According to IATA, the airline industry body based in Geneva, global airfreight volumes fell by 3.4% in the year to May and, although the decline in the aggregate data continued to be led by weakness amongst the Asian & Middle East carriers, it was also very apparent that the US air-freight data has lost virtually all of its previous momentum, something that is perhaps the more significant revelation within this particular data set.

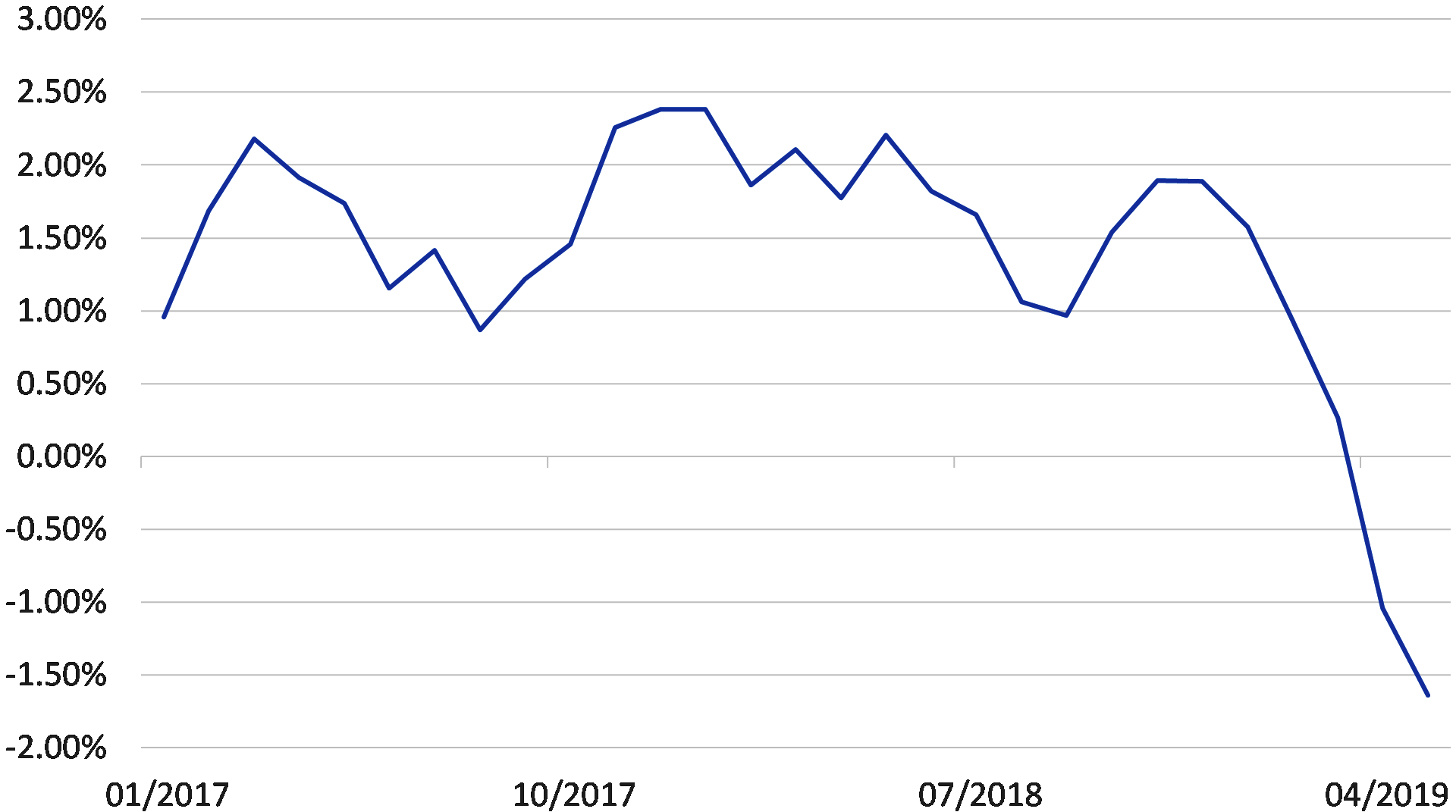

Indeed, we must confess that even we (who at the start of the year had in any case a very weak and non-consensus outlook for US growth in the middle part of the year) have been somewhat taken aback by the weakness that has been emerging within much of the US shipments and transport sector in general over the last two – three months. When we last visited the USA (only a month ago) it was clear that the economy was decelerating but the acute weakness that is now visible within the latest shipments plus unfilled orders data has come as a surprise even to us.

USA: Total Shipments + Unfilled Orders %3 months, 3mma

At a micro level, we note that the Port of Long Beach has just reported a 14% decline in inbound container traffic and a similarly weak rate of outbound traffic. Also of note within the Long Beach data is that the number of empty containers in the Port has hit an all-time high – eclipsing even that witnessed during the GFC. Elsewhere, there have been a number of articles in the various trade journals concerning a significant downturn in the volume of freight being carried by trucks in the USA since the first quarter. Indeed, some of the trucking sector commentary has referred to there having been a near ‘bloodbath’ in the industry (particularly it seems within the NE of the country) and it does seem that freight rates have fallen very sharply indeed since last year. In addition, we note that the volume of heavy truck inventories has become very high as sales growth in the sector has evaporated.

The decline in the US domestic freight data is clearly a very worrying sign, particularly given the recent increase in inventories that has been recorded in the macro data. It does indeed appear that the USA economy has joined the global slowdown and that the financial markets are right to assume multiple rate cuts over the remainder of the year. However, whether rate cuts will prove to be the panacea for the economy that the markets are anticipating will remain to be seen.

Elsewhere amongst our favoured global indicators, we find that our own weighted measure of Global Industrial Production deteriorated further as the second quarter ended. Indeed, the three-month rate of change in the data has been firmly in negative territory since October last year, thereby confirming the existence of a ‘technical recession’ in the global industrial sector. Another of our data ‘chores’ this week has been to update our measure of dollar denominated global GDP. This data also suggests that the Global Economy is now in a recession when GDP is measured in current dollars (which for our purposes we believe is how it should be measured – we do after all invest in current dollars not imaginary PPP or chain-weighted dollars).

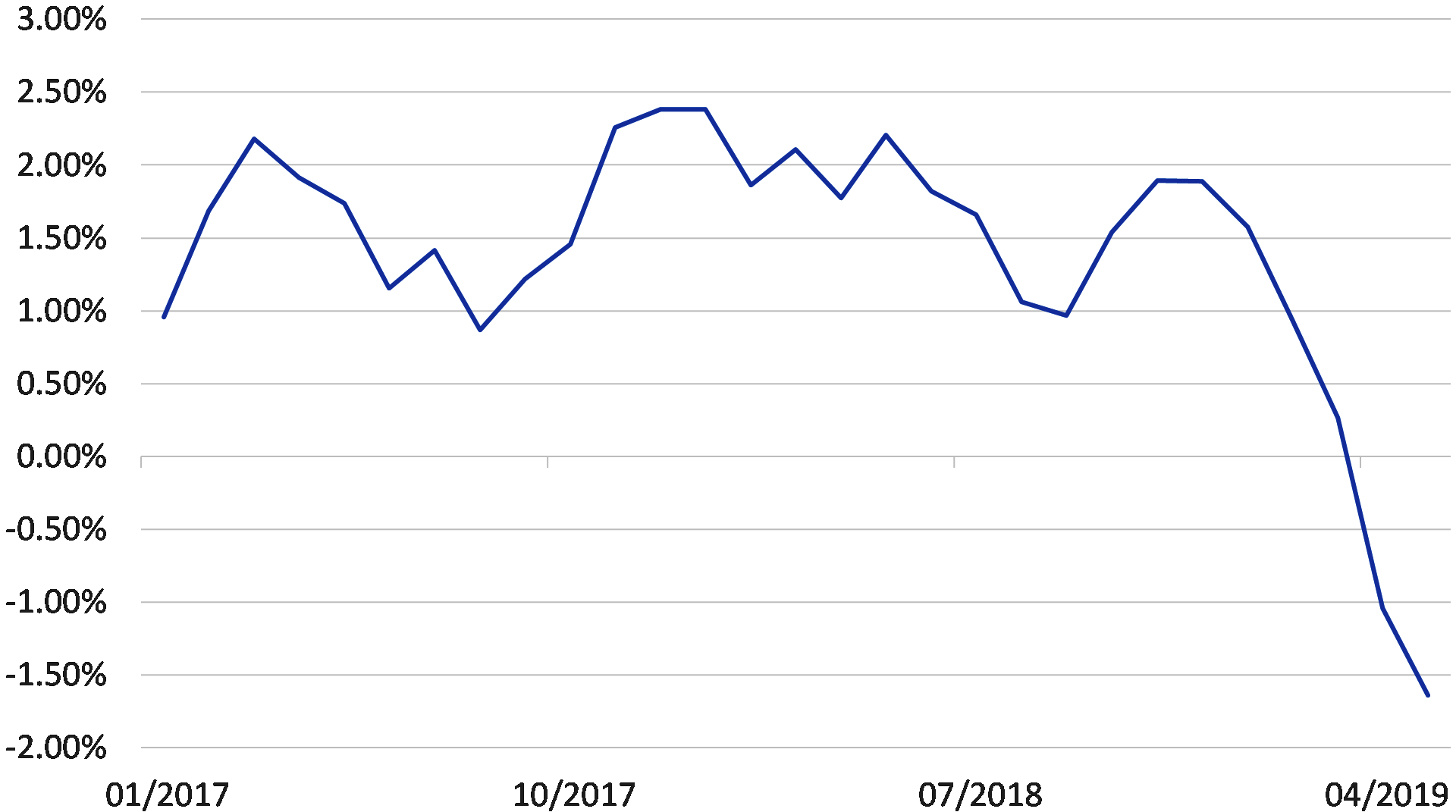

Global Nominal GDP % YoY in current USD at current FX Rates

The weakness in dollar denominated GDP is likely to be significant for a number of reasons. Firstly, it is noticeable that headline GDP (= total incomes, i.e. wages & profits) is growing at a rate that is significantly weaker than the aggregate wage data. According to out estimates, global nominal GDP growth is currently zero in year-on-year terms, while the global wage bill has increased by 2% over the last year, thereby we can suggest that global profits in current dollars must therefore have declined by around 4-5% over the last 12 months, not that the equity markets seem to have cared so far…..

Given the weakness in the profit data, we can assume that, in the current corporate free cash flow obsessed world in which we now operate, companies will soon move to attempt to reduce their wage costs. Therefore, we can expect labour markets and wage incomes to come under pressure over the coming quarters, with the result that we can also expect the so far relatively resilient global consumer and service sectors to ‘join’ the economic slowdown. It would seem that the global slowdown has further to run and that this is far from a temporary pause in the global growth cycle.

Another important implication that we suspect will arise from the lack of nominal income growth within the global economy concerns debt sustainability in both the public and private sectors. The sensitivity of the public sector’s finances to weak nominal growth is already well documented and understood (Japan having already served as a working example…) and we can assume that those countries with high existing public sector debt burdens will feel some discomfort and pressure either to adopt austerity measures despite the weak growth environment, or to throw caution to the wind and attempt some MMT-type experiment of large monetized budget deficits. Interestingly, the latter may yet come to include the UK given recent political developments.

However, we suspect that it is subject of debt sustainability within the private sector that is the more likely to be of concern for financial markets in the months ahead. During the 2017 credit boom that preceded the economic slowdown, we estimate that the global private sector incurred a further $8 trillion in new bank credit and probably around $2-3 trillion in capital market debt, although the latter figure may well represent a significant understatement. It would be our further assertion that a relatively large proportion of the debt that was created was either directly dollar denominated (i.e. much of the debt securities issuance in the USA and EM) or ultimately funded from USD-based sources.

In fact, we suspect that many investors are still not aware of just how important wholesale dollar-based bank funding was to the global credit boom of 20017 and the obvious conclusion that follows from thus is, of course, that much of the world is now implicitly ‘short dollars’. In fact, in some countries (most notably China) this has already become a significant constraint on their systems and room for policy manoeuvre.

Certainly, if the world is in fact now fundamentally ‘short dollars’, then we can assume that the recent slowdown / contraction in dollar-denominated income growth will have been quite painful – or at least uncomfortable - for those debtors that have previously incurred large dollar liabilities.

Consequently, we are expecting credit spreads amongst the more vulnerable companies and countries to widen over the remainder of the year, even in the context of a world that still seems intent on chasing yield wherever possible. Moreover, we are also becoming concerned that the US may be attempting to amplify the ‘dollar shortage’ for reasons that are not centred on economics.

Trump and Triffin

The Triffin Paradox is a relatively well-known construct that was formalized during the 1950s that suggests that the supplier of the World’s Reserve currency has to grow its stock of external liabilities at a reasonable rate in order to facilitate global (trade and economic) growth. In short, it can be argued that the provider of the Global Reserve Currency has, if not a duty, then potentially a requirement to supply its currency to the World so that the latter can expand.

However, it is not clear how this international duty sits with the current administration. Indeed, not only are there whispers of the US regulators showing a less accommodating stance to lending by US institutions to certain parts of the World, there is also an increasing amount of evidence that the ‘supply of dollars’ to the world from the US is starting to become tighter. Primarily as a result of some loss of appetite amongst US investors to venture abroad, it does seem that the US may now be running an underlying balance of payments surplus and we can certainly see that the notional supply of dollars to the World from the combination of the US current account deficit and US resident purchases of assets abroad has begun to look somewhat diminished.

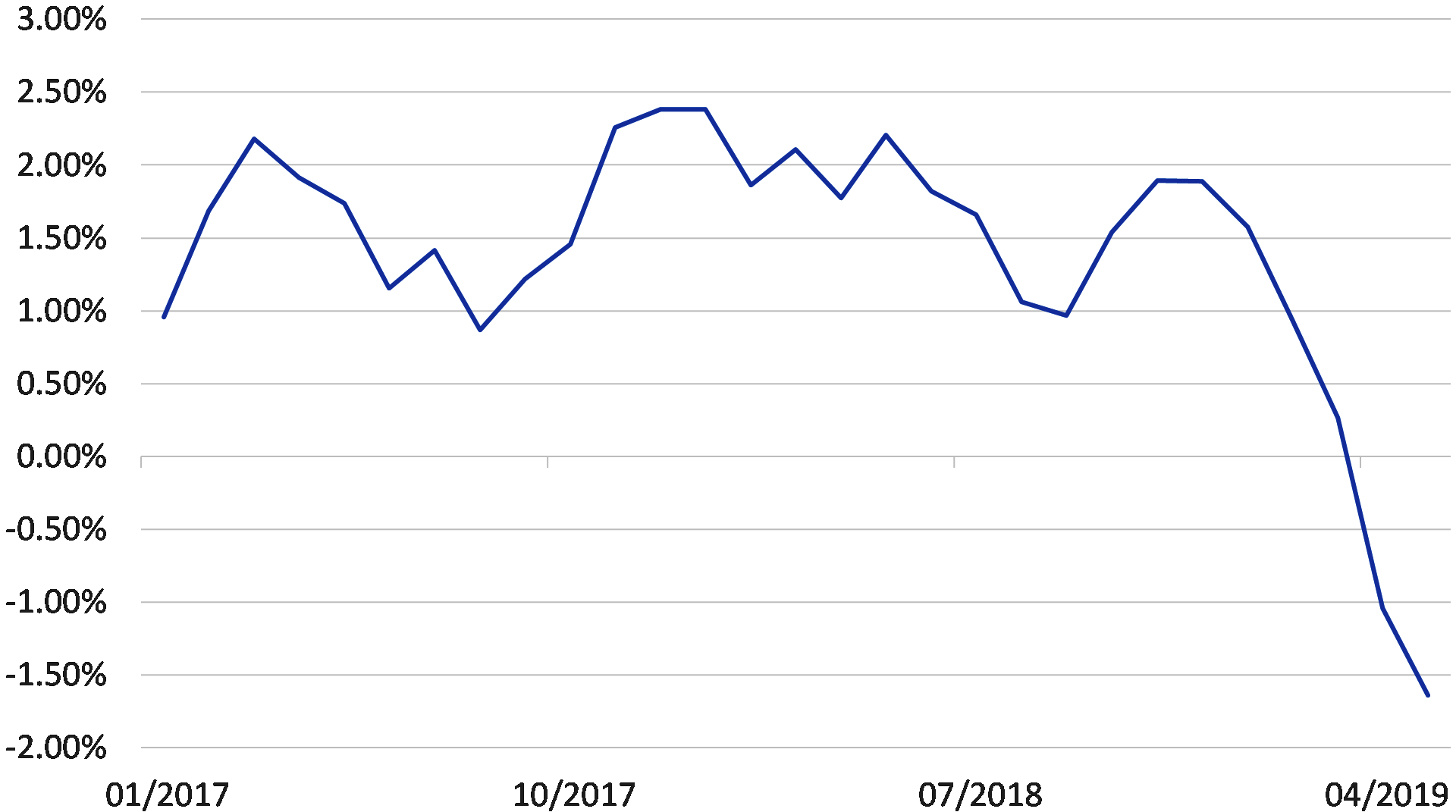

USD: Supply of Dollars to the World*

*US Current Account Deficit plus US acquisitions of foreign assets, USD billion 4QMA

In fact, we must wonder if the US Administration may be moving the ‘Trade War’ into the Capital Account (where the US has more power and hence more chance of achieving its geopolitical aims) and the data above seems to confirm that the World’s supplier of the Reserve Currency is indeed beginning to become less generous at a time when the rest of the World may already be quite short dollars and requiring of dollar liquidity. We are therefore minded to become medium term positive on the outlook for the dollar, even as the FOMC reduces interest rates.

In fact, we suspect that the ‘dollar shortage’ may become even more pressing later in the year as the Treasury starts to play ‘catch up’ with regard to its bond issuance. For much of this year, the Treasury has systematically under-issued bonds relative to the current budget deficit and instead it has relied on funding itself from its stock of existing cash reserves that are held at the Federal Reserve, As we witnessed in 2017 (when a similar event occurred), this activity tends to inflate the monetary base and it is certainly apparent that so far this year at least the US monetary base has enjoyed periods of growth and that the US commercial banking system has therefore been able to provide significantly more credit to the financial markets. We believe that it has been this ‘flow of funds factor’ that has allowed the equity market to perform well despite the weak earnings environment that we noted earlier.

However, if the Debt Ceiling and Budget Processes can be resolved over the coming weeks, we would anticipate that the Treasury Department will begin playing “catch up” with regard to its debt issuance and this will likely lead to a sharp contraction in liquidity growth of the type that was witnessed in April 2018 and early December 2018.

Clearly, such an event will make any ‘dollar shortage’ within the global system somewhat more acute and we suspect that even the hitherto Teflon domestic equity markets may be obliged to take notice of the weakening liquidity situation at that time, particularly in light of the poor corporate earnings backdrop that we described earlier. The closing months of 2019 may yet prove to be quite volatile.