With apologies to the 'Bard of Avon' for the misuse of ‘wherefore’, but the market is becoming lost in its desire to chase growth, quality and safety with little or no attention being given to the value they are paying. This may be a major factor that drives performance in reporting season. Many of the beaten down cyclicals may arguably be already pricing in any bad news and conversely the very expensive stocks could be set up for a fall if they do not deliver on their lofty expectations.

The ASX 200 is closing in on record highs, helped by a now dovish RBA, elevated iron ore prices and a Coalition victory at the Federal Election that was out of the box. The one important issue currently missing is earnings growth. This will be required for the market to sustain its trajectory. FY19 earnings growth for the market is now close to zero — the worst outcome since FY16 (with resources the exception; they’re exhibiting double digit growth.)

Reporting season

Reporting season will see the market turn its focus to FY20 earnings. The market is currently forecasting EPS growth of c10%, which seems a little high given the current macro backdrop that is challenging at best. New government policy should help with a combination of interest rate cuts, likely tax cuts and increased stimulus through both Federal and State spending on infrastructure.

Confession season has started with a bang marked by a litany of downgrades in domestic cyclicals — particularly those exposed to consumer spending — but also others such as Caltex, Incitec Pivot, Star Entertainment and Adelaide Brighton which are impacted more stock specific issues. The poor sentiment over the past six months, given both local and global uncertainty, has certainly kept the operating conditions subdued in many sectors.

Reporting season is not just about the past (which we already know is not great) but, more importantly, about the outlook and trading conditions going forward. The market will be looking for any green shoots given the election is behind us, two rate cuts have been announced and we are likely to get some fiscal stimulus.

The political stress points of China/USA, Brexit and USA/Iran remain and may be larger drivers of the market (both positive and negative) than the reporting season itself.

The case for value

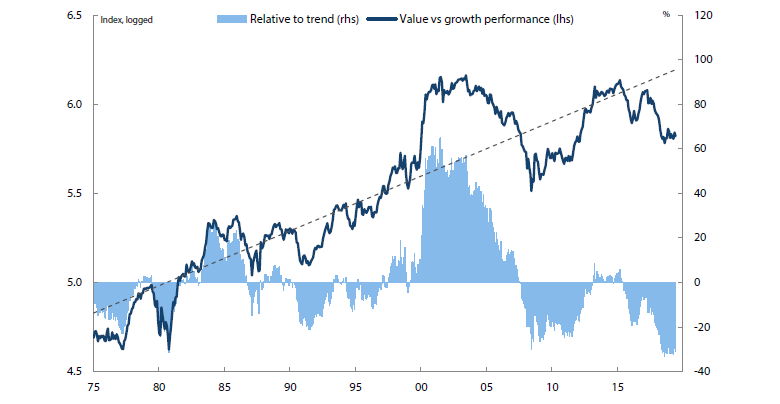

Many academic studies show that in most major developed equity markets, value as a style has outperformed in the long run. This has been termed the “value anomaly”. However, this is in the long run, and value can be in the wilderness for some time, as it is right now. But history tells us, and our long term history shows us, that value does prevail — sometimes we just need to be patient as markets always go in cycles — and that these ‘safety’ trade bubbles, like every other bubble, always eventually burst.

Chart 1 MSCI Australia value relative to growth

Source: Deutsche Bank

What about now?

Where we are right now, is that the equity market is buoyant despite concerns about global economic growth. However, when we look intra-market we can see, given the huge divergence in valuations between stocks, that on a relative basis the economically sensitive stocks are pricing in a meaningful economic downturn.

So, what can trigger a reversal? History tells us that we don’t necessarily need a catalyst for this extreme valuation divergence to get back to more normal levels. However, there are two potential catalysts on the horizon today.

Firstly, any meaningful resolution in the US/China trade war is likely to trigger a massive reversal and burst the ‘safety’ trade bubble. This is impossible to predict due to conflicting interests: on the one hand both parties have deep seated non-economic issues that are difficult to resolve without major concession by one party, and on the other hand they both want their economies to get back to steady good growth. Will pragmatism prevail?

A possible second catalyst for normalisation would be central banks cutting cash rates to reflect the softening economy. This should lead to bond yield curves steepening and encourage economic activity, which could be ably assisted by fiscal stimulus via tax cuts and infrastructure spending given how low cash rates are.

In the event of no resolution in the trade war this, combined monetary and fiscal stimulus but in a more forceful way, is ultimately the back stop to support the economy. However, this could lead to more pain initially before we see the benefits. Given the extreme divergence in relative valuations, which are factoring in this pain, the extent of further drawdowns for value would appear to be somewhat limited and a positive price reaction to news that is perhaps less negative than priced currently may result in some alpha generation in the value end of the market.

Important Information

This material was prepared and is issued by Nikko AM Limited ABN 99 003 376 252 AFSL No: 237563 (Nikko AM Australia). Nikko AM Australia is part of the Nikko AM Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It is for the use of researchers, licensed financial advisers and their authorised representatives, and does not take into account the objectives, financial situation or needs of any individual. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided.