More often than not, external conditions overwhelm internal fundamentals as the key driver of emerging market (EM) asset prices. At the moment, easing external conditions are forming tailwinds for EM. The wildcard this time is the on-again, off-again trade war that is now shifting supply chains, the consequences of which will remain regardless of whether a trade deal gets done.

The key change this quarter is that developed market (DM) central banks around the world, including the US Federal Reserve (Fed), either have or are preparing to ease, with rates collapsing to new lows not seen since the deflationary scare of 2016. On one hand, this development might reflect an impending global recession, but we see it more as an unusual turn in central bank policy in the face of otherwise okay growth.

Central banks are reacting earlier than prior cycles would have predicted, even though the recent slowdown looks similar to the one in 2015, when the Fed was biding its time to continue the tightening cycle that it is now firmly backtracking on. Yes, the introduction of trade wars changes the economic balance and relative risks, but steady adjustments to China’s stimulus seem to be doing the job intended.

Meanwhile, the shift in monetary policy gives latitude to EM central banks to ease on the back of weak inflation pressure. What’s more, central bank liquidity, which had been relatively tight from the second half of 2018 into early 2019, is now returning. This is also adding to EM capital inflows in search of yield against an otherwise stable dollar.

The reconfiguration of supply chains creates winners and losers, such as China losing out on manufacturing exports while ASEAN is slated to fill the gap. But China’s stimulus aimed at supporting the private sector, including the consumer, creates new sectoral winners, both within China and across the region, that benefit from rising consumer demand.

As we have suggested for some time, sticking with quality still makes sense. It is true that the return of liquidity combined with the search for yield suggests interesting opportunities, such as in Turkey, where real yields are 4% above the cash rate even after a 4.25-point rate cut. Still, any shock to conditions remains a critical risk to such assets, and we believe there are better, far less risky opportunities elsewhere.

Despite this favourable backdrop, we are not abject bulls either. First and foremost, while we appreciate the tailwinds from DM easing, their shift is not without risks. It is unprecedented for the Fed to ease when unemployment is so low and economic growth is still reasonable. What could happen? We are not sure, but inflation, which is widely presumed to be dead, could eventually surprise to the upside.

We like gold mining stocks in South Africa, China and Peru to hedge such risks of inflation or policy mistakes. We also stick to quality and distinguish not just by geography but by sectors to determine where winners and losers may lie.

Asia consumer preferred over manufacturing

North Asian equities are mixed, as shifts in supply chains are now firmly entrenched and new trade spats keep emerging. Japan recently moved to limit technology hardware exports to South Korea, while the US placed a 400% duty on steel imports from Vietnam using materials from South Korea and Taiwan.

China manufacturing is suffering from low investment due to trade war uncertainty. Nevertheless, we still like China consumer-oriented stocks which benefit from easing targeted at the private sector and consumers. A-share inclusion in the MSCI index is still a positive as the rate of inclusion is set to steadily increase.

India equities were upgraded given President Narendra Modi’s strong mandate in recent elections to continue his reform efforts. Less positive was the announced budget that showed a more hawkish stance than markets were expecting, leading equities to sell off. However, over the long term, the move is positive as evidenced by the decline in bond yields, even though economic growth may be more subdued in the coming quarters.

Indonesia and the Philippines were upgraded among ASEAN countries as inflation concerns ebb and investment flows stabilise, while the Fed’s rate cut opens the path to easing at home.

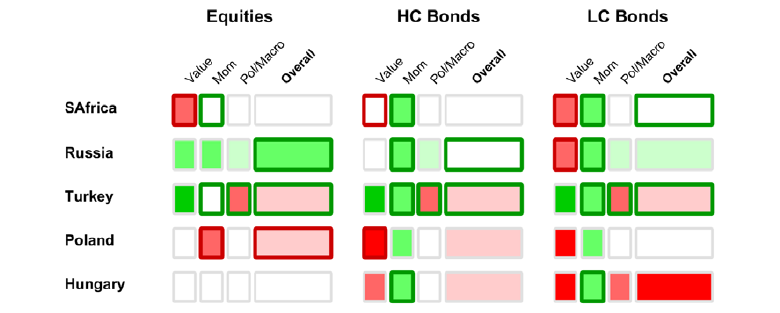

Asset class scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

China staying the course on sustainable growth

After US President Donald Trump called the trade war back on in an early May tweet, China might have been forgiven for upscaling its stimulus effort. However, the government remains fixated on stimulating private sector growth, which it believes is a better outlet for sustainable, quality growth than yet another round of credit-financed infrastructure spending, where productivity gains are more questionable.

It was widely reported that China realised its ’slowest growth since 1992‘ in 2Q19. This is numerically correct, but it misses the point that growth was expected to slow given the size of the Chinese economy and near-term headwinds from last year’s tightening and trade wars. Trade wars have certainly had an impact on manufacturing as investment has pulled back considerably, but ’the new China economy‘, in the form of consumption, remains healthy and is gathering pace.

Earnings recovered in 1Q19 (net profits were up 11% year-on-year) helping to support employment. About 90% of job creation is from the private sector, where fiscal easing has remained focused through tax cuts and incentivised bank lending. The auto sector appears to have bottomed and, although retail spending is still relatively weak, ecommerce continues to take off; revenues for the latter have seen a compound annual growth rate of 41% between 2013 and 2017.

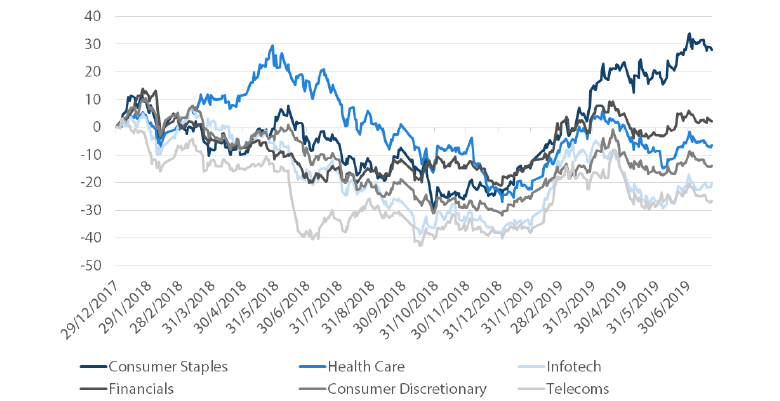

Not surprisingly, stimulus focused on the private sector and consumption has driven a divergence in equity sector performance. As shown in Chart 1, consumer stocks are up nearly 30% versus the rest of the market, which is flat to down since the end of 2017.

Chart 1: China A-Share (CSI 300) Sector Performance

Source: Bloomberg, July 2019

Markets tremored in late May when the People’s Bank of China took over Baoshang Bank, which implied the removal of the implicit government guarantee of China banks. Baoshang is a large regional bank, and, while the event might have led to contagion, targeted interventions helped restore confidence, allowing credit to flow to the real economy.

China is not without significant risks as it navigates the challenges of deleveraging while keeping growth intact amid manufacturing headwinds due to trade wars. However, the combination of steady policy adjustments and ongoing reforms is painting an increasingly positive backdrop for long-term sustainability.

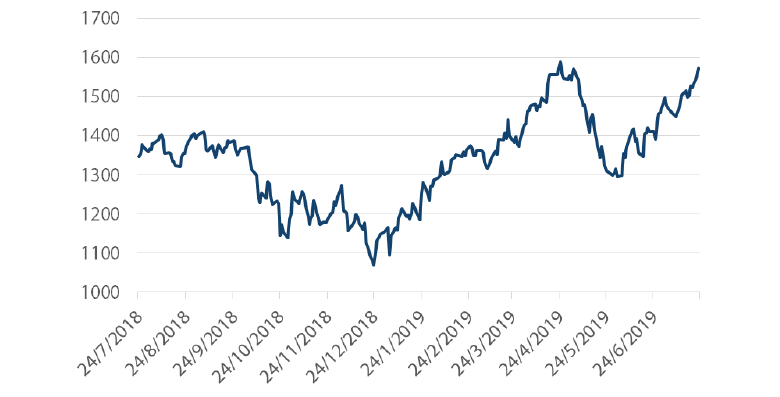

Semiconductor respite, but still vulnerable to new trade disputes

The technology hardware sector, in particular semiconductors, had been recovering nicely from the 2018 downturn up until early May. However the return of the trade war, including a US export ban on Huawei, caused semiconductors to drawdown more than 18% during the month.

From early June, losses were subsequently reversed with the first indications of a potential trade truce that ultimately came to fruition at the G20 Summit held in Osaka, where the US agreed to ease export restrictions on Huawei.

Chart 2: Philadelphia Semiconductor Index

Source: Bloomberg, July 2019

On the demand side, electronics have generally suffered, but the growth fundamentals underlying cloud computing and the Internet of Things (IoT) remain intact. That said, winners and losers are less easy to decipher amid the trade spats that continue to emerge.

So far, Taiwan (including TMSC) has fared quite well. Conversely, South Korea faces new headwinds from Japan, which announced exports restrictions on its semiconductors and OLED materials effective 4 July. We prefer smaller semiconductor companies under the radar of higher-level trade disputes.

EMEA tailwind from external easing

While not much has improved in the EMEA region, including Turkey and South Africa, the collapse in yields and the stable dollar has resulted in risk appetite in the search for yield. Turkey was upgraded to neutral-negative, given the steep decline in inflation that has allowed for central bank easing, though we remain highly cautious given the continued imbalances and rising political risks.

Russia equities were upgraded on account of improving valuations. Its market is one of the strongest performers across EM year-to-date as earnings have continued to deliver, keeping valuations attractive. While economic growth remains tepid, external macro fundamentals are the strongest across EM with a budget surplus reaching 3%—the highest in 10 years—and a current account surplus of 6.9%. Meanwhile, the consumer price index (CPI) declined to 4.7% in June, allowing the easing cycle to begin.

Eastern Europe is benefiting from easing inflation and impending rate cuts from the European Central Bank, reducing some of the risk of overheating we have been noting for some time.

Asset class scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

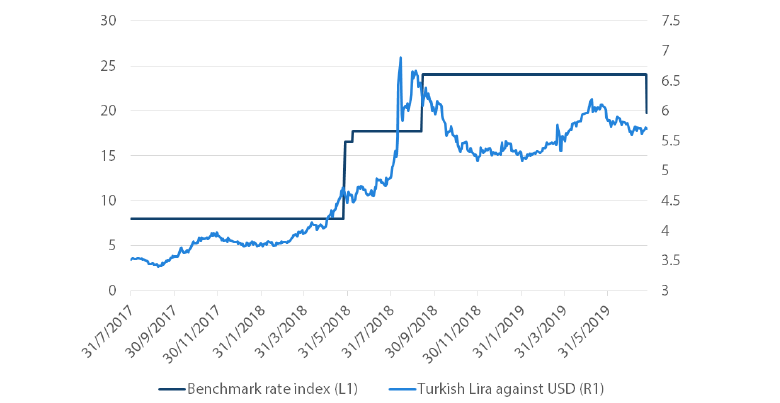

Turkey saved by better liquidity, for now

President Tayyip Erdogan fired Central Bank Governor Murat Cetinkaya in early July as he would not cut rates to his satisfaction. In reaction to the firing, Fitch downgraded Turkey’s investment rating to “BB-.” New Governor Murat Uysal promptly cut rates by 4.25 points, from 24% to 19.75% on July 25, a significantly larger cut than what was anticipated under the prior governor.

Typically, the overt loss of central bank independence coupled with a downgrade would not be well-received by markets—especially in the case of Erdogan, who holds the unconventional belief that rate cuts (rather than hikes) are the best tool to fight inflation. However, as evidenced by the Turkish lira’s rally from a USD/TRY of over 6 to 5.7 since Cetinkaya’s removal, markets are apparently willing to be patient.

Chart 3: Turkey Interest Rate and Lira

Source: Bloomberg, July 2019

Patience is partly justified by the sharp decline in inflation, where CPI has fallen from a peak of 25.24% back in October 2018 to 15.72% in June, still leaving real rates at a chunky 4%. Given the return of risk appetite and the crash in rates, it is perhaps not surprising that markets are willing to overlook political risks for now in order to pick up an otherwise attractive yield.

We remain wary of chasing yields in Turkey as political risks abound, and not just from changes at the central bank. In July, Turkey received the first shipments of Russia’s S-400 missile system. While this threatens its NATO standing and is likely to trigger sanctions by the US, a meeting between Presidents Trump and Erdogan at the G20 Summit in Osaka seems to have forestalled this outcome, at least for the moment.

The Istanbul mayoral election redo on 23 June brought a crushing defeat to Erdogan and his AKP party. Not long after, former Deputy Prime Minister Ali Babacan resigned from the AKP and is likely to start a new opposition party. President Erdogan is slowly losing his grip on power, but one can be sure that he will do what he can either to regain support and/or crush the opposition.

Boosting the economy is often a go-to mechanism for boosting support, but with a slipping fiscal position and still-large external imbalances, Erdogan’s chosen policies could eventually prove to be the tipping point to a more dire macro scenario. The rising probability of such an event simply keeps risks too skewed to the downside.

South African gold miners

Macro and political stability always matter for supporting sound investment decisions, but attractive valuations coupled with conducive external macro developments can also reveal interesting opportunities, such as is the case for gold miners in South Africa.

Gold miners are notoriously volatile. They are partly affected by local fundamentals, including mining strikes and, in the case of South Africa, an ailing power infrastructure. However, the price of gold is ultimately the principal driver of gold miner prices.

Gold prices broke above USD 1350 per ounce and then quickly reached USD 1400 for the first time since 2012, which is a significant tailwind for gold mining stocks. Gold miners have actually strongly outperformed the broader market since the summer of 2018.

Chart 4: South Africa broad market equities versus goldminers

Source: Bloomberg, July 2019

The drivers of the gold price are difficult to distinguish but they generally include global real rates, geopolitical risk and central bank policy—all of which seem supportive at the moment.

Beginning in the summer of 2018, geopolitical risks rose on the back of a combination of trade wars, rising tensions in the Middle East and balance of payment shocks in Turkey and Argentina. In 2019, the collapse in real rates coupled with a policy shift to global easing has lent further support.

We have long said that experimental monetary policies, including negative rates and quantitative easing, will be difficult to unwind, and that is proving to be the case. As central bankers have returned to debasing their currencies with more of the same, gold and gold miner equities are simply a good hedge against policy risks and mistakes.

LatAm mixed

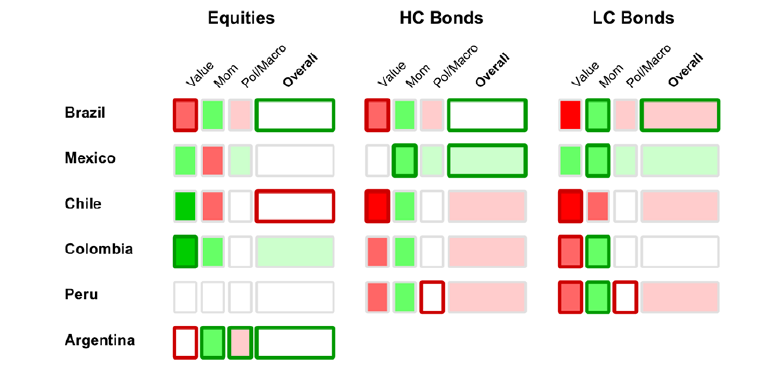

Positive developments in the region include Brazil moving to the final stages of pension reform. On the other hand, Mexico is losing credibility on downgrades of state oil company PEMEX, as well as less-than credible fiscal plans.

We believe risks in Mexico are overdone, given the still-low levels of debt against hawkish rates of 8.25%, with June CPI only at 3.95%, down from 4.28% in May. Growth is weak, but unlike Brazil, which remains on the fiscal edge, Mexico’s finances have a great deal of room to deteriorate before justifying this large risk premium.

Brazil assets were upgraded as a function of the meaningful progress on pension reform that looks set to pass with significant fiscal savings. Chile equities were downgraded on the back of slower growth and weak copper prices.

In Argentina, it is election time. Even though Moody’s recently downgraded its outlook on the country to negative, the election outcome is what will define the future movement of asset prices.

Asset class scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Brazil tackling pension reform

We have remained sceptical about whether meaningful pension reform would make it through the legislative process, but when the lower house approved by a large margin in early July a bill with substantial cuts, the outlook became clearly more positive.

A second vote by the lower house has been delayed until August, but indications are that it will pass and meet the approval of the senate without any significant amendments. This is a firm positive for the country to help put government finances back on a sustainable path. Meanwhile, reform efforts that began with the resignation of President Dilma Rousseff in the spring of 2016 continue to make headway.

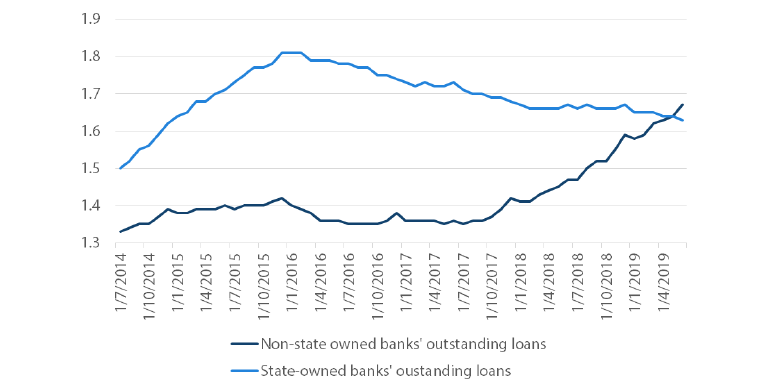

The massive Lava Jato probe has helped tackle corruption on many different levels, including the use of state-owned banks to engage in it at the expense of squeezing out the private sector. In another milestone, the wind down of these corrupt funding channels has allowed non-state owned bank loans to surpass state-owned bank loans for the first time in 2Q19, which is critical for improving productivity.

Chart 5: Brazil loans held by state-owned versus non-state owned banks

Source: Bloomberg, July 2019

Brazil still has far to go before it will reap the full benefits of its reform agenda, but momentum remains positive. The principal risk is the return of tight global financial conditions, which for the moment remain benign. Brazil has absorbed several shocks since 2016, and so far the reform agenda has managed to endure.

Argentina election hope

President Mauricio Macri has seen positive momentum in the polls, which is positive for the upcoming primaries on August 11. Inflation remains high with CPI running at 2.7% month-on-month in June. But the central bank has stayed hawkish, keeping rates at 58.7% to retain confidence in the currency.

Nevertheless, risks remain high, as indicated by Moody’s shifting the country’s outlook in mid-July to negative, citing risks of “damaging currency shocks”. The currency has since slipped over 5%, but the results from the primaries will be the critical determinant of the trajectory moving forward.