Summary

- USTs rallied in August. The month opened to bearish markets, on the back of escalating US-China trade tensions and the depreciating Chinese yuan. Markets’ de-risking mood was sustained by the deepening US-China trade war and growing concerns of recession in major economies. At the Jackson Hole symposium, the US Federal Reserve (Fed) chairman said that trade wars have contributed to the global economic slowdown, but did not commit to more aggressive monetary easing. Overall, 2-year and 10-year yields ended the month at 1.51% and 1.50% respectively, about 37 basis points (bps) and 52bps lower compared to end-July.

- Asian credits registered returns of 1.48% in August. Gains were driven by lower UST yields as risk aversion prompted credit spreads to widen. In total returns, high-grade credits were up 2.22% while high-yield credits closed the month down 0.94%.

- Within the region, inflationary pressures were mixed. Headline Consumer Price Index (CPI) inflation prints rose in China, Indonesia and Thailand, and moderated in South Korea, Singapore and the Philippines. Economic activity in India, Indonesia, Philippines, and Thailand registered slower in Year on Year (YoY) terms in the second quarter of 2019 relative to the preceding three months. Meanwhile, central banks in Thailand, Indonesia, the Philippines and India lowered their policy rates.

- In China, the People's Bank of China (PBoC) launched the new Loan Prime Rate (LPR) on 20 August. Separately, India announced measures to improve liquidity and credit flow.

- It was a quiet month in the primary market. The high-grade space saw USD 6.25 billion of new issues during the month, while the high-yield space had 12 new issues amounting to USD 2.95 billion.

- For Asian local currency bonds, we maintain our preference for mid to high carry bonds with room to further ease monetary policy in the near term. Bank Indonesia (BI) has started its monetary policy easing cycle and has hinted that there is further room to unwind a series of hikes. Similarly, our view is that central banks in India and the Philippines have room to further cut interest rates. On currencies, we are cautious on the Singapore dollar (SGD) and Korean won (KRW).

- As for Asian credit, we expect modest widening in Asian credit spreads in the near term. We also expect the major central banks to maintain or strengthen their dovish lean, which will partially offset the negative development on the trade front.

Asian Rates and FX

Market Review

USTs rallied in August

The month opened with bearish general market sentiment, as US-China trade tensions further escalated after US President Donald Trump announced additional tariffs on Chinese imports to the US, and China's central bank allowed the yuan to breach the psychologically significant threshold of 7 against the dollar. Markets' de-risking mood was sustained as soft activity data from China, weak July business surveys from Germany and a contraction in the latter's second quarter GDP triggered renewed concerns about global growth. The US-China trade war was ratcheted up again towards month-end, as China unveiled a new round of retaliatory tariffs on imports from the US. Trump responded with higher rates on existing tariffs on Chinese goods. At the Fed’s Jackson Hole symposium in late August, US Fed Chairman Jerome Powell said that trade wars have contributed to the global economic slowdown, but did not commit to more aggressive monetary easing. Overall, 2-year and 10-year UST yields ended the month at 1.51% and 1.50% respectively, about 37bps and 52bps lower compared to end-July.

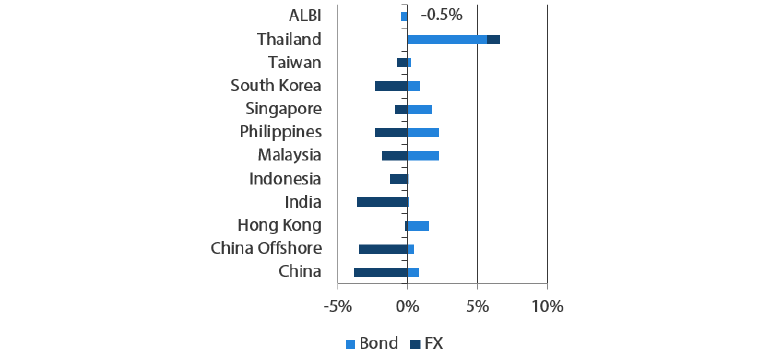

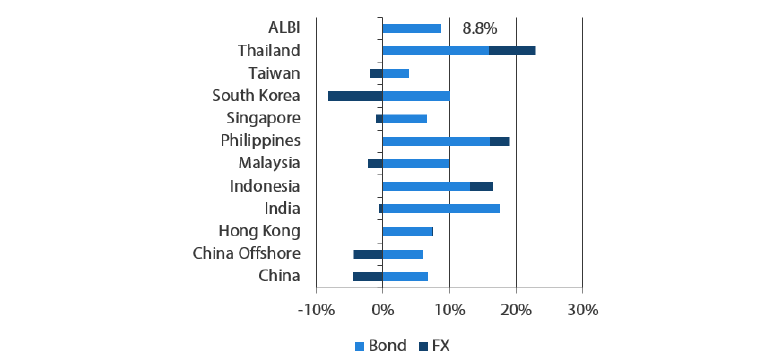

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 August 2019

For the year ending 31 August 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region registered mixed

Headline CPI inflation prints rose in China, Indonesia and Thailand, but moderated in South Korea, Singapore and the Philippines. Higher clothing and transport prices contributed to the acceleration in Indonesia's headline inflation print, while increases in fresh food prices were the main driver of headline CPI in Thailand. Nonetheless, at 0.98% YoY, inflation remains below the lower bound of the Bank of Thailand's (BoT) 1%-4% target. In the Philippines, inflationary pressures eased to a 31-month low in July due to a slower increase in food and non-alcoholic beverage prices, although most subsectors also posted slower price gains than previous months. Elsewhere, consumer prices in Singapore moderated to 0.4% YoY in July, prompted partly by lower electricity prices from the Open Electricity Market initiative.

Economic growth moderated in the second quarter

Economic activity in India, Indonesia, the Philippines, and Thailand registered slower in YoY terms in the second quarter of 2019 relative to the preceding three months. Indonesia's 5.05% YoY expansion was the slowest in two years, with growth in private and government consumption offsetting weak exports. Philippine GDP growth registered its slowest pace in four years, as government spending stalled with the delay in the passage of the national budget. In Thailand, growth slowed markedly to 2.3% YoY—its slowest pace in nearly five years—due in part to slower government spending and a contraction in exports. In contrast, second quarter GDP growth in Malaysia defied regional trends, accelerating to 4.9% YoY, thanks to a pick-up in private consumption growth. This was up slightly from 4.5% in the first three months of the year.

Central banks lowered their policy rates

The BoT lowered its policy rate by 25bps, and announced that it now expects annual average headline inflation to print below the lower bound of its target range. The bank also reiterated concerns about baht strength, which it said could have a greater effect on growth amid escalating trade tensions. BI also decided to cut rates by 25bps—a move which BI Governor Perry Warjiyo described as "pre-emptive"—to help sustain growth momentum in the face of a slowing global economy. In the Philippines, the central bank also delivered a 25-bps rate cut, citing a benign inflation outlook. Although the Bangko Sentral ng Pilipinas (BSP) expects the domestic economy to hold "firm", it highlighted some growth concerns as a result of escalating trade tensions. Elsewhere, the Reserve Bank of India (RBI) lowered its policy rate by an unconventional 35bps, and downgraded its GDP growth for next year to 6.9% (from 7.0%), noting risks are "somewhat tilted to the downside."

China revamped interest-rate mechanism; RBI announced transfer of surplus reserves to the government

On 20 August the PBoC launched the new LPR, which is benchmarked to the central bank's Medium-term Lending Facility rates and set according to real-world bank lending prices. Per the PBoC's directive, the LPR officially replaced benchmark lending rates as a reference for bank pricing of new loans, effectively providing the central bank the power to influence borrowing rates for these loans. Meanwhile, the RBI board announced that it will transfer to the government close to INR 1.8 trillion of surplus reserves during the current fiscal year, a much larger amount than what markets had expected. Separately, the Indian finance ministry announced targeted measures to revive economic growth which include accelerating the timeline for recapitalising banks and providing liquidity support for non-bank financial companies.

Market Outlook

Maintain preference for mid to high carry bonds

We maintain our preference for mid to high carry bonds of countries with room to further ease monetary policy in the near term. We highlight that BI has started its monetary policy easing cycle. BI Governor Warjiyo has also hinted there is further room in 2019 to unwind a series of hikes given that the Fed is slated to ease, that inflation remains benign and the rupiah and current account balance are relatively stable. These factors, together with favourable technicals, should provide solid support for Indonesian bonds. Similarly, we believe central banks in India and the Philippines have room to further cut interest rates. Prior to this month's move, BSP Governor Benjamin Diokno had telegraphed a 50bps cut before the end of the year. Meanwhile, benign inflation and the deceleration in GDP growth in India have raised chances of the central bank cutting interest rates further.

Cautious on the SGD and KRW

On currencies, we hold cautious views on the SGD and KRW. The recent forecasts published by the Monetary Authority of Singapore (MAS) downgraded both GDP growth and core inflation for 2019, causing renewed pressure on the SGDNEER and increasing the risk that the MAS may ease its FX policy. Singapore's externally-reliant economy might continue to suffer from trade pessimism. Moreover, close correlation to the euro and pound—which have been under pressure from a dovish European Central Bank and uncertainties surrounding Brexit—would further dent sentiment towards the SGD. At the same time, KRW underperformance is likely to persist on the back of worsening trade tension between Korea and Japan and continued weakness in the global trade environment.

Asian Credits

Market Review

Asian credits registered gains

Asian credits ended the month 1.48% higher. Gains were driven by lower UST yields as risk aversion prompted credit spreads to widen. In total returns, high-grade credits were up 2.22%, even as spreads widened by about 10bps, on the back of lower UST yields. High-yield credits closed the month down 0.94%, as weak market sentiment caused spreads to widen 60bps.

The month opened with bearish general market sentiment, as US-China trade tensions further escalated after US President Trump announced additional tariffs on Chinese imports to the US, and China’s central bank left the yuan to breach the psychologically significant threshold of 7 against the dollar. The widening trend in credit spreads continued as weak business surveys from Germany and soft activity data from China triggered renewed concerns about global growth. The protests in Hong Kong and idiosyncratic events in Argentina also kept market sentiment fragile. The US-China trade war was ratcheted up again towards month-end, as China unveiled a new round of retaliatory tariffs on imports from the US. Trump responded with higher rates on existing tariffs on Chinese goods. The deterioration on the trade front and in global macro data occurred amidst signs that members of the US Federal Open Market Committee (FOMC) are not unanimous in their views on the appropriate scale of additional monetary easing, thus depriving the market of a soothing factor for risk sentiment. By country, Indonesian, Indian and Philippine credit spreads widened, while Singaporean and Korean credits outperformed amidst the risk-off tone in August. The outperformance of Korean credits came amid the growing tension with Japan that threatens to broaden from trade-related issues. Meanwhile, hitherto resilient Hong Kong credits started showing cracks as the protests not only persisted, but also escalated during the month. China high-yield property developers reported generally decent 1H 2019 results, but their spread performance was affected by the risk-off sentiment in August.

A quiet month in the primary market

The bearish tone in markets, coupled with seasonality, caused issuance volume to plummet in August. The high-grade space saw USD 6.25 billion of new issues during the month, including the three-tranche USD 2.0 billion issue from Sinopec Group, while the high-yield space had 12 new issues amounting to USD 2.95 billion.

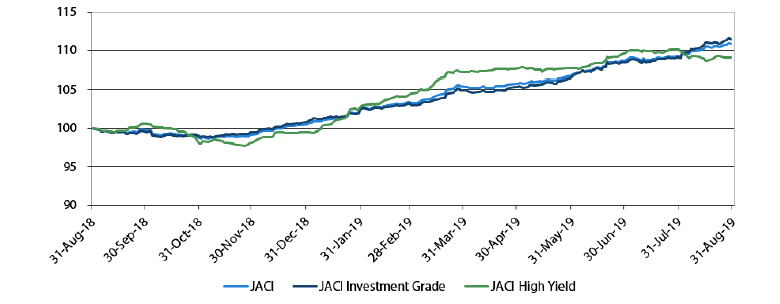

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 August 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 August 2019

Market Outlook

Expect further easing to partially offset negative trade developments; modest credit spread widening likely in the near term

While we had been of the view that a final resolution to the trade conflict between the US and China remains uncertain and unlikely to materialise in the near term, the move in early August by the US was still largely unexpected by the market and negative for risk sentiment. China announced its retaliation measures on 23 August, and the US immediately responded with further tariff increases. With this escalation in the trade conflict, coupled with continued softness in global macro data, the major central banks are likely to maintain or strengthen their dovish lean. Global rates have adjusted lower in response to the unexpected escalation in trade tensions and resulting risk-off sentiment, and are likely to remain around current levels unless both sides take a step back. That said, given the scale of adjustments in August, further downside in yields may be limited as many of the negatives have been priced in.

The expectation of further monetary easing will partially offset negative developments on the trade front, although overall we are still expecting a modest widening in credit spreads in the near term, especially as valuations remain less attractive. One upside risk to our view is if the Fed turns even more dovish than it already is. We will therefore be closely watching the signals coming from the FOMC meeting in mid-September. Within Asia, we are also closely monitoring developments in Hong Kong and Korea.