Global Equity Investment Philosophy

Our philosophy is centred on the search for ‘Future Quality’ in a company. Future Quality companies are those which will attain and sustain high returns on investment. ESG considerations are integral to Future Quality investing as good companies make for good investments. Please see our September Future Quality Insights article for further observations about the rising influence of multiple stakeholders.

The four pillars used to assess the Future Quality characteristics of an investment are as follows:

Franchise—does the company have a sustainable competitive advantage?

Management—does the company make sound strategic and capital allocation decisions?

Balance Sheet—is growth appropriately financed?

Valuation—are the company’s prospects under-appreciated by the market?

We believe that investing in Future Quality companies will lead to outperformance over the full market cycle. Our strategy is based on fundamental, bottom-up research, therefore sector and country allocations are a function of stock selection. The Global Equity strategy is a concentrated, high-conviction portfolio with a high active share ratio.

Market Review

Global equity markets continued to rise in Q2 2019, this time increasing by 3.6%. Technology retained its leadership across regions and markets, despite questions about data privacy and the perceived market dominance of a few tech giants.

Interestingly, economic data generally weakened over the first half of 2019 as the impact from the trade war between the US and China took hold and supply chains were disrupted and consumer confidence dented. The tightening in US interest rates we experienced in 2018 came to a halt, and markets started to predict an easing cycle—which at first looked unlikely, but now appears imminent. Higher real rates have helped strengthen the US dollar and in turn put pressure on emerging market currencies and equities.

Politics has never been far from the headlines and rarely in a good way. Osaka hosted the 14th meeting of the G20 and G7 countries, and there was hope that the two superpowers—the US and China—would resolve their differences. However, the current rhetoric between the two in respect to tariff posturing is almost trivial when compared to their ideological differences and a longer-term ‘cold war’ we see developing based on a race for technological advantage. We perceive the changes to be longer term in nature.

Given the situation, it is all the more surprising that markets are at highs despite disappointing results and lower guidance in a number of sectors. Performance has been driven by a narrowing band of growth companies, many of which reside in the Technology sector. Although leadership from this cohort of stocks may not quite be at extremes yet, we are cognizant that it is not a question of if there will be a change, but when. Increased regulation on the FANG stocks, pressure on data protection and privacy, etc., suggest that the ingredients for a change are in place, even if they are not yet in full swing.

Leadership in equity markets was fairly broad over Q2, with Information Technology continuing to lead and Industrials, Financials and Consumer Discretionary also performing well. Defensive sectors, such as Real Estate and Utilities underperformed the market.

Regional performance was very mixed with more cyclical exposed regions, such as Europe, Australia and Canada, performing well, whereas Japan fared poorly. (Comparative returns are against the MSCI All Country World Index in USD.)

Market Outlook

We put our Future Quality strategy into effect by assessing all the holdings through the four pillars. We start with the quality of the management team, the strength of the franchises they manage and the strategic flexibility afforded to them by their balance sheets. Once we have evaluated these aspects, the final pillar is a careful appraisal of the stocks’ valuations. While there are plenty of quality businesses that are fairly or even over-valued, there are many more that fall foul of our other requirements.

As bottom-up stock pickers, our search for Future Quality companies is unconstrained by sector or geography and this holds true irrespective of the economic climate. We do not spend our time guessing at the path for global growth, although we remain of the view that the majority of the tightening appears to have already taken place.

Geopolitics also appears to favour a benign outcome. At the current juncture it seems we are just as likely to experience further gains as a bear market. Despite this view, we generally do not spend our time trying to time the peak in markets and instead focus on finding ideas that meet our ‘Future Quality’ criteria.

Although a company’s share price may change, the quality of its management team does not rely upon how US Federal Reserve President Jerome Powell views the latest inflation data. We continue to look for management teams that have a proven track record in allocating capital and can demonstrate their approach to long-term generation of wealth by considering all stakeholders. Examples of such firms include Rentokil, and its focus on its employee base; or Unilever, and its approach to sustaining the supply chain. In a similar vein, the strength of a company’s balance sheet does not change subject to, for example, the most recent political spat between the US and its trading partners. If anything, the substance of its balance sheet even becomes more important.

Our valuation discipline is anchored around metrics prioritising cash flow generation and growth. The focus on the former leads us to avoid investing in technologies that have ‘IPO-ed’ as the ‘next big thing’ but, at the same time, whose end application, competitive advantage and / or ultimate beneficiaries remain unclear. We do not suffer from FOMO—the ‘Fear Of Missing Out’. Often the relative novelty of these issues commands a premium valuation as investors clamour for an analytical ‘edge’ available in these names while ignoring other names whose characteristics are more well-established.

The forthcoming IPO of WeWork is a case in point. Its CEO believes his company is a ‘state of consciousness, a generation of interconnected emotionally intelligent entrepreneurs’. However, its community-adjusted EBITDA is perhaps an ‘adjustment’ too far. High ‘cash’ returns is what we seek, and with WeWork, we do not believe the company carries the requisite characteristics to support this.

Instead, we prefer technology companies where competitive advantage is likely underestimated and management has a proven ability to reinvest the cash that they generate, thereby extending their advantage. These characteristics are present in current holdings such as Microsoft, Adobe and Accenture. The adoption of technology is also important. A number of the investments in the portfolio are winning market share because they have been early to adopt technology, thereby making it easier to identify opportunities, lower costs and grow. Transunion and Progressive are good examples of this.

Whilst retaining our valuation discipline, we have continued to improve the quality of the businesses in the portfolio. In particular, we took advantage of the recent push higher in equity markets to sell names whose path to higher cash flows was reliant upon the economic cycle and we instead prioritised firms in greater control of their future performance. The portfolio continues to enjoy a much higher level of cash return on investment and a lower level of leverage than the broader market.

Our approach as long-term investors and our focus on management teams that consider all stakeholders naturally leads to a portfolio that ‘scores’ well on any of the ESG criteria. This is particularly prominent in the portfolio’s low carbon footprint, consistently high Governance scores, and our increased engagement and voting approach on these issues. We believe that management teams that consider all stakeholders are more likely to appropriately allocate capital over a longer time frame.

We can see the argument for another move higher in equity markets, driven by a seemingly endless injection of liquidity by central banks. There are substantial risks to this view, however. Against this backdrop, we will continue to only invest in companies that can satisfy our tests of Future Quality and which come at a reasonable valuation.

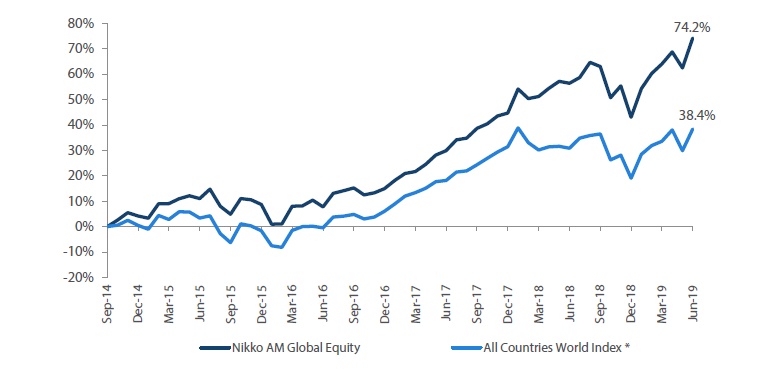

Global Equity Strategy Composite Performance to Q2 2019

Cumulative Returns October 2014 to June 2019

Past performance is not indicative of future performance.

Source: Nikko AM, FactSet, Bloomberg

The track record for Nikko AM portfolio is based on a composite portfolio from 01 October 2014 to 31 March 2019.

*The benchmark for this composite is MSCI AC World Index. The benchmark was previously the MSCI All Countries World Index ex AU since inception of the composite to 31 March 2016. Returns are US Dollar based and are calculated gross of advisory and management fees, custodial fees and withholding taxes, but are net of transaction costs and include reinvestment of dividends and interest.

*The track record for SWIP is based on a composite portfolio managed by the investment team whilst at SWIP from 31 March 2011 to 31 March 2014. The team was subsequently acquired by Nikko AM in August 2014. The benchmark for this composite was the MSCI World Index.

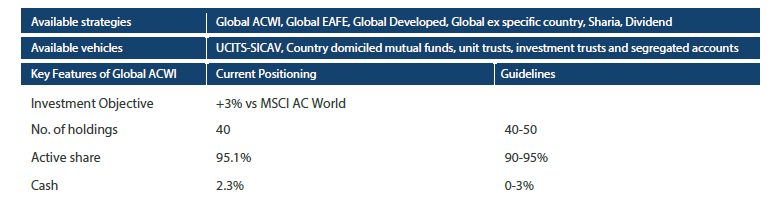

Nikko AM Global Equity: Capability profile and available funds (as at 30 June 2019)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually ‘joining the dots’ across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 22 years’ industry experience and have worked together as a Global Equity team for eight years. They have recently recruited an analyst, who is the first appointment of a new generation of talent to the team. The team’s deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team’s philosophy is based on the belief that investing in a portfolio of ‘Future Quality’ companies will lead to outperformance over the long term. They define ‘Future Quality’ as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 224 billion* under management, Nikko Asset Management is one of Asia’s largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 June 2019.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.