Trust in active management is easier when you ask the right questions

by William Low

Sunday mornings are always a pleasure for me as I get a chance to read the newspaper in full. The Sunday Times is my paper of choice and this weekend I was presented with headlines in the business section that included the following: "Fund managers face crackdown after Woodford scandal", "Who needs a Woodford? Build a cheap DIY pension" (with index trackers) and "Try to find where your fund manager is investing—I dare you".

As way of background for those who are not aware, Woodford Investment Management had been run by Neil Woodford, a "star" fund manager who set up the firm following a long period of managing assets at Invesco Perpetual. However, the record at his new firm was poor, and the resulting outflows revealed that the scale of the firm’s investments in illiquid smaller companies was incompatible with meeting redemptions in a timely manner. As a result, an avalanche of liquidations resulted in both the gating of funds and ultimately the demise of the firm.

Source: Shutterstock

We will leave others to analyse the details, accountability and any possible actions from regulators. What is clear, however, is that the whole debacle has demonised the fund management industry in the UK, and as the headlines above attest, active managers in particular. When we discuss these events amongst ourselves we just shake our heads, as we don't face any of the issues that contributed to the demise of Woodford. I'm sure many of our successful competitors would reach the same conclusion. This has led me to ponder what issues the marketing veneer of Woodford's firm had somehow masked for so long.

In our view the issues that matter relate mostly to trust. These specifically include whether the investment manager delivers what it promises, whether it prioritises the client rather than itself and whether it invests in companies that deliver profitable growth in the right way. While prior investment performance does not determine whether your manager is on the right side of these important issues, deeper analysis of the issues can.

Trust—sticking to our philosophy

Having already spent 32 years in the industry has given me plenty of time to observe how markets can condition the behaviours of investment managers. Being measured on how well you perform every single day—a wholly inappropriate time period—is a pressure that is best mitigated by the clarity and confidence of an investing philosophy that does not waver with market volatility. As a team we are very clear that our focus is on only picking companies globally that meet our Future Quality criteria. Other competing firms will have differing philosophies that they will pursue with confidence. Hence our role is often to be part of a portfolio of such managers based on our style of investing. A shift away from our defined philosophy would be, in effect, a breach of the promise we have made to our clients. We therefore have no intention of doing so.

It however appears that this is what occurred at Woodford Investment Management, raising the question of whether your manager can indeed be trusted not to alter course. We would suggest that the transparency of what managers are doing with clients’ money goes a long way to answering that particular question. Since we believe that every investor should know where their savings are being deployed, every quarter when writing our insights piece we disclose all our holdings as of the prior quarter-end (where permitted by the relevant regulations). We believe that disclosing only the top 10 holdings or hiding behind offshore entities is disrespectful of clients. The latest full portfolio holdings can be reviewed at the end of this document. (Note: If they are not disclosed this will be due to regulatory restrictions in your respective region and we recommend that you make contact with our local office to discuss further.)

We consistently receive feedback from clients that our Future Quality portfolios have investments in companies that are not typically seen in those of many of our key competitors. As a result, our commitment to transparency makes it easier for investors to assess what we do and how we may complement a client’s overall portfolio.

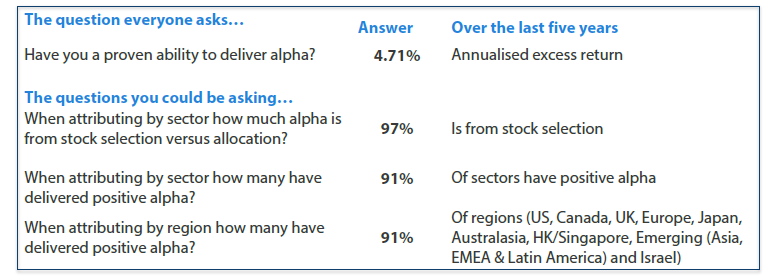

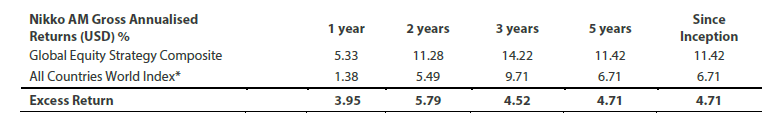

Past performance is certainly debated by some as a tool for selecting active managers, but delving below the headline returns can provide insights on whether the excess returns are resulting from the managers’ prescribed philosophy or other factors, including luck. The average fund factsheet provides limited details on where investment returns are really coming from, while the greater insights from third-party analysis of portfolio returns is generally only available for professional managers who pay for such services. We believe that all investors should have some insight into where returns have been garnered and the following table provides some analysis on where the excess returns for our Global Equity institutional composite have been delivered over the last five years.

Source: Nikko AM and FactSet

Trust—putting clients first by managing capacity

I joined the investment management industry on 20 August 1987 and the October crash later that year was a very early introduction to market volatility. As everything was still new to this fresh-faced youngster back then, the Asian crisis, a decade later, was much more of a genuine learning experience. Speaking to one of our favoured brokers in June 1997 at Peregrine Investments (we relied on quaint things such as faxes and conversations then!) only to see the firm liquidated within six months was a rather brutal reminder of how painful and quick forced liquidation can be. The technology, media and telecommunications (TMT) bubble and the global financial crisis were further evidence that the stock market can be very unforgiving for forced sellers.

Why the reminiscing? The Woodford situation is a timely reminder of how forced liquidation at an investment firm can significantly impact client performance when the scale of the unwinding is large relative to available market liquidity. It would appear that delving down the market cap curve was a primary cause of Woodford’s demise but it’s worth considering other sources of illiquidity. The investment management industry has seen an increasing concentration of assets into fewer players. This is a result of mergers amongst both managers and consultants and of underlying client flows. However, for these already successful managers the question is: what level of client assets is appropriate for still delivering the investment philosophy and scale of excess returns that were delivered historically?

Source: Shutterstoc

Recent events highlight that sudden firm-wide outflows, whilst a relatively low probability event, are a risk that can have significant client impact when the firm’s overall exposures are large relative to market liquidity. Hence, we would not be surprised if clients have a much greater focus on the level of ownership and ability to trade at the firm level rather than just at the individual fund level. Many managers do the right thing and close the door to clients when these predictable issues become relevant. But history would suggest that for some, the profit motive can also be of greater importance than promises to clients.

To continue with our theme of transparency, the Nikko AM Global Equity team manages strategies with AUM of USD 1.75 billion. According to our analysis, the liquidation of all client assets would take eight days,1 and all our stock-picking decisions are wholly independent from any other strategies managed by the firm.

Trust—investing in companies that deliver returns in the right way

As we highlighted earlier, the Woodford situation has generated multiple headlines that question the efficacy and motivations of active managers. We know that the statement “active managers don’t add value” is a fallacy as there is a clear cohort, including ourselves and many of our successful competitors, that has been able to demonstrate consistent excess returns over the long term. It is also worth considering that good active managers know exactly what they are looking for when they pick stocks and willingly avoid companies that don’t meet their designated criteria. This is increasingly important as clients are quite rightly questioning whether corporations are delivering profits and growth whilst also looking after all stakeholders. Many of these stakeholders are increasingly focused on the social and environmental challenges we all face.

We wrote last quarter about how important it is that companies address the requirements of all their stakeholders, rather than just shareholders. Our Future Quality philosophy is specifically seeking companies that will attain and sustain high returns on capital, with the quality of the franchise and its management team being key pillars in this analysis. Companies that are solely focused on shareholder returns at the expense of other stakeholders such as employees, customers and broader society are less likely to sustain high returns on capital over the long term. We believe that our investment philosophy is completely aligned with ESG principles which are now the focus of the entire investment community.

Delivering for all stakeholders, however, is a challenge for passive investing, as it’s difficult to not end up with exposure to the good, the bad and indeed the ugly on this metric. Applying ESG scoring methodology may improve that situation. But given the significant inconsistencies between such data providers, the confidence that you are investing in the company doing the “right” thing is not as good as it could be. We also need to consider whether companies are just appearing to comply (aka greenwashing) with investor demands or whether they are actually undertaking actions that will deliver profits AND genuinely address the needs of all stakeholders. We would suggest that enduring positive change is best delivered by companies that address the issues of our time whilst also delivering profitable growth.

Our search for companies involves assessing all these aspects when we research the business prior to investing. We are confident that all our 40 holdings meet such criteria and can be described as businesses that will attain and sustain high returns on capital, address the needs of all stakeholders and whose growth is not to the detriment of the environment or society.

Summary

Another headline from the Sunday Times paper I mentioned above, on an unrelated matter, was “Measure what you value—so long as you don’t value just what you measure”. This would seem a rather appropriate summary of what I have outlined above: performance, or the comfort of joining a large roster of other clients, is easy to measure but not necessarily highly predictive of future returns. Whilst more difficult to assess, other factors to consider are how the managers’ philosophies may have migrated over time, the degree to which firm level AUM is a hindrance to alpha delivery and whether the strategy is one that can combine alpha and ESG investing. None of these factors are easy measures, but assessing them may be key to selecting the right active manager.

From Woodford…to Woodward—leader in engine efficiency

Apologies for taking so long in this update to get to the stuff that really matters in portfolios...the stocks we pick. This month we have added Woodward as a position. Woodward is an innovation leader in the area of energy efficiency for aerospace and industrial engines. Whilst electric vehicles will no doubt see greater penetration and further use, the improvement in energy usage of existing modes of transport will be a key element in alleviating the environmental challenges the world faces. We believe Woodward is well placed to help deliver this.

Like many of our stock picks, we seek drivers of growth and profitability that are unique to that business rather than those that are wholly dependent on broader demand trends. Market share is one such driver and we believe that companies that spend more than 6% of their revenues on research and development can sustainably outgrow the competition. We expect a steady improvement in cash return on investment, with the roll out of its latest technologies being a key driver.

Source: iStock

Technology—shift from selecting technology to selectivity within may be underway

The technology sector is a fantastic hunting ground for Future Quality stocks, with the power of innovation at the company level creating opportunities to grow rapidly and deliver consistent high returns on capital. However, we need to be realistic as this thesis is already widely adopted by investors. The technology sector, and software sector in particular, are valued more highly relative to the market than they have been for many years with historically high levels of profitability.

The importance of innovation has not lessened and will remain both an opportunity and threat for individual companies. However, we also need to ponder a couple of issues that will influence how investors assess the overall sector in the coming years:

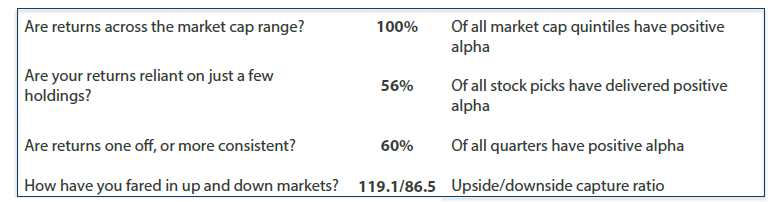

- Supply. The technology sector appears to be undertaking a bout of excessive investment, though the visibility is limited as it is taking place in the unlisted sector. Third-party research has indicated that the level of funding for private equity in the US is at record levels. High and increasing proportions of this funding are heading into the technology sector—software/loss-making businesses in particular. The scale of this capital allocation relative to the US GDP is similar to the mutual fund frenzy around the TMT bubble in 2000.

The good news is that the dry powder is still at high levels and a capital shortage does not appear imminent. The bad news is that a wide array of companies are being supported in their search for new customers and profitability even though there is no evidence of a significant upward shift in end demand. Hence, there is a risk that the focus on the demand side for technology (some examples of durable growth drivers are 5G, Edge computing, cloud AI) is blinding us to a wave of new and typically unlisted competitors. There is typically a lack of pricing power given the deflationary environment that characterises technology, and this will not be helped by a proliferation of providers. - Policy. As we approach almost a decade of QE it may become more evident that the low cost of capital and scale of investment in technology are contributing to both the overall low rate of inflation and the low share of incomes to GDP. Whether there is a proven causal link between technology-led productivity and the wage rates for less skilled jobs, this may not matter as the political narrative could demand change irrespectively. How this will develop, as is always the case when politics is involved, is difficult to predict. However, it is reasonable to assume that the environment in which record levels of profitability are deemed acceptable may be coming to an end.

- Politics. Whilst the political cycle may result in a lessening of trade tensions in the coming quarters, the hegemonic war between the US and China is out in the open and technology is an integral part of the weaponry. We should assume, therefore, that what has been a global market for technology products may become a more regionalised one over time. This is a challenge that is not limited to technology, with both consumer and industrial goods and services in the firing line.

We are fully weighted still in technology but our confidence in the individual business models is more important than broader demand growth. Companies that meet this criteria for us are Microsoft (cloud leader), Adobe (creative software leader), Hexagon and Keyence (digitisation of industrial world), Dolby (next generation sound and vision) and Accenture (IT consultancy).

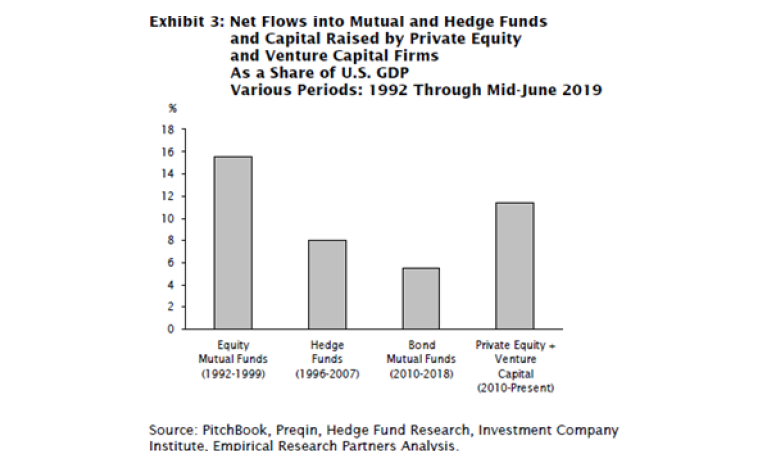

Portfolio positioning

The table below highlights our Global Equity Strategy holdings as of the end of September 2019.

Global Equity Strategy Composite Performance to Q3 2019

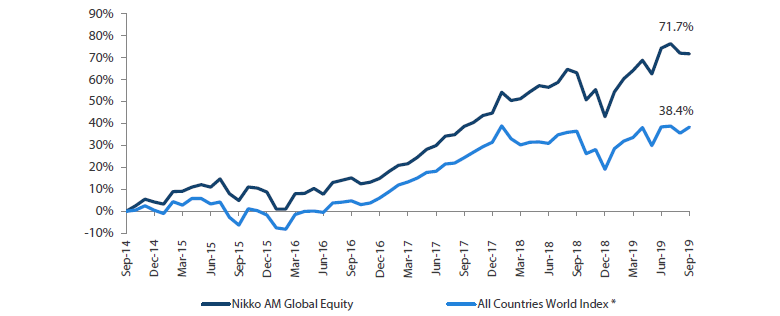

Cumulative Returns October 14 to September 19

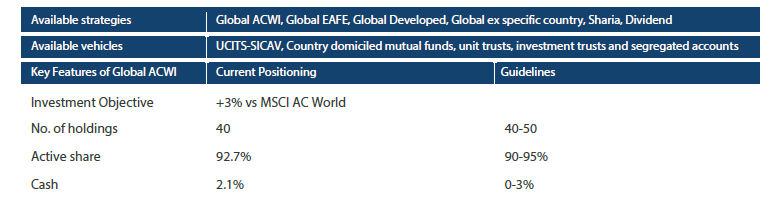

Nikko AM Global Equity: Capability profile and available funds (as at 30 September 2019)

Past performance is not indicative of future performance.

This is provided as supplementary information to the performance reports prepared and presented in compliance with the Global Investment Performance Standards (GIPS®). Nikko AM Representative Global Equity account. Source: Nikko AM, FactSet.

Nikko AM Global Equity Team

This Edinburgh based team provides solutions for clients seeking global exposure. Their unique approach, a combination of Experience, Future Quality and Execution, means they are continually "joining the dots" across geographies, sectors and companies, to find the opportunities that others simply don’t see.

Experience

Our five portfolio managers have an average of 22 years' industry experience and have worked together as a Global Equity team for eight years. In February 2019, Michael Chen joined the team and later in September Ellie Stephenson joined the team as Portfolio Analysts. They are the first in a new generation of talent, on the path to becoming Portfolio Managers. The team's deliberate flat structure fosters individual accountability and collective responsibility. It is designed to take advantage of the diversity of backgrounds and areas of specialisation to ensure the team can find the investment opportunities others don’t.

Future Quality

The team's philosophy is based on the belief that investing in a portfolio of "Future Quality" companies will lead to outperformance over the long term. They define "Future Quality" as a business that can generate sustained growth in cash flow and improving returns on investment. They believe the rewards are greatest where these qualities are sustainable and the valuation is attractive. This concept underpins everything the team does.

Execution

Effective execution is essential to fully harness Future Quality ideas in portfolios. We combine a differentiated process with a highly collaborative culture to achieve our goal: high conviction portfolios delivering the best outcome for clients. It is this combination of extensive experience, Future Quality style and effective execution that offers a compelling and differentiated outcome for our clients.

About Nikko Asset Management

With USD 230.8 billion* under management, Nikko Asset Management is one of Asia's largest asset managers, providing high-conviction, active fund management across a range of Equity, Fixed Income, Multi-Asset and Alternative strategies. In addition, its complementary range of passive strategies covers more than 20 indices and includes some of Asia's largest exchange-traded funds (ETFs).

*Consolidated assets under management and sub-advisory of Nikko Asset Management and its subsidiaries as of 30 September 2019.

Risks

Emerging markets risk - the risk arising from political and institutional factors which make investments in emerging markets less liquid and subject to potential difficulties in dealing, settlement, accounting and custody.

Currency risk - this exists when the strategy invests in assets denominated in a different currency. A devaluation of the asset's currency relative to the currency of the Sub-Fund will lead to a reduction in the value of the strategy.

Operational risk - due to issues such as natural disasters, technical problems and fraud.

Liquidity risk - investments that could have a lower level of liquidity due to (extreme) market conditions or issuer-specific factors and or large redemptions of shareholders. Liquidity risk is the risk that a position in the portfolio cannot be sold, liquidated or closed at limited cost in an adequately short time frame as required to meet liabilities of the Strategy.

Footnote

1Source: Bloomberg, based on average daily traded values as of 13 November 2019.