Summary

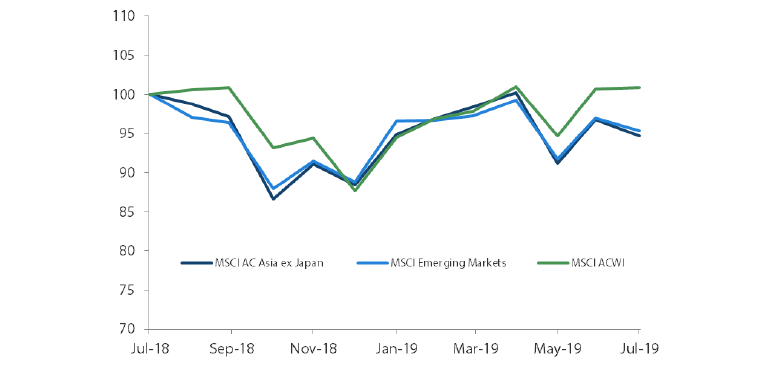

- Asian stocks succumbed to profit-taking in July; the MSCI AC Asia ex Japan Index dipped 1.8% in USD terms. Disappointing economic and manufacturing data across the region, as well as growing concerns about the slowing global economy, weighed on Asian stocks.

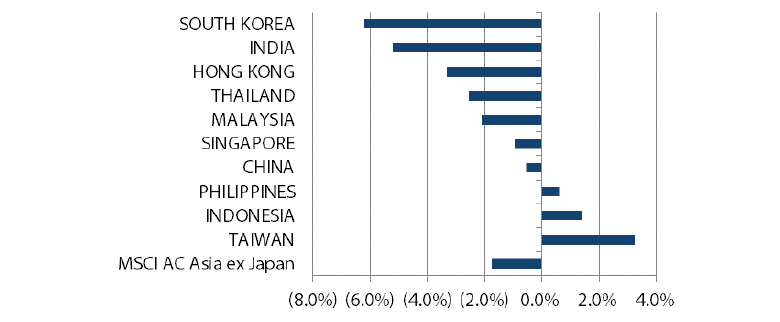

- Within the region, Taiwan and Indonesia posted the biggest gains. Better-than-expected GDP growth underpinned the Taiwanese market, while Indonesia’s central bank cut its interest rate for the first time in almost two years to boost growth.

- Conversely, South Korea lagged. The export and tech heavy market was weighed down by rising trade tensions between Seoul and Tokyo. India also underperformed, owing to weak corporate results.

- Volatile times could persist, but Asia ex-Japan equity markets ought to fare better against the backdrop of a weaker US dollar. In the region, there are markets that are little impacted by trade wars (such as India) as well as those that are beneficiaries of shifting supply chains (such as ASEAN).

Asian Equity

Market Review

Asian equities dipped in July

Following strong gains in the previous month, Asian stocks succumbed to profit-taking in July; the MSCI AC Asia ex Japan Index dipped 1.8% in USD terms. Disappointing economic and manufacturing data across the region as well as growing concerns about the slowing global economy weighed on Asian stocks. While the US Federal Reserve (Fed) implemented a 25 basis point (bps) rate cut as expected, its first in more than a decade, comments from Fed chairman Jerome Powell that the latest rate reduction was not the beginning of a long series of rate cuts dented market expectations of further easing. The latest round of US-China trade talks in Shanghai, which concluded without any significant progress, also did little to lift sentiment. Nonetheless, it was not a sea of red for all Asian markets as Taiwan, Indonesia and the Philippines posted gains for the month, while South Korea, India and Hong Kong were the worst hit in the region.

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 July 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

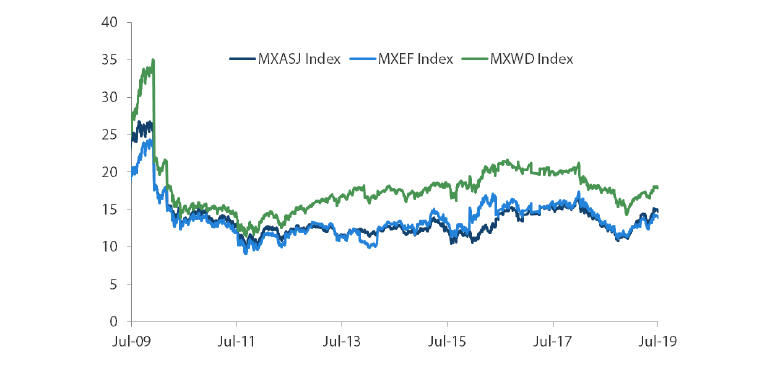

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 31 July 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

Taiwan and Indonesia led the winners

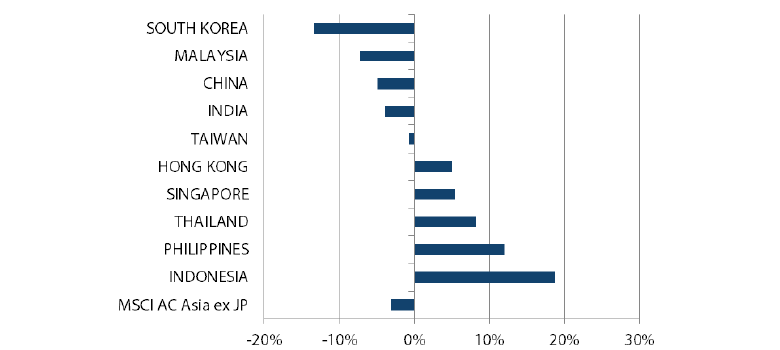

Stocks in Taiwan led the winners in July after turning in USD gains of 3.2%, boosted by better-than-expected 2Q economic growth. Strong gains from index heavyweight Taiwan Semiconductor Manufacturing Company (TSMC) following better-than-expected sales guidance for 3Q 2019, also lifted sentiment for Taiwanese stocks over the month.

Within the ASEAN region, stocks in Indonesia and the Philippines were the best performers, rising 1.4% and 0.6% in USD terms in July, while Thailand, Malaysia and Singapore incurred USD losses of 2.6%, 2.1% and 1.0% respectively. Bank Indonesia cut its interest rate for the first time in almost two years to boost growth, trimming the seven-day repurchase rate by 25bps to 5.75%. The Constitutional Court's ruling that opposition leader Prabowo Subianto's challenge of the election results was without merit also improved sentiment. In the Philippines, stocks were buoyed by the central bank's intention to resume policy easing in 2H 2019. The nation's robust Purchasing Managers' Index (PMI) for July, which rose to a six-month high of 52.1, also supported stocks in the Philippines.

In China, stocks dipped 0.5% in USD terms over the month. China's economic growth decelerated further in 2Q to 6.2% year-on-year (YoY), marking the softest growth since at least 1992 amid the ongoing trade spat with the US. In Hong Kong, stocks fared poorly as large-scale demonstrations and violent protests in the city-state disrupted businesses and transport networks. Hong Kong's 2Q GDP also disappointed investors, coming in at 0.6% YoY or -0.3% quarter-on-quarter.

South Korea and India hardest hit

South Korea was the worst performing Asian equity market, slumping 6.2% in USD terms. The export- and tech-heavy South Korean market was weighed down by rising trade tensions between Seoul and Tokyo. Over the month, Japan placed export restrictions on three key materials that South Korean companies need to manufacture semiconductors and display screens. Japan also planned to remove South Korea from a list of nations that enjoy minimum trade restrictions.

India was another laggard among the regional stock markets, diving 5.2% in USD terms over the month due to weak corporate results. In July, the International Monetary Fund lowered its projection for India's 2019 growth to 7%, citing weaker domestic demand.

MSCI AC Asia ex Japan Index1

For the month ending 31 July 2019

Source: Bloomberg, 31 July 2019

For the period from 31 July 2018 to 31 July 2019

Source: Bloomberg, 31 July 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Entering a lower-growth world

Markets have had something to cheer about year-to-date; however it appears, especially given the Fed's commentary, that the coming quarters will be less sanguine. It is increasingly obvious that the US-China trade discussions will be protracted. With China committed to its ‘quality over quantity’ metamorphosis and associated lower growth, and with tailwinds from easy money ebbing everywhere else, we are entering a lower-growth world. The Middle East has always been restive but recent developments vis-à-vis Iran have the potential to ignite the powder keg. Connecting these dots hints that volatile times could be ahead, requiring patience and a strong stomach as an investor. Asia ex-Japan ought to fare better in a weaker US dollar world; also in its favour are markets that are little impacted by trade-wars (such as India) or beneficiaries of shifting supply chains (such as ASEAN).

Maintaining core holdings in Chinese insurance, healthcare and software

China's continued reluctance to unleash a broad-brush stimulus, plus the remarkable restraint and maturity it has shown in handling the political unrest in Hong Kong augur well for the risk premium associated with the market. However, the negative impact on growth resulting from the monetary and fiscal restraint will weigh on asset prices as expectations are tempered, albeit with a lag. This will also have a dampening effect on growth across the region given China's trade linkages and especially so in Hong Kong. The prognosis is relatively healthier for domestic consumption than it is for export-dependent businesses. As such, our preference for core long-term holdings in insurance, healthcare, software and select consumer sub-sectors in China remains unchanged.

Positive on India and Indonesia

In India, the Modi government's renewed and strengthened mandate for the next five years and the government's demonstrated willingness to push through major reforms present an opportunity to fix a number of persistent issues in the areas of capital, labour and infrastructure that have hamstrung India's ability to realise its full potential. Lacklustre growth in India resulting from a clogged financial system sets a low bar. However, valuations at least partially reflect a rebound in economic prospects, making the risk-reward trade-off less attractive in large pockets of the market. Thus, we remain invested in strong private sector Indian banks, which should benefit from any uptick in growth, real estate developers, and selectively in the consumer space.

The tech-heavy markets of Taiwan and South Korea have not made for happy hunting grounds. However, recent optimistic commentaries from tech industry leaders, the potential bottoming of memory prices and attractive valuations, coupled with high cashflow yields, warrant a cautiously optimistic view. We remain invested in stocks that are leaders in niche sectors that are relatively insulated from weak domestic trends, such as healthcare and electric vehicle technology.

In ASEAN, our preference for Indonesia remains, mainly on account of the low hanging fruit that can be captured by the Jokowi government on the back of a renewed mandate. As with India, a genuine upward shift in the economic growth trajectory in Indonesia will require major reforms. However, we believe a near-term cyclical rebound off a low base is likely.

Appendix

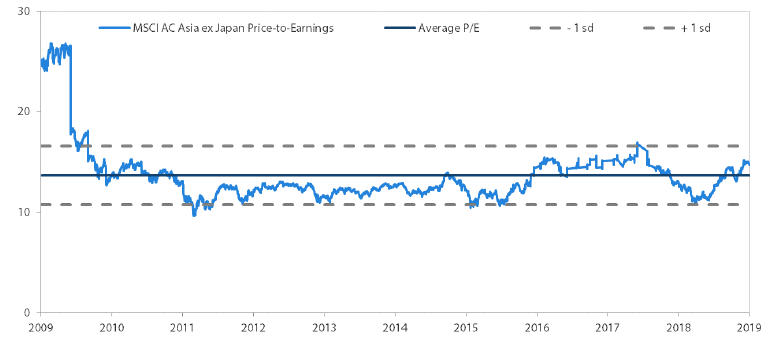

MSCI AC Asia ex Japan Price-to-Earnings

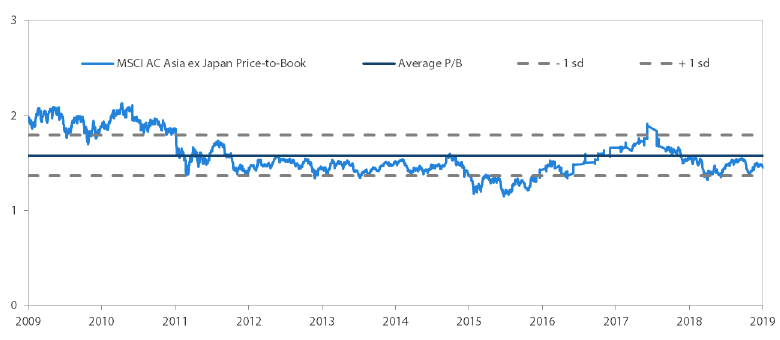

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 July 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.