Summary

- The macroeconomic backdrop for Asian countries remains stable. While GDP growth is likely to moderate, notably in China and Hong Kong, policy support and a slower pickup in defaults compared to the global average should underpin credit performance in 2020.

- We expect fiscal policy to remain supportive of growth in most Asian economies, notably China, and offset weakness in external and private domestic demand. With inflation remaining subdued, we expect monetary policy to stay neutral to accommodative across most Asian economies.

- Against a constructive economic backdrop, we expect Asian corporate credit fundamentals to moderate slightly because of modest earnings growth. That said, we do not expect an earnings recession in Asia. Credits with strong management and a track record of operating through tough business and funding environments will be preferred. Within China high yield (HY), we favour short-dated property bonds over industrials.

2020 Asian credit outlook

Fundamentals

Macro

The macroeconomic backdrop for Asia remains stable. The International Monetary Fund expects that growth to remain relatively healthy at 5.1% in 20201. Moreover, policy support and a slower pickup in defaults compared to the global average should underpin credit performance in 2020. GDP growth is likely to moderate, notably in China and Hong Kong, although we do not expect any hard landings. Export growth could slow as impact of existing tariffs strengthens. However, import growth is also expected to moderate, especially if commodity prices remain broadly stable to moderately lower on global growth concerns. The contribution of net exports to GDP growth is therefore expected to be only slightly less supportive relative to 2019. That said, countries with large current account deficits will remain the focal point for credit investors, staying vulnerable to spikes in the US dollar and crude oil prices.

We expect fiscal policy to continue to support growth in most Asian economies, notably China, and offset weakness in external and private domestic demand. With inflation remaining subdued, we expect monetary policy to stay accommodative across most Asian economies. With policy focus on ensuring adequate financing to the private sector and provincial public infrastructure projects, we expect credit conditions in China to gradually improve. Hong Kong will likely enter into a prolonged recession amid the escalating social unrest and China’s slowdown. India will be in the spotlight after its growth in 2019 was affected by shadow banking woes and manufacturing and construction activities dragged down by lacklustre domestic demand.

Credit

While the economic backdrop is constructive, we expect Asian corporate credit fundamentals to moderate slightly as earnings growth is at a modest level. However, we do not expect an earnings recession in Asia. Overall, spreads in Asia should be anchored by modest easing, any sequential domestic growth and low Asian default rates. Key risks include higher US dollar/Chinese yuan volatility resulting from the trade war, a slide in commodity prices, inventory increases in the Asian housing market and an escalation of political tensions in Hong Kong. On the other hand, any resolution of trade disputes or monetary easing from US and China would be positive for Asian credit.

Leverage and debt servicing ratios of Asia’s investment grade (IG) corporate sector have improved over the last few years. Earnings growth remained decent across most sectors with some moderation likely in 2020. Despite a less constructive macro backdrop resulting in lower earnings growth and higher funding costs, we do not expect a major deterioration in the credit profile of Asia IG corporates in 2020.

On the HY side, the differentiation both between and within sectors will continue in 2020. The Chinese property sector will likely see slower presales growth in 2020 but larger developers should continue to outpace their peers given their leading positions. The tighter grip on debt financing channels will also slow down land banking activities and cause property prices to moderate. While we expect growth prospects to be modest, developers will focus on preserving cash and cash flow collection to anchor their credit profiles. Similar to 2019, credit metric trends for China HY industrials will be more credit-specific; at the same time, still difficult onshore financing conditions will exert pressure across the sector.

We believe refinancing risk remains manageable overall; that said, the Asia HY default rate is likely to remain at a historically elevated range of 2–3% due to a challenging operating environment and still-tight credit availability affecting Chinese industrial issuers with limited liquidity.

Valuations

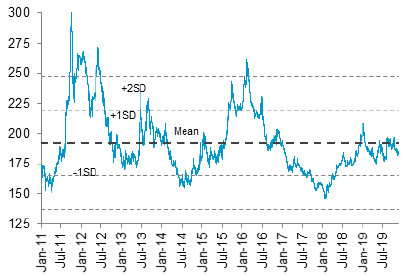

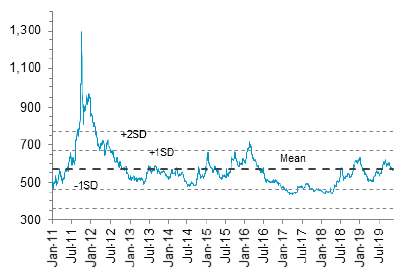

Asian credit spreads tightened in 2019. High-grade (HG) tightened by 20 basis points (bps) to 185 bps2 and HY corporates tightened by around 46 bps to 569 bps. Both HG and HY spreads remain below their historical post-global financial crisis mean levels.

Chart 1: Asian high-grade spread

Chart 2: Asian high-yield corporate spread

Source: J.P. Morgan, Bloomberg, as of 15 November 2019

Asian credits remain attractive compared to US credits. The yield pickup over US credits widened by 22 bps to 84 bps2 given the recent underperformance. Within IG Asian credits, BBB-rated pickup over A-rated credits is still around the average level of 70 bps for the last five years. We thus prefer BBB-rated credits over A-rated credits for higher pickup. Asian HY also provides attractive yield pickup versus its US peers. Within Asia, the single B segment shows higher relative value as the pickup over BB has increased substantially to 223 bps2.

Technicals

The technical backdrop for Asia remains positive. The external flows into emerging market (EM) funds should stay fairly constructive; with the LIBOR rate at a low level, we expect lower funding costs to drive private bank flows. Indigenous demand for Asia credit should also remain intact as seen from the take-up in primary issuance despite the weak backdrop for most of the year. We think China-based investors’ demand for US dollar Chinese credit will be strong given ample dollar deposits; default risk is forecast to be manageable. Gross supply is likely to moderate to around US dollar (USD) 260 billion after a near record print of USD 295 billion in 2019. The decline would be driven by some prefunding of maturities next year, less funding needs for capital expenditure amid a more challenging macro environment, tighter China property bond issuance regulation and financials diverting their capital funding needs back onshore. This is positive for technicals as demand is expected to remain robust.

Strategy

We expect US Treasury yields and credit spreads to remain bound in range for the time being, with a bias towards slightly tighter spreads and higher rates with returns mainly from carry. Credits with strong management and a track record of operating through tough business and funding environments will be preferred. Within China HY, we favour short-dated property bonds over industrials. The key risk to our near-term outlook is the failure of China and US to sign even a partial “Phase 1” trade deal, which will likely result in a significant fall in US Treasury yields and widening of credit spreads. Over the medium term, downside risks remain. The scope of the trade agreement between the US and China, even if a “Phase 1” deal is reached, looks likely to fall well short of the comprehensive deal that Washington was aiming for. Resolution on these issues will likely take much longer and US-China tensions could persist, possibly resulting in a re-escalation of the trade conflict in 2020.

Sector outlooks

Financials

For the banking sector, a generally robust capital reserve will underpin the stability of the sector despite some expected uptick in credit costs due to a weaker economic outlook. In China, the regulators have stepped in to restructure and support capital replenishment of smaller regional banks in a bid to contain risk. We prefer larger Chinese banks as they have better risk management practices and lower exposure to weak private companies. In Hong Kong, we expect higher credit costs in 2020 as the protests there have disrupted business. However, Hong Kong’s banks have sufficient capital and loan loss reserve buffers to withstand such a risk. In South Korea and Singapore, the outlook for the banking sector remains stable as strong balance sheets will buffer slower economic growth. In India, we are seeing some improvements in asset quality and capitalisation. However, the persistent liquidity crisis in the non-banking finance companies/housing finance companies sector and increasing stress for telecom companies will continue to pressure asset quality.

We still see value in China’s asset management companies (AMC) and leasing companies. For China AMCs, they are on a path to recovery and are refocusing on traditional distressed asset management business. Their role in cleaning up non-performing loans has strengthened amid weakening macroeconomic conditions. Leasing companies still offer decent spread premiums over their parent bank senior notes. These bank-affiliated leasing companies are expected to receive timely support if required from their parent banks with explicit liquidity/capital support under the articles of association of leasing companies.

Real estate

We see value in China high yield property developers, as fundamentals are likely to stabilise and valuations are attractive. Market technicals are also likely to improve due to lower issuance. We expect the stabilisation of credit profiles to be driven by the following three broad trends:

- Regulators have been introducing macro-prudential measures to tighten financing to both developers and consumers, and this will likely improve discipline and limit debt growth among developers.

- ost developers maintain sufficient liquidity.3

- Many developers will report strong revenue and profits from sales in previous years.4

In Indonesia, persistently weak property demand has weighed heavily on developers. Demand after Indonesian elections failed to crystallise and we do not see any immediate catalysts to drive home buyers in the near term. We expect the credit profile of Indonesian developers to deteriorate further in 2020.

Infrastructure

We expect economic growth across most Asian countries to slow further in 2020. Fiscal policies of governments are expected to remain supportive of growth as a counter-cyclical stabiliser. In China, we expect the government to continue rolling out measures that support infrastructure projects and counter weaker economic growth. We expect fixed asset investments in 2020 to remain robust, backed by strong backlog of orders. Capital expenditures and working capital needs will remain elevated for engineering and construction (E&C) companies. Hence leverage is expected to continue rising as a result. While acknowledging broadly deteriorating credit metrics, we remain largely constructive on the sector as most participating companies have government backing and retain their strategic role in smoothing out the economy. Furthermore, we do not expect a large rebound in infrastructure spending on the back of the government’s implicit debt curbs, while stricter control on public-private partnership (PPP) projects and issuance of local government special bonds should also partially offset capital pressure for construction companies.

Telecommunication, media and technology

The telecoms sector across Asia is facing rising competitive pressure from new entrants, and potential further investments for 5G roll out. Hence, we expect credit metrics of telecom operators in the region to deteriorate further in 2020. However, market leaders should fare better than the industry and defend their ratings given their strong balance sheets and diversified revenue sources.

In the technology sector, we expect broadly stable credit profiles for Chinese internet bond issuers in 2020. Credit metrics are likely to be stable due to their strong cash balance, and their investment activities are expected to be within cash flow generation capability. The industry will see slower growth versus previous years due to weaker economy, higher competition and increased online advertisement supply. However, we expect the leading players to still post healthy top line growth at the expense of smaller players. Profit margins will narrow due to heightened investments on content and customer acquisition.

Hardware technology sector growth was weak in 2019 due to subdued mobile phone shipments and slow economic growth. However, there might be a small uptick in 2020 due to incremental investments into 5G and 5G phone launches. Hence, we expect to see a small recovery in top line growth for the leading players in the industry in 2020. The margins could still remain under pressure due to high competition and the strains from the US-China trade war.

Oil and gas

Oil prices were mostly range-bound in 2019, averaging USD 63 per barrel. We expect oil prices to remain at those levels on proactive supply management by OPEC plus members; this, in turn, will stabilise the credit profiles of Asian upstream oil & gas companies. The situation for downstream oil & gas companies, however, is likely to be less benign, as their gross refining margins have been under pressure due to softer-than-expected oil demand. The implementation of IMO2020 sulphur cap regulations will, to a degree, help the overall margins for complex refiners who are able to capitalise on increases in diesel-linked oil products. But we still expect credit metrics for oil refiners in the region to weaken due to compression in overall margins.

Footnotes

1International Monetary Fund, Regional economic outlook, Asia and Pacific October 2019

2J.P. Morgan, Bloomberg, as of 15 November 2019

3Ample liquidity, however, will increase differentiation among developers’ access to funding channels and pressure smaller players with weaker liquidity profiles.

4Sales growth could eventually decrease with the slowdown in the economy, shifts in household formation, and urbanisation. Developers in lower-tier cities may face more pressure as the government has lowered shantytown redevelopment targets.