Summary

- After a momentary truce, the US-China trade war flared up once again, triggering a 4.4% decline in the MSCI AC Asia ex Japan Index in USD terms in August, as the two nations hurled fresh tariffs at each other.

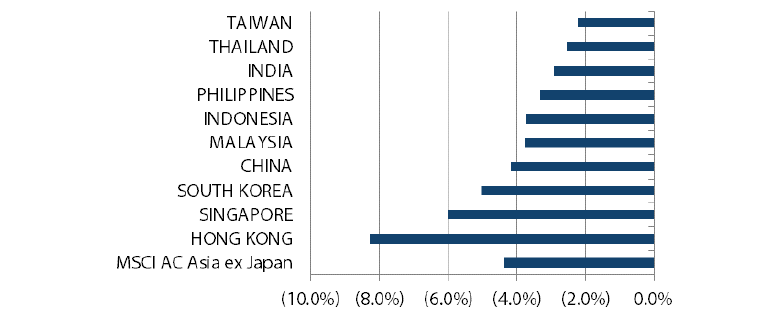

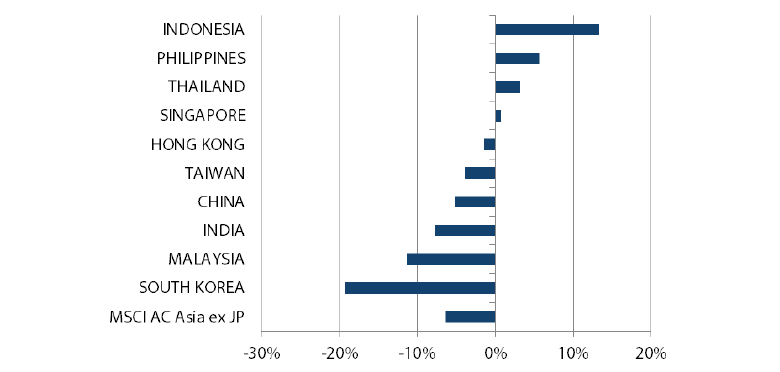

- All Asian markets ended the month in the red, with Hong Kong and Singapore the hardest hit. Hong Kong slumped over 8% in USD terms as large-scale street protests continued. Singapore fell by 6%, as the government cut its full-year GDP growth forecast range to 0-1%, compared to its previous projection of 1.5-2.5%.

- Taiwan was the most resilient, as losses were mitigated by the rebound in semiconductor stocks towards the month-end. Bucking the regional economic slowdown, Malaysia’s 2Q 2019 GDP grew faster than expected at 4.9% year-on-year.

- Despite the market downturn, there are some positive developments across Asia that are currently being overlooked. These include relatively inexpensive valuations, the bottoming of commodity-type technology components, as well as monetary and fiscal easing.

Asian Equity

Market Review

August weakness masks some incremental positives

Sentiment soured at the start of August after US President Donald Trump unexpectedly announced a fresh 10% tariff on USD 300 billion worth of Chinese imports from 1 September; he later postponed the tariffs on some of these imports to 15 December.

China hit back by allowing its currency to weaken to an 11-year low against the USD, while slapping new tariffs ranging from 5% to 10% on USD 75 billion worth of US goods in two batches, effective on 1 September and 15 December. Trump retaliated immediately by announcing a hike on all existing tariffs on Chinese goods from 25% to 30% on 1 October as well as the planned tariffs that are due to start on 1 September from 10% to 15%.

After weeks of selling, markets rebounded towards the end of August when Trump insisted that China 'wants to make a deal' on trade, while China's Vice Premier Liu He also called for a de-escalation in US-China trade tensions. Notwithstanding the late rally, all Asian markets ended the month in the red, with Hong Kong and Singapore the hardest hit, whereas Taiwan and Thailand were the most resilient.

Despite the market downturn, there are some positive developments across Asia that are currently being overlooked. These include relatively inexpensive valuations, the bottoming of commodity-type technology components, as well as monetary and fiscal easing.

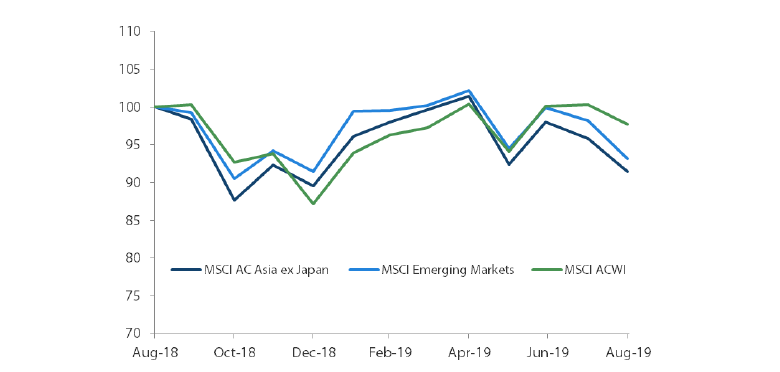

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 31 August 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

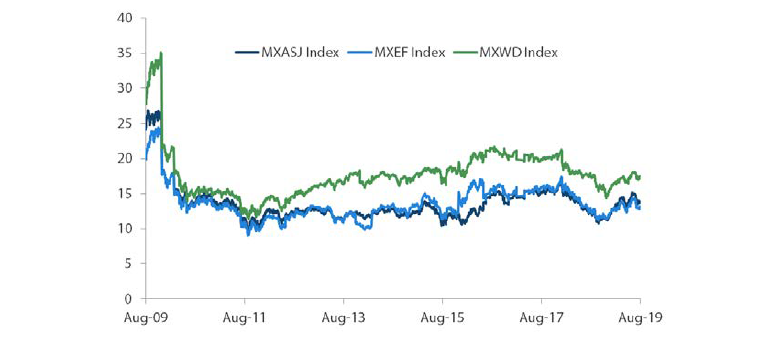

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index price-to-earnings

Source: Bloomberg, 31 August 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

Hong Kong hardest hit; Taiwan most resilient

Hong Kong was the worst performing Asian equity market in August, slumping 8.3% in USD terms as large-scale street protests continued. Amid the unrest, Hong Kong's government announced an economic support package worth HKD 19.1 billion as the escalating political crisis in the city-state and the prolonged US-China trade war weighed heavily on its economy.

Elsewhere, South Korea fell 5% in USD terms as trade tensions with Japan worsened. The market was also weighed down by index heavyweight Samsung Electronics, which underperformed in August after the country's Supreme Court ordered a retrial of Samsung heir Lee Jae-yong, who had been acquitted of corruption charges.

In China, the government unveiled a series of measures to boost consumer spending. Still, Chinese stocks fell 4.2% in USD terms as the escalating US-China trade conflict and a RMB slump dented sentiment. Elsewhere in North Asia, Taiwan (-2.2% in USD terms) was relatively resilient in August, as losses were mitigated by the rebound in semiconductor stocks towards the month end.

India fell on rupee weakness; Singapore declined the most in ASEAN

Indian stocks returned -2.9% in USD terms, largely on rupee weakness. India's 2Q 2019 GDP growth plunged to just 5% year-on-year (YoY), its lowest level in six years. During the month, the Indian government announced a slew of measures to boost sentiment and support the economy, including the rolling back of tax hikes on foreign and domestic equity investors, plus a series of mergers to combine six public sector banks with four of their better-performing counterparts.

Within the ASEAN region, Singapore was the month's worst performer, slumping 6% in USD terms. The Singapore government cut its full-year GDP growth forecast range to 0-1%, compared to its previous projection of 1.5-2.5%, on the back of a worsening global outlook. Malaysia, Indonesia and the Philippines turned in USD losses of over 3% in August, while Thailand (-2.5% in USD terms) fared slightly better. Bucking the regional economic slowdown, Malaysia's 2Q 2019 GDP grew faster than expected at 4.9% YoY, compared to 4.5% in 1Q19, boosted by solid domestic demand.

MSCI AC Asia ex Japan Index1

For the month ending 31 August 2019

Source: Bloomberg, 31 August 2019

For the period from 31 August 2018 to 31 August 2019

Source: Bloomberg, 31 August 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Positives in Asia being overlooked

While broader markets endured a tough month on the back of further trade war escalation, slowing economic growth rates and rising geopolitical risks, we would note that there are some positive developments across Asian markets which are currently being overlooked. These include relatively inexpensive valuations, the bottoming of commodity-type technology components, as well as monetary and fiscal easing.

With China still committed to its 'quality over quantity' metamorphosis and concomitant lower growth, we are unlikely to get the credit or fiscal impulse needed to revive global or even regional growth significantly. We continue to observe a more restrained China, committed to reforming widespread issues within its financial system and policy transmission channels. In this environment of lower but consistent growth rates, we continue to focus on areas of domestic structural growth and consolidation, namely healthcare, insurance, software and select consumer sub-sectors.

Interestingly, the Chinese A-share markets are still up more than 10% this year despite all the negative press regarding trade and economic slowdown. In this standout market, we now have access to the best quality companies in China, many of whom are benefiting from market consolidation and consumption trends.

Hong Kong remains a significant issue for authorities in both the special economic zone and mainland China. Anti-protester sentiment currently prevails in the mainland. With the 70th anniversary of the founding of the People's Republic of China due to take place on 1 October, Chinese authorities will undoubtedly hope that the unrest will have passed. We remain underweight, whilst maintaining select positions in regional insurance and capital markets.

Sanguine on India and Indonesia

In India, the Modi government's renewed and strengthened mandate for the next five years and the government's demonstrated willingness to push through major reforms present an opportunity to fix a number of persistent issues that have hamstrung India, keeping it from reaching its full potential. Such issues include the availability of adequate capital, labour reform and infrastructure development. Aggressive monetary easing has been complemented with some fiscal easing and efforts to reform the country's ailing public sector banks through accelerated recapitalisation and mergers. This may result in weaker growth in the near term given management focus on mergers instead of lending, but it should have a positive effect over the longer term. We remain invested in strong private sector banks, which should benefit from any uptick in growth. We also favour real estate developers and selective stocks in the consumer space.

The technology-heavy economies of Taiwan and Korea haven't made for happy hunting grounds. However, recent optimism from technology industry leaders, the potential bottoming of commodity-type technology components, and ongoing localisation efforts from China warrant a cautiously optimistic view in select beneficiaries. We continue to be invested in stocks that are leaders in niche sectors that are relatively insulated from weak domestic trends, such as healthcare, 5G components and electric vehicle technology.

In the ASEAN region, our preference for Indonesia remains, mainly on account of the low hanging fruit that can be captured on the back of the Jokowi government’s renewed mandate. Here we would also note the recommendations by local policymakers for fiscal support through corporate tax cuts. As with India, a genuine upward shift in the economic growth trajectory will require major reforms. However, we believe a relatively robust nominal growth rate of 8% and a moderate pick-up in activity make Indonesia look attractive relative to other markets.

Appendix

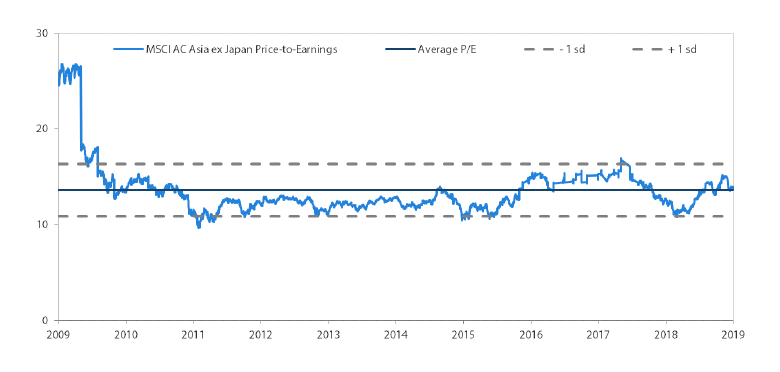

MSCI AC Asia ex Japan Price-to-Earnings

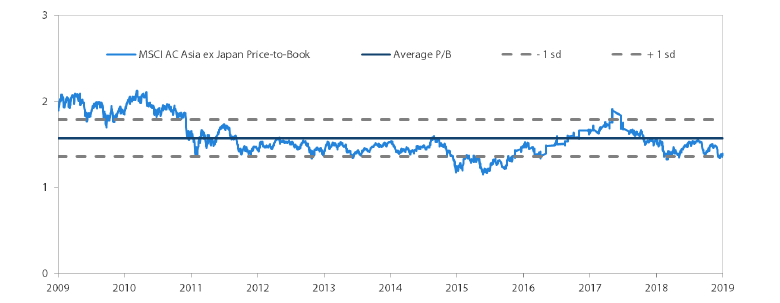

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 31 August 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.