Amid rising concerns over global economic growth and trade tensions, central banks across the globe are once again turning to interest rate reductions to help bolster growth. As a result of this unprecedented monetary easing, the spread between the performance of Japanese growth and value stocks has widened to levels not seen in recent years.

Against this backdrop, value investors—who are seeking to generate excess returns through fundamental research that identifies companies with poor stock performance due to temporary structural issues—have been met with both new challenges and opportunities.

On one hand, a market driven by macro forces and easy access to low-cost capital has not rewarded value investors so far in 2019. On the other, we believe the current P/E level for Japanese equities and continued structural changes in Japan are combining to create compelling investment opportunities for those who have not yet seen a full manifestation of the value effect or of recent corporate governance reforms.

Japan Equity Valuations at Historic Lows

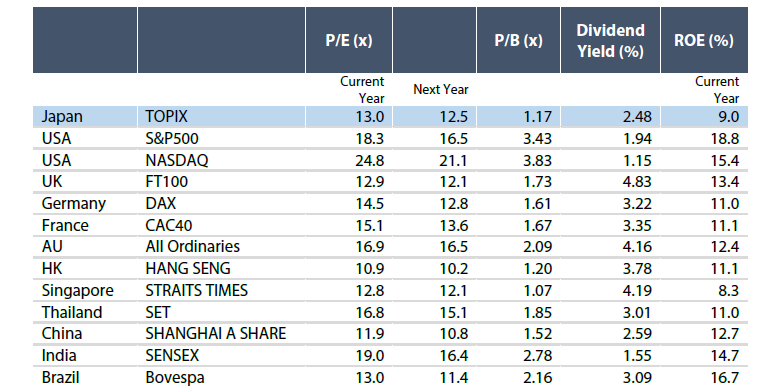

The current P/E level for the Tokyo Price Index (TOPIX) is 13.0x. This is not only significantly lower than the index’s average of 15.6x over the past ten years, but also than the level of most other major market indices. For example, the S&P 500 (US), CAC40 (France), DAX (Germany) and SENSEX (India) are all trading at higher multiples than the TOPIX.

Source: Bloomberg as at 13 September 2019

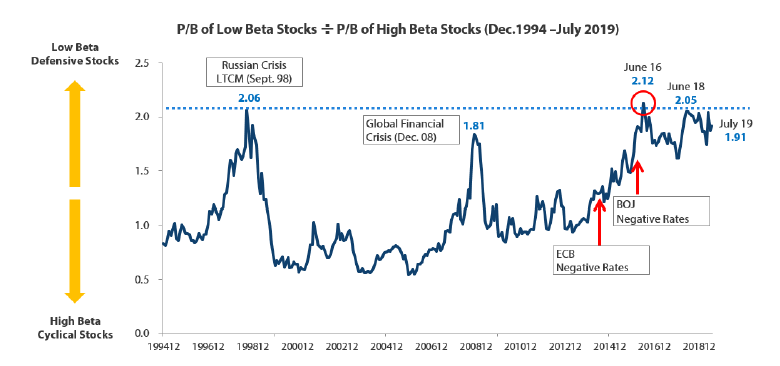

In addition, the valuation gap between low beta defensive stocks (with higher valuations) and high beta cyclical stocks (with lower valuations) in Japan has further diverged since negative interest rates were adopted by the Bank of Japan in January 2016. In the past year alone, there were several occasions where this valuation gap approached its June 2016 record high.

Source: Nikko Asset Management

Corporate Governance Reforms Bearing Fruit

Under Prime Minister Shinzo Abe’s leadership, several corporate governance initiatives designed to enhance shareholder value have been introduced and fortified in recent years—most notably Japan’s Stewardship Code and Corporate Governance Code. Designed to enhance shareholder value, improve disclosures and ultimately enhance companies’ return on equity (ROE), we believe these reforms are producing meaningful changes across publicly traded companies in Japan.

For example, top executives at companies with low ROEs are increasingly facing opposition to their re-election at annual shareholder meetings. Despite uncertainty in the macroeconomic environment, the total value of stock repurchases by companies in FY2018 reached JPY 6.2 trillion (about USD 58 billion)—a record high that’s widely expected to be topped again in FY2019.

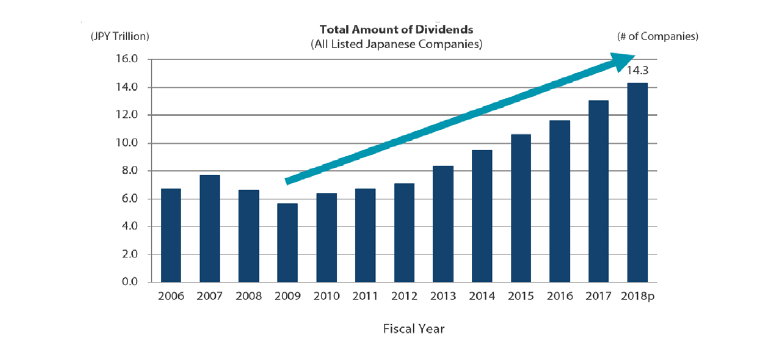

More and more Japanese companies are also strengthening shareholder returns through dividends. After bottoming out during the Global Financial Crisis in 2009, total dividends paid by listed Japanese companies have increased for nine consecutive fiscal years, reaching a record high of JPY 14.3 trillion (about USD 130 billion) in FY2018.

Source: Nomura Securities; p = preliminary figures for FY2018

Amid these structural changes, we believe the current political stability—the July 2019 election for the upper house of Japan’s legislature resulted in the ruling coalition maintaining its majority—helps ensure the continuation of the government’s economic policies (aka ‘Abenomics’) and create an environment conducive to additional measures that will improve shareholder value.

Not All Value Opportunities Are Created Equal

Thanks to the above-mentioned trends and developments, we believe Japan value strategies are well-positioned to return to an uptrend in 2020 and beyond. That said, uncovering attractive value opportunities—those that can deliver stable excess returns—and avoiding costly value traps will continue to require thorough bottom up research from experienced investors. Particularly important is the ability to identify:

- -whether a stock’s performance is due to structural or cyclical issues; and

- -if a company has an attribute—e.g. an attractive brand, technology, human capital, product or service—that has yet to be recognized by the market, but will serve as a future growth catalyst.

This focus on turn-around catalysts allows for the discovery of undervalued Japanese companies with the potential for positive revaluation in the years ahead. Examples uncovered by Nikko Asset Management’s Value Strategy Fund Management Team include:

- -Nintendo – a well-known brand in the gaming industry. The video game and console maker is uniquely positioned with a broad portfolio of games that are embraced around the world and across generations. Sluggish sales of the Wii-U console and 3DS handheld system resulted in three consecutive years of operating losses through FY2013. However, leveraging its experience and unique intellectual property, the firm rebounded in 2017 with the Switch, its new gaming console. The Switch has been a success for the company and we believe that it will be a continued driver of growth.

- -Sony – outside of a few specific genres such as comics, animation and games, Japan has a limited presence in the USD 555-billion global content industry. Specifically, Japan is underrepresented in the key categories of broadcasting, movies and music, which collectively represent a USD 446-billion opportunity. We believe Sony is the only Japanese company with the platform and content to unlock these markets.

With Japan growth stocks outperforming undervalued stocks year-to-date in 2019, investors are no doubt tempted to abandon value investments in search of greener pastures. However, the market environment continues to change, with global geopolitical uncertainty rising outside Japan and structural reforms within the country beginning to produce meaningful results, all the while equity valuations are hovering at historic lows. We believe that investors with the vision, discipline and conviction to recognize these developments will be rewarded.