Summary

- USTs rallied in June. Economic data suggesting that the trend in jobs growth has downshifted, together with trade pessimism, initially pushed UST yields lower. Following hopes of easing US-China trade tensions, dovish comments from the US Federal Reserve (Fed) chairman and the European Central Bank (ECB) president drove yields down. At month-end, 2-year and 10-year yields were at 1.76% and 2.01% respectively, about 17 basis points (bps) and 12bps lower compared to end-May respectively.

- Asian credits registered gains of 1.59% in June, mostly due to the rally in USTs. Credit spreads tightened as risk sentiment turned positive. High-grade credits were also up 1.59% on a total-return basis, with spreads tightening by about 6.5bps. High-yield corporates chalked up total returns of 1.58%, with spreads contracting 7bps on the month, despite heavy new issuances. By country, Indonesia outperformed due to S&P’s upgrade of the country’s long-term sovereign credit rating in May and the resumption of fund inflows into emerging markets (EM).

- Within the region, inflationary pressures mostly rose in May, prompted largely by higher food inflation. The Reserve Bank of India (RBI) cut its policy rate, while Bank Indonesia (BI) lowered banks' Reserve Requirement Ratio (RRR). Meanwhile, Chinese activity data worsened in May. China’s policymakers also set new rules for foreign debt issuance and allowed special bonds as capital for qualified projects.

- The month saw heavy primary issuance due to the market’s positive tone. There were 37 new issues amounting to USD 19.6 billion in the high-grade space, while the high-yield space saw a whopping 56 new issues amounting to USD 16.8 billion.

- For Asian local currency bonds, we maintain our preference for mid to high carry bonds of countries with room to further ease monetary policy in the near term. Particularly, the Indonesian central bank is likely to unwind the series of hikes it undertook earlier in 2019, as long as the rupiah remains stable. Similarly, we view central banks in India and the Philippines as having room to further cut interest rates. Meanwhile, regional currencies are expected to benefit from a dovish Fed.

- As for Asian credit, a final resolution to the US-China trade conflict remains uncertain and unlikely to materialise in the near term. Against the backdrop of rising downside risks, we expect major central banks to maintain their current dovish lean. This will help offset weaker macro fundamentals and support credit spreads, despite valuations turning less attractive.

Asian Rates and FX

Market Review

USTs rallied in June

Yields of USTs fell across the curve in June. Economic data suggesting that the trend in jobs growth has downshifted, together with trade pessimism, initially pushed UST yields lower. There was a short-lived rebound in yields mid-month, following the conclusion of the trade agreement between the US and Mexico. Towards the month-end, markets were also hopeful of a softening in US-China trade tensions. Subsequently, a signal from the Fed that it was poised to ease, and ECB President Mario Draghi's comment that ‘additional stimulus’ may be announced in the absence of any improvement in growth and inflation, pushed the benchmark 10-year UST yield to a low of 1.97%. Meanwhile, worries over conflict between Iran and the US also supported UST buying. At month-end, US President Donald Trump and Chinese President Xi Jinping agreed to resume trade negotiations, with the former consenting to halt additional tariffs on Chinese imports ‘for the time being’, while China agreed to buy more US agricultural products. At the end of the month, 2-year and 10-year yields were at 1.76% and 2.01% respectively, about 17bps and 12bps lower compared to end-May respectively.

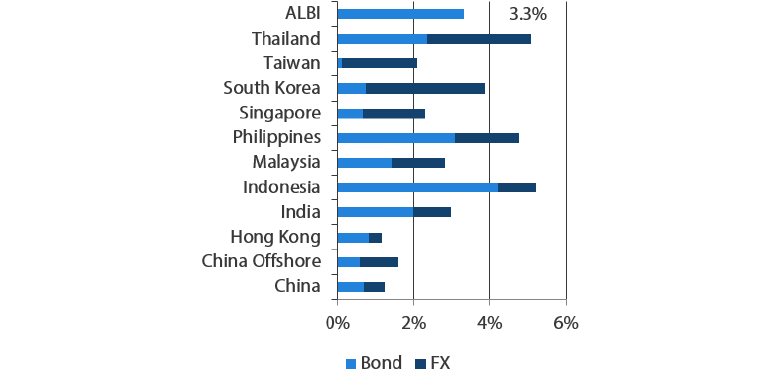

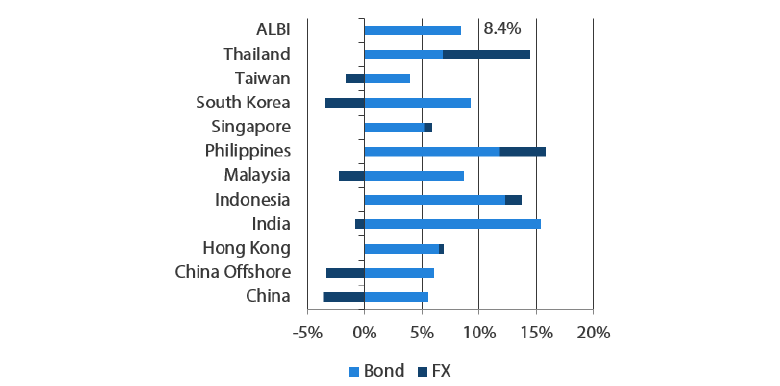

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 June 2019

For the year ending 30 June 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures mostly rose

Regional headline Consumer Price Index (CPI) inflation prints mostly accelerated in May, prompted largely by higher food inflation. Headline CPI in India inched up to 3.05% year-on-year (YoY) in May from an upwardly revised 3% in April. However, after stripping out food and beverages, as well as fuel price inflation, core inflation actually eased. In Indonesia, the annual consumer inflation rate picked up its pace on the back of Ramadan festivities spending. Although the headline number was the highest since April 2018, it remains within the central bank's 2019 target range of 2.5-4.5%. Similarly, inflation in the Philippines rose to 3.2% in May from 3% in April, but also remained within the target range of the Philippine central bank. Elsewhere, energy price deflation in South Korea eased on the back of the expiration of the temporary fuel tax cut.

RBI lowered its policy rate; BI cut banks' RRR

The Indian central bank cut its key lending rate for the third time this year. The RBI's monetary policy committee voted unanimously to lower the rate by 25bps, and shifted its monetary policy stance from 'neutral' to 'accommodative'. The monetary authority also lowered its FY20 GDP growth projection from 7.2% to 7.0%. Meanwhile, BI trimmed banks' RRR by 50bps in a move aimed to help boost loan growth and overall growth momentum. BI Governor Perry Warjiyo also signalled a rate cut is coming, noting that global financial market conditions and the country's balance of payments are the main factors being considered in lowering the policy rate. Separately, the Philippine central bank kept interest rates unchanged 'for the time being', as it lowered its inflation forecast for this year and next. The monetary authority now expects headline inflation to average 2.7% in 2019 (down from 2.9%), and 3% in 2020 (from 3.1%). According to the governor, the lower inflation forecasts are due to the decline in global oil prices and the stronger peso. The central bank described the decision as ‘a prudent pause’, allowing it to ‘observe and assess the impact of prior monetary adjustments including the phased reduction in the reserve requirements.’

Chinese activity data worsened in May

Activity data worsened across the board in May. Growth in industrial production, fixed asset investment, property investment and new homes sales (by volume) all decelerated.

Market Outlook

Maintain preference for mid to high carry bonds; regional currencies to benefit from dovish Fed

Although the US and China agreed to restart trade negotiations following the meeting between Presidents Trump and Xi at the G20 summit in Osaka, a final resolution to the trade conflict remains uncertain and unlikely to materialise in the near term. Nonetheless, with tempered uncertainty, the positive risk tone in markets should be supported. Against such a backdrop, our preference for mid to high carry bonds of countries with room to further ease monetary policy in the near-term remains. We highlight that the Indonesian central bank has strongly hinted that it is ready to unwind a series of hikes in 2019, as long as the rupiah remains stable. Similarly, we view central banks in India and the Philippines as having room to further cut interest rates, as their inflation rates become well-entrenched within their respective targets.

Meanwhile, the sudden swing in Fed expectations towards rate cuts should bode well for regional currencies. The tempered uncertainty resulting from the US-China trade truce also translates to weakened support for safe-haven buying of the USD, further benefitting regional currencies.

Asian Credits

Market Review

A positive month for Asian credits

Asian credits registered gains of 1.59% in June, driven mainly by the rally in USTs, although credit spreads also tightened. High-grade credits were also up 1.59% on a total-return basis, with spreads tightening by about 6.5bps. High-yield corporates chalked up total returns of 1.58%, with spreads contracting 7bps on the month, despite heavy new issuances.

Risk sentiment turned positive in June, pushing credit spreads lower. Hopes of easing US-China trade tensions, comments from both the US Fed Chairman and ECB President that markets interpreted to be dovish, and China’s announcement of new measures supporting infrastructure investment sustained a positive market tone throughout the month. By country, Indonesia outperformed, benefitting from both the Standard & Poor’s upgrade of the country’s long-term sovereign credit rating at the end of May and the resumption of fund inflows into EM. Credit spreads in Hong Kong were barely affected by the street protests against proposed China extradition legislation. Meanwhile, the sharp hike in oil prices in the latter half of the month, prompted by tensions between the US and Iran, caused some credit spread contraction in the oil and gas sector.

China set new rules for foreign debt issuance; special bonds allowed as capital for qualified projects

China’s National Development and Reform Commission (NDRC) issued new guidance on offshore bond issuances by local State-Owned Enterprises (SOEs). According to the regulator, SOEs must now have at least three years of operating history to be eligible to tap the offshore market. On top of this, offshore borrowings cannot be guaranteed by local governments, and financing arms of local governments can only borrow to refinance existing foreign debt maturing within one year. Separately, policymakers—in a bid to boost economic activity—declared that local governments will now be allowed to use proceeds from special bonds as capital for qualified major investment projects. During the month, the People’s Bank of China also announced increased quotas for the re-discounting window by RMB 200 billion and for the standing lending facility by RMB 100 billion to support lending by smaller banks.

A month of heavy primary issuance

A positive market tone supported robust primary market activity in June. There were 37 new issues amounting to USD 19.6 billion in the high-grade space, including a four-tranche USD 2.3-billion issue from CNAC HK Finbridge Co, a two-tranche USD 1.5-billion issue from ICBC Bank, and sovereign issues from Korea and Indonesia. Meanwhile, the high-yield space saw a whopping 56 new issues amounting to USD 16.8 billion, including a USD 2-billion sovereign issue from Sri Lanka and a USD 1.4-billion capital instrument from Guangzhou Rural Commercial Bank.

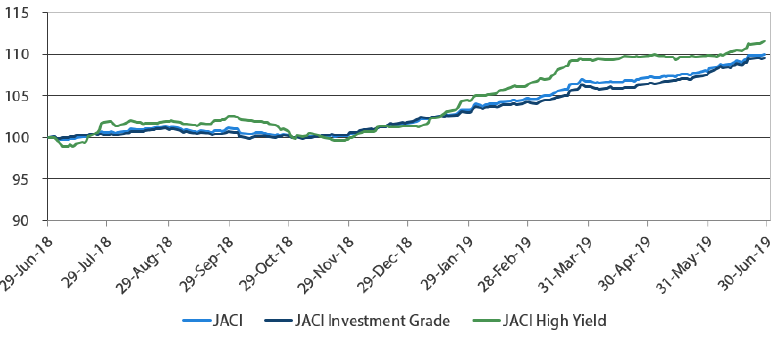

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 June 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 30 June 2019

Market Outlook

Resolution of trade conflict unlikely to materialise near-term; major central banks expected to maintain dovish lean

Although the US and China had agreed to restart trade negotiations following the meeting between Presidents Trump and Xi at the G20 summit in Osaka, a final resolution to the trade conflict remains uncertain and unlikely to materialise in the near term. In addition, recent global macroeconomic data has remained soft, and the ongoing trade uncertainties will likely weigh on exports and business investments globally. China’s ongoing stimulus will continue to support the domestic economy, but the resurfacing of external uncertainties is likely to dampen any positive impact. Given the emerging downside risks, the major central banks are likely to maintain their current dovish lean or move to an explicit easing bias. As had been the case in June, this expectation of easier monetary policy will provide an offset to weaker macro fundamentals and support credit spreads, despite valuations turning less attractive.