Global Outlook

Trade tensions with China continues to dominate global risk sentiment, with a further escalation of tariffs in August. On 1 August President Trump announced a 10% tariff on an additional USD 300 billion of Chinese imports, directly impacting consumer goods such as electronics and toys. China’s subsequent retaliation on USD 75 billion of US imports, including a 5% tariff on oil, was met with counter-retaliation from Trump of a further 5% tariff on top of all existing and proposed tariffs. Meanwhile, while the US Federal Reserve (Fed) has tended to push pack against the aggressive easing demanded by Trump, at the Jackson Hole symposium Fed Chair Jerome Powell indicated that the escalating trade uncertainty warranted further easing. However, Powell also warned of the limitations of monetary easing, drawing further ire from President Trump. All the talk of easing is despite signs of relative stability in domestic economic data. Though employment has shown some signs of weakness of late, job gains remain well above recessionary levels. Furthermore, financial conditions have helped foster a nascent recovery in the housing sector, as there has been a notable surge in mortgage applications of late. With a 25bp rate cut having materialized in September, further cuts will be dependent on any prospect of progress in trade negotiations, which is looking uncertain at this stage. At the same time, however, sentiment has because excessively gloomy, with the inversion of the US yield curve heightening fears of recession. We still believe that recessionary concerns in the US are overblown as the yield curve, though concerning, owes much of its flatness to global factors, such as quantitative easing from international central banks.

On the economic front, the latest set of data suggests that activity within the Eurozone remains very subdued. The ongoing China-US trade tensions, the more recently increased risk of no-deal Brexit, and protracted protests in Hong Kong also continued to add headwinds to the global economy, in turn weighing on the Euro area manufacturing sector. The weakness in the sector was confirmed by the latest manufacturing PMI data, which, despite coming slightly above expectations (47.0 versus 46.2 in August) remain stuck firmly in contractor territory. Industrial production also disappointed, with June output of -1.6%, resulting in an annual figure of -2.6%. Services continue to be a bright spot, with the latest PMI index coming at a solid 53.4. On the inflationary front, the final July measure of headline inflation came in below the consensus figure of 1% (-0.5% m/m), with the core measure also subdued at 0.9% y/y. Given the ongoing weakening of economic activity and the very weak pace of inflation across the Eurozone, the ECB, as widely expected, delivered a 10bps cut to the deposit rate facility (-40bps) during its September meeting. The bank also announced further details on the future size and shape of its asset purchase programme. The expectation of further monetary accommodation by the ECB, had led the rates market to price in over 30bps of additional policy easing in the coming year.

On the political front, following months of political wrangling, Italian Prime Minister Giuseppe Conte, handed in his resignation, effectively collapsing the feeble collation between the far-right Northern League and the anti-establishment Five Star Movement. This followed pressure from Northern League leader Matteo Salvini, who, after seeing a rise in his party’s popularity, had called the coalition government unworkable. This gamble subsequently backfired, however, as the left-wing populist Five Star Movement tentatively agreed to what was previously thought to be an unlikely coalition with the more centrist, and EU-friendly, Democratic Party.

Brexit negotiations have also failed to yield any progress, with new UK Prime Minister Boris Johnson insisting on a change to the Northern Ireland backstop arrangements, which the EU is unwilling to amend. Furthermore, Boris Johnson also revealed plans to suspend parliament in late September, which was interpreted by many as a ploy to prevent the passage of any legislation that would block a no-deal Brexit.

In Australia, economic data remained generally weak, although there are some early indications the housing market is beginning to stabilise. Inflation also remains subdued, despite the Q2 consumer price index coming in at an above-consensus pace of 1.6%. The latest labour market report also surprised to the upside, with over 40,000 jobs added in July. This was driven mainly by a strong growth in full time employment. The unemployment rate was affirmed at 5.2%, with a largely flat participation rate. During its scheduled meeting earlier in the month, the RBA decided to its keep policy rate at 1%, following two consecutive interest rate cuts. More cuts are still expected, particularly if external demand and domestic consumption continue to disappoint.

In New Zealand, recent data showed a mixed picture. The labour market continued to tighten amid solid employment growth, leading to a sharp drop in the rate of unemployed persons (3.9%) and a marked pick-up in wage growth. Inflation expectations, however, continued to ease, with 2-year expectations dropping to 1.86%, marking lows last seen in late 2016. The deteriorating external environment and a lack of inflationary pressure led the RBNZ to lower the interest rate by a larger-than-expected margin of 50bps, hence taking the policy rate down to 1%.

Following a couple of years of solid growth in Norway, spare capacity has gradually diminished. Domestic economic activity has, at least until recently, been supported by external demand, resilient oil prices and low domestic interest rates. More recently, however, a weakening external environment has seen an easing of economic activity, with June Industrial Production declining 8.6% y/y, yet the overall pace of growth remaining close to potential. A gradual reduction in spare capacity has also seen a build-up of inflationary pressures, with the latest underlying CPI coming in at an-above target pace of 2.2%. Following the June interest rate hike, the Norges Bank, in line with expectations, decided to keep the policy rate unchanged at 1.25%. Given the strength of the domestic economy, further policy rate hikes cannot be completely ruled out at this stage, though external developments are likely to dampen expectations for the foreseeable future.

In Canada, the protracted global trade conflicts continued to put pressure on the domestic economy, as trade restrictions introduced by China, in retaliation to US tariffs, are having a direct impact on Canadian exports. Positively, however, the removal of steel and aluminium tariffs and rising prospects of USMCA ratification are likely to boost the country’s exports and investment, partially offsetting the negative effects of the US-China trade war. As such, the Bank of Canada sounded confident that the slowdown in late 2018 and early 2019 was temporary and a pick-up in economic activity should be expected. The strength of the labour market also suggests that businesses perceive the recent weakness as transient. The tight labour market conditions continued to lead to higher remunerations, with the average hourly wage rate for permanent workers growing a notable 4.5% y/y in July. Domestic prices also remained well supported, with the latest measures of core inflation all coming in at or above market expectations, and, in general, slightly above the central bank’s 2% target. Despite the economy returning to potential, the persistent trade tension continues to cloud the outlook for both inflation and economic activity. This led the BoC to ascertain that the degree of accommodation provided by the current policy rate remains appropriate.

The general expectation for emerging markets at the start of the year was that the major central banks were likely to continue to tighten liquidity through rate hikes and/or balance sheet reduction. However, the situation now looks materially different given the increasingly dovish turn by the Fed and the ECB. We see these developments as continued positives for emerging market bonds, particularly those that are supported by sound fundamentals, as they will continue to receive welcome support from international investors. The moderate growth slowdown of developed economies also makes growth in emerging economies look more attractive on a relative basis. Furthermore, the slowdown in China, which has fed its way through the emerging world, is already well accounted for. However, we have to consider the rising possibility of a prolonged trade war, after tensions escalated significantly in August, with tariffs now in place on the majority of US imports from China. However, at the same time, China is utilising a number of stimulus measures to help offset the impact of tariffs. Despite the recent sell-off, and hence improved currency valuations, given the escalating trade rhetoric, we feel that near-term caution is warranted; nevertheless the medium-term outlook remains compelling.

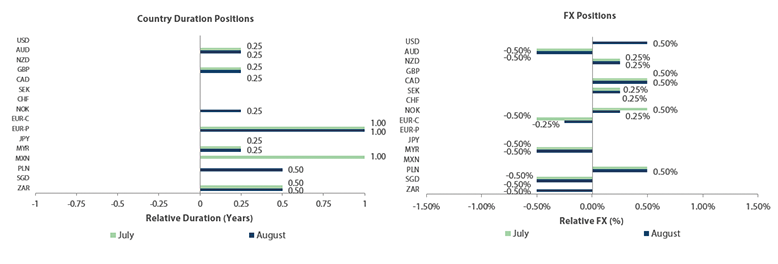

Developed Markets Positioning

The investment team remained steadfast in its duration and dollar positioning for its August IP meeting. With Trump and China at the forefront driving duration risk, the team noted China's likely desire to wait out the trade war to see if they have a more favorable negotiating counterparty, while Trump has incentive to keep the issue outstanding for his reelection campaign. The team noted the difficulty in predicting US-China political flareups, but do foresee elevated political risk going forward. In terms of dollar positioning, the team reduced its neutral weighting from the previous month to an overweight position on relative interest rate trends in developed countries; despite lower rates in the US, it's worse elsewhere.

The team moved to remain neutral on Sterling while taking a slight duration position given the relative level of interest rates with that of the Eurozone. The team noted the ongoing event risk surrounding the 31 October deadline and deadlock in parliament.

In the Eurozone, the team remained neutral to underweight on core markets positioning, noting the extreme negative level of interest rates. However, due to the negative EUR-USD swap basis, European government debt still made some sense relative to dollar assets on a hedged basis. The team remained overweight on its periphery positioning given the constructive progress in Italian politics. In terms of the euro, the team remained underweight on expectations of a more dovish ECB and potential shock-and-awe monetary policy from Mario Draghi in his penultimate monetary policy meeting.

Regarding Scandinavia, the team made a notable change in its Norwegian Government positioning, moving towards a long duration bias on the view that the Norges Bank will be forced to turn dovish on slowing inflation and weaker oil prices in general. For the Norwegian krona, the team moved towards an RV play with that of the Eurozone given the continued local divergence in rates. For Sweden, the team remained in line with other core European markets in neutral positioning, while noting that the Riksbank will likely be forced to turn dovish by both slowing economic data locally and pressure from a more dovish ECB.

In Australia and New Zealand, the team continued to reduce positioning on growing central bank dovishness and ongoing risk from the trade war given both countries’ export exposure to China. While the team favours longer duration positioning given the easing cycle, it acknowledges the increased risk in both Australian and New Zealand dollars.

In terms of Canada, the team remained more constructive, given Canada's absolute level of interest rates, while noting the potential for diversification given the less dovish expectations from the Bank of Canada.

Emerging Markets Positioning

In emerging markets we remain constructive on duration overall, given the continued dovish rhetoric from the US Fed and ECB, with further rate cuts by the US Fed expected over the coming months and still-high real yields in many emerging local currency bonds. In FX, however, we remain cautious due to ongoing weakness in global growth, particularly in the export sector, and remain sceptical regarding a potential trade truce between the US and China, due to the structural nature of the issues at hand.

In FX we remain underweight the Malaysian ringgit and Singapore dollar as both economies are highly exposed to global trade with exports (particularly those in the electronics sector) under pressure due to weak external demand. We also reduced our exposure to South Africa given weaker expectations for mining exports as a result of slowing Chinese investment spending. We also took into consideration the lingering threat of a ratings outlook downgrade by Moody’s at its upcoming November review, which would leave the country on the verge of junk. Meanwhile, we remain overweight Poland as we believe that the central bank will buck the global trend of monetary easing, and will therefore retain an attractive interest rate differential relative to the euro.

In rates, we have removed our overweight in Mexico as valuations are no longer cheap; over 100bps of interest rate cuts are now expected despite core inflation measures staying stubbornly above the central bank’s 3% target rate. However, we retain a long duration position in South Africa, and to a lesser extent, lower-yielding Malaysia, where real yields are still significant. We also added a long duration position in Poland as, despite higher domestic inflation, we expected rates to converge to those in core Europe as the expected announcement of a second round of QE by the ECB will stoke regional demand for positive yielding assets.

Global Credit

As seen in previous months, fundamentals in Europe have remained weak. Manufacturing PMI figures continue to fall with anticipation of the US-China trade war being felt in Europe. However, we would note that services remain strong. From a technical perspective, there has been strong flows in European IG and HY credit in recent months, mostly deriving from the strong performance of the asset classes in 2019. Valuation has cheapened recently, but remains on the costly side and is not particularly attractive at the moment. In terms of an investment theme to monitor closely, the ECB announced it would cut its deposit rate from minus 0.4 per cent to a new record-low of minus 0.5 per cent. It also said it would restart its quantitative easing (QE) programme, buying EUR 20 billion of bonds every month from November until inflation expectations came “sufficiently close to, but below, 2 per cent”, at which point interest rates could also start rising again. The impact of this announcement and the future policy of the ECB will be important to European credit as Draghi steps down from his position.

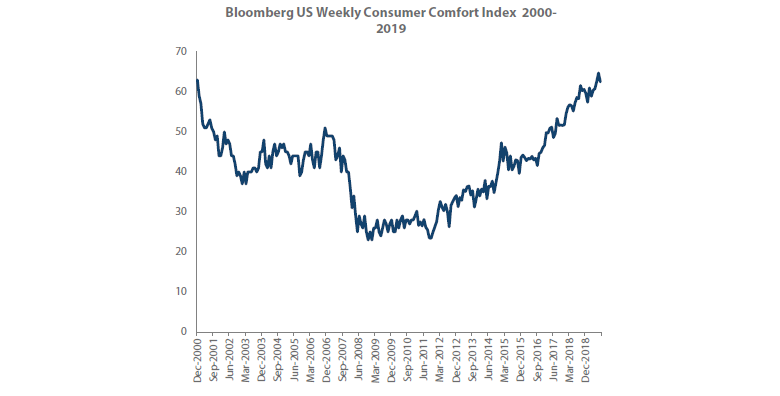

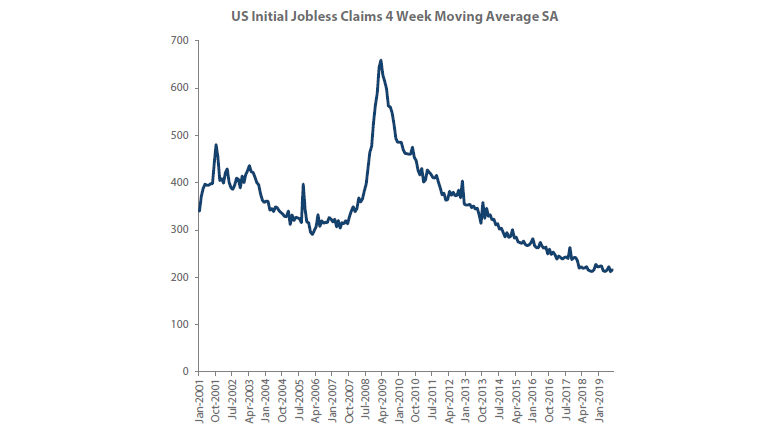

Looking at the US, we have seen similar macro signs in Europe, with a reduction in manufacturing and political risk starting to rise amid the continued trade war, the start of presidential primaries, and the president’s comments on central bank policy all seen as a negative. US consumer indicators remain strong, with jobless claims also falling. Therefore, despite the somewhat large headlines, we still have an optimistic view of the US economy.

Figure 1 – Bloomberg US Weekly Consumer Comfort Index

Source: Bloomberg, as at 31 August 2019.

Figure 2 – US Initial Jobless Claims

Source: Bloomberg, as at 31 August 2019.

Continuing in the US on the micro side, default rates have marginally ticked upward, with the majority of that coming from the energy sector. We would argue that going into next year that this figure should decline. Elsewhere, leverage has started to tick up with non-financial leverage approaching 2.0x and earnings for 1H2019 in line with expectations, although growth has flattened. Regarding technicals, there have been strong YTD flows in IG and HY. There is continued supply, but in large corporations there is a focus on deleveraging, and in some HY names, the amount outstanding continues to decline. Lastly, in valuation overall, we see it as a negative, spreads are below average and break-evens are also below the mean. In the current environment, we would look to purchase high quality auto names in the “A” space front end, and we would argue corporate hybrids are still a compelling trade opportunity.

In Asia from a macro perspective, there has been a small uptick from our last observations, which were fairly negative. We have seen recent CNY weakness and USD strength, which is a negative for Asia FX and credit. Stocks and balance of payments are currently negative given that sentiment is weighed down by trade tensions. We expect US-China trade talks to continue in October, where we may see a change in fortune. Consumer confidence is broadly stable but could turn negative given the recent backdrop. In terms of the politics, protests in Hong Kong continue to be a concern, and escalating tensions between Korea and Japan are something to monitor closely. For the current micro situation, H1 2019 earnings growth remain decent across most sectors, including Chinese HY. We expect some moderation in earnings growth in 2H 2019, but not an earnings recession in Asia. IG leverage is broadly stable, however, HY debt levels remain high for Chinese property despite resilient earnings. Default rates in high yield are likely to remain elevated in the 2% to 3% range. In technicals, supply in IG lifted early in the month after a very quiet August. HY supply may moderate, especially in China Real Estate. In terms of flows, EM hard currency inflows have remained robust. Regional flow has remained strong, but it’s worth monitoring in light of recent developments. Lastly, valuation is still relatively flat where IG spreads are still close to historical average, but yields are approaching all-time lows. Spreads in HY have widened to slightly above historical average, whilst yields are also at a historical average. Overall we are less cautious on Asia after the widening in August, but are still looking for better levels to add back risk.

In Australia, from a macro perspective the economy is still quite resilient, but the outlook is less compelling despite there being some improvement in sentiment and improvement in the Sydney and Melbourne housing markets. Despite low unemployment (5.3% with a generally improving participation rate), the RBA cut rates by 25bps in each of May and June to spur the economy to ‘kick-start’ inflation (stuck below the 2% target).The Australian dollar is being pressured down to lower levels, as currency and trade wars come to the fore and expectations building for further RBA rate cuts. From a micro perspective, despite a slightly negative tone in some sectors, reporting season has not suggested any major concerns. Australian corporates remain reasonably leveraged compared to their overseas counterparts. However, their healthiness will remain untested unless interest rates rise or the economy declines severely. For technicals, a broad array of borrowers have come to the market and been well-received. Recent activity has been dominated by financials, both local and offshore issuers, and supply has met market demand. In terms of valuation, cash and synthetic credit spreads have tightened this year, although August saw some widening. Volatility has risen. Whilst current spreads provide some protection against widening, a sustained risk-off could cause substantial under-performance.

In LATAM, there was a widening of spreads in August, part of a sell-off in Argentina due to surprising primary election results. We currently favour Brazil and Mexico consumer names, specifically names that are leveraged to the US. In the Middle East, there has been a new energy minister appointed in Saudi Arabia, which could affect oil. On the whole, valuation is more attractive both from global and domestic names, and we remain confident that LATAM can benefit from a continued dovish Fed.

Lastly in Japan, the main points to consider are new issuance and an increase in net supply given a fall in issuer costs. Demand has been positive for spread, while valuation is also widening given the quality of credit. Current investment themes are JPY hybrid bonds and life insurers.