Summary

- Asian stocks staged a relief rally in June, buoyed by expectations of interest rate cuts by the US Federal Reserve and the resumption of trade talks between the US and China. The MSCI AC Asia ex Japan Index turned in gains of 6.6% in USD terms over the month, owing to an improvement in market sentiment.

- Within the region, Singapore and Thailand posted the biggest gains. Banking and telecommunication stocks led gains in Singapore, while Thai equities were lifted by the surge in heavyweight Energy stocks as oil prices rose. South Korean and Chinese stocks also performed well over the month.

- Conversely, India was the worst-performing Asian market, edging lower as a delayed monsoon threatened to weigh on agricultural production. The Reserve Bank of India cut its repo rate by 25 basis points to 5.75%, citing weak growth impulses.

- With global growth showing signs of slowing, central banks around the world have turned increasingly dovish. Yet, it remains to be seen whether this current wave of easing would be sufficient to meaningfully mitigate economic headwinds caused by the trade-related loss in confidence globally. However, the longer-term narrative of the structural Asian growth story remains on track, characterised, among other things, by positive reforms and consumption upgrades.

Asian Equity

Market Review

Asian equities rallied in June

Asian stocks staged a relief rally in June, boosted by expectations of interest rate cuts by the US Federal Reserve (Fed) and the resumption of trade talks between the US and China. The increasingly dovish tilt of the European Central Bank and other major central banks, which has caused government bond yields of many developed nations to slip into negative territory, also enhanced the attractiveness of risk assets, such as equities. The improvement in market sentiment lifted the MSCI AC Asia ex Japan Index, which turned in gains of 6.6% in USD terms over the month.

At the same time, the scheduling of a month-end meeting between US President Donald Trump and Chinese President Xi Jinping at the G20 Summit in Osaka further improved market sentiment. The Trump-Xi meeting didn't disappoint markets, with the US and China agreeing to restart trade talks. In addition, Trump agreed not to impose additional tariffs on Chinese exports for the moment and to allow US corporations to resume sales to Huawei. For its part, China committed to buy more US goods.

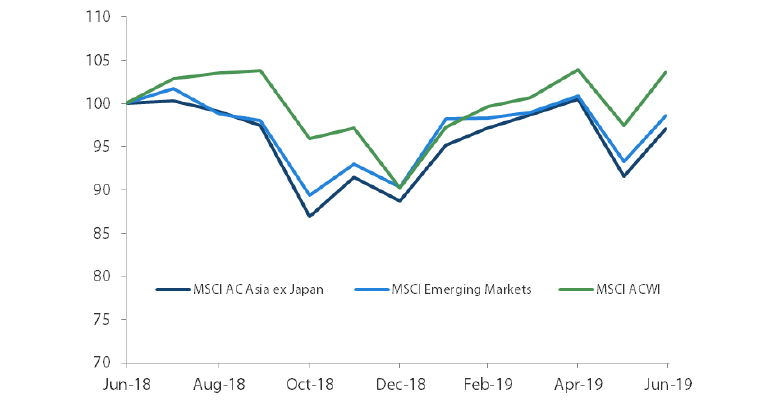

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 June 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

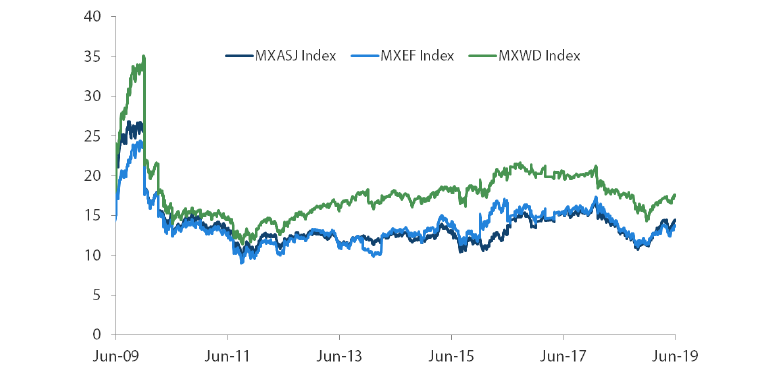

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 30 June 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

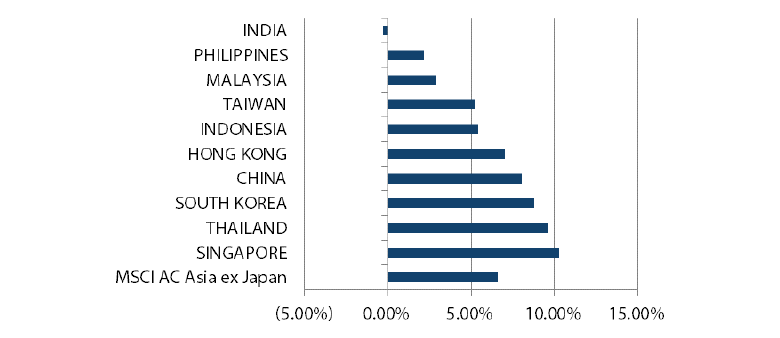

Singapore and Thailand led the winners; India declined

Within the region, stocks in Singapore and Thailand led the winners after turning in USD gains of 10.3% and 9.6% respectively in June, while Indian stocks bucked the regional uptrend, slumping 0.3% in USD terms for the month.

In Singapore, banking and telecommunication stocks outperformed, particularly those of benchmark heavyweight Singapore Telecommunications, which announced that it was looking to unlock value out of its loss-making digital investments. Bank shares also rallied on trade optimism.

Thailand’s stock market was lifted by the surge in heavyweight Energy stocks in June as oil prices rose. The country’s new parliament voted to elect Junta chief Prayuth Chan-ocha as prime minister after a prolonged post-election period of backdoor deals. The Thai central bank kept its interest rate on hold at 1.75% but cut its forecast for 2019 economic growth to 3.3%, compared to a forecast of 3.8% in March.

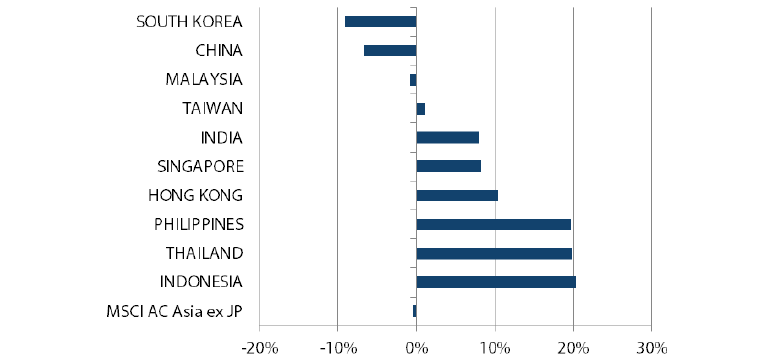

South Korean and Chinese stocks also performed well for the month, rising 8.8% and 8.0% in USD terms respectively. The export-centric and tech-heavy equity market of South Korea rallied in June after a bruising May on optimism of a breakthrough in US-China trade talks ahead of the two countries’ G20 meeting and thanks to a recovery in the global memory chip industry. Meanwhile, Chinese stocks also moved higher on signs of a thaw in Sino-US trade negotiations. A new trading link between Shanghai and London, plus the adding of China A-shares into the FTSE Emerging Markets Index also lifted Chinese equities during the month.

Despite large-scale demonstrations in Hong Kong protesting against a controversial China extradition bill, Hong Kong stocks managed to track the regional uptrend and surged 7.0% in USD terms in June. Elsewhere in North Asia, Taiwanese stocks rose 5.2% in USD terms over the month, led by export- and electronic-related stocks.

The worst performing Asian market in June was India, whose equity market was weighed down by rising oil prices and a delayed monsoon, which could negatively impact agricultural production. Citing weak growth impulses, the Reserve Bank of India cut its repo rate by 25 basis points to 5.75% from 6.0%.

All ASEAN markets saw positive returns

In the ASEAN region, Indonesia was up 5.4% in USD terms in June, while Malaysia and the Philippines turned in relatively muted USD gains of 2.9% and 2.3% respectively. Indonesia's central bank left its key interest rate unchanged for a seventh month in a row in June, but cut the reserve requirement for banks to ensure adequate liquidity to boost lending, while signalling that rates are set to be reduced in future. Malaysia’s manufacturing sector contracted at a faster rate in May with a manufacturing PMI score of 48.4, down from 49.4 in April. In the Philippines, the central bank kept the interest rate unchanged at 4.5% despite lowering its inflation forecasts for 2019 and 2020.

MSCI AC Asia ex Japan Index1

For the month ending 30 June 2019

Source: Bloomberg, 30 June 2019

For the period from 30 June 2018 to 30 June 2019

Source: Bloomberg, 30 June 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Structural Asian growth story remains on track

With global growth showing signs of slowing, central banks around the world have turned increasingly dovish. Consequently, many emerging markets, which previously were under pressure due to their dependence on capital imports, are now enjoying some reprieve. Yet, it remains to be seen whether this current wave of easing will be sufficient to meaningfully mitigate the economic headwinds caused by the trade-related loss in confidence globally. However, the longer-term narrative of the structural Asian growth story remains on track, characterised, among other things, by positive reforms and consumption upgrades. The former is particularly salient after recent positive election results in India, Indonesia and Thailand, countries in which we expect pro-growth reforms to be key growth drivers in the medium to long term.

Sanguine on Chinese insurance, healthcare and software sectors

Notwithstanding the month-end truce, China's trade issues with the US are expected to be protracted and complex. The central government is well aware of the country's growth risk in the current macro environment and has sensibly responded with a series of measured and targeted stimulus in areas of strategic priority. In our opinion, the discipline to resist any broad-based stimulus programme to date demonstrates the government's commitment to quality over quantity. On a separate note, China's commitment to Hong Kong's One Country Two System status is being increasingly questioned, as shown in the latest large-scale protests against the extradition bill. That Chief Executive Carrie Lam's stance has softened significantly with her public apology has reassured us that tensions which arose from her political misstep could dissipate in the not-too-distant future. Our stance with regard to core long-term holdings in insurance, healthcare, software and select consumer sub-sectors remains unchanged in spite of the geopolitical developments.

Positive on India; selective in South Korea and Taiwan

In India, the recent resounding majority win for Modi and the Bharatiya Janata Party is a clear positive for the Indian economy, with the prospect of further market-orientated reforms and pro-growth policies over the medium term. Much needs to be done on the policy front with obvious low hanging fruit in infrastructure, housing and healthcare. Urbanisation and productivity growth are longer-term issues that will also have to be addressed. While risks to the economy continue to lurk, the good news is that external pressures are much less onerous than they had been over the last year, with an easing global interest rate environment along with India's low dependency on trade. Meanwhile, we remain invested in strong private sector banks and real estate developers and have recently increased our positions in the consumer space.

Good news, however, has been a rare commodity for the technology hardware sector which has endured a torrid few quarters, as have, by extension, the South Korean and Taiwanese equity markets. In addition to challenging trade conditions, the domestic economies in both countries continue to be under pressure. The few recent bright spots include real estate owners who stand to benefit from the shift of the technology supply chain back into South Korea and Taiwan. We do, however, find some quality companies in pockets of the market, which are trading at attractive valuations. For example, in healthcare, electric vehicle, and niche technology companies.

Indonesia our preferred ASEAN market

Indonesia is our preferred exposure within the ASEAN region, as it stands to benefit from post-election government policy and reforms. Armed with a significant new mandate, the government can now push away roadblocks and roll out much-needed infrastructure projects nationwide. Longer term, for Indonesia to remain competitive within the region, it is imperative for labour laws to be reformed. But that continues to be one of the hardest reforms to execute. In the shorter term, with more political visibility post-election, we can look forward to some cyclical improvements in consumer spending and industrial capital expenditure. Lower rates and an unexpected sovereign ratings upgrade should lend additional support to a potential consumption recovery and a better-positioned banking system.

Appendix

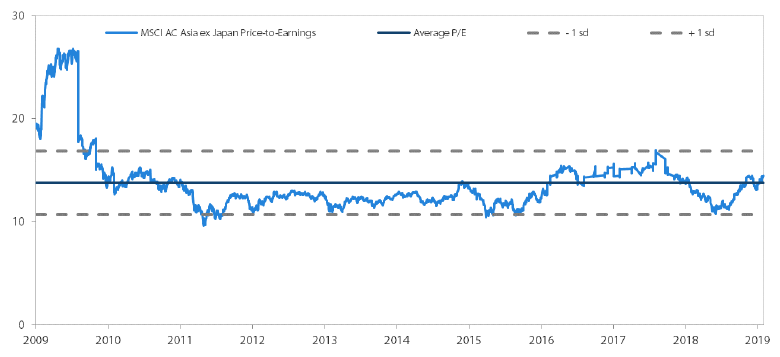

MSCI AC Asia ex Japan Price-to-Earnings

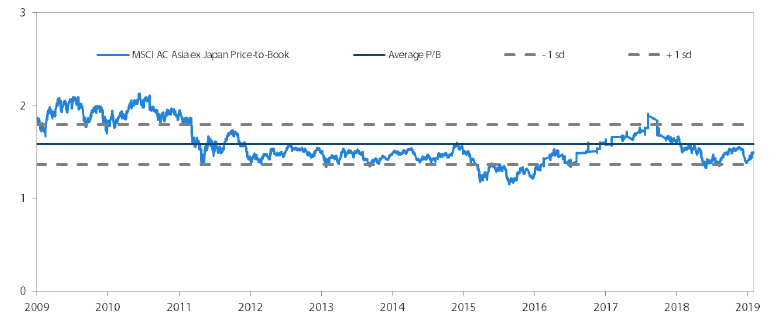

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 30 June 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.