Summary

- In May, US Treasuries (UST) rallied as US-China trade tensions escalated. Negative trade news headlines and subdued Purchasing Managers’ Index (PMI) data from the US, Japan and Germany, pushed UST yields lower. Overall, two-year and 10-year yields were at 1.92% and 2.12% respectively, about 34 basis points (bps) and 38 bps lower compared to end-April.

- Asian credit managed to chalk up 1.04% of total return despite wider credit spreads, as UST yields fell. High-grade credit was up 1.33% on a total-return basis, even as spreads widened by about 13bps, on the back of lower UST yields. The weaker market backdrop left high-yield more vulnerable, with spreads widening 44bps on the month, but still managed to eke out a 0.05% total return.

- Monetary authorities in Malaysia and the Philippines lowered their policy rates. Within the region, inflationary pressures registered mixed. GDP growth in Indonesia, Malaysia, Thailand, Singapore and the Philippines all moderated in the first quarter of 2019. Separately, credit rating agency Standard & Poor’s (S&P) raised Indonesia’s sovereign credit rating to ‘BBB’ and maintained its outlook at stable. The country’s strong economic growth prospects and supportive policy dynamics were reasons that supported the upgrade. It was also a landslide victory for Indian Prime Minister Narendra Modi. Markets cheered the continuity in administration, boosting demand for the rupee and rupee-denominated assets.

- Meanwhile, fragile sentiment caused primary market activity to slowdown in May. There were 25 new issues amounting to USD 11.7 billion in the high-grade space, while the high-yield space saw 21 new issues amounting to USD 7.9 billion.

- For Asian local currency bonds, we maintain our preference for mid to high carry bonds with room for a dovish shift in monetary policy in the near-term. For instance, we expect central banks in the Philippines and Indonesia to possibly embark on looser monetary policies. Additionally, the breakdown in US-China trade talks has led us to be cautious on currencies that are tightly correlated to the yuan. This includes the Korean Won (KRW) and Singapore Dollar (SGD), as China is a major trading partner for both countries.

- As for Asian credit, the outcome of US-China trade talks remains uncertain. In addition, recent global macroeconomic data has again softened. While a dovish Federal Reserve (Fed) remains supportive, the other factors providing support to Asian credit spreads, namely the global growth outlook and US-China trade negotiations have turned less favourable. Thus, some widening pressure is likely in the near-term, allowing valuation to revert to more neutral territory.

Asian Rates and FX

Market Review

USTs rallied as US-China trade tensions escalated

The UST yield curve shifted lower in May, with yields ending much lower across the curve. The rally in treasuries was triggered by the sudden deterioration of trade negotiations between the US and China, which reversed apparent progress made in recent months. Negative trade news headlines persisted throughout the period, overshadowing strong US April payroll numbers, as well as positive earnings surprises from US companies. Towards month-end, subdued PMI data from the US, Japan and Germany prompted worries about global growth anew, and pushed UST yields to year-to-date lows. At the end of the month, 2-year and 10-year yields were at 1.92% and 2.12% respectively, about 34bps and 38bps lower compared to end-April.

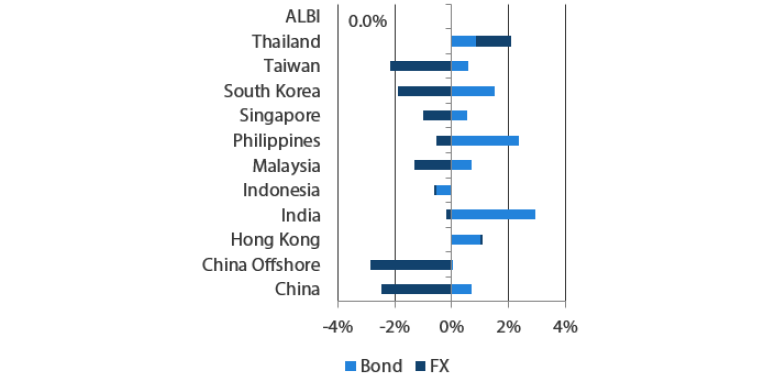

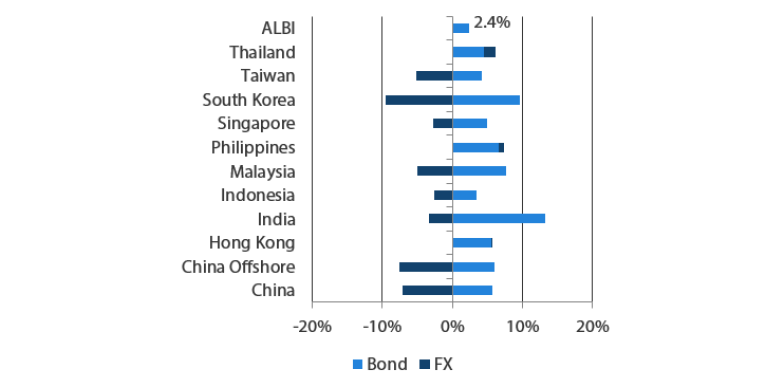

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 May 2019

For the year ending 31 May 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 May 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures registered mixed

Headline Consumer Price Index (CPI) inflation prints in Indonesia, South Korea, China and Singapore rose, was largely unchanged in Malaysia, Thailand and India, and moderated in the Philippines. A spike in food prices due to Ramadan was the main driver of the acceleration in Indonesia’s headline CPI. Similarly, higher food prices together with easing transport deflation, led headline CPI in Korea to rise 0.6% Year-on-Year (YoY) in April. Higher car and petrol prices pushed headline inflation in Singapore to rise 0.8% YoY (from 0.6% in the previous month), whereas a moderation in food inflation prompted consumer price inflation in the Philippines to ease in April.

Monetary authorities in Malaysia and the Philippines lowered their policy rates

Malaysia lowered its benchmark interest rate for the first time since July 2016. The 25bps cut was deemed necessary to “preserve the degree of monetary accommodativeness.” Bank Negara Malaysia expects GDP growth for the year to register between 4.3-4.8%, notably lower than the government’s 4.9% projection. Similarly, the Philippine central bank cut its policy rate by 25bps to 4.5%, citing lower inflation and inflation expectations. The monetary authority also revised its 2019 headline inflation forecast lower by 0.1% to 2.9%, although it raised its 2020 forecast higher by the same magnitude to 3.1%. The Bangko Sentral ng Pilipinas also announced that it will lower banks’ reserve requirement ratios by 200bps – to be implemented in stages.

Economic growth moderated in the first quarter of 2019

GDP growth in Indonesia, Malaysia, Thailand, Singapore and the Philippines all moderated in the first quarter of 2019. Economic activity in Indonesia eased to 5.1% YoY, on the back of a slowdown in gross fixed capital formation growth, while private consumption spending growth rose further. Meanwhile, weaker exports dragged down growth in most other countries in the region. The moderation in Malaysia’s first quarter growth was similarly driven by weaker investment spending. Meanwhile, the Philippine economy registered a 5.6% growth rate in the same period, as export growth eased and public sector spending slowed. In Thailand, GDP growth slowed to a four-year low. A spike in political risk surrounding the general election weighed on the domestic economy, while net trade was a drag.

A landslide victory for Indian Prime Minister Narendra Modi

The prime minister’s Bharatiya Janata Party and its allies won a landslide re-election victory, making Narendra Modi the first prime minister in nearly 50 years to win majorities in the parliament in back-to-back elections. Markets cheered the continuity in administration, boosting demand for the rupee and rupee-denominated assets.

Indonesia’s rating raised to ‘BBB’ by S&P

S&P lifted the sovereign credit rating on Indonesia to 'BBB' from 'BBB-' at the end of May and maintained its outlook at stable. According to S&P, the rationale behind the upgrade was primarily to reflect Indonesia's strong economic growth prospects and supportive policy dynamics, following the re-election of President Joko Widodo recently. In addition, the government's relatively low debt and its moderate fiscal performance are supportive of the sovereign rating.

Market Outlook

Maintain preference for mid to high carry bonds with potential pivot to dovish monetary policy

We maintain that demand for regional bonds will be well supported, as central banks in developed markets signal patience in raising rates. Our preference for mid to high carry bonds of countries with room for a dovish shift in monetary policy in the near-term remains. We note that the Philippine central bank in particular, has room to further cut interest rates, as the inflation rate becomes well-entrenched within the central bank’s target, and inflation expectations further soften. Separately, the Indonesian central bank has turned slightly more dovish at its recent meeting, saying it will consider whether there is room to ease monetary policy. This, together with our expectation that inflationary pressures will likely moderate after Ramadan, lead us to believe that the door is open for Bank Indonesia to ease policy rates, as long as the rupiah remains stable. That said, we believe that near-term bond demand would be largely influenced by rupiah direction, given markets’ risk-off sentiment.

Cautious on currencies with tight correlation to the yuan

The breakdown in US-China trade talks is likely to add to weakness of currencies that are closely correlated to the yuan. Consequently, we are cautious of the KRW and SGD as China is a major trading partner for both countries. That said, we expect moves in other regional currencies to be largely susceptible to trade headlines.

Asian Credit

Market Review

Asian credit registered gains in May

Asian credit managed to chalk up 1.04% of total return despite wider credit spreads, as UST yields fell. High-grade credit was up 1.33% on a total-return basis, even as spreads widened by about 13bps, on the back of lower UST yields. The weaker market backdrop left high-yield more vulnerable, with spreads widening 44bps on the month, but still managed to eke out a 0.05% total return.

The grind higher in Asian credit spreads was triggered by the abrupt deterioration in trade negotiations between the US and China, which reversed apparent progress made in recent months. Both countries subsequently hiked tariffs on each other’s imports, and while the door to further trade talks have not been completely shut, both sides have adopted a more confrontational stance as the month progressed. On top of trade concerns, China’s high-frequency economic data have weakened anew, denting optimism regarding a more sustained global economic recovery. By country, the frontier Emerging Markets of Asia, such as Sri Lanka and Pakistan, fared the worst as the global risk-off tone was exacerbated by local concerns. Within the investment grade space, Indonesian credit bore the brunt of the risk-off tone, with the sell-off exacerbated by political noise following announcement of the Presidential election results. Credit rating agency S&P upgraded Indonesia’s long-term sovereign credit rating from ‘BBB-’ to ‘BBB’ with a ‘stable’ outlook at month-end. The impact of this positive news on Indonesia’s credit spread was overwhelmed by the global risk-off tone on the day, though it is testament to Indonesia’s improving structural development over the medium-term. Indian Prime Minister Narendra Modi’s landslide re-election victory boosted optimism towards Indian credit in mid-May, though there was still some widening in Indian credit spreads towards the end of the month.

Chinese economic data dipped anew in April; central bank announced a targeted Reserve Requirement Ratio (RRR) cut

Chinese money and credit data for April slowed more than expected. Banks extended RMB 1.02 trillion of new loans in April, markedly lower than March’s RMB 1.69 trillion, while aggregate financing was RMB 1.36 trillion in April, less than half of the RMB 2.86 trillion in March. Similarly, Chinese April activity data weakened anew, with year-on-year growths of industrial production, retail sales, and fixed asset investment all moderating following a rebound in March. The readings also came in much lower than expected, suggesting that the country’s economy recovery has yet to stabilise. Meanwhile, the People’s Bank of China (PBoC) announced a targeted RRR cut for small banks, effective 15 May. The PBoC expects the move will release about RMB 280 billion of liquidity into the system, all of which will be lent to SMEs and private enterprises. Notably, Bloomberg reported mid-month that the Chinese government is contemplating further stimuli for the domestic economy.

A slowdown in primary market activity

Fragile sentiment caused primary market activity to slowdown in May. There were 25 new issues amounting to USD 11.7 billion in the high-grade space, including the USD 1.9 billion multi-tranche issue from Huarong Finance and a USD 1 billion sovereign issue from Hong Kong. Meanwhile, the high-yield space saw 21 new issues amounting to USD 7.9 billion, including a two-tranche issue from MGM China.

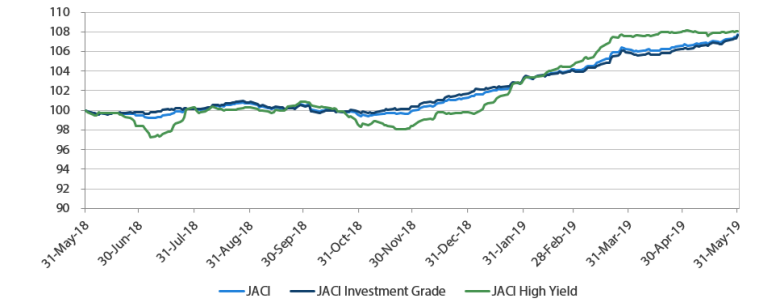

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 May 2019

Market Outlook

Outcome of US-China trade talks uncertain; some widening pressure likely in the near-term for Asian credit spreads

The outcome of US-China trade talks remains uncertain although developments in May point to an outcome that is more negative than previously expected, with additional import tariffs imposed by both countries. There remains the possibility that a trade deal may eventually be reached, but the risk on this front has increased. In addition, recent global macroeconomic data has again softened. China’s ongoing stimulus will continue to support the domestic economy, but the resurfacing of external uncertainties is likely to restrain the positive impact. Given the rising external risks, the major central banks are unlikely to shift away from their current dovish lean, even if recent Fed communications indicate a ‘patient’ stance in relation to the weakness in inflation. While a dovish Fed remains supportive, the other factors providing support to Asian credit spreads, namely the global growth outlook and US-China trade negotiations have turned less favourable. Thus, some widening pressure is likely in the near-term, allowing valuation to revert to more neutral territory.