Summary

- In October, risk sentiment improved further over news that China and the US have reached a tentative agreement for the "first phase" of a trade deal. Chances of a hard Brexit were reduced. The Federal Reserve (Fed) also cut interest rates for the third time this year, in line with expectations. Overall, US Treasury (UST) yields traded higher, with 10-year yields ending at 1.69%.

- Asian credits ended the month 0.52% higher. Credit spreads tightened about 6 basis points (bps) on the back of improving risk appetite, offsetting the negative impact from slightly higher long-end UST yields. High-grade credits ended 0.25% higher, while high-yield credits closed the month 1.41% higher.

- Within the region, the Monetary Authority of Singapore (MAS) eased its policy by “slightly” reducing the slope of the SGD NEER band. The central banks in Indonesia and India cut their rates, while the central bank in the Philippines reduced the Reserve Requirement Ratio (RRR). The Philippines' headline inflation for September fell sharply to the lowest in three years.

- Meanwhile, issuance volume rose in October as risk sentiment stabilised. The high-grade space saw 23 new issues amounting to about USD 9.8 billion in October, while the high-yield space had 30 new issues amounting to about USD 10.4 billion.

- For Asian local currency bonds, we are positive on Malaysian and Indonesian bonds due to their attractive yields. We also expect the easing of trade tensions to support the Renminbi (RMB) and other Asian currencies. On the other hand, we are neutral on low yielding countries such as South Korea and Singapore.

- As for Asian credit, given the mildly positive and limited nature of the trade talks, we expect UST yields and credit spreads to remain range-bound, with a slight bias towards tighter spreads and higher rates in the near-term.

Asian Rates and FX

Market Review

Risk sentiment improves in October, long-end UST yields higher

Risk sentiment improved further in October, over news that China and the US have reached a tentative agreement for the "first phase" of a trade deal, preventing a further escalation of the trade tensions between the two countries. Meanwhile, the likelihood of a hard Brexit was reduced as the UK and the European Union (EU) agreed on a revised deal. Lastly, the Fed Funds rate was cut for the third time this year, in line with market expectations. The accompanying Federal Open Market Committee statement (FOMC) was more balanced and hinted at a pause in monetary policy stance going forward. Overall, 10-year UST yields traded from 1.66% to a high of 1.85% in October, before easing to 1.69% at month-end on an ebb in optimism over phase two of the US-China deal.

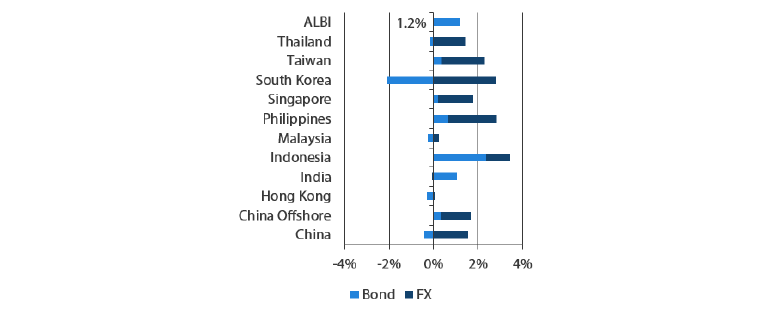

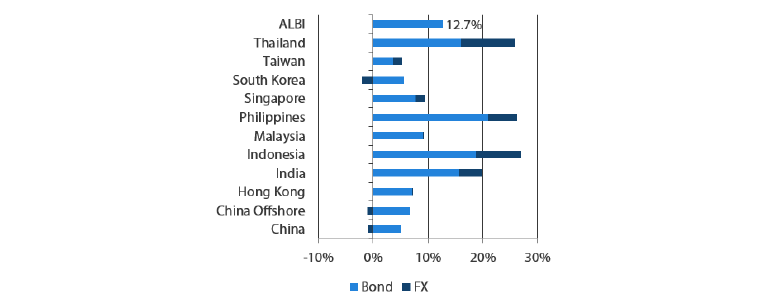

Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 October 2019

For the year ending 31 October 2019

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 October 2019

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

MAS eases policy with "slight" reduction in SGD NEER band slope

During the MAS bi-annual meeting in October, the central bank eased its policy by "slightly" reducing the slope of the SGD NEER band, while keeping the width and the level at which it is centred unchanged. The central bank cited below-potential output and muted inflationary pressures as reasons for the easing. Separately, Singapore's advance estimate of 3Q GDP grew at 0.6% Quarter-on-Quarter on a seasonally adjusted annualised basis. Growth was driven by domestic services, which offset the decline in manufacturing output volumes. Consequently, the Singapore economy narrowly avoided a technical recession.

Bank Indonesia (BI) reduces policy rates, new ministerial cabinet announced

BI delivered a 25 bps cut at its October meeting, bringing the policy rate to 5.0% in a pre-emptive move to support growth. Benign inflation in the country has allowed the central bank to cut interest rates for the fourth time this year. BI expects the Q3 GDP growth to come in below its expectation of 5.1%, led by the ongoing global slowdown. However, it still expects growth to rebound to the middle of the target range of 5.1–5.5% in 2020 on the back of improving investment, structural reform and looser monetary policy. Meanwhile, the new ministerial cabinet was announced in October shortly after the inauguration of Joko Widodo as president for his second term. Sri Mulyani was re-appointed as Finance Minister and this was positively taken by the market as a sign of fiscal policy continuity.

Philippines inflation falls further, Bangko Sentral ng Pilipinas (BSP) reduces RRR by 100 bps

The Philippines' headline inflation for September fell sharply to the lowest in three years, to 0.9% Year-on-Year (YoY) from 1.7% the previous month, led by base effects and lower rice, fresh vegetables and fish prices. Meanwhile, BSP announced another reduction in the RRR by another 100 bps, effective December. With this cut, the BSP has reduced the RRR by a total of 400 bps in 2019, bringing the RRR rate to 14%. A 100 bps reduction in RRR releases approximately PHP 100 billion of liquidity into the system.

Reserve Bank of India (RBI) cuts policy rates in October, downgrades growth prospects

The RBI Monetary Policy Committee opted for a calibrated monetary easing of 25 bps in a unanimous vote, taking the policy repo rate to 5.15%. All six members unanimously voted to maintain the accommodative stance of monetary policy "as long as it is necessary to revive growth, while ensuring that inflation remains within the target". The central bank cut its FY20 GDP growth forecast sharply to 6.1%, from 6.9% which it had provided in August 2019. It also tweaked its near term Consumer Price Index inflation trajectory marginally upwards but retained its medium term projection of 3.5–3.7%.

Market Outlook

Easing of trade tensions to support RMB and other Asian currencies

We expect that an extended period of the Fed's policy rate pause should bode well for Asian currencies. In addition, the apparent easing of trade tensions will likely boost global risk sentiment and therefore provide support to the RMB and other Asian currencies. Going forward, the progress of trade talks will continue to be the main determinants of market direction.

Malaysian and Indonesian bonds to outperform Indian bonds; neutral on other low yielding countries

Within the Asian bond market, we favour Malaysian and Indonesian bonds and expect them to outperform other bond markets due to their attractive yields. At this juncture, we prefer to be cautious on Indian bonds, given the country’s expansionary fiscal stance and rising inflation. Meanwhile, we are neutral on low-yielding and trade-sensitive countries such as South Korea and Singapore. We do not expect much catalysts for these bond markets, with trade tensions easing and risk sentiment improving.

Asian Credits

Market Review

Asian credit spreads end tighter, but flattish in total returns

Asian credits ended the month 0.52% higher. Credit spreads tightened about 6 bps on the back of improving risk appetite, offsetting the negative impact from slightly higher long-end UST yields. High-grade credits ended 0.25% higher, as spreads tightened by about 3 bps. Improving risk appetite prompted high-yield credits to outperform, with spreads tightening 26 bps to close the month 1.41% higher.

Asian credit spreads widened at the start of the month. The market was initially less positive on prospects of the US-China trade negotiations which was scheduled for 10–11 October in Washington. However, after the meeting, sentiment was lifted as both sides indicated that significant progress has been made towards achieving the “first phase” of a trade deal. Thereafter, Asian credit spreads reversed the widening seen earlier in the month and ended the month a little tighter. The cancellation of the mid-November APEC Summit in Chile, which was the intended venue where US President Donald Trump and Chinese President Xi Jinping were expected to sign the “first phase” trade agreement, also created some uncertainty. However, market sentiment was not affected as both sides signalled that negotiations remained on track. During the month, risk appetite was also boosted by the abatement of no-deal Brexit risk in Europe. Positive developments on the trade front largely overshadowed the slightly weaker-than-expected Q3 China GDP growth data, which came in at 6.0% YoY, as well as the official manufacturing Purchasing Managers’ Index, which slipped to 49.3 in October from 49.8 in September.

After a slight dip early in the month, the subsequent improvement in risk appetite drove longer-end UST yields higher at month-end. Overall, 2-year UST yields ended the month about 10 bps lower, while 10-year UST yields ended about 3 bps higher, compared to end-September.

Primary market activity picks up momentum

As risk sentiment stabilised, issuance volume rose. The high-grade space saw 23 new issues amounting to about USD 9.8 billion in October, including a USD 1 billion issue from the Republic of Indonesia, a two-tranche USD 1.0 billion issue from PT Perusahaan Listrik Negara and another two-tranche USD 850 million issue from ChinaThree Gorges. Meanwhile, the high-yield space had 30 new issues amounting to about USD 10.4 billion.

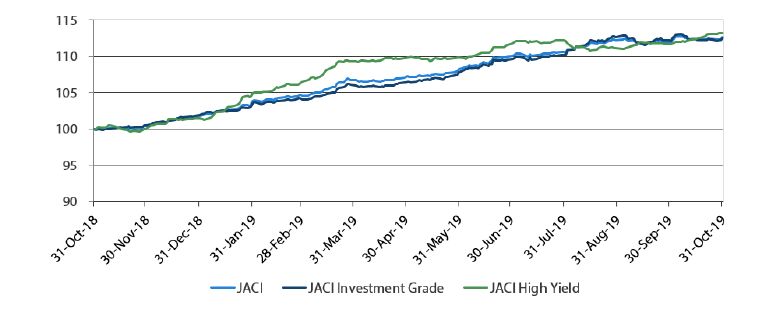

JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 October 2018

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: JP Morgan, 31 October 2019

Market Outlook

Credit spreads, UST yields likely to remain range-bound amid mildly positive but limited nature of US-China partial trade agreement

The outcome of the US-China trade negotiations in mid-October was mildly positive. Currently, it seems likely that the “first phase” of the trade deal will be signed, although this is yet to happen. The scope of the agreement looks likely to fall well short of the comprehensive deal that the US was aiming for earlier. There remains significant differences between both sides on more difficult strategic issues, such as intellectual property protection, technology transfer and China’s industrial policies. The resolution on these issues will likely take much longer; as such, tension in the US-China relationship is likely to persist into the medium-term even as both countries head into the new year by putting their tariff spat on ice.

Global economic data released in October was generally weaker than expected, but markets have turned optimistic that the US-China “first phase” trade deal will result in at least some stabilisation in global economic momentum. At the same time, global central banks are expected to remain accommodative until there is a clearer resolution on trade and geopolitical developments as well as modest improvement in economic data. Talks of fiscal stimulus in Europe have added to the positive backdrop.

In light of the mildly positive but limited nature of the trade talks, we expect UST yields and credit spreads to remain range-bound for the time being, with a slight bias towards tighter spreads and higher rates in the near-term.