With complexity, opportunity?

Banking regulations in the European Union (EU) have become very complex given the high number of stakeholders involved, with the European Parliament and the European Commission pushing from one direction and national parliaments and regulators from the other. However, mastering this complexity can be quite profitable for investors. In particular, our credit research has uncovered attractive investment opportunities by focusing on bank requirements around minimum total loss absorbing capacity (TLAC) standards.

Since the start of 2019, global systematically important banks, or ‘G-SIBs’, have been required to comply with TLAC standards. The requirement was issued in 2015 by the Financial Stability Board and aims to ensure that G-SIBs will have sufficient loss-absorbing and recapitalisation capacity. For European banks, the Bank Recovery and Resolution Directive (BRRD) set out a separate but similar regulatory concept to define the minimum requirement for capital reserves and eligible liabilities (MREL), which not only covers G-SIBs, but any bank in Europe.

In June 2019, the EU Commission integrated TLAC into the European bank regulation and then subsequently combined it with MREL in its recent release of the Banking reform package. The package revised the BRRD as well as the Single Resolution Mechanism, the Capital Requirements Regulation and the Capital Requirement Directive. This new legislative package is designed to reduce risk in the European banking sector and reinforce the ability of banks to withstand shocks. EU countries now have two years to integrate the package into local law.

According to the changes, TLAC will become a Pillar 1 requirement for European G-SIBs. Banks currently have to cover 16% of total risk weighted assets and 6% of unweighted assets with equity capital in line with international peers. This requirement will go up to 18% of weighted and 6.75% of unweighted assets by 2022.

In contrast, European financial institutions that are not G-SIBs are not required to meet specific ratios under MREL, but instead have to comply with Pillar 2 requirements, which are determined on a case-by-case basis. The regulator can also apply Pillar 2 add-ons to G-SIBs when necessary. Pillar 2 requirements are defined by the national regulatory authorities. For all Eurozone banks, these requirements are determined by the Single Resolution Board.

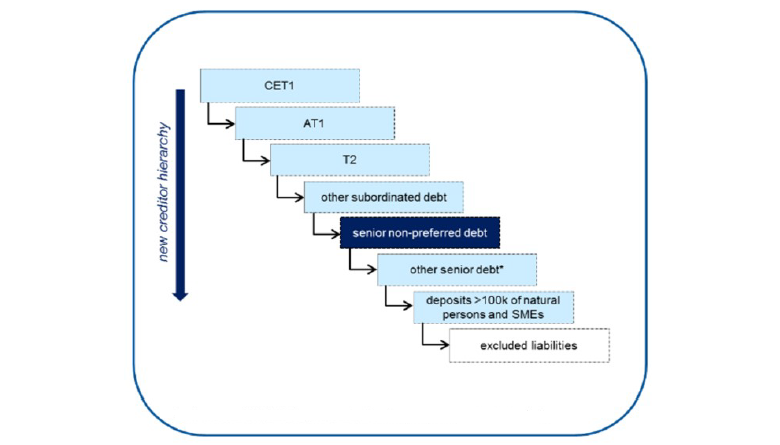

Figure 1: Bail-in hierarchy

*senior unsecured debt, derivatives, unsecured banks and large corporate deposits,structured notes

Source: Prometeia

In order to comply with capital needs under TLAC and MREL rules, a new asset class (senior non-preferred bonds) was created and integrated into local laws across Europe. Traditionally banks have funded themselves through deposits, covered bonds, senior bonds and T2 as well as Additional Tier 1 bonds. While deposits up to EUR 100,000 and covered bonds aren’t available to fund a bail-in, Additional Tier 1 bonds are first in line to get written down or converted into equity (Figure 1 above). The other layers of capital fall somewhere in between these two poles. In particular, the write down of senior unsecured bonds had often been a political issue when these bonds were sold to retail investors. With the introduction of TLAC/MREL, senior unsecured bonds were split into two asset classes: senior preferred and senior non-preferred. The senior non-preferred bonds are either statutorily (EU-Approach) or structurally (only applied by UK and Irish Banks) subordinated to senior preferred bonds and can, according to MiFID II (Markets in Financial Instruments Directive), only be sold to qualified investors, with retail investors restricted from the asset class.

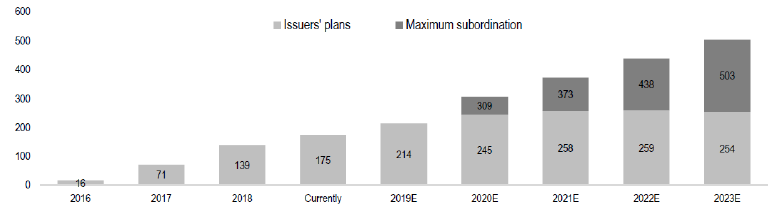

However, to some extent, European banks can use senior preferred bonds to fulfil capital requirements, but only up to 2.5% of Risk-Weighted-Assets (RWA), with a planned increase to 3.5% of RWA from 1 January 2022. The majority of capital requirement needs are met through senior non-preferred bonds which has driven a recent surge in issuance and, according to JP Morgan (Figure 2), more is expected to enter the market over the coming months. Often these bonds come with an attractive spread over risk-free assets. The spread always depends on various parameters such as the bank’s fundamentals and its home country, and the maturity of a bond.

Figure 2: Senior Non-Preferred debt issuance in EUR billions

Source: JP Morgan

Investors considering senior non-preferred bonds compare the spread to that of outstanding senior preferred bonds and the give-up vs. an investment in Tier 2 bonds, which are higher up in the bail-in hierarchy and therefore carry higher risk. Usually the senior non-preferred bonds trade at a premium of between 25-40bps over preferred senior bonds while Tier 2 bonds offer 60-100bps more than senior non-preferred.

By incorporating the above parameters and setting them in context with the spreads on offer, investors decide the issuer and the instrument (senior non-preferred or Tier 2). In addition, the investor’s individual risk budget will also play a role in the final decision. Tier 2 bonds come with a higher premium over senior preferred and non-preferred but often also with higher volatility and sometimes extension risk that is related to an imbedded call option.

The banking sector’s fundamental tailwind

Investments in bank capital can be very profitable but very complex, thereby requiring a solid understanding of bank regulation, country risk analysis and bottom-up credit research, combined with a clear view on the acceptable level of volatility. We believe that after a decade of improving fundamentals, the banking sector has created attractive investment opportunities, in particular for senior non-preferred bonds. We also believe that banks in general are sufficiently capitalised, not inclined to increase leverage, and better shielded from the global trade war than many non-financial companies.

Senior non-preferred bonds offer a yield advantage over senior preferred bonds, while not materially altering the portfolio risk profile. They therefore represent an ideal investment to optimize the risk/return profile of a strategy in a low yield environment.