Summary

- Asian stocks staged a rally and ended September on a positive note, recovering from steep losses in the previous month. The MSCI AC Asia ex Japan Index gained 1.7% in USD terms as sentiment was boosted by continued easing across major central banks.

- South Korean equities led the gains, surging 7.2% in USD terms in September on easing US-China trade tensions, expectations of rate cuts by the Bank of Korea and a strong rally in domestic semiconductor stocks. In India, stocks soared 3.1% in USD terms after the Indian government announced a surprise corporate tax cut.

- In the ASEAN region, all markets except Singapore suffered USD losses in September. Indonesia and the Philippines were the hardest hit, slumping 2.9% and 2.0%, respectively, for the month. Meanwhile, ongoing political protests and a weak economic outlook weighed down Hong Kong.

- Positive structural reforms complemented by cheap valuations, bottoming of commodity type technology components, monetary policy easing and fiscal stimulus should support Asia's performance in the event of a cyclical rally. We continue to find sustainable returns in reasonably valued structural areas across technology, healthcare and select consumer sub-sectors.

Asian Equity

Market Review

Asian equities rebounded in September

Asian stocks staged a rally and ended September on a positive note, recovering from steep losses in the previous month. The MSCI AC Asia ex Japan Index gained 1.7% in USD terms during the month.

Sentiment was boosted by a 25 basis points (bps) interest rate cut by the US Federal Reserve (Fed), a 50 bps cut in banks' reserve requirement ratio by the Chinese central bank and the resumption of trade talks between the US and China, with ministerial-level meetings planned in Washington on 10-11 October.

The market upturn in September, however, wasn't all smooth sailing. Regional equities had to overcome intermittent market jitters during the month, which saw a fleeting spike in oil prices when Saudi Arabia's oil facilities were hit by drone attacks. New political wrangling in the US, where a formal impeachment inquiry was launched against US President Donald Trump, also heightened market nervousness towards the end of September.

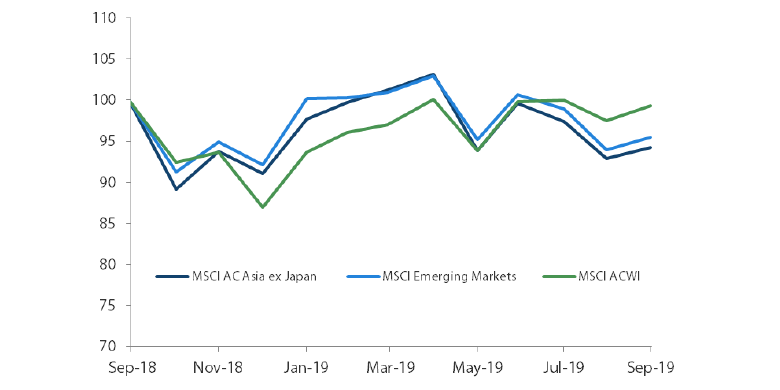

1-Year Market Performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 September 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

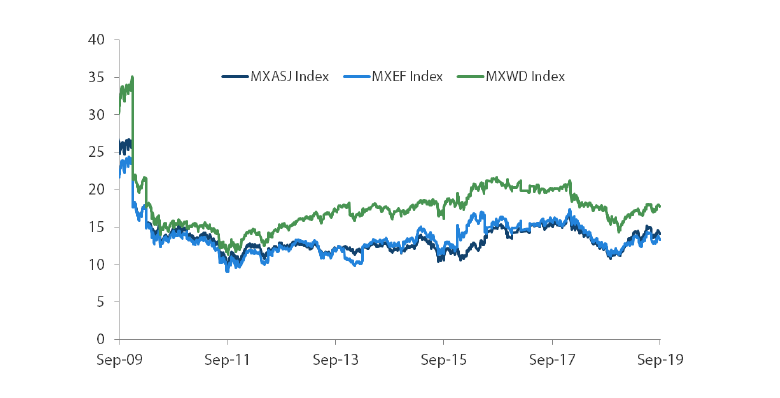

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 30 September 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

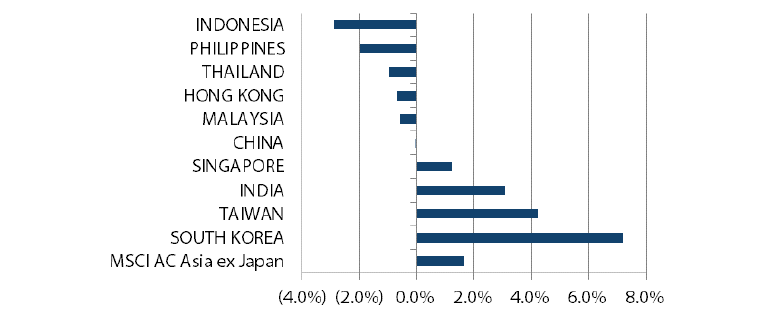

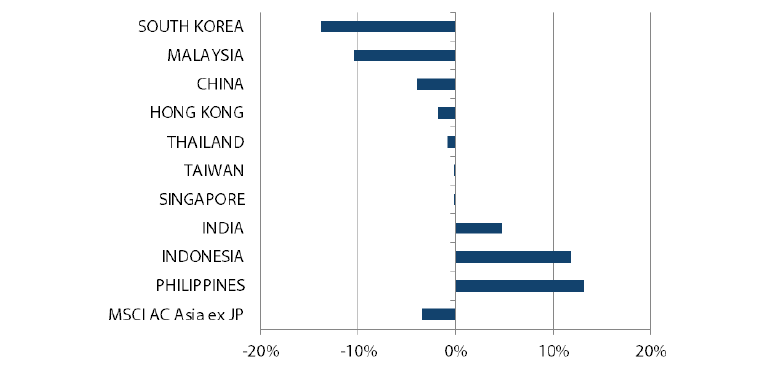

South Korea surged; China saw flat returns

Enjoying a spectacular 13-day winning streak, South Korean equities surged 7.2% in USD terms in September, buoyed by easing US-China trade tensions, expectations of rate cuts by the Bank of Korea and a strong rally in domestic semiconductor stocks. The country's consumer confidence index also improved in September for the first time in five months.

Likewise, Taiwanese stocks gained 4.2% in USD terms during the month on optimism over the market's dominant semiconductor industry. The introduction of Apple’s new iPhone 11 lifted Taiwanese semiconductor manufacturers, which are key chip suppliers to the smartphone maker. Taiwan's manufacturing Purchasing Managers' Index (PMI) and consumer sentiment also improved in September.

In other North Asian markets, China turned in flat returns, while Hong Kong posted USD losses of 0.7%. The official Chinese manufacturing PMI for September was above expectations at 49.8, slightly higher than 49.5 in August, but still showed a contraction. During the month, China's State Council announced more stimulus to boost growth, allocating more funds to workers' skill training and infrastructure investment. Over in Hong Kong, ongoing political protests and the weak economic outlook weighed on stocks in the city-state, which saw its credit rating downgraded by Fitch from AA+ to AA.

India soared; ASEAN markets underperformed

In India, stocks soared 3.1% in USD terms after the Indian government announced a surprise corporate tax cut from 34.3% to 25.17%, effective in the current financial year. For manufacturing companies set up in India after 1 October 2019, the corporate income tax will be reduced to an even lower rate of 17%.

In the ASEAN region, all markets with the exception of Singapore turned in USD losses in September. Indonesia and the Philippines were the hardest hit, slumping 2.9% and 2.0%, respectively, for the month, while Thailand and Malaysia fell 1.0% and 0.6%. Bucking the downtrend, Singapore stocks rose 1.2% in USD terms in September. Factory output in Singapore, however, fell sharply by 8% year-on-year in August, its worst performance since December 2015. Elsewhere, the central banks of Indonesia and the Philippines both cut interest rates by 25bps during the month.

MSCI AC Asia ex Japan Index1

For the month ending 30 September 2019

Source: Bloomberg, 30 September 2019

For the period from 30 September 2018 to 30 September 2019

Source: Bloomberg, 30 September 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market Outlook

Asia could fare relatively well in a cyclical recovery

Over the month, a factor rotation from growth to value took centre stage, reversing a trend over the past year in which growth stocks gained while value stocks underperformed. Yet, whether this trend reversal can be sustained remains highly debatable. With the absence of material global reflationary expectations, the recent shift in leadership may be fleeting. In contrast, what is arguably more sustainable are secular reforms which lead to structural productivity gains as evidenced in China and India. Nevertheless, if we do indeed witness any sort of cyclical recovery, Asia could fare relatively well. Positive structural reforms complemented by cheap valuations, bottoming of commodity type technology components, monetary policy easing and fiscal stimulus should support Asia's performance in a cyclical rally. We continue to find sustainable returns in reasonably valued structural areas across technology, healthcare and select consumer sub-sectors.

In China, the impact of targeted policy support is beginning to trickle through into the real economy, as seen in a pickup in cement shipment, excavator sales, and power/gas consumption. Apart from Renminbi weakness providing some breathing space, monetary and fiscal policies—especially critical against a backdrop of a complex and protracted trade war with the US—also appear more synchronised. That said, our base case is that the Chinese government remains resolute in its commitment to the new regime of 'quality over quantity', eschewing growth for growth’s sake. Hence, we continue to be positioned in areas of domestic structural growth and consolidations, namely insurance, healthcare, software and select consumer sub-sectors, albeit with a preference for relative value.

In India, armed with a renewed and strengthened mandate, the Modi administration continues to make major progress in positive structural reforms. Pertinently, reducing corporate tax rates to make India more competitive in a world of shifting global supply chains as well as reforming public sector banks through accelerated recapitalisation and mergers are examples of reforms that would have been a lot more onerous under a less-supported government. We look forward to further reforms in fixing a number of persistent issues that have hamstrung India's ability to realise its full potential, such as labour reform and infrastructure development. In our opinion, India has made giant leaps in reforms under the Modi regime, but these positive reforms have been mispriced due to short-term concerns about economic growth slowdown and the health of non-bank financial companies. We look to continue to exploit this mispricing through our investments in strong private sector banks (which should benefit from any uptick in growth), real estate developers and selectively in the consumer space.

Green shoots appearing in the Asian technology sector

There hasn't been much to cheer about in the technology-heavy economies of Taiwan and South Korea for some time now given their lacklustre domestic economies and global technology destocking. In the last couple of months, however, we began to see green shoots appearing in the sector. Whilst parts of global technology supply chain may be shifting out of China, technology localisation in China is a major structural trend within the sector, with Chinese companies increasingly favouring Asian suppliers. In addition, as we approach the end of technology destocking and hence the potential bottoming of commodity type technology components, technology supply chain leaders have also become increasingly optimistic in their guidance. Our preference in this space continues to be in stocks that are leaders in niche sectors that are relatively insulated from weak domestic trends, such as healthcare, 5G components and electric vehicle technology.

On the note of supply chain shifting from China, the ASEAN region continues to be a major beneficiary with its significant cost advantage and existing infrastructure. In particular, Indonesia, where expectations are extremely low, is one of the countries that could see an influx of such investments and continues to be our preferred exposure within the ASEAN region. Similar to India, there is also a strong likelihood of reforms getting pushed through after the renewed mandate of Indonesian President Joko Widodo. Major reforms could precipitate a genuine upward shift in the economic growth trajectory. In the shorter term, further countercyclical policy support should also bolster potential recovery in consumption and investment.

Appendix

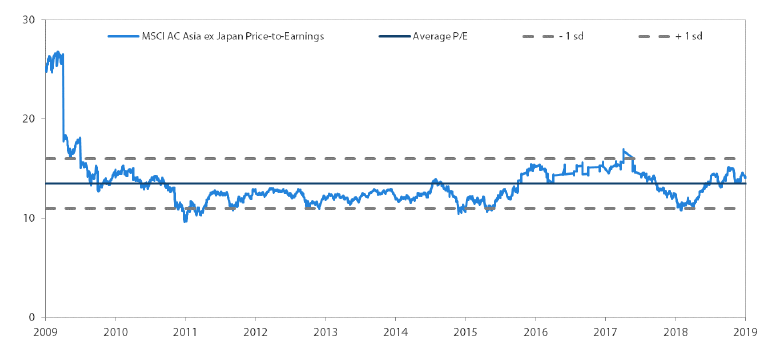

MSCI AC Asia ex Japan Price-to-Earnings

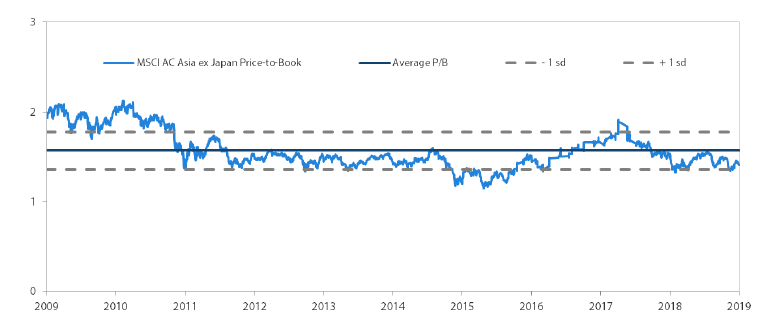

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 30 September 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.