The US-China trade war escalated in August as the exchange of retaliatory tariffs between the two economic powers seemed to have spun out of control. But with Washington and Beijing agreeing to a truce of late, the outlook for global markets, including emerging markets, has improved significantly over the past few weeks. Our base case is that the placement of more tariffs will be avoided and perhaps reduced in the not-too-distant future, which would be positive for China, the US and the rest of the world.

The tariffs may have offered leverage in earlier negotiations, but a further trade war escalation no longer favours US President Donald Trump now that the negative feedback loop is finally beginning to affect his own country’s economy. President Trump appears to be settling for a smaller deal to nullify the pain from fresh tariffs, particularly the ‘4B’ tariffs scheduled for December. These tariffs would hit US consumers hard and potentially push the country into recession, jeopardising President Trump’s chances of winning a second presidential term.

Although details are still scarce, it appears that China’s hawks may have gotten their way, gaining a more balanced approach to enforcement that does not require laws to be rewritten. Otherwise, China’s ‘concessions’ to the US had, for the most part, been baked into the reform agenda. For example, buying more US soybeans and pork (that it needs) seems achievable for China.

The Sino-US technology war still continues, and Chinese companies like Huawei are still risk being choked off from US suppliers. Interestingly, though, China’s pivot from manufacturing exports to semiconductors and other hardware is firmly underway, helping lift growth while reducing exposure to unreliable external supply chains.

We believe that the trade truce and expectations that further tariffs will not be activated can remove uncertainty, thus preventing a global recession. As in 2012 and 2015, a global manufacturing recession is under way, with uncertainty resulting in an outsized inventory cycle. The uncertainty is not just generated by trade conflicts, but also by faltering demand for technology hardware, which prompted manufacturing cuts in 2018.

There are early indications that the outsized inventory cycle may be winding down. As the trade war settles, resulting drawdowns in inventories could lift manufacturing. A pick-up in manufacturing will lift global growth, but not without some drag from the damage already caused by tariffs already imposed and the extended period of uncertainty.

Easy monetary policies undertaken by central banks around the globe are helpful, but developed economies do not have much policy options left. However, the US Federal Reserve’s (Fed) shift from monetary tightening to easing (monthly purchases of USD 60 billion of T-bills) represents a considerable change in balance sheet flows, which we believe will ease liquidity conditions across emerging markets.

On the fiscal front, China continues to adjust its policy mix with some additional allocations to infrastructure investment, but none is expected to have a significant impact on global demand. However, Europe is now leaning toward fiscal easing. In our view, pockets of fiscal stimulus, revived confidence and a pick-up in manufacturing can put growth back on track.

Asia: Supply Chains Shift as China Pivots Manufacturing Focus

ASEAN is a beneficiary of reconfigured supply chains that have so far added to foreign direct investment (FDI). The technology war also benefited Taiwan as the US-China trade conflict, targeted sanctions against Chinese companies and a trade spat between South Korea and Japan significantly disrupted supply chains.

Within the region, Vietnam is still likely the biggest beneficiary of reconfigured supply chains. Enthusiasm was tempered in June when President Trump commented that “Vietnam takes advantage of us even worse than China does”. The president was pointing to the US trade deficit with Vietnam that had grown 40% in 1H19, although some of those exports were seen to have originated from China and relabelled as ‘Made in Vietnam’ to circumvent tariffs. But Vietnam has managed to stay clear of President Trump’s wrath for the most part and remains a top equity performer in the region.

Growth in the rest of ASEAN remains stable thanks to a mix of supply chain related FDI, monetary easing and fiscal stimulus–factors that have helped fill some of the demand gap from China. Taiwan is picking up on increased demand for its semiconductors. South Korea has lagged, partly due to its trade spat with Japan, which limits its ability to import key materials required for semiconductor production.

Growth in India remains weak. The country continues to experience feeble consumption and investment due to an undercapitalised banking system, with shadow banking still frozen up. The recent corporate tax cut, which was a big surprise, could lift both earnings and growth, but it will take time.

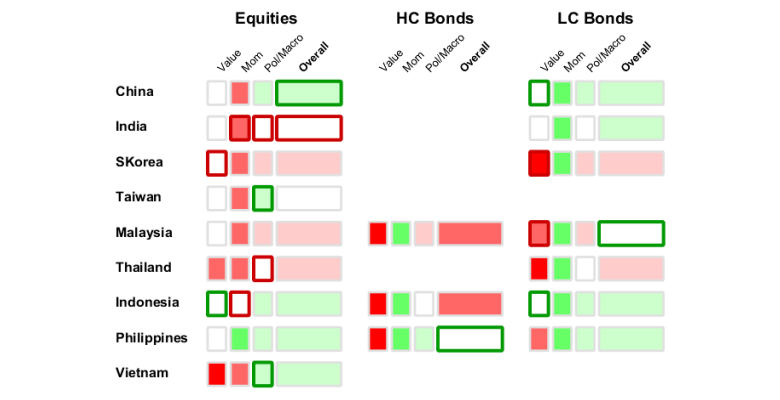

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

China Earnings Continue to Defy Trade War Uncertainty

Traditional measures of China’s economic health, including Fixed Asset Investment (FAI) and the credit impulse, remain weak. This is disappointing for the rest of the world as it depends on Chinese demand to absorb their exports. However, the Caixin manufacturing Purchasing Managers’ Index—a better measure of the health of private firms—has climbed from just above 50 in August to 51.4 in September, a level not seen since early 2018.

Stimulus is helping the private sector with tax cuts and better access to cheaper capital. But falling demand for manufactured exports is now being replaced with domestic demand for semiconductors and other high tech parts, a key development amid US threats to cut off supplies to Huawei and possibly other companies as well.

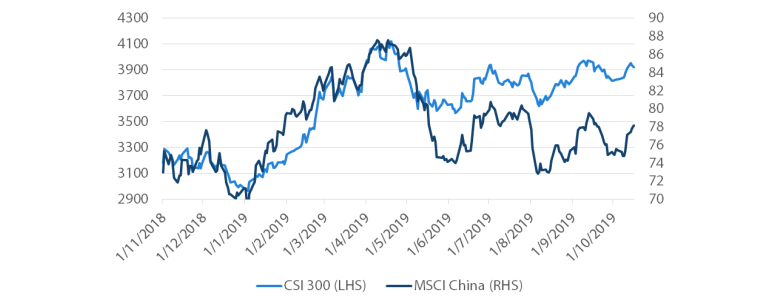

Through top line growth and improving profit margins, forward earnings estimates in the A-share market have risen since the end of January. Although prices always follow earnings over the long term, the trade war has not helped sentiment and caused a downward divergence in prices. This does, however, leave decent upside potential should a trade deal be reached.

Chart 1: CSI 300 Earnings Picking Up while Price Moving Sideways

Source: Bloomberg, October 2019

While A-share performance is disappointing, MSCI China, with sectors more representative of old China, has performed considerably worse on the trade war and still disappointing growth in old China sectors.

Chart 2: China A Shares (CSI 300) Versus MSCI China

Source: Bloomberg, October 2019

India Surprises with Significant Corporate Tax Cuts

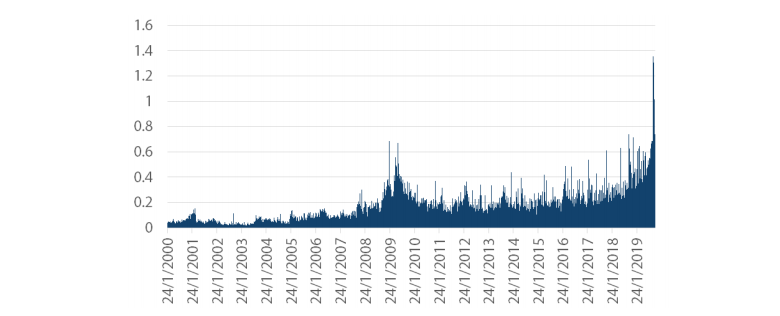

The Modi administration surprised markets in late September when it cut the corporate tax rate from 30% to 25%, worth USD 20 billion (or 0.7% of GDP), which is estimated to boost growth by 65-200 basis points (bps) over two to three years. The tax cut also amounts to an immediate 9% boost to FY20 profits. The jump in equity trade volume highlights the significance of the tax cuts, helping lift Indian equities weighed previously by disappointing growth.

Chart 3: India (NSE Nifty 50) Daily Trade Volume Soared on the News

Source: Bloomberg, October 2019

Some reductions in government spending will help cover the revenue loss resulting from the tax cut. The fiscal slippage from -3.3% of GDP to -3.8% is not insignificant, but not enough to outweigh the benefits of badly needed growth. Bond yields jumped by 12 bps from 6.76% to 6.89% on the news. At current levels, bonds in India still offer value given the country’s low inflation (3.2% CPI in Sep) and as more rate cuts are expected.

Fiscal and monetary growth certainly reinforced India’s growth outlook, but full recovery will take a long time. Unemployment stands at a 45-year high of 6.1%, partly driven by a weak property sector that has increasingly employed population segments of the outsized country.

Consumption is correspondingly weak and credit is also shaky as non-performing loans (NPLs) have risen to 9.1%, while the squeeze continues across shadow banking. In August, the government moved to accelerate an INR 700 billion bank recapitalisation, but the rescue still looks small in size relative to the size of the NPL problem. Equities are now moderately more attractive after the tax cut, but bonds show better value.

EMEA: Mixed With Some Upside Surprise

Turkey has orchestrated surprisingly fast changes to its economy, managing to slow down inflation and revive growth. This led to a significant upsurge in asset prices. However, Turkey’s recent invasion of Syria, partly aimed at attacking US-allied Kurds, has triggered a new wave of geopolitical risks.

South Africa continues to suffer from outflows as markets are losing faith in President Cyril Rhamaphosa’s ability to execute his reform agenda against a highly resistant faction within his African National Congress party. The economy is weak and coupled with rising twin deficits, a Moody’s downgrade seems inevitable, which will push the country out of the WGBI Bond index and lead to even larger outflows.

Eastern Europe is finally slowing in tandem with the rest of Europe, although sluggish growth does have the positive effect of tempering inflationary pressures. The region’s populist policies that run counter to the EU’s requirement of adhering to defined budgets continue to create friction with policymakers in Brussels. Romania holds the most risk with its large, rising twin deficits, reversing the repairs made following the Global Financial Crisis.

Russia remains a pillar of strong policies, producing twin surpluses. The country is now much less dependent on the price of oil, with real growth starting to accelerate on rate cuts. Earnings are improving as well.

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Turkish Bonds Attractive but Not Without Volatility

Turkish President Recep Tayyip Erdogan is once again testing US patience. After US President Trump surprised the world by suddenly withdrawing US troops from Syria, Turkey invaded the country with the offensive including an attack against US-allied Kurds in northeast Syria. The US announced sanctions and tariffs against Ankara, and President Trump even threatened to “swiftly destroy” Turkey’s economy. Turkey has since paused its offensive in Syria and the US has lifted its sanctions on Turkey, but clearly the situation remains fluid.

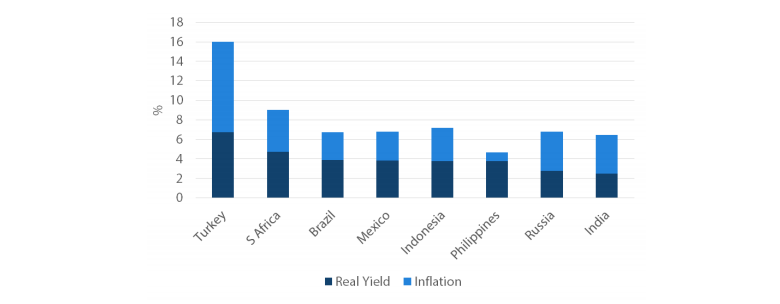

Despite such a poor geopolitical backdrop, Turkey has still surprised with its positive fundamentals. Most importantly, a dramatic decline in inflation has allowed the Turkish central bank to reduce rates by 750 bps over two months, with another 150 bps cut expected by December. Inflation has fallen precipitously from just over 25% in October 2018 to 9.26% in September, pushing up real yields to levels that are among the most attractive in the world.

Chart 4: Real yields across regions

Source: Bloomberg, October 2019

Growth in Turkey has also surprised to the upside, with its GDP rising 1.2% quarter-on-quarter in Q2 on strong credit, fiscal stimulus, robust exports and a recovery in consumption. Credit expansion and increased fiscal spending are concerning as bank balance sheets are already stretched, and fiscal slippage needs to be watched closely. On the other hand, better growth can help heal bank balance sheets and increase government revenues as well. Rising political risks remain a key point of concern, but Turkish bonds are attractive and justify an upgrade to neutral.

Russia Emerging from Sanctions With Returning Growth

Russian assets have suffered from a long bout of uncertainty connected with sanctions and threats of new restrictions, the last of which was imposed in August. But the light touch of this particular sanction signed by President Trump reduces the chances of a far harsher sanctions bill being turned into law going forward.

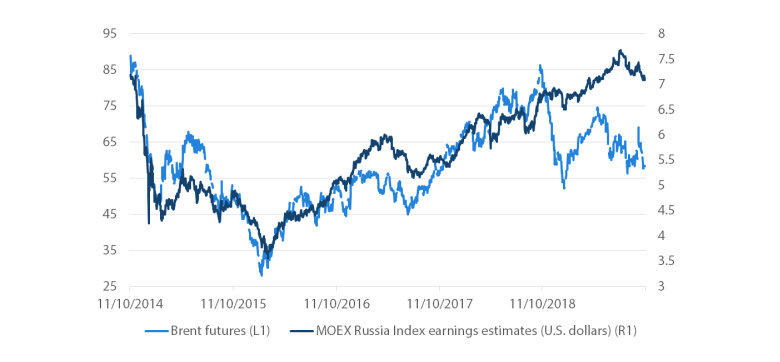

Caught between looming sanction threats and tight domestic policy, it was not a surprise that the Russian economy slowed considerably. But with low inflation, multiple rate cuts and some fiscal easing, Russia’s GDP growth is beginning to recover and is expected to accelerate to 2.1% by 2021. Although growth is still less impressive compared to Asian peers, it is still a tailwind for earnings at a time when Russian equities remain quite inexpensive.

Further support for the economy are the prudent policies that have helped the country earn twin surpluses (in both current and fiscal accounts), which are the highest in the world. While the twin surpluses support the currency, Russia’s prudent policies are helping the economy decouple from oil price fluctuations, offering more stable earnings going forward.

Chart 5: Russian Equity Earnings Versus Oil

Source: Bloomberg, October 2019

Latin America Struggles to Find Growth

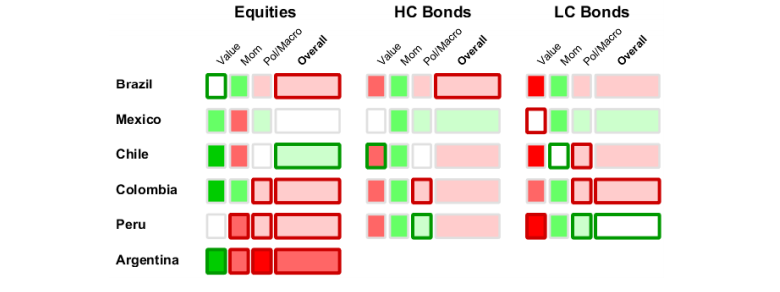

The Latin American region suffers from weak growth and failing reforms. This was dramatically displayed in Argentina, where a surprise primary result in August in the run-up to the presidential election virtually assured a return to populist policies and prompted a massive currency decline and a technical default within weeks.

Brazil is sticking to its reform agenda, but patience is wearing thin both among the populace and its politicians. The reforms promised a return to growth which is yet to materialise. The fiscal spigots being opened by the politicians, a development the country simply cannot afford, is a risk factor ahead of looming elections.

Growth is otherwise weak across the region. Mexico is now under a micro-managing president who pushes a less business friendly, populist agenda, although the administration does at least adhere to fiscal prudence. The country’s debt dynamics are far healthier than Brazil and given the near parity of their respective yields, we still prefer Mexican bonds over those in Brazil.

Asset Class Scores

Score Summary: For each country and asset class, scores are represented by colours – white is neutral, green is positive and red is negative. The overall score is shown to the right with the underlying scores – value, momentum and political/macro – shown to the left. The border shows grey for no score change, while green shows positive and red negative.

The asset classes mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Brazil Strong on Reforms but With Rising Risks

Brazil has been pushing the world’s most aggressive reform agenda. But market optimism is fading, partly due to weaker external conditions and a possible recognition that reforms do not always work, as displayed dramatically in Argentina.

Ostensibly, the reform agenda is on track. Pension reform is expected by late October, with many other aggressive reforms also in the pipeline. President Jair Bolsonaro’s approval rating is steady at 44%, but his lack of allies in Congress is his weak spot.

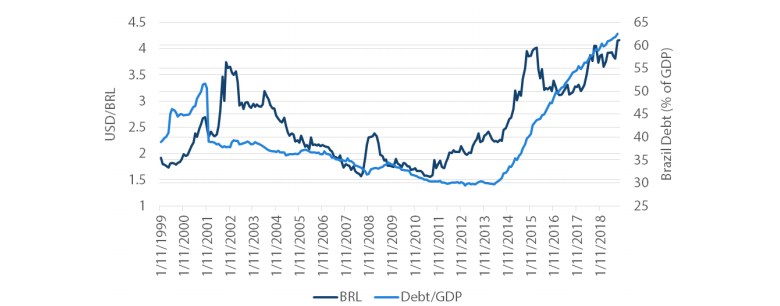

Aggressive reforms still continue to move forward, albeit slowly. This is apparently due to a broad recognition that reforms are necessary to return the country to growth, providing the politicians with their only path to re-election. But patience is wearing thin as the real currency (BRL) continues to weaken in line with the country’s rising debt-to-GDP ratio, which is already at a dangerously high level.

Chart 6: Brazilian Real (BRL) Continues to Weaken Reflecting the Rise in Levels of Debt to GDP

Source: Bloomberg, October 2019

As the 2022 elections approach, a chief concern is that the politicians might abandon their reforms and return to fiscal priming, something the government cannot afford and the markets will not tolerate. Typically, the reforms take time to generate growth. Reform gestures still attract foreign capital due to the perceived opportunities they create, and that supports near-term growth. In Brazil’s case, reforms are moving forward but at a slow pace. They are unable to generate the confidence required to attract foreign capital and have therefore left growth stagnant. Foreign investors remain underweight on Brazilian assets because of these concerns, with the only source of support seemingly coming from local investors. Brazilian assets look expensive in light of these risks.

Hopes Dashed for Argentina

The primary presidential election in mid-August was met with shock and horror as the results virtually assured that Argentine President Mauricio Macri would be replaced by his opposition, populist leader Alberto Fernandez. Argentina’s reforms were deep and painful, but the hope was that inflation would decline and growth would return, allowing President Macri to win a second term.

However, inflation remained high and growth weak. This cost President Macri the August primary election, and Argentina is likely to embrace anti-business policies again. The peso currency promptly lost about 25%, forcing a technical default within two weeks as the government sought to extend the maturities of the debts it could not pay.

Argentina’s currency (FX) reserves have once again declined to dangerous levels as shown in Chart 7, with IMF injections briefly lifting reserves before they were depleted again. Argentina received the largest IMF bailout in history and with the next USD 5.4 billion disbursement still pending, it may just have to cut its losses and allow its currency and financial system to collapse.

Chart 7: Argentina Central Bank FX Reserves in Steep Decline

Source: Bloomberg, October 2019

The best hope for Argentina, in our view, is Fernandez shifting to a more centrist stance if he is elected, instead of reintroducing the disastrous policies of his running mate, former President Cristina Fernandez de Kirchner.