Summary

The macroeconomic backdrop for Singapore is likely to be challenging in the near term with possible economic downgrades. Yet, AAA-rated Singapore government bonds continue to hold their own, offering relatively attractive yields versus those of many developed-market sovereign debt.

Earning top marks in terms of credit rating, safe-haven Singapore government bonds not only offer price resilience, low volatility but also relatively attractive yields. In the current downward trending interest-rate environment, where yields of several developed-market government bonds have already sunk into negative territory, Singapore government bonds remain one of the handful of AAA-rated sovereign debt in the world that are still having a decent yield.

Defensive Quality

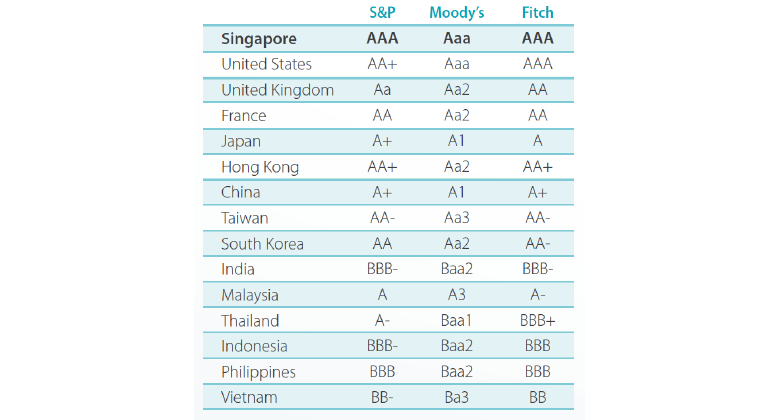

To be sure, Singapore is the only Asian country that has the highest AAA credit rating awarded by all three major credit-rating agencies (see Illustration 1). The city-state has retained this coveted status over the past two decades, covering periods of economic crises, including the Asian Financial Crisis in 1997 and the Global Financial Crisis in 2008. Singapore’s AAA credit rating is supported by its USD 293 billion1 of official foreign reserves and a prudent fiscal policy characterised by consistent government budget surpluses.

Illustration 1: Sovereign Credit Ratings of Countries

Source: Bloomberg, Nikko AM Asia, March 2019

Over the years, the Singapore dollar (SGD) bond market has experienced steady growth, owing to a burgeoning issuer universe and rising investor interest. The Singapore government actively issues bonds up to 30 years in maturity to develop a liquid benchmark yield curve, which is used by government agencies and corporates in Singapore to price their bond issuances.

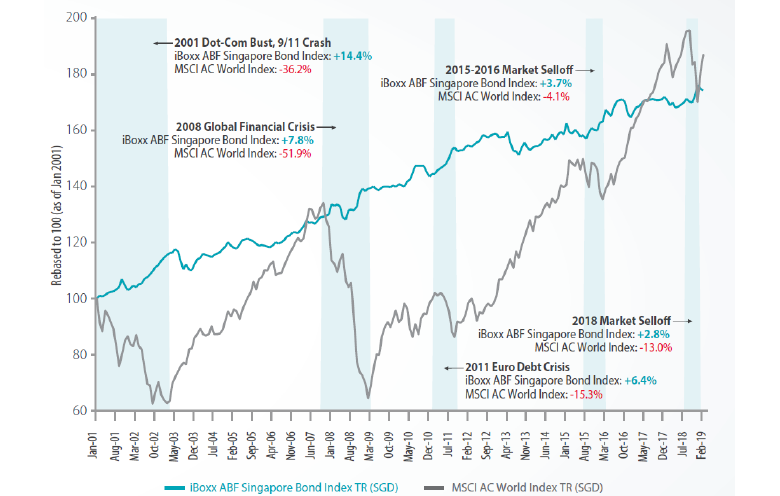

Historically, Singapore government bonds have performed remarkably well during periods of market turbulences due to their defensive characteristics and the strength of the Singapore dollar (see Illustration 2).

Illustration 2: A Safe Haven During Market Upheavals

Footnotes: Singapore government bonds depicted in the above illustration are measured by the iBoxx ABF Singapore Bond Index, which comprises primarily of SGD bonds issued by the Singapore government and Singapore government-linked entities. MSCI AC World Index is a market capitalisation index that measures equity market performance throughout the world. Source: Bloomberg, Nikko AM Asia, as of 28 February 2019. The chart is for illustration purposes only. Past performance is not indicative of the future performance.

Relatively Attractive Yields

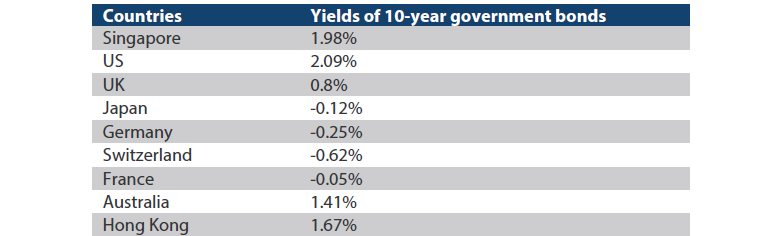

Of late, the US Federal Reserve (Fed) has signalled its intention to cut interest rates to prevent the US-China trade war from stalling economic growth in the world’s biggest economy. Likewise, the European Central Bank has indicated that it is prepared to cut policy rates if economic growth in the Eurozone weakens in 2H 2019. The dovish stance of the Fed and other major central banks have pushed yields of many developed-market government bonds notably lower in recent times; 10-year government bond yields of several European nations and Japan have even sunk into negative territory (see Illustration 3).

Illustration 3: Yields of Developed-Market Government Bonds

Source: Bloomberg, Nikko AM Asia, 15 July 2019

In the current low interest-rate environment, where decent income is hard to come by, the appeal of low- and negative-yielding government bonds is dwindling. Yet, Singapore government debt continues to hold its own, offering relatively attractive yields versus those of many developed-market sovereign bonds.

For instance, yields of 10-year Singapore government bonds—currently hovering near the 2% mark—are notably higher than those of their developed Asian and Western peers. What’s more, yields of one-year Singapore Treasury Bills, ranging from 1.84%2 to 1.96%2, currently exceed the 12-month SGD fixed deposit rates3 offered by the three local banks.

Singapore Fixed Income and SGD Outlook

The challenging macroeconomic backdrop facing the open and trade-dependent Singapore economy could further enhance the appeal of safe-haven assets like Singapore government bonds that earn a decent yield.

Negatively impacted by a slowdown in the global trade due to the ongoing US-China trade feud, the Singapore economy suffered its lowest growth rate in close to a decade in 1Q 2019 after posting year-on-year (YoY) growth of 1.2%. More recently, flash estimates by the Singapore Ministry of Trade and Industry (MTI) pinpointed to an even slower YoY growth of 0.1% (or a 3.4% quarter-on-quarter contraction) in 2Q 2019.

A technical recession—defined as two consecutive quarters of negative economic growth—occurring in Singapore in 2H 2019 is now a real possibility. It is likely that MTI will again lower its full-year economic growth forecast for Singapore. In May 2019, it downgraded Singapore’s 2019 GDP growth to 1.5-2.5% from an earlier range of 1.5-3.5%.

Due to the weak economic backdrop and the ultra-dovish stance taken by G3 central banks, we reckon that the Monetary Authority of Singapore (MAS) in its October policy meeting could bring about a modest flattening or a reduction of the SGD Nominal Effective Exchange Rate (NEER) slope. The SGD NEER is the exchange rate between the SGD and a basket of currencies of Singapore's major trading partners. A reduction of the SGD NEER slope will make the SGD appreciate at a slower pace, while a sharpening of the SGD NEER slope enables the SGD to appreciate faster. For the moment, the SGD NEER policy band is on a mild upward trajectory, paving the way for a modest and gradual appreciation of the SGD (see Illustration 4).

At the end of 2Q 2019, the short end of the Singapore Government Securities (SGS) yield curve rallied as the SGS bond market mirrored a sudden swing in Fed expectations toward rate cuts. The US-China trade truce concluded at the G20 summit in end-June could stabilise global trade and spur growth, albeit full resolution remains subject to challenging negotiations. With tempered uncertainty and a moderate growth-inflation mix, we maintain our ‘neutral’ view on SGS.

USD appreciation reversed in the first half of June as expectations of Fed cuts were priced into global markets. The SGD NEER continued to bounce around the upper half of the assumed trading band and USDSGD forwards also pointed to FX market expectations of moderate SGD appreciation relative to the start of the year. Though the Singapore economy remains exposed to global weakness, we believe it should see some near-term stability with the recent resumption of US-China trade talks in late June. Therefore, we change our view on SGD back to ‘neutral’.

Illustration 4: SGD Nominal Effective Exchange Rate (NEER)

Source: Bloomberg, Standard Chartered, 1 July 2019

To conclude, the macroeconomic environment for Singapore is likely to be challenging in the near term with possible economic downgrades and a technical recession on the cards. The precarious backdrop, however, could enhance the attractiveness of safe-haven Singapore government bonds, which not only offer price resilience, low volatility but also relatively attractive yields.

Footnotes:

1Source – Monetary Authority of Singapore (MAS), February 2019

2Source - Daily SGS Prices, MAS’ website, 16 July2019

3Source - DBS, OCBC & UOB; 12-month fixed deposit rates of the three local banks range from 0.7% to 1.7%, as at 16 July 2019

Important Information

This document is for information only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in unit trusts or ETFs are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”). Past performance or any prediction, projection or forecast is not indicative of future performance.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This publication has not been reviewed by the Monetary Authority of Singapore.