Summary

- In July, solid US economic data caused markets to pare back expectations on the depth of expected Federal Reserve (Fed) rate cuts, which consequently pushed US Treasury (UST) yields higher. However, the Fed's communications remained dovish, capping the rise in yields. At month-end, the US Fed lowered the Fed funds rate by 25 basis points (bps) while the European Central Bank (ECB) suggested that a rate cut could be on the horizon. Overall, 2-year and 10-year yields ended the month at 1.87% and 2.02% respectively, about 12bps and 0.9bps higher compared to end-June respectively.

- Asian credits registered returns of 0.58% in July, with gains coming from tighter credit spreads as UST yields rose. Both high-grade and high-yield credits were up 0.58% each on a total-return basis, with high-grade spreads tightening 7bps and high-yield spreads contracting 2bps.

- Within the region, inflationary pressures mostly moderated. The headline Consumer Price Index (CPI) inflation prints in the Philippines, Indonesia, Singapore and Thailand dropped in June. Separately, the monetary authorities in Indonesia and Korea lowered their policy rates while the Indian government announced a fiscally prudent budget for Fiscal Year (FY) 2020.

- In China, the National Development and Reform Commission (NDRC) tightened rules for offshore bond issuance by property developers. Premier Li Keqiang declared that China is seeking to create an equal playing field for all companies, and announced new plans to open up the domestic financial industry.

- It was another month of heavy primary issuance. There were 33 new issues amounting to USD 17.6 billion in the high-grade space, while the high-yield space saw 41 new issues amounting to USD 14.3 billion.

- For Asian local currency bonds, we maintain our preference for mid to high carry bonds with room to further ease monetary policy in the near-term. Bank Indonesia (BI) has started its monetary policy easing cycle and has hinted that there is further room to unwind a series of hikes. Similarly, we view central banks in India and the Philippines to have room to further cut interest rates. On currencies, we are cautious on the Singapore Dollar (SGD) and Korean Won (KRW).

- As for Asian credit, we expect modest widening in Asian credit spreads in the near-term. We also expect the major central banks to maintain or strengthen their dovish lean, which will provide some offset to the negative development on the trade front.

Asian Rates and FX

Market Review

The US Fed lowered its policy rate by 25bps

Solid US economic data which included a robust June jobs report, a stronger-than-expected 2Q19 GDP figure and a modest firming in inflation, caused markets to pare back expectations on the depth of expected Fed rate cuts. These were reasons that consequently pushed UST yields higher. However, the Fed's communications which included both the Fed Chairman Jerome Powell's semi-annual testimony to US Congress and minutes of the June's Federal Open Market Committee meeting remained dovish, capping the rise in yields. At month-end, the Fed lowered the Fed funds rate by 25bps, while the ECB suggested that a rate cut could be on the horizon. Overall, 2-year and 10-year yields ended the month at 1.87% and 2.02% respectively, about 12bps and 0.9bps higher compared to end-June respectively.

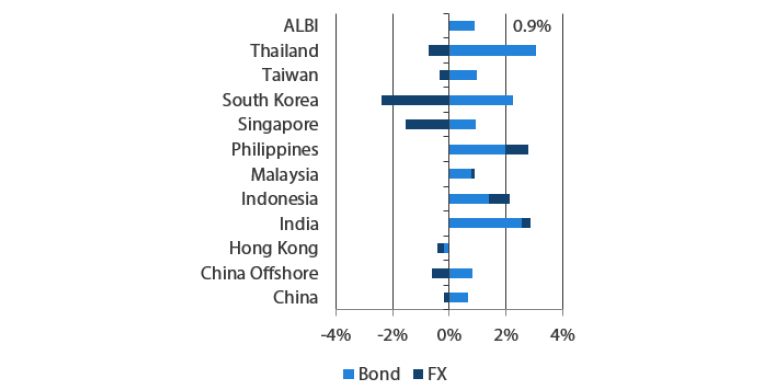

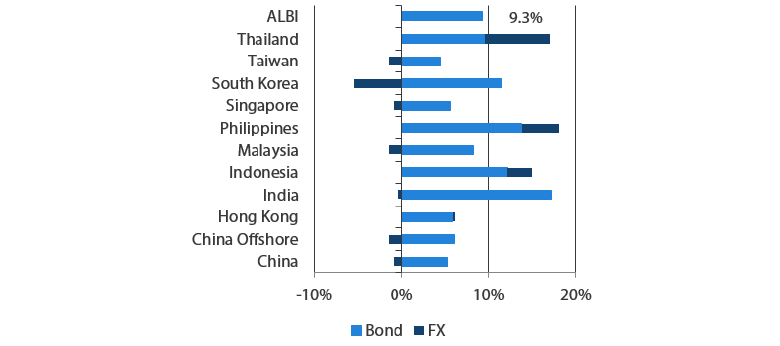

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 July 2019

For the year ending 31 July 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 July 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region mostly moderated

There was a drop in headline CPI inflation prints in the Philippines, Indonesia, Singapore and Thailand. Headline CPI in the Philippines moderated to 2.7% Year-on-Year (YoY) in June, from 3.2% in the previous month. The decline was relatively broad-based. Indonesia's annual inflation rate moderated in June as prices of goods and services returned to normal, following the end of the Muslim fasting month of Ramadan. The drop in Thailand's transport inflation offset a rise in food inflation, leading the headline CPI in Thailand to fall to 0.9% YoY in June, from 1.1% in May. Meanwhile, falling oil prices and certificate of entitlement premiums were the main drivers of the moderation in Singapore's headline CPI. Elsewhere, headline CPI inflation prints in South Korea and China remained unchanged from May levels.

Monetary authorities in Indonesia and Korea lowered their policy rates

BI began its easing cycle, lowering its policy rate by 25bps in the month. According to BI Governor Perry Warjiyo, the move was taken amid low inflation and the need to boost domestic growth, noting that external pressures have eased. Notably, Mr. Warjiyo added that there continues to be room for further monetary policy easing. Elsewhere, Bank of Korea (BoK) also announced a 25bps rate cut, and lowered its 2019 GDP growth expectation to 2.2% (from 2.5%), and full-year inflation forecast to 0.7% (from 1.1%). BoK Governor Lee's comments following the move were decidedly dovish. He cited the country's friction with Japan as one of the factors in the downgraded growth forecast, and noted that 'the need to support economic recovery has become bigger.'

Indian government announced a fiscally prudent budget for FY 2020

Finance Minister Nirmala Sitharaman positively surprised markets in her first Union Budget, as she announced a lower fiscal deficit of 3.3% (from 3.4%) of GDP. According to the minister, taxes on housing and smaller companies will be lowered, while taxes on the rich will be raised and import tariffs will be increased. The budget speech also focused on increasing infrastructure spending, with the government intending to increase private participation. A capital infusion of INR 700 billion into selected state banks and credit guarantees to support shadow lenders was also announced. In addition, the finance minister also said that the government will look to ease restrictions on foreign businesses in the retail, insurance, media and aviation industries. Notably, Ms. Sitharaman declared that part of the budget deficit will be financed by the issuance of the country's first overseas sovereign bond, which consequently sparked a rally in Indian government bonds.

China tightened selected offshore bond issuance; announced plans to further open its domestic market

Premier Li Keqiang declared that China is seeking to create an equal playing field for all companies, and announced new plans to open up the domestic financial industry. According to the State Council Financial Stability and Development Commission, among other things, the restriction on foreign ownership of life insurance companies, brokerage firms, futures brokers and fund managers will be lifted from 2020, one year ahead of the original timeline. Separately, the NDRC tightened rules for offshore bond issuance by property developers. New bond issues from Chinese real estate companies will only be permitted if proceeds are to be used to refinance medium or long-term offshore debt maturing within the next year.

Market Outlook

Maintain preference for mid to high carry bonds

Our preference for mid to high carry bonds of countries with room to further ease monetary policy in the near-term remains. We highlight that BI has started its monetary policy easing cycle. BI Governor Perry Warjiyo has also hinted that there is further room to unwind a series of hikes in 2019, given that the Fed is slated to ease, inflation remains benign and the rupiah and current account balance are relatively stable. These factors, together with favourable technicals should provide good support for Indonesian bonds. Similarly, we view central banks in India and the Philippines to have room to further cut interest rates, as their inflation rates become well-entrenched within their respective targets.

Cautious on the SGD and KRW

On currencies, we hold cautious views on the SGD and KRW. The latest sentiment indicators for Singapore's manufacturing and electronics have indicated further contraction. This has caused renewed pressure on the SGDNEER and increased the risk that the Monetary Authority of Singapore may ease its FX policy. Singapore's externally-reliant economy might continue to suffer from trade pessimism. Moreover, close correlation to the euro and pound - which have been under pressure from a dovish ECB and uncertainties surrounding Brexit – would further dent sentiment towards the SGD. Similarly, underperformance of the KRW is likely to persist, on the back of worsening trade tensions between Korea and Japan, and continued weakness in the global trade environment.

Asian Credits

Market Review

Asian credits posted positive returns in July

Asian credits registered returns of 0.58% in July, with gains coming from tighter credit spreads as UST yields rose. Both high-grade and high-yield credits were up 0.58% each on a total-return basis, with high-grade spreads tightening 7bps and high-yield spreads contracting 2bps.

Positive risk sentiment, supported by strong US nonfarm payrolls and the US-China trade truce, pushed credit spreads tighter at the start of the month. Subsequent dovish rhetoric from US Fed officials sustained the spread compression. Although China’s second quarter GDP growth slipped to 6.2% YoY – the weakest in more than two decades - fears of a prolonged slowdown were tempered by rebounds in June’s activity growth, as well as money and credit numbers. Spreads crept higher mid-month, led by weakness in the high-yield space, on the back of idiosyncratic events related to Indonesian credits. However, high-grade spreads resumed tightening towards month-end, supported by optimistic expectations on both Fed easing and US-China trade negotiations. By country, continued fund inflows into emerging markets benefitted Indonesian sovereign and quasi-sovereign credits which outperformed, even as Indonesian high-yield were impacted by idiosyncratic events. Meanwhile, decent gains were also seen in Indian credits, partly prompted by the government declaring funding support for non-bank financial companies during the budget announcement, as well as a potential offshore Indian sovereign bond that could reprice Indian high-grade credits.

Another month of heavy primary issuance

Issuance volume continued to be heavy in July. There were 33 new issues amounting to USD 17.6 billion in the high-grade space, including a two-tranche USD 1.5 billion issue from Pt Pertamina (Persero) and a two-tranche USD 1.4 billion issue from Perusahaan Listrik Negara. Both issues are Indonesian quasi-sovereigns. Meanwhile, the high-yield space saw 41 new issues amounting to USD 14.3 billion.

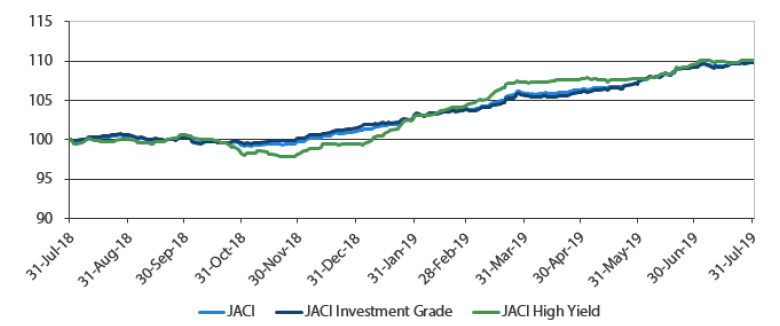

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 July 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 July 2019

Market Outlook

Expect further monetary easing which will partially offset the negative development on trade; modest widening in spreads likely in the near-term

In another twist to the trade negotiations between the US and China, US President Trump announced on 1 August, the imposition of 10% tariffs on roughly USD 300 billion of Chinese imports into the US, effective from 1 September 2019. While we had been of the view that a final resolution to the trade conflict remains uncertain and unlikely to materialise in the near-term, this particular move was largely unexpected by the market, and is clearly negative for risk sentiment. However, with this escalation in the trade conflict, coupled with continued softness in global manufacturing sentiment, the major central banks are likely to maintain or strengthen their dovish lean. The expectation of further monetary easing will provide some offset to the negative development on the trade front, although overall we are still expecting a modest widening in Asian credit spreads in the near-term, especially as valuations have turned less attractive.