Outlook for 2020

Most Asian central banks eased monetary policy in 2019, supporting a strong rally in Asian local bonds. We do not expect the remarkable bond performances to be repeated in 2020, as most central banks appear to be done with monetary easing for now. Nonetheless, we think that a selection of Asian local bonds can still do well next year, albeit at a smaller magnitude compared to 2019, as growth and inflation remain low globally and as demand for carry remains strong.

While highly dependent on trade talk outcomes, we expect Asia’s growth to bottom out in 1H 2020, followed by gradual recovery in the rest of the year. Amid the growth recovery, we expect higher-yielding bonds to perform better than the lower-yielding counterparts, which are more correlated to global rates. Our volatility-adjusted real yields ranking currently puts Indonesia and Malaysia at the forefront amongst Asian local bond markets. This supports our view that Indonesian and Malaysian bonds are likely to outperform when global risk sentiment is stable. In addition, we think that Indonesia and Malaysia still have room to ease policies next year, given their benign inflation backdrop. Likewise, we think that if needed, other Asian countries such as India, the Philippines and South Korea also have room to ease next year. Overall, we expect central banks in the region to be more data-dependent in 2020.

In the event that a trade deal is negotiated and the Federal Reserve goes on an extended pause, we think that the US dollar is likely to ease against Asian currencies until signs of material pick-up in inflation or economic activities emerge. As such, we think that trade-sensitive currencies like the Chinese yuan and South Korean won will likely be the key beneficiaries versus the US dollar when trade tensions ease. That said, the key risk to Asian markets currently is trade negotiations breaking down and the trade war re-escalating—a situation that will not be new to us. We are likely to experience more volatility in Asian local markets if such a risk scenario unfolds.

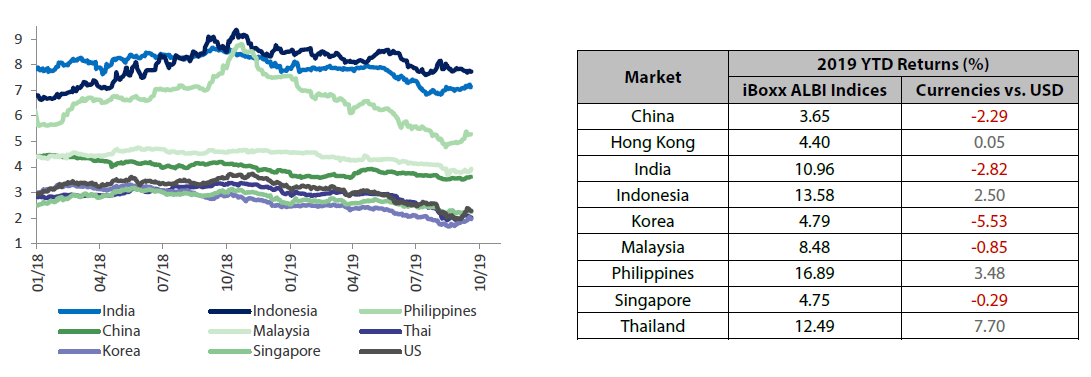

Chart 1: 2019 10-year benchmark yields, returns and FX returns

Source: Bloomberg, IHS Markit, as of 29 November 2019.

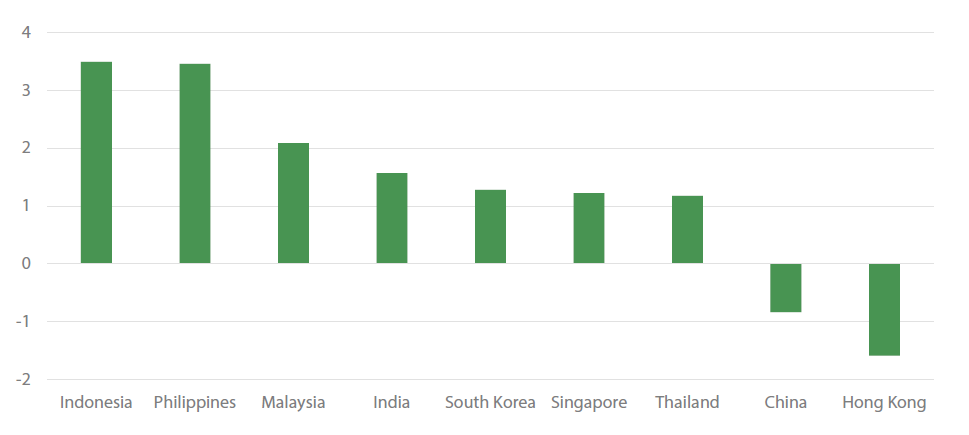

Chart 2: Asian real rates (%) - 5-year yields vs CPI

Source: Bloomberg, as of 29 November 2019.

Individual country outlooks

China

Chinese economic growth is poised to slow further in 2020 and range between 5.8–6.2%, with the impact of the trade war still seeping through the economy. However, the earlier easing measures, on both the monetary and the fiscal front, should slow the decline. While inflationary pressures from food prices could potentially result in the CPI rising above 4% in 1Q 2020, PPI remains in deflationary territory and the GDP deflator is unlikely to pick significantly. Thus, inflation is unlikely to be a persistent issue. Credit growth has also improved in 2H 2019 and should continue to see further improvement in 2020 with the credit impulse turning positive. The deleveraging effects of the Asset Management Rules that were put in place in 2017 would have peaked and thus could even make a small contribution to credit growth.

China’s economy continues to rebalance with consumption and services contributing more to growth than fixed asset investment and heavy industry. Fixed asset investment is likely to remain stable in a 5–5.5% range. As government approvals on infrastructure projects have picked up speed and financing activities for projects have become easier, we expect infrastructure investment growth to remain supported in 2020. Real estate investment growth should continue slowing gradually considering the high base from 2019 and continued government vigilance against real estate speculation. We expect manufacturing investment growth to rebound from the low levels in 2019. Even without a comprehensive trade deal, inventory destocking in 2019 suggests that there is likely to be some basing, and restocking would provide a boost to manufacturing investment. Manufacturing investment will also draw support as China moves up the value added chain to increase self-sufficiency, making manufacturing upgrades necessary.

Fiscal policy will remain the tool of choice with monetary policy playing a complementary role. As long as growth remains in a stable range without significant deterioration, monetary policy will be balanced. The People’s Bank of China (PBOC) remains focused on credit transmission than large-scale easing and it will continue to refine the role of the Loan Prime Rate (LPR). As more new loans are benchmarked to the LPR—which in turn is linked to the medium-term lending facility (MLF) rate—we expect them to continue cutting the MLF rate to alleviate lending conditions to corporates. This should help support financing while tax and fee cuts would help SME profitability.

2020 is likely to be a tale of two halves for China, with growth improving in 1H 2020 and moderating in 2H 2020. Given the leveraged nature of the economy, it is unlikely to be able to withstand a high level of borrowing rates. In addition, the structure of the market remains short duration for corporates. If lending rates rise too far too fast, corporates will face refinancing pressures and this will limit growth. The inclusion into the various global bond indices should provide some support for Chinese bonds. Investors could find value in buying Chinese bonds as the renminbi (RMB) basket of currencies is at a low level. Risks on the currency remain balanced as the outcome of trade talks remain binary in nature. Should the trade talks continue to progress in a positive direction, US dollar (USD)/Chinese yuan (CNY) could be pressured below 6.90 while a breakdown in talks and reimposition of tariffs could see USD/CNY test new highs.

South Korea

South Korea’s growth was hit in 2019 by the US-China trade war, a tech down-cycle and an already decelerating domestic economy. Business sentiment, and thus facilities investment, was visibly affected by uncertainty stemming from the trade war. Domestically, construction investment slowed as house prices moderated. The only bright spot was fiscal consumption, with public investment alleviating a more dramatic slowdown. Private consumption was stable although wage growth remained lacklustre. Both headline and core inflation remained muted through 2019. We expect inflationary pressures to remain weak through 2020.

The Bank of Korea (BOK) cut interest rates twice in 2019, fully reversing its two hikes from 2017. We expect the BOK to remain accommodative due to the negative output gap and the lack of inflationary pressures. Views within the committee have diverged on growth, the effect of monetary policy on growth and the effective lower bound; nevertheless, we retain our view that the BOK will need to cut at least once to support growth and complement active fiscal policy.

We hold a medium term positive view on South Korean rates. But considering their high sensitivity to US rates and tendency to sell off at the end of the year, we remain neutral until the outcome of the US-China trade negotiations becomes clearer or better levels are reached. On the South Korean won (KRW), it had rallied strongly on the back of a potential “Phase 1” US-China trade deal being reached but has since given back some of its gains. We are constructive on KRW given our outlook of global growth bottoming next year and US-China tensions easing.

Malaysia

The 2020 Budget is more focused on policy details and specific growth measures than the previous year. The encouraging shift away from repairing public finances could kick-start investment which has hitherto been hampered by a lack of strategic direction from the Federal government. 2019 GDP growth benefited as manufacturing/exports grew thanks to demand being diverted by the trade war. Capacity constraints in certain parts of the value chain is resulting in more private investment, albeit on a smaller scale. Domestically, private consumption has grown at an average rate exceeding 7% because of higher income and employment growth. This trend should not weaken significantly in 2020, especially with additional monetary easing, but we do not think it will be sufficient to support a growth rate of 4.5–4.7% witnessed thus far in 2019.

Bank Negara Malaysia (BNM) refrained from consecutive rates cuts in 2H 2019 leading to expectations that it will further reduce rates next year from the current 3%. BNM cutting the bank required reserves ratio by 50 basis points (bps) in November is a clear indication of the central bank’s increasingly dovish stance. Malaysian inflation was subdued at well under 2% in 2019, leaving the country’s real rates at relatively high levels compared to their peers. Favourable base effects for inflation seen in 2019 will fade, limiting upcoming easing to just one rate cut in early 2020. We expect the outlook for 2020 to be more mixed as government spending, especially in rural and digital infrastructure development, will still be subject to overall fiscal deficit constraints. The external sector should continue to carry forward the momentum from 2019 although the outcome will be highly dependent on US-China trade talks.

We hold a positive view on Malaysian rates as potential rate cuts and high real yields in a global easing environment would generally be supportive. We are however, neutral on the Malaysian ringgit (MYR) due to the unpredictable nature of US-China trade negotiations.

Singapore

The Singapore economy, a bellwether of global trade, saw stress in export-facing sectors drag 2019 growth to a near-standstill. The US-China trade war took a toll on growth; manufacturing was hit, with electronics suffering the most, while non-oil domestic exports (NODX) contracted by more than 10% YoY up to October 2019. The negative momentum in trade seems to be easing as a “phase one” US-China deal looks probable, injecting much-needed stability for global trade in 2020. A cyclical recovery in NODX is possible even with just a limited “phase one” deal, as inventory de-stocking is reversing, especially in the consumer electronics value chains. Domestically, strong modern services and construction growth helped the economy avoid a mid-year recession. Retail sales, however, slowed due to lower discretionary spending in the first signs of spill-over from weak export sectors. Tourism benefited from political unrest in other regional markets, a trend that we expect will continue into 1H 2020.

The Monetary Authority of Singapore (MAS) is likely to hold policy steady in 1H 2020, having cut the appreciation of the Singapore dollar (SGD) NEER slope by an assumed 50 bps p.a. Core inflation could pick up slightly due to administrative price hikes and possible fiscal spending via pre-election handouts. Otherwise, as with the rest of Asia, MAS’s policy options are dependent on the outcome of US-China trade talks which are highly unpredictable. As a base case, the official 2020 GDP growth estimate of 1.5% looks achievable if the US-China trade war does not escalate. Although the chances are slim, Singapore’s trade-sensitive sectors could quickly drive growth higher if a more comprehensive deal emerges.

We therefore hold a neutral view on Singapore government bond yields; after their underperformance in 2019, the bonds’ alignment with US Treasury yields should increase following easing by the MAS. We are also neutral on the Singapore dollar as the slope reduction by MAS will keep the currency in line with the US dollar and other regional currencies.

Thailand

Thailand’s 2019 general election results turned out to be rather predictable as was the subsequent fractious nature of the ruling coalition, dominated by senior figures from the former military government. The weak coalition underperformed expectations but institutional constraints favouring the establishment and status quo limited potential instability immediately after the elections. The government could add more ad-hoc stimulus in the same mould of the Thai baht (THB) 100 billion fiscal stimulus package targeted at rural/agricultural sectors. Private consumption had been a strong support for growth but deteriorated over 2019 and is projected to weaken further in 2020. Some of the weakening was due to the persistently outperforming THB hurting tourism-related sectors.

The Bank of Thailand (BOT) attempted to stave off further THB appreciation by cutting already low rates to 1.5% with inflation stuck at the 1.0% level. The BOT’s projected 2020 output gap also turned negative, suggesting that domestic inflation pressures would be minimal. More macro-prudential measures could be implemented in 2020 to encourage large current account inflows to be recycled.

We are neutral on Thai government bond yields as low inflation and a dovish BOT would be balanced against very low real yields compared to ASEAN peers. We are also neutral on the THB despite BOT efforts to reduce the current account surplus as domestic owners of THB capital continue to hold a strong home bias.

India

India’s growth momentum was considerably weak in the first half of the fiscal year through March 2020, driven by feeble consumption and lacklustre investment activities. Consumer sentiment related to income and employment remains soft. In addition, weak tax collections reflected slower demand, as did sluggish credit growth as banks and non-banks tightened due diligence. Meanwhile, concerns lingered with regards to the financial sector which include the public sector banks, cooperative banks and non-bank financial companies (NBFCs). These developments have together led to a downgrade in Moody’s credit rating outlook for India, from “stable” to “negative”.

We expect H2 2020 growth to stabilise and improve on favourable base effects and moderate effects of recent monetary and fiscal stimulus. Fiscal spending is likely to pick up after slower disbursements in 1H 2019 due to the general elections. On the monetary policy front, the Reserve Bank of India (RBI) cut the policy rate by a total of 135 bps in 2019, and we expect them to remain accommodative in 2020, although there might be a period of pause and assessment of previous measures. We think that the RBI will see the recent spike in headline inflation past 4% as temporary and primarily driven by volatile food prices and therefore will retain their accommodative stance.

Given the backdrop of weak growth and benign inflation (core inflation is still weak), we think that Indian bonds will likely remain supported. That said, we expect volatility in bonds until the government formally address the uncertainty of the fiscal slippage. India’s persistent twin deficits problem also means that the Indian rupee will continue to underperform the region in 2020, although we do acknowledge that the balance of payment has improved on falling imports and strong FDIs.

Indonesia

We expect Indonesia‘s growth to hold up above 5% for 2020, improving slightly from 2019, with FDI flows and investment activities seen improving after this year’s election. In addition, the effects of cumulative100 bps policy rate cuts in 2019 should support economic activities in the country. The reappointment of Sri Mulyani as finance minister provided relief to markets in terms of fiscal credibility. The budget deficit in 2019 is expected to be slightly above 2% of the GDP while official estimates of 2020 budget deficit stands at 1.8% of the GDP. The current account deficit is expected to persist next year amid a continuation in investment-related imports, but we still see the deficit contained within -3% of the GDP.

Besides the series of rate cuts since July 2019, Bank Indonesia (BI) had also announced a 50 bps reduction in the reserve requirement ratio (RRR) in their November19 policy meeting, to be effective in Jan 2020. A 50 bps RRR cut should release around Indonesian rupiah (IDR) 25 trillion of liquidity (eq. 0.2% of GDP). Heading into 2020, we expect BI to maintain their accommodative stance as the low inflation backdrop gives the central bank the room to do so. Inflation has been below the mid-point of BI's target band throughout 2019 and may gradually recover in 2020. But the magnitude should not be substantial enough to alter BI‘s accommodative stance, in our view.

The global hunt for yield has been positive for Indonesia’s local currency bonds as their real yields remain one of the highest in Asia. We think that stability of the rupiah , low domestic inflation, attractive real yields and improved global risk sentiment will continue to attract inflows into Indonesia in 2020. That said, we think that local bond market performance will be more moderated compared to its remarkable performance in 2019. We think the rupiah’s outlook will be heavily dependent on the current account deficit trend in 2020 and global risk sentiments.

Philippines

We expect growth momentum in the Philippines to recover, with public investment in infrastructure to pick up after stalling in 2019 on delayed in approval of the national budget. We expect a growth range of 6–7% next year with higher fiscal spending driven by the government’s “Build, Build, Build” infrastructure programme. Also, fiscal reforms including cuts in corporate income tax rate and rationalisation of fiscal incentives are expected to be passed next year. Private consumption will be supportive as credit grows back after the central bank lowered interest rates by 75 bps, along with 400 bps of bank RRR cuts in 2019. Inflation has moderated in 2019 with the liberalisation of rice importation laws; after forecasting inflation at 2.5% in 2019, the central bank expects a slightly higher figure of 2.9% in 2020. Volatilities in oil prices and the impact of the African swine flu are some of the risks that could push up inflation.

On monetary policy, our base case for the central bank to continue reducing the RRR amid its aim to bring the rate down to single digit levels. On the policy rate, we believe that a pro-growth stance will lead to some rate cuts next year, with the timing dependent on economic data. There is still room for some accommodation in 2020 as only 75 bps of the 175 bps hike implemented in 2018 has been reversed so far.

Philippine bonds performed well in 2019, their yields declining as high inflation in 2018 was addressed (through liberalisation of rice importation) and the accommodative shift in monetary policy in the second half of 2019. We see inflation expectations to be manageable next year, and the pressure on higher yields will primarily come from increasing supply risk as the government looks to finance its fiscal spending. Meanwhile, we anticipate the Philippine peso (PHP) to underperform its regional peers in 2020, as risk of continued deterioration in the current account persists on the back of infrastructure being built out and firm domestic consumption. Some of the large-ticket infrastructure projects are funded through official development assistance by multilateral agencies in addition to countries such as China and Japan. As such, they can help mitigate negative impact on the currency.