Global Outlook

The US Federal Reserve (Fed) has taken an increasingly dovish turn over recent months, with no more rate hikes expected for the balance of the year and potentially beyond. Moreover, the Fed’s latest meeting also saw Chair Jerome Powell suggest that risks to the outlook have increased since its meeting in early May and that a rate cut could be coming if conditions continue to weaken. Market-based interest rate expectations are even more aggressive, however, pricing in up to three 25bp cuts for the remainder of the year.

Meanwhile, trade tensions with China continue to dominate sentiment, with President Trump hinting at a possible thawing of tensions at his meeting with President Xi at the G20 Summit in Osaka. Given the recent dovishness from the Fed and tentative progress in trade talks, the US yield curve has steepened marginally of late, reducing fears of an imminent recession. We continue to believe that recessionary concerns in the US are overblown given that consumption remains relatively robust.

Following the end-May European Elections where, in line with expectations, populist parties gained ground at the expense of the continent’s long-standing political centre, the EU is set to decide the composition of the influential committee heads. This includes a new president of the Commission and another vice president who will scrutinise and amend legislation in the years ahead. Having lost its combined majority, however, the mainstream centre-left is unlikely to secure as many of the top posts, which had allowed it to set the course of legislation in the past four decades. Despite the new legislature becoming more fragmented, polarised and perhaps somewhat more unpredictable, a solid result for both the Liberals and Greens will continue to more broadly provide pro-European parties a strong workable majority.

On the economic front, the latest set of data suggests activity within the Eurozone continues to ease, as a slowdown in global growth due to China-US trade tensions appears to have continued to filter through to the euro area manufacturing sector. Lower growth and softer inflation outlooks eventually led outgoing ECB governor Mario Draghi to suggest in a June speech in Sintra, Portugal that, unless inflation improves, more stimulus by a means of interest rate cuts and/or bond purchases will be needed. This pushed both the euro and European bond yields sharply lower and led the rate market to price in a total of 20bps in additional monetary policy easing in the next 12 months.

In Australia, economic momentum continues to be generally weak. The latest release of national statistics showed the gross domestic product expanding at a below-consensus pace of 0.4% in Q1. Growth continued to be supported by exports, non-mining business investment and public expenditure. Weak growth in household consumption and investments was understood to have been the main drag on economic performance. Frail economic momentum and rising labour force participation rate saw a slight uptick in the rate of unemployment, suggesting a moderate build-up in a labour market slack. This together with subdued inflation and a deteriorating external environment led the Reserve Bank of Australia to cut its policy rate by a quarter of a percentage point to 1.25% in a move that was widely expected by market participants. If the slack in the labour market continues to build, further monetary policy easing will likely be appropriate.

In New Zealand, following a widely expected policy rate cut during the May meeting, the Reserve Bank of New Zealand’s Monetary Policy Council decided to keep the Official Cash Rate (OCR) unchanged at 1.5%. In the past year, domestic growth eased on the back of softer house prices and subdued business sentiment, which translated into feeble domestic spending. The RBNZ believes that low interest rates and higher government expenditure will boost economic activity and employment in the coming quarters. Inflation is also expected to converge to the 2% mid-point target, in line with a tightening labour market. In the meantime, however, given the uncertain nature of global economic momentum and the risk of domestic growth remaining subdued, a lower OCR may be needed in the coming months to maintain employment near its maximum sustainable level and anchor inflation (and expectations of inflation) near its target.

Following a couple years of solid growth in Norway, spare capacity continued to gradually diminish. Domestic economic activity has mainly been supported by the past strength of external demand, higher oil prices and low domestic interest rates. More recently, a weakening external environment saw a modest easing in economic activity, even though the pace of activity remains close to its potential. A gradual reduction in spare capacity has also seen a modest build-up in inflationary pressure, with the latest underlying CPI coming at an above-target pace of 2.3%. Given the strength of domestic economy, the Norges bank decided to hike the policy rate by a quarter percentage point to 1.25%. In the coming months, a cautious approach is likely to be adopted, as uncertainties related to trade tensions continue to weigh on external demand.

The latest escalation in trade conflicts continued to put pressure on Canada’s domestic economy, as restrictions introduced by China are having a direct impact on Canadian exports. Positively, however, the removal of steel and aluminium tariffs and rising prospects of USMCA ratification are likely to boost the country’s exports and investment, partially offsetting the negative implication of a US-China trade war. As such, the Bank of Canada sounded confident that the slowdown in late 2018 and early 2019 was temporary and that a pick-up in economic activity starting from Q2-19 would ensue. The strength of the labour market is also suggesting that businesses are likely to perceive the recent weakness as being of a transient nature. Inflation generally continued to surprise to the upside, with the latest core CPI re-accelerating to 2.3%, well above the market consensus of 2.1%. Similarly, on the back of food, shelter and transportation prices, the headline inflation measure picked up momentum to come in at 2.4%, which is above the mid-point of the BoC’s tolerance threshold of 2.0 (+/-1%). Given the weak external backdrop, the BoC is seen as remaining on hold for some time, preserving its data dependency bias as far as the future path of interest rates is concerned.

The general expectation at the start of the year was that the major central banks were likely to continue throughout the year to tighten liquidity through rate hikes and/or balance sheet reduction. However, the situation now looks materially different given the increasingly dovish turn by the Fed, with no further rate hikes expected and, more recently, even increased talk of rate cuts. As for the ECB, President Draghi has recently hinted at the possibility of further rates cuts and asset purchases. We see these developments as positive for emerging market bonds, particularly those that are supported by sound fundamentals, as they will continue to receive welcome support from international investors. The moderate growth slowdown of developed economies also makes growth in emerging economies more attractive on a relative basis. Furthermore, the slowdown in China, which has fed its way through the rest of the emerging world, is already well accounted for. We still have to consider the possibility of a prolonged trade war, despite positive rhetoric between Trump and Xi at the G20 meeting, with tariffs of 25% still in place on USD 200 billion of US imports from China. However, at the same time, China is utilising a number of stimulus measures to help offset some of the impact of tariffs. So, while the consensus view might still be cautious, we strongly believe that individual emerging markets will continue to recover this year.

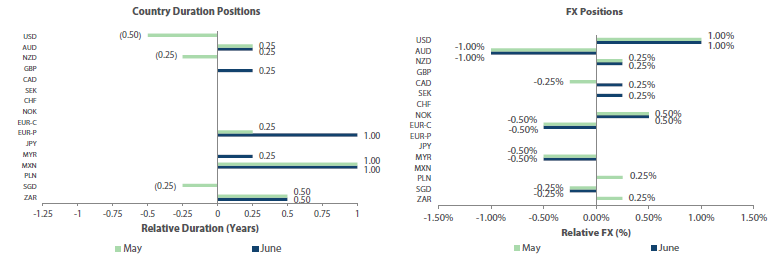

Developed Markets Positioning

Given the changing backdrop of their evolving US-China trade conflict, the London team moved duration positioning to neutral from a slight underweight on the global developed market central bank shift to an easing cycle. While the US data largely remained intact, the team could no longer ignore the uncertainty surrounding the extreme inversion of the short end of the US yield curve. The market is currently pricing in at least one rate cut for the Fed’s July meeting and there is also growing expectation of a cut by the ECB and potential for the ramp-up of a new QE program in the fall. The team notes that the recent post-G20 lull between Trump and Xi may flare up again in the fall as Trump begins to build his 2020 reelection campaign.

As for Europe, the team struggled to justify maintaining its core positioning given the all-time low negative yields. However, the team believes neutral positioning would be most reasonable given the significant dovish shift by the ECB and Draghi’s ‘whatever-it-takes’ approach. The team moved to increase its weight on Italy with yields heavily supported by the ECB and Italy spreads trading at the wides, excluding the 2012 Euro sovereign crisis.

Credit markets views remained relatively benign, with the team remaining biased to European IG names over US names, especially with the shift in ECB expectations. The team however also noted that SSA paper still contained value relative to government bonds on the May selloff in credit.

The team looked to shift its SEK position to overweight on the steadfast hawkish stance of the Riksbank, despite the ECB shifting to a more dovish tone, as the Swedish central bank reiterated the potential for a hawkish tilt by its October meeting if the inflation data were to hold. While the team remained sceptical of the data, we decided the Riksbank’s extreme conviction on monetary policy could not be ignored.

The team maintained its view on Norway from both the FX and bond perspectives, as the Norges bank kept its hawkish message in the face of a dovish Eurozone, as Brent crude stabilized in June going ahead of an OPEC meeting.

For sterling, the team preserved its relatively neutral stance, tweaking duration longer in line with the team’s view on global rates. With Boris Johnson emerging as the 98% favourite to take over as UK prime minister, the team holds that the 31 October Brexit deadline remained the most relevant factor to risk positioning over the longer term.

For Australia and New Zealand, the team remained cautious due to the repercussions arising from the ongoing US-China trade conflict. It therefore maintained its net underweight Oceania positioning. The team did increase duration position slightly on New Zealand due to the Kiwi market’s higher relative yields and still-dovish central bank shifting from the relative underweight. The team notably sustained its long duration positioning in Australia on the expectation of further dovishness from the RBA.

Emerging Markets Positioning

We are becoming even more constructive in emerging markets on duration overall, given the increasingly dovish rhetoric from the US Fed and the ECB, with an increasing likelihood of rate cuts by the Fed over the coming months and still-high real yields in many emerging local currency bonds. In FX, however, we are slightly more cautious due to ongoing weakness in global growth, particularly in the export sector, and remain somewhat sceptical regarding a potential trade truce between the US and China due to the structural nature of the issues at hand.

Also in FX we remain underweight the Malaysian ringgit and Singapore dollar, as both Malaysia’s and Singapore’s economies are highly exposed to global trade, and with exports—particularly in the electronics sector—under pressure due to weak external demand.

In rates we remain long in high-yielding currencies such as those of Mexico and South Africa, and to a lesser extent, that of lower-yielding Malaysia, where real yields are still significant. Mexico, in particular, offers considerable value with elevated real yields, currently almost 4% higher than the current rate of inflation.

Global Credit

Global credit markets have performed strongly, especially within US credit markets, due to a strong rates rally. Latam was the next-best performing market on an absolute basis, and this is interesting because—despite how different these markets are—it’s a reflection of where current risk appetite is for duration. Additionally, we saw surprising excess returns in European credit as expectations for ECB easing heightened. Overall, looking at current global credit markets from a macro level, we currently see many negatives with some pockets of idiosyncratic positives. After a period of strong performance, we expect July to be a ‘wait and see’ month in how we position the portfolio and manage it with a neutral bias for the immediate future.

In Europe, we have seen much change on the macro side, but what has largely changed is the geopolitical risk. What is worth in particular drawing attention to is the Italian budget deficit and its potential effect on European credit markets. Focusing more on technical factors, we have seen inflows into credit, with significant assets coming into the markets following comments made by Draghi in June, where he stated that USD 13 trillion of bonds are now in negative debt. This caused a knock-on effect for assets with yield and, for example, has caused BB & BBB credits to rally. Lastly, it is worth confirming a theme noted in previous outlooks that prices of new issues have become relatively expensive. There has been a trend that new issues have certainly tightened well within the initial price guidance causing them to become less attractive to purchase.

In Australia, we see some positive sentiment in the market due to a degree of stability on the domestic front, especially in terms of politics and the housing market. In terms of the credit market itself, we have little concern as it continues to operate in a healthy environment. In terms of supply, we have seen a good amount for 2019, mostly from financials, but we now expect a period of calm in July and possibly in August. It is worth pointing out a concern, however, of how spreads have moved in and become a bit tight, moving to levels close to the minimum since the financial crisis. Overall, we may suggest lightening up on credit, but at the same time this may be difficult given the environment where we are not facing any signalling of a sudden reversion out.

Asian credits registered gains in June, driven mainly by the rally in USTs, although credit spreads also tightened. High-grade credits were also up on a total-return basis, with spreads tightening. Risk sentiment turned positive in June, pushing credit spreads lower. Hopes of easing US-China trade tensions, comments from both the US Fed Chairman and ECB President that markets interpreted to be dovish, and China’s announcement of new measures supporting infrastructure investment sustained a positive market tone throughout the month. By country, Indonesia outperformed, benefitting from both the Standard & Poor’s upgrade of the country’s long-term sovereign credit rating at the end of May and the resumption of fund inflows into EM. Credit spreads in Hong Kong were barely affected by the street protests against proposed China extradition legislation. Meanwhile, the sharp hike in oil prices in the latter half of the month, prompted by tensions between the US and Iran, caused some credit spread contraction in the oil and gas sector.

Lastly in the US, the micro side looks quite stretched, especially when looking at earnings and how leverage and defaults are increasing. Fundamentals are mixed at the moment but we expect July to be a better month. Given the aggressiveness of US companies at the moment they need to be operating in a positive macro environment to avoid potential shortcomings. Valuations are not that stretched yet, and on an unhedged basis we can still find some value on the curve. Lastly, we are currently in a rally where everyone is playing it safe—if you were focusing on HY you would look to buy a BB-rated credit, while in IG you would look to buy A-rated credit. We don’t see this situation changing any time soon.