Summary

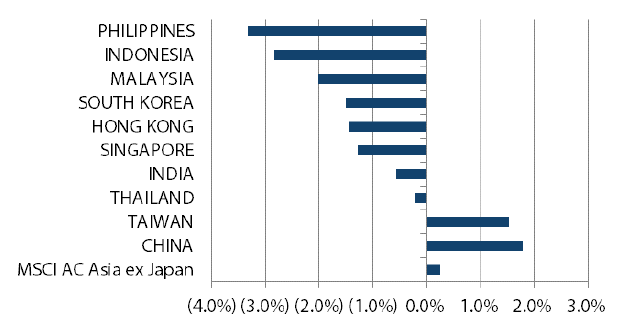

- The ebb and flow of US-China trade talks and the prospect of the two nations reaching a "Phase One" trade deal continued to dictate market moods in November. Risk aversion rose at the end of the month on concerns that a newly-legislated US law backing the pro-democracy protesters in Hong Kong could complicate US-China trade negotiations. Still, the MSCI AC Asia ex Japan Index managed to eke out marginal gains of 0.2% in US dollar (USD) terms over the month.

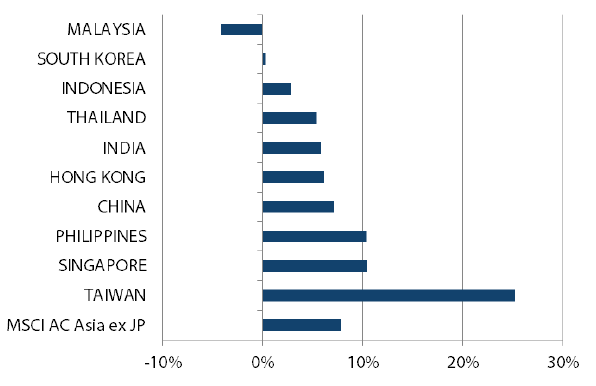

- China led the gains, rising 1.8% in USD terms in November on the back of continued monetary policy easing by the Chinese central bank and the completion of MSCI's partial inclusion of A-shares in its indices. Taiwan also did well, lifted by gains in index heavyweight Taiwan Semiconductor Manufacturing Company and other technology stocks.

- Indian stocks slipped 0.6% in USD terms over the month, largely on weakness in the Indian rupee. Meanwhile, Moody's lowered its outlook for India to negative, citing concerns over insufficient government action to manage a slowing economy. The ASEAN region also underperformed, with the Philippines and Indonesia posting the biggest declines over the month.

- While Asian markets, at least in the short term, continue to be gripped by trade deal-related news flow, we observe more positive structural changes underway. These include broad-based monetary easing, targeted fiscal support and positive structural reforms in China and India. Valuations across the region remain attractive, and we continue to favour areas of undervalued structural growth and positive fundamental change.

Asian equity

Market review

Asian equities eke out marginal gains

The ebb and flow of US-China trade talks and the prospect of the two nations reaching a "Phase One" trade deal continued to dictate market moods in November. Although US stocks hit fresh highs on trade optimism, Asian equities traded cautiously in range. Risk aversion rose at the end of November, on concerns that a newly-legislated US law backing the pro-democracy protesters in Hong Kong could complicate the ongoing US-China trade negotiations. Still, the MSCI AC Asia ex Japan Index managed to eke out marginal gains of 0.2% in US dollar (USD) terms over the month. Within the region, stocks in China and Taiwan posted the strongest gains, while those of the Philippines and Indonesia underperformed.

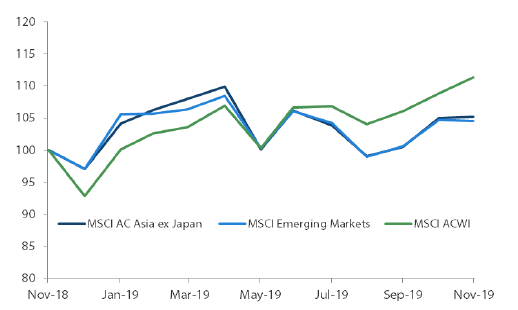

1-year market performance of MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index

Source: Bloomberg, 30 November 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

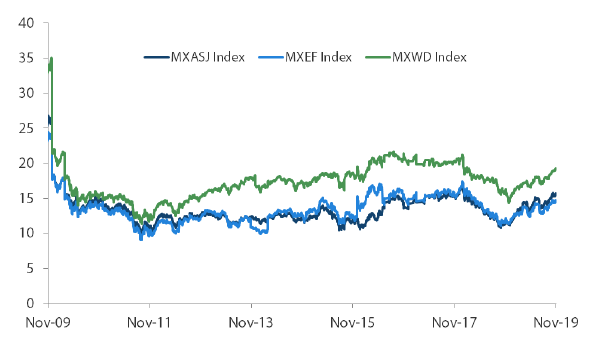

MSCI AC Asia ex Japan versus Emerging Markets versus All Country World Index Price-to-Earnings

Source: Bloomberg, 30 November 2019. Returns are in USD. Past performance is not necessarily indicative of future performance.

China and Taiwan outperform

China stocks gained 1.8% in USD terms in November, buoyed by the Chinese central bank’s continued monetary policy easing and the completion of MSCI's partial inclusion of A-shares in its indices. China also reported better-than-expected official manufacturing purchasing managers' index (PMI), which rose to 50.2, indicating an expansion in output.

In Taiwan, stocks advanced 1.5% in USD terms, lifted by gains in index heavyweight Taiwan Semiconductor Manufacturing Company and other technology stocks. Taiwan's improving economy, which expanded 2.99% year-on-year (YoY) in 3Q 2019 (beating the advance estimate of 2.91%), gave investors another reason to be bullish.

In South Korea, stocks succumbed to profit taking and fell 1.5% in USD terms in November after generating strong gains in recent months. Sentiment was also hit by the country's deteriorating exports, which plunged 14.3% YoY in November.

Ongoing political protests and a weak economic outlook continued to weigh on Hong Kong stocks, which fell 1.5% in USD terms over the month. Hong Kong's October PMI fell to 39.3, the lowest on record.

Indian stocks slip, ASEAN underperforms

Indian stocks slipped 0.6% in USD terms over the month, largely on weakness in the Indian rupee. The country's economic growth in the July-September quarter decelerated to 4.5% YoY, its slowest pace since 2013. Moody's lowered its outlook for India to negative, citing concerns over insufficient government action to manage the economic slowdown.

In the ASEAN region, the Philippines, Indonesia and Malaysia in November slumped 3.3%, 2.8% and 2% in USD terms, respectively, while Singapore and Thailand—the relatively better performers—shed 1.3% and 0.2%, respectively, in USD terms. The MSCI Index rebalancing announced at the beginning of the month weighed on ASEAN stocks in general, especially those of the Philippines. Jaime Augusto Zobel de Ayala, Chairman and CEO of one of the largest conglomerates in the Philippines, commented that the property market had peaked, adding to the selling pressure on local equities. Elsewhere, the Singapore economy recovered in 3Q 2019, expanding by a stronger-than-expected 0.5% YoY, while Indonesia's 3Q 2019 GDP grew by 5.02% YoY.

MSCI AC Asia ex Japan index1

For the month ending 30 November 2019

Source: Bloomberg, 30 November 2019

For the period from 30 November 2018 to 30 November 2019

Source: Bloomberg, 30 November 2019

1Note: Equity returns refer to MSCI indices quoted in USD. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Market outlook

Valuations across the region remain attractive

While Asian markets, at least in the short term, continue to be gripped by trade deal-related news flow, we observe more positive structural changes underway. These include broad-based monetary easing, targeted fiscal support and structural reforms in China and India—Asia's leading growth engines. Valuations across the region remain attractive, and we continue to favour areas of undervalued structural growth and positive fundamental change.

Because China continues to prioritise "quality over quantity", we are unlikely to see the government launch significant infrastructure/property policy stimulus as we saw in the past. Instead, China’s emphasis is on developing strategic industries and welfare in areas such as semiconductors, 5G, healthcare and insurance. Evidence in the financial sector shows China is more willing to let market forces dictate risk pricing; as a result, defaults in fixed income markets are increasing to levels common in other markets. This is a welcome development and part of the People's Bank of China's three-year de-risking efforts, but we remain vigilant of any broader stress beyond these policy-induced casualties.

India’s economic growth has slowed to its lowest level since early 2013, but the country has ratcheted up monetary, fiscal and other policy support measures. Earlier structural reforms of the goods and services tax, Real Estate Regulation Act and the Bankruptcy Bill have taken time to digest, but we believe that they will pave the way for long-term structural growth. Following a recent corporate tax cut, which typically impact economies with a nine- to 12-month lag, we expect activity to pick up towards the first half of next year. We remain in favour of areas that should benefit from formalisation, under-penetration and long-term growth—namely private banks, real estate and logistics.

Improving outlook for the technology sector

The economies of Taiwan and South Korea remain fairly lacklustre. However, we have witnessed an improvement in both demand and earnings in their respective technology sectors as China accelerates spending and as its supply chains re-organise. We continue to focus on healthcare, environmental technology and long-term beneficiaries of 5G.

ASEAN is the other region that ought to benefit from the redesign of supply chains that are currently heavily reliant on China. Indonesia, in particular, stands out not least because of its cost advantage; Indonesian President Joko Widodo's renewed mandate offers the possibility of real and long overdue structural reform.

Appendix

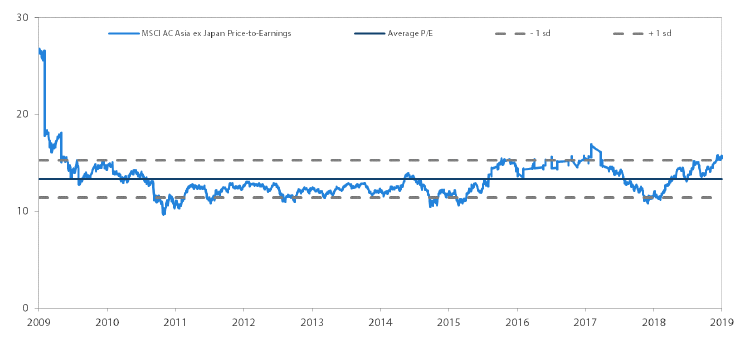

MSCI AC Asia ex Japan price-to-earnings

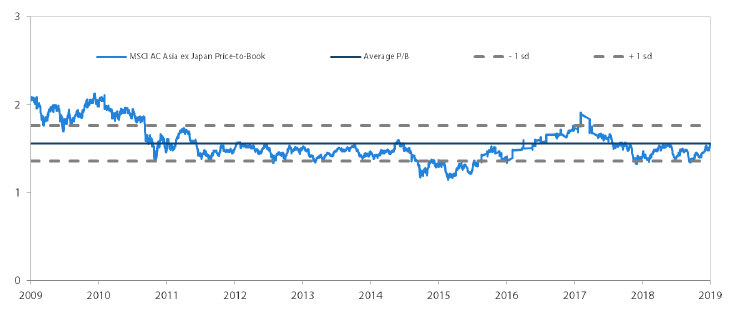

MSCI AC Asia ex Japan Price-to-Book

Source: Bloomberg, 30 November 2019. Ratios are computed in USD. The horizontal lines represent the average (the middle line) and one standard deviation on either side of this average for the period shown. Past performance is not necessarily indicative of future performance.