The recent gyrations in financial markets, and of course the growing signs of weakness in much – or all – of the global economy have left many investors and commentators bemused, primarily we suspect because, just as was the case back in 2006, relatively few people are currently aware that there was in fact a ‘Global Credit Boom’ in 2017, and we further suspect that even fewer investors are aware that not only has the boom ended quite abruptly, but that it has caused four – or maybe five - major dis-continuities within the global system.

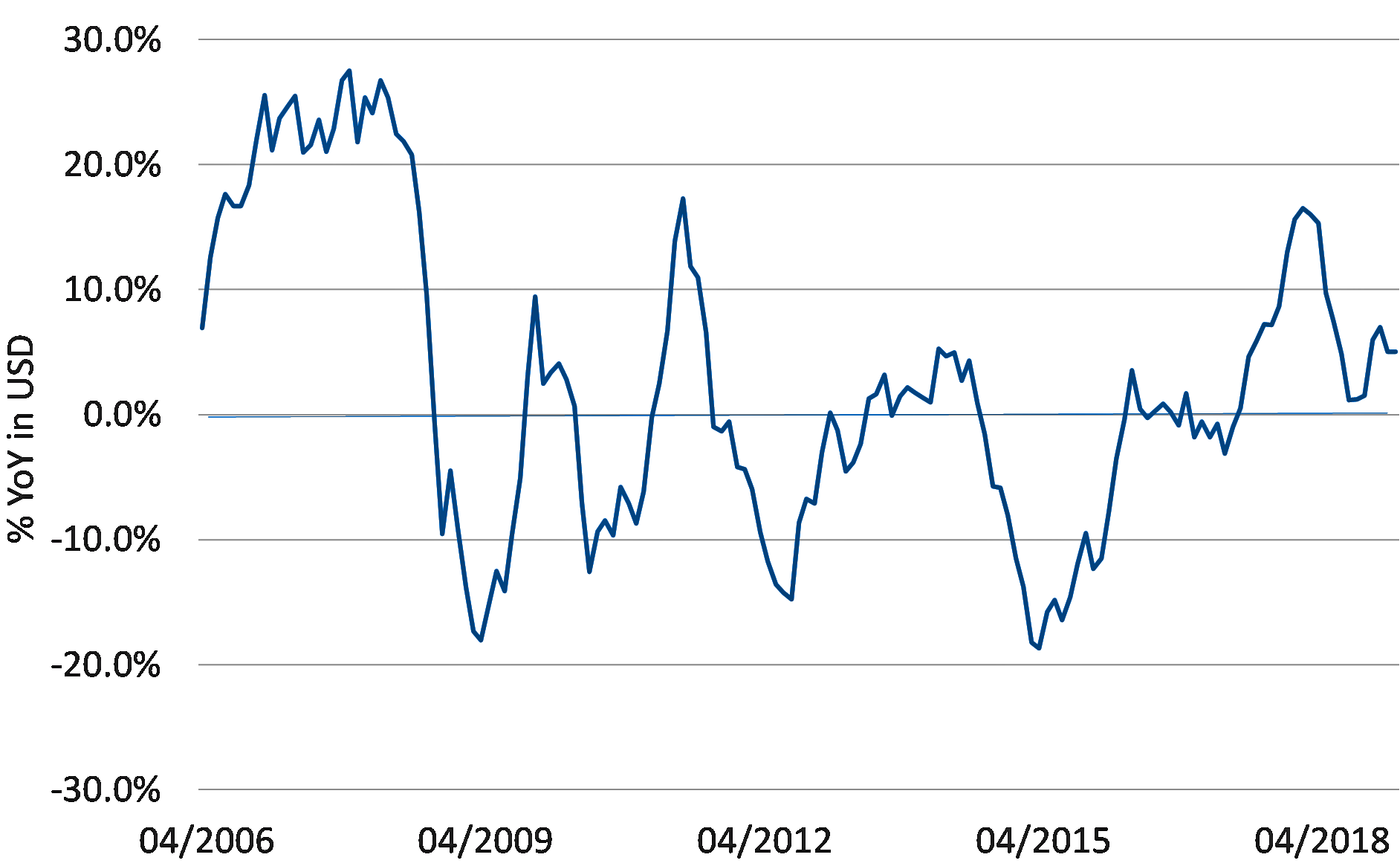

One result – which is already all too visible - of the ending of the credit boom has been a slump in global nominal GDP growth as measured in current dollars. We use current dollars at current exchange rates in the chart that we show below simply because real people and companies spend current dollars, judge corporate earnings in current dollars, and service our now higher debt burdens in conventional dollars, rather than ‘constant price’ or PPP dollars. Moreover, we must note that the decline in nominal GDP growth to a rate that is now well below global wage growth mathematically implies that corporate profits must now be falling worldwide (since GDP essentially comprises wages plus profits).

Global Nominal GDP

*YoY in current USD at current FX rates, Q2 includes estimates for India and Canada

First the credit boom. In 2017 a unique confluence of events resulted in there being a $300 billion (and at times more) injection of new ‘excess’ reserves into the US banking system – essentially there was a de facto QE that was not announced nor even commented upon in the mainstream media. In essence, an unusual collision between the Trump Administration and the Debt Ceiling resulted in a sharp run down in the Treasury Departments ‘contingency reserve’ at the Federal Reserve (known officially as the Treasury General Account) and the monetary implication of this event was a sharp rise in the level of excess reserves within a banking system that was much more expansionary minded than it had been earlier in the decade (when the Fed had been operating its more ‘conventional’ QEs).

Indeed, one or two of the major US banks were actually quite ‘gung-ho’ with regard to their desire to expand in 2017 and one of the (we presume regulation-avoiding) ways in which they expanded was via the lending of dollars through the exchange traded derivatives markets, repo-markets and most of all the cross currency basis swap markets to a group of European and Japanese banks that had become international ‘refugees’ from the zero rate environments that they were facing in their own domestic markets.

These banks then embarked on a massive lending programme within the Emerging Markets; it is perhaps somewhat ironic that the ‘Trump QE’ resulted in a boom in the credit systems – and the economies – of many of the EM (including China), but we have noted that credit in a boom always seems to result in aggressive flows into the periphery…

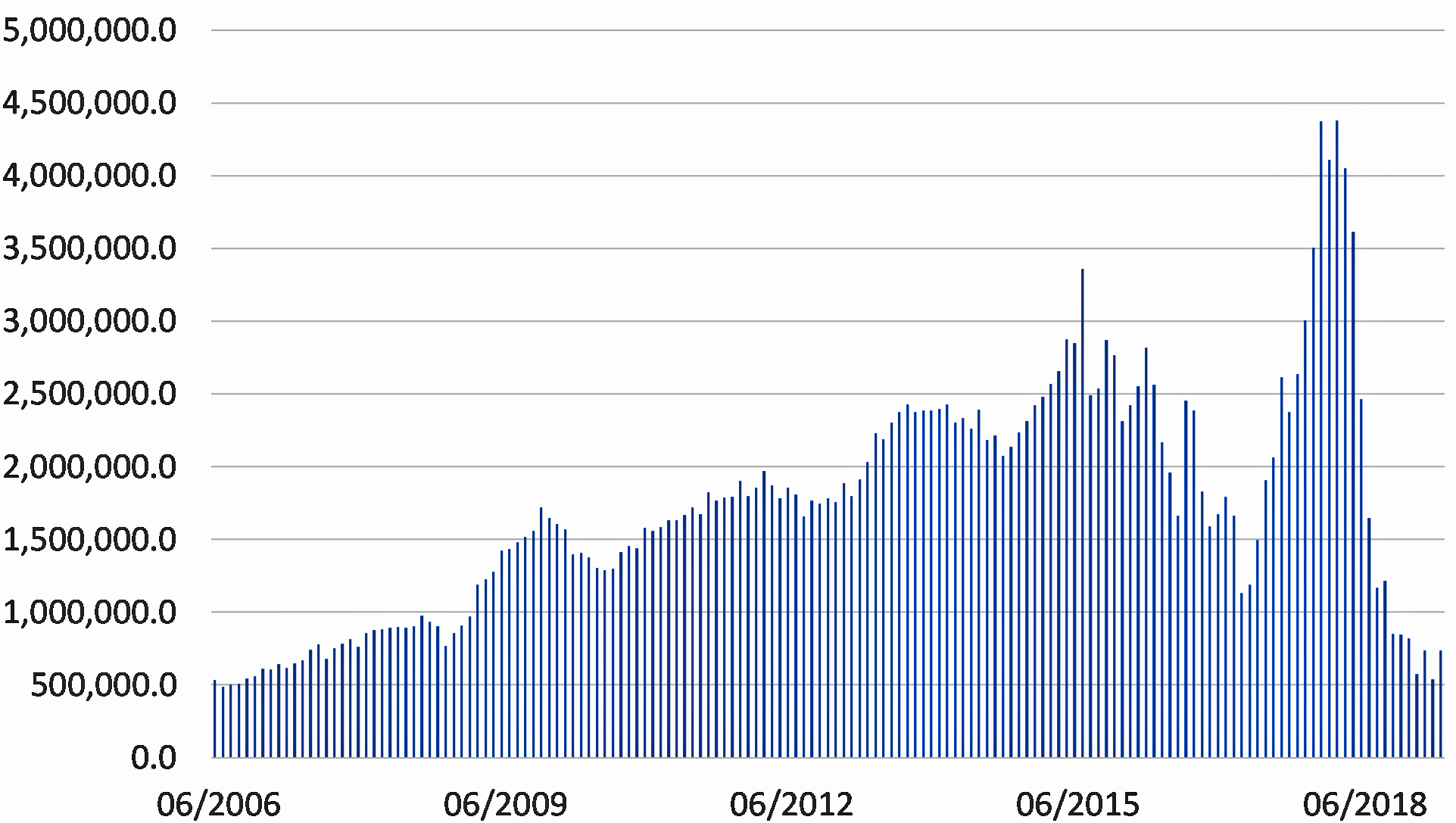

Total Global Credit in USD

It is our belief, based on several interviews, that relatively few in officialdom either recognized or perhaps cared about the 2017 credit boom at the time. The BIS (Bank for International Settlements), for reasons that are not entirely clear to us, was certainly caught ‘asleep at the wheel’, while the IMF may have had its own reasons for downplaying the event.

Most surprisingly of all, the by then much more academically-leaning New York Federal Reserve seems to have completely missed what was occurring on its watch; the more market-savvy Dudley-era having apparently come to an end at the NY Fed. Naturally, the lack of official acknowledgement of the event implied that the media also missed the ‘party’, although two notable official organizations, namely the US’s OCC and Japan’s FSA, did start to take notice of the risks that were building in the system. As we shall see, the involvement of these two entities was later to become a particularly crucial event.

Again, for reasons that are not entirely clear, the World’s media in 2017 also largely failed to spot that one of the biggest borrowers of dollars during the 2017 global credit boom was China’s economy. China’s banks, companies, SOEs and even households became massive borrowers of dollars during the period, in much the same way that the smaller Asian economies had done during the early and mid-1990s.

From late 2016 onwards, China’s authorities were in general moving towards a tighter monetary stance and an official ‘bias towards deleveraging’ behind some newly imposed and stringent capital controls. However, it is very much our view that the re-imposition of capital controls in China in the wake of the 2015 ‘almost currency crisis’ significantly reduced the ‘utility’ of the RMB as a savings instrument to most people and, as a result, people quite rationally began to stop saving and they started to spend more despite the theoretically tighter official stance. This was the genesis of the PRC’s upswing in late 2016.

However, once the economy began to improve (and in particular once house prices started to inflate in early 2017), China’s population naturally wished to leverage its participation in the upswing – most credit booms start with a ‘genuine’ stimulus that then becomes exaggerated and amplified by credit flows. This was certainly the case in China in 2017.

China: Private Credit

Growth over 12 months in USD billion

Of course, the population’s ever-increasing demand for yet more leverage (i.e. credit) ran counter to the government’s desire for less leverage and a tighter monetary stance and this collision resulted in the Chinese banking system - and indeed many companies - turning abroad for their marginal financing needs and, as a consequence, China became one of the world’s largest cross-border borrowers. In fact, by the end of 2017, China’s credit boom had become simply immense.

Not only was there at least $5 trillion of new credit being advanced within the system (making China’s 2017 credit boom the largest ever witnessed in a single country) but households were saving less of their incomes and the combined corporate and local government sectors had become cash flow negative at an operating level to the tune of 16-20% of China’s aggregate GDP.

Indeed, on a relative basis, China’s corporate / Local Government financial deficits in 2017 had become four or five times as large as the equivalent US and UK household sector deficits in 2006 and this is why China’s economy required so much credit to support its rapid – but certainly not exceptional – rate of nominal GDP growth in 2017.

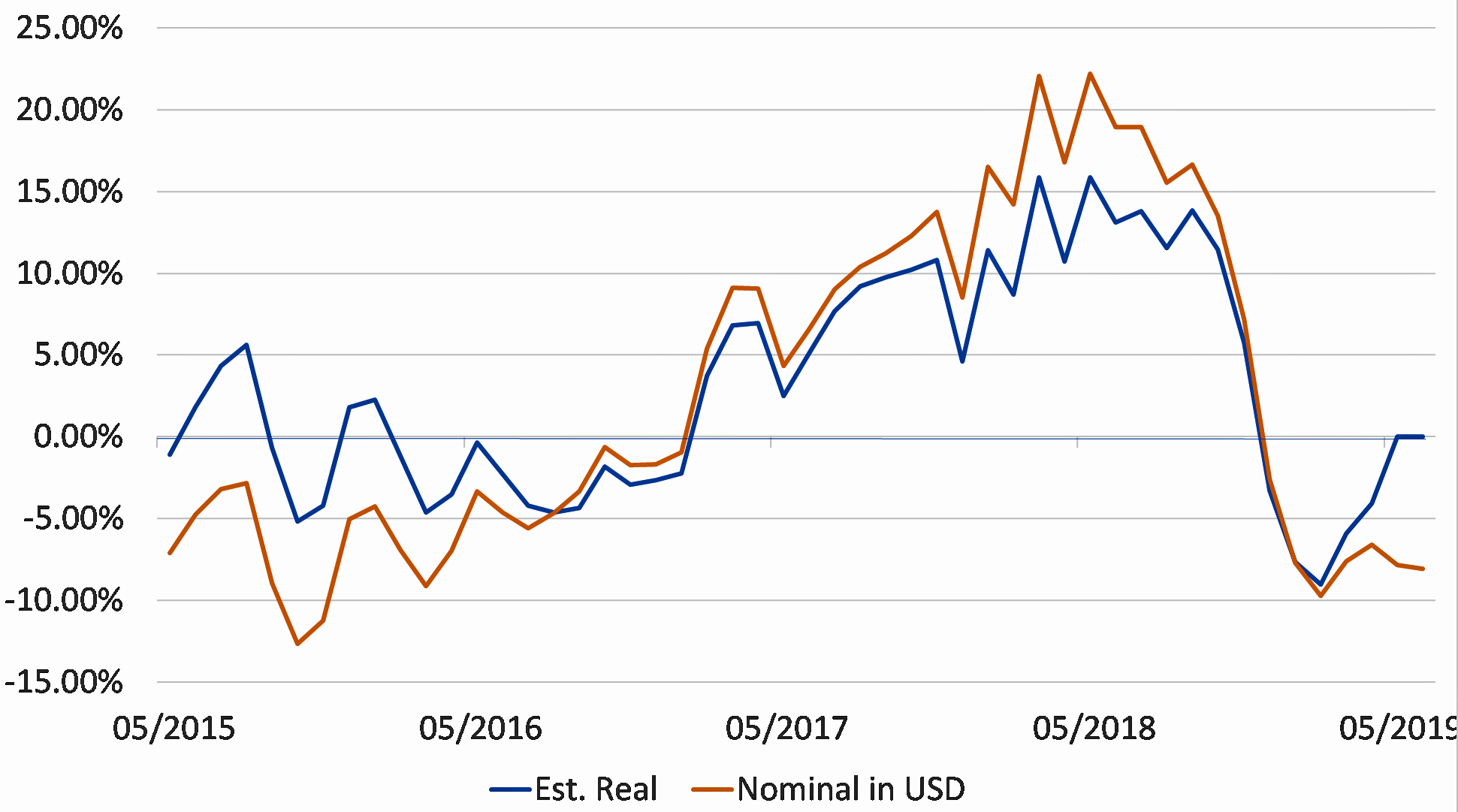

One of the hugely important side-effects of China’s late 2016 and 2017 economic expansion was a jump in the economy’s demand for imports and in particular for ‘labelled’ consumer goods, high-end autos, and some capital goods. Quite simply, China’s rate of import growth ‘exploded’ in 2017 and it was this event that lit the touch-paper for the global trade boom that in turn triggered the global economic recovery of 2017.

Indeed, by the end of 2017 / early 2018 it appeared that China had succeeded in delivering such a powerful stimulus to the world trading system that the latter looked to be finally escaping the post GFC slump in nominal growth.

China: Non Oil / Non Commodity Imports

% YoY, 3mma

This of course represented a ‘happy time’ for equity markets in that not only was global growth accelerating but thanks to the injection of funds into the US financial system that we described above, financial sector liquidity was booming.

However, in late 2017 and early 2018, two important players entered the game. The US regulator, the OCC called its banks and expressed concern about their mounting exposure to the EM. In Japan, the FSA was even more explicit in its guidance to its banks. This implied regulatory tightening occurred on top of the Fed’s move towards higher rates; the beginning of QT; a period in which the Treasury also decided to rebuild its own reserves in the General Account at the expense of the banking system’s reserves in an often haphazard, difficult to predict and frequently aggressive manner; and the adoption of the BEAT reforms (part of the Trump Tax Package) radically altered the tax treatment of dollar borrowings that were for use offshore.

These were all very significant events that each contributed to a sharp reduction in dollar liquidity growth – the dollar feast of 2017 became the famine of 2018 – but what was amazing in all of this is that the inward-looking senior staffers at the NY Federal Reserve largely missed what was going on.

By then, the few remaining staffers from the Dudley-era staff had it seems left the NY Fed building for careers in the private sector and it seems that the remaining staff – who relied on academic and theoretical models and who had seemingly abandoned the NY Fed’s traditional role as a conduit for information between the banking system and the FOMC in Washington – were ill-equipped to understand what was occurring on the ground. Hence, a shortage of dollar liquidity was created almost ‘by accident’.

By far the biggest casualty of this crucial change in dollar funding conditions was the Chinese banking system. By the middle of 2018, the PRC banking system was only capable of providing on half as much credit to the economy that it had been doing on 2018 and this quite naturally began to create some discomfort within the economy. Certainly, the latter began to slow and also to reduce its demand for imports at the margin, an event that was felt across the globe.

However, in October 2018 the rate of credit growth within China finally dipped below the critical level that was necessary to fund the current combined cash flow deficits of the SOEs, property developers, and most of the local governments. Indeed, nowhere was the funding crisis more severe than in the local governments within the interior of the country. Since 2010, the official data suggests that these relatively less affluent areas of the country have traditionally relied on local government spending for 60-80% of their economic and income growth but, in 2018Q4 a lack of funding implied that these areas were obliged to experience a sharp decline in their expenditure levels.

As the availability of credit dried up, the private & local government sectors in China were obliged to radically alter their behaviour and the aggregate savings rate leapt in an essentially discontinuous manner that was remarkably reminiscent of those that had occurred in Asia in early 1997 and – most of all – the US household sector in 2008. Naturally, the primary route through which this occurred was via enforced austerity – i.e. a CAPEX recession.

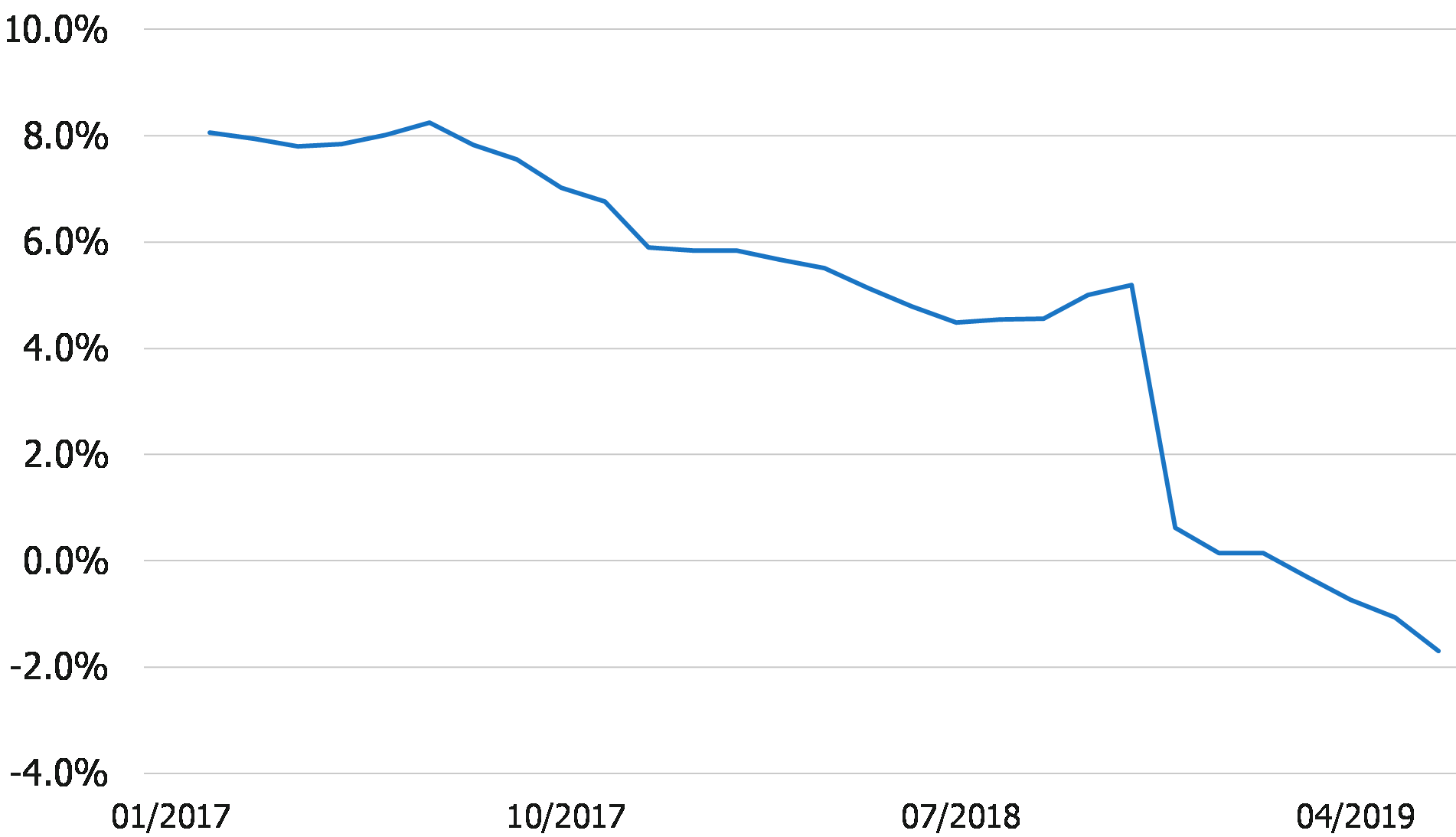

China: Fixed Asset Investment

12 month sum, % YoY

Moreover, as capital spending slumped, household income growth will have weakened and most importantly of all the country’s demand for imports all but collapsed. It is this – much more than anything else – that has been responsible for the world trade recession that has engulfed us since October last year.

China’s annual rate of import volume growth slowed from plus 15% YoY to minus 5% in a matter of weeks, something which represents an incredible change in circumstances in the World’s second largest economy and its on occasion largest importer.

For many, and in particular those that wish to believe China’s official 6%-7% growth numbers, the slowdown in Global Trade came (has still to come?) as a very great surprise and, as a result, we have witnessed an intense unintentional inventory build on both sides of the Pacific and Atlantic oceans that cannot simply be explained by tariffs. Moreover, as inventories have piled up and corporate access to funding has become tighter, there has been a clear move towards heavy price discounting by suppliers and hence a return to world trade price deflation. In this regard, the bond markets have it right.

Moreover, it is clear that without China’s participation, there is little that will revitalize global growth or pricing trends in 2019H2 or even early 2020 and this, having already dawned on the bond markets, is also beginning to impact the ‘risk markets’ and in particular estimates of corporate earnings growth. Hence, we have turned cautious on the outlook for equity markets.

At first sight, it would seem that the easy solution to the current global malaise would of course be for China to ease its policy settings and once again ‘go for growth’. We suspect that this view is – in fact – the current consensus view in markets. However, and unbeknown to many, China faces two important constraints on its ability to ease at this time.

Firstly, it may not wish to add more debt into its already highly leveraged economy. More importantly, the authorities will be aware that if they provide too much ‘cheap domestic funding’ for either the banks or the wider economy, then the first use that the private sector will make of this money will be to repay the expensive foreign liabilities that they have amassed over recent years. China’s economy now possesses at least $2.5 trillion of foreign liabilities and we suspect that around a quarter of these are relatively short-term liabilities of the banks. If China’s MoF (through fiscal policy) or the PBoC (through its monetary policies) were to flood the system with funds, there would instantly be large capital outflows that we believe would place acute pressure on the RMB that even the country’s much-remarked-upon foreign exchange reserves could not offset.

Of course, exporters might well welcome the sharply weaker exchange rate (just as their Korean and ASEAN counterparts did in 1997) but it is most unlikely that very many of China’s banks and other financials could discharge their foreign currency denominated debts before the RMB fell, a situation that would imply massive losses for those banks and companies that ‘failed to get out of their foreign debts in time’.

Certainly, the Asian Crisis of 1997 provides an easy template for what could happen if the authorities in China were to ease too aggressively. When the Bank of Thailand decided to ease to offset the domestic credit crunch that had formed in late 1996 / early 1997, there was an immediate rush by domestic entities to repay their foreign debts and the currency naturally dived. A small number of companies with foreign debts were able to ‘escape’ in time but most did not and as the Baht value of the foreign debts ‘exploded’, the banking system and several major companies were driven towards bankruptcy, and a predictable Financial Crisis ensued. China will not wish to follow this route and so there has so far been a limit on how much China can do to save itself – and by implication the World.

However, if the PRC does miss-judge its actions – and the events of recent weeks suggest that there may well be a rising probability of this occurring – then we can assume that the RMB could easily fall significantly further, thereby triggering not only a growth-constraining financial crisis within China but also a further increase in global deflationary pressures. Where the RMB goes other EM currencies tend to follow, and we certainly suspect that a weak RMB could tip the world towards a full-blown deflation scare – or worse.

Indeed, it would not be impossible for global GDP in dollar terms to fall 3 – 5% under these circumstances, with a clearly adverse impact on corporate profits, and debt sustainability in both the private and public sectors.

There is also the risk that some of China’s larger borrowers might default on their external liabilities in much the same way that some of the Russian banks (as well as the State) did in the autumn of 1998. Perhaps by why of a retaliation in the trade war, it might be tempting for the authorities in China to create a ‘bad bank’ that was ‘loaded with foreign liabilities and toxic assets’ and which then defaulted in the way that the conceptually similar InKomBank and TokoBank in Russia failed, in effect taking some of their Western creditors ‘with them’…..

In a series of papers earlier this year, we hypothesized that the “Nominal GDP Fail” as we have named 2019H1 could signal a long trend period of near zero nominal GDP growth in the world ‘on average’. In short, what we are seeing may in fact be the beginning of a widespread Japanification of the global system (i.e. low growth and interest rates that remain close to zero ad infinitum) but we have also noted that in such systems, equity markets tend to be anything but stable – they may well develop flat long term trends but their year to year volatility may be relatively extreme and those investors that can capture at least some of the turning points may be able to produce quite promising returns for their portfolios.

Japan’s equity may have been flat for a generation but the intra-year moves in the indices have been relatively large – capturing the moments in which liquidity tightened and/or investors lost faith will have saved investors from losing money while capturing the bouts of liquidity growth & optimism will have made clients money as well.

It may well be that financial markets are about to face a difficult period, but there will be a policy reaction – some version of Abe/Kuroda will presumably be found within the global economy to create the next trading rally......