives. In Malaysia, the central bank eased monetary policy, cutting interest rates by 25 basis points (bps) to 3% in an attempt to boost growth. Not to be outdone, the central bank of the Philippines cut its key interest rate by 25 bps to 4.5% and subsequently announced that it would cut its reserve requirement ratio for banks by 2% to 16% between May and July. This helped stocks in the Philippines—one of the best performing Asian markets in May—to gain 0.7% in USD terms over the month.

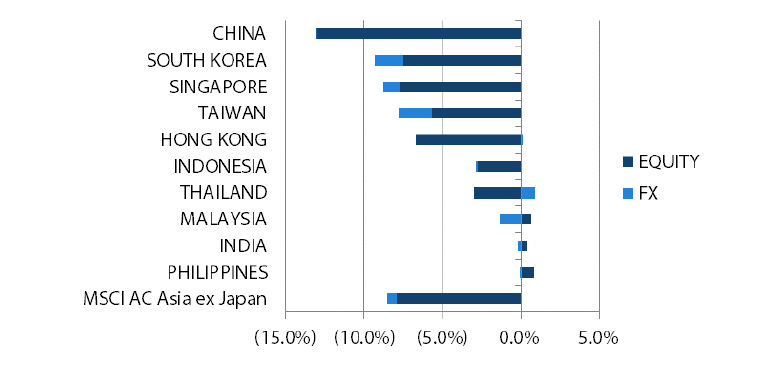

MSCI AC Asia ex Japan Index1

For the month ending 31 May 2019

Source: Bloomberg, 31 May 2019

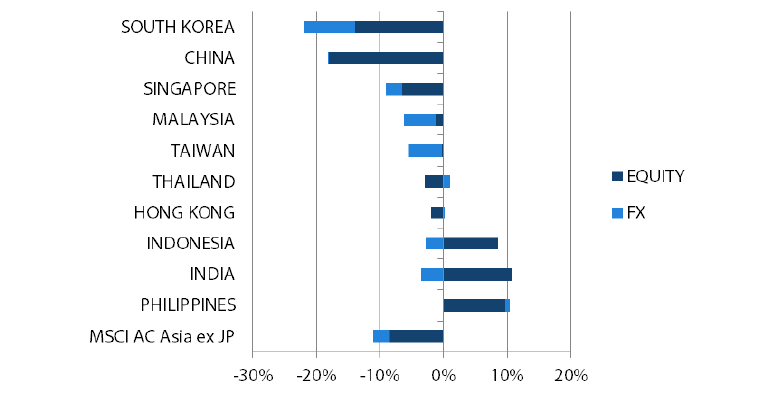

For the period from 31 May 2018 to 31 May 2019

Source: Bloomberg, 31 May 2019

1Note: Equity returns refer to MSCI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Prospects of US monetary policy easing bode well for Asia

As geopolitical tensions escalate further, there are indications of slowing growth in the world's largest economies. The prospects of easing monetary policy in the US, something that was unthinkable only six months ago, is now being discussed more openly. This has not, however, led to any respite for technology or internet related names as the fallout from the Huawei case and prospects for tighter regulation weigh on sentiment. The turn in the interest rate environment is a big positive for many emerging markets which were under significant liquidity stress throughout last year and into the start of 2019. In Asia, this has also come at a time when elections have passed smoothly and delivered market friendly results in two of the region's most populous nations, India and Indonesia. We remain constructive and focus on areas of structural growth and positive fundamental change.

Sanguine on Chinese insurance, healthcare and software sectors

China's response will be key to the next leg of geopolitical events with recent rhetoric becoming ever more nationalistic. Without the prospect of an improvement in trade, the domestic economy looks set to weaken as the boost from the first quarter’s easing measures starts to fade. China's commitment to quality over quantity remains, and we continue to expect measured and targeted stimulus in areas of strategic priority. Our stance with regard to core long-term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged.

Overweight in India; selective in South Korea and Taiwan

We remain positive on the Indian equity market over the longer term. The resounding majority win for Modi and the BJP sets up the prospect of further market orientated reforms and pro-growth policies over the next five years. Economic growth, unemployment and capital investment cycle are key areas that need to be addressed early in this presidential term but with an easing global interest rate environment, low dependency on trade and stable oil prices, external pressures are much less onerous than they have been over the last year. Meanwhile, we remain invested in strong private sector banks and real estate developers and have recently increased our positions in the consumer space.

The technology sector has endured a torrid few quarters, and by extension, so have the South Korean and Taiwanese equity markets. Across both, the domestic economic outlook remains lacklustre. In pockets of the markets, we find some quality companies at attractive valuations—healthcare, electric vehicle, niche technology companies and content producers.

Indonesia our preferred ASEAN market

With elections having now passed in the ASEAN region, we can re-focus on underlying economic growth and the prospect of new government policy and reforms. In Indonesia at least, the expectation is that the government now utilises its renewed mandate to roll out much needed infrastructure build-out although reforms to labour laws are one of the most important if Indonesia is to remain competitive within the region. Lower rates and an unexpected sovereign ratings upgrade will lend additional support to a potential consumption recovery, and a better positioned banking system. Together, these factors make Indonesia our preferred market.

Appendix

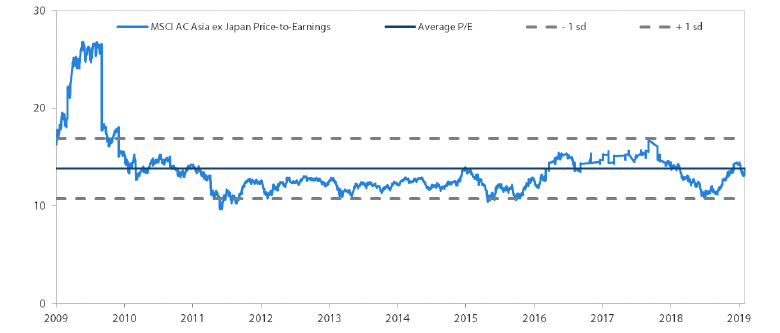

MSCI AC Asia ex Japan Price-to-Earnings

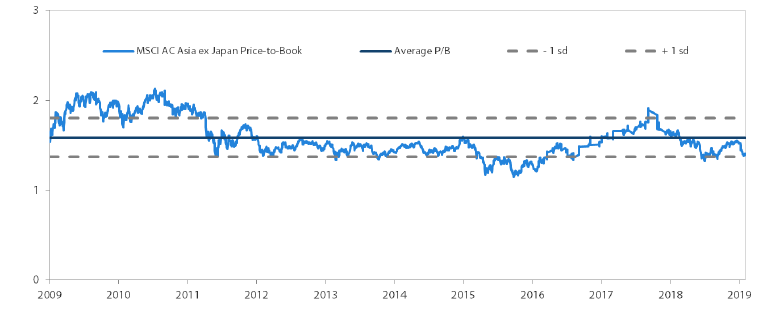

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 May 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.