Summary

- UST yields rose in September as risk appetite returned, prompted initially by developments on the US-China trade front. The risk-on mood in the markets was subsequently supported by further monetary easing from major global central banks. Yields edged down from their highs following the drone attack on Saudi Arabian oil production and volatility in US funding markets. But overall, the 2-year and 10-year UST yields ended the month at 1.62% and 1.67% respectively, about 12 basis points (bps) and 17bps higher compared to end-August.

- Asian credits ended the month 0.18% lower, mainly due to the sell-off in USTs, even as credit spreads tightened about 5 bps. High-grade credits ended 0.36% lower, while high-yield credits outperformed and closed the month 0.43% higher.

- Within the region, inflationary pressures were mixed. Headline Consumer Price Index (CPI) inflation prints in India, Singapore and Indonesia rose, while similar gauges of consumer inflation fell in South Korea, Thailand and the Philippines. Central banks in Indonesia and the Philippines lowered their policy rates. In China, the People’s Bank of China (PBOC) announced Reserve Requirement Ratio (RRR) cuts while policymakers scrapped foreign investment quotas. JP Morgan (JPM) announced that it will add China to its bond indexes, while FTSE Russell (FTSE) will keep Malaysia in its WGBI index.

- Meanwhile, issuance volume rose in September as risk sentiment stabilised. The high-grade space saw 43 new issues amounting to about USD 21.6 billion while the high-yield space had 36 new issues amounting to about USD 10.4 billion.

- For Asian local currency bonds, we are positive on Malaysian and Indian bonds, while being neutral on other ASEAN bonds. On currencies, we continue to expect the Singapore Dollar (SGD) to underperform.

- As for Asian credit, global central banks are likely to remain accommodative until there is a clearer resolution on trade and geopolitical developments, in addition to modest improvement in economic data. The outcome of trade negotiations between US and China will be crucial for the near-term direction in UST yields and spreads.

Asian Rates and FX

Market Review

UST yields rose in September

Risk appetite returned in September, prompted initially by developments on the US-China trade front which suggested willingness on both sides to work towards a solution. The markets' risk-on mood was subsequently supported by further monetary easing from major global central banks. The European Central Bank (ECB) lowered its deposit rate by 10bps, and launched a new bond-buying programme. The Federal Reserve (Fed) delivered on expectations and cut the Fed Funds Rate by 25bps, while the PBOC announced RRR cuts and lowered its one-year benchmark lending rate. Yields soon reversed course and moved lower, following the drone attack on Saudi Arabian oil production and volatility in American funding markets. Meanwhile, market reaction was muted to the commencement of an impeachment investigation on US President Donald Trump. Overall, 2-year and 10-year UST yields ended the month at 1.62% and 1.67% respectively, about 12bps and 17bps higher compared to end-August.

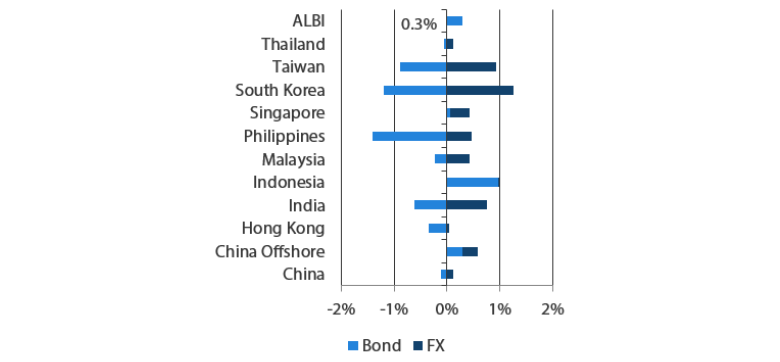

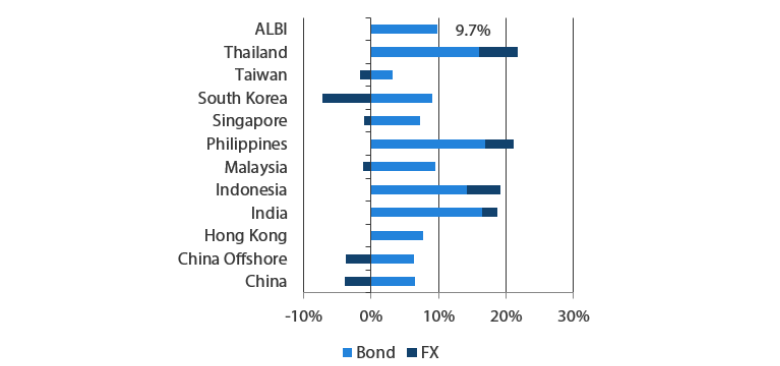

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 September 2019

For the year ending 30 September 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 September 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures in the region mixed

Headline CPI inflation prints in India, Singapore and Indonesia rose, while similar gauges of consumer inflation fell in South Korea, Thailand and the Philippines. Higher private road transport inflation and a smaller decline in accommodation costs caused headline CPI in Singapore to edge up in August, whereas the pick-up in inflationary pressures in Indonesia was driven mainly by higher food inflation. In Thailand, August CPI rose by 0.5% Year-on-Year (YoY), slowing down from the 1% rate in the previous month due to a sharp slowdown in the food component and a deeper decline in the transport component. Meanwhile, price pressures in the Philippines eased broadly, pushing headline CPI inflation below the central bank's target. Elsewhere, YoY inflation in South Korea dropped to an all-time low last month due to an unfavourable base effect on agricultural product prices.

Central banks in Indonesia and the Philippines lowered their policy rates by 25bps each

The Indonesian central bank cut its policy rate by 25bps for a third consecutive month, taking the policy rate to 5.25%. In addition, it announced macroprudential measures to spur growth. According to the central bank governor, the move was "a pre-emptive step to support the momentum of domestic economic growth amid slowing global economic conditions." Similarly, the Philippine central bank trimmed its policy rate by 25bps for the third time this year. Bangko Sentral ng Pilipinas Governor Benjamin Diokno cited easing price pressures and the need to spur growth as the main reasons for the move. Prior to the rate-setting meeting, the central bank had lowered its inflation forecast for the year to 2.5% from 2.6%.

PBOC announced RRR cuts; policymakers scrapped foreign investment quotas

China’s central bank announced that the RRR will be lowered by 50bps for nearly all financial institutions, with an additional 100bps RRR cut for select city commercial banks. It also reduced its one-year benchmark lending rate by 5bps. The 50bps blanket RRR cut was effective 16 September. On the other hand, the 100bps targeted reduction will take effect in two phases (50bps on 15 October and the remaining 50bps on 15 November). The PBOC mentioned that this move will add RMB 900 billion in liquidity to the banking system. Separately, policymakers further opened Chinese markets to global investors with the State Administration of Foreign Exchange announcing that it will remove quotas on dollar-denominated qualified foreign institutional investor (QFII) scheme and its yuan-denominated counterpart (RQFII). The removal of investment limits for foreigners was likely made to encourage capital inflows, seen by some to potentially ease trade tensions with the US.

JPM to add China to Bond Indexes; FTSE keeps Malaysia in WGBI

Index provider JPM announced it will start including Chinese government debt in various indexes from 28 February 2020. According to JPM, the inclusion will be phased over a 10-month period, with 1% weight included each month. Notably, the biggest impact will be on its emerging market indexes. Meanwhile, index provider FTSE announced it will keep Malaysian bonds in its WGBI Index – a relief to both Malaysian bond investors and policymakers. Early in the year, FTSE had indicated that it could potentially remove the bonds from the index, citing market liquidity concerns. To address FTSE's concerns, Bank Negara Malaysia (BNM) took steps to further liberalise its dynamic hedging programme. FTSE left Malaysia on its watch list, however, and will "continue to engage with market participants to understand the practical impact of recent initiatives announced by BNM to improve market liquidity and accessibility."

India lowered corporate income taxes

During the month, the Indian government announced a major overhaul of corporate income taxes, lowering the corporate tax rate by 8% to 22%. The government estimates total revenue loss of about INR 1.45 trillion —or 0.7% of GDP— from the measures. Separately, policymakers also announced measures to help the export and housing sectors during the month. Worries about the effects of these growth measures (the corporate tax cuts in particular) on the country's fiscal position dampened sentiment towards Indian government bonds.

Market Outlook

Positive on Malaysian and Indian bonds; neutral on other ASEAN bonds

In the month ahead, markets are likely to focus on the outcome of upcoming trade talks in Washington, China's GDP print and the Chinese Politburo's meeting on economic conditions. All these factors are likely to generate cautious bias in the markets. Against such an uncertain backdrop, we prefer to be defensive on duration and therefore prefer shorter-dated bonds in general. That said, we are slightly more positive on Malaysian bonds following FTSE's decision to keep Malaysia in its WGBI index, while maintaining the country on its fixed income watch list for further review next year. We anticipate investors to return to this space, as Malaysian bonds continue to offer attractive real yields and face a favourable supply backdrop for the rest of the year. We also see value emerging from the sell-off in Indian bonds. Indian policymakers are working towards having Indian bonds included in global indices, which should be a long term positive for the instruments.

Cautious on the SGD

Among regional currencies, we continue to expect the SGD to underperform. The weak external demand outlook is likely to persist and this could add more depreciation pressure on the currency. We believe that the two potential easing options for the Monetary Authority of Singapore (MAS) at the upcoming Monetary Policy Committee meeting are either a 50bps reduction or full neutralisation of the SGDNEER slope. Moreover, close correlation to the Euro and Pound - which have been under pressure from a dovish ECB and uncertainties surrounding Brexit – would further dent sentiment towards the SGD.

Asian Credits

Market Review

Asian credit spreads ended tighter; total returns still edged lower due to sell-off in USTs

Asian credits ended the month 0.18% lower, mainly due to the sell-off in USTs, as credit spreads tightened about 5bps on the back of improving risk appetite. High-grade credits ended 0.36% lower, even as spreads tightened by about 3bps. Improving risk appetite led high-yield credits to outperform, with spreads tightening 13bps, to close the month 0.43% higher.

Asian credit spread tightening was prompted initially by greater policy support from China and some positive developments on the US-China trade front with high-level negotiations set to resume in early October. Risk appetite was also supported by expectations of further monetary easing by major global central banks, as well as expectations of greater fiscal stimulus to ease the burden on monetary policy. Towards the latter half of the month, sentiment was weighed by a combination of heavy corporate and sovereign bond supply across developed and emerging markets, central bank easing measures which failed to live up to the market’s dovish expectations, and emerging political risk in the US. This caused some reversal of the earlier tightening in credit spreads. By country, Indian credits outperformed in September, buoyed in part by the announcement of a sharp cut in corporate tax rates.

A meaningful increase in primary market activity

Issuance volume rose in September as risk sentiment stabilised. The high-grade space saw 43 new issues amounting to about USD 21.6 billion in September, including a three-tranche USD 2.5 billion issue from ICBC and a two-tranche USD 1.25 billion issue from CK Hutchison. Meanwhile, the high-yield sphere witnessed 36 new issues amounting to about USD 10.4 billion.

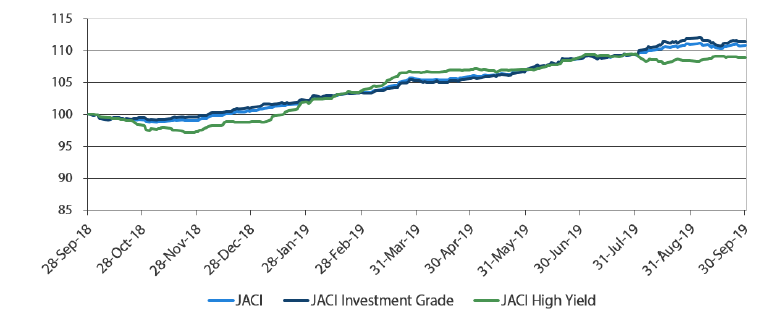

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 28 September 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 30 September 2019

Market Outlook

Outcome of US-China trade negotiations crucial for the near-term direction in UST yields and spreads

Global central banks are likely to remain accommodative until there is a clearer resolution on trade and geopolitical developments, as well as modest improvement in economic data. Signs of disagreements within the Fed and ECB on the scale of additional easing that will be required going forward are limiting the downside in global rates at the moment. However, the medium-term trajectory hinges on the evolution of macro data and business confidence readings in the coming months. This will, in turn, be heavily influenced by the outcome of trade negotiations between the US and China, which still remain uncertain at this juncture even though both sides adopted a more conciliatory stance in September. The outcome of the meeting in early October will be crucial for the near-term direction of UST yields and credit spreads.